All Articles

Trending Articles

What Is a POS System and How Does it Work? Everything You Need to Know

A point of sale (POS) system used to be a cash register that simply recorded the day’s sales and organized your cash into sections. With today’s technology, however, a POS ...

Best Point Of Sale Systems

What Is a Sales Growth Calculator? How It Works and Why It Matters

What is Sales Growth? A Sales Growth Calculator is an analytical tool that quantifies the percentage increase in sales revenue over a defined period. Beyond simple tracking, it leverages historical ...

Point of sale Solution Alternatives

Bottle POS Review 2025: Overview, Features, Pricing, Pros and Cons

💡 Key Takeaways: Looking for an in-depth look at Bottle POS? This Bottle POS review will cover everything you need to know about the point of sale system in 2025, ...

Point Of sale Product Comparisons

Zettle vs. Square: Which POS Solution Should You Use to Take Payments for Your Business in 2025?

If you’re considering Zettle vs Square, you’re likely looking for an affordable and user-friendly solution to process payments and manage sales. Zettle and Square offer card readers, mobile POS apps, ...

Point of sale Product Pricing Guides

Clover Fee Calculator: Instantly Estimate Your Monthly POS Costs

What Are Clover POS Fees? Below, we explore Clover POS pricing, including Clover’s hardware costs, software subscription plans, payment processing fees, and add-on costs. Clover Hardware Fees Hardware can be ...

Testimonials

Bottle POS Review 2025: Overview, Features, Pricing, Pros and Cons

💡 Key Takeaways: Looking for an in-depth look at Bottle POS? This Bottle POS review will cover everything you need to know about the point of sale system in 2025, ...

Inventory Management

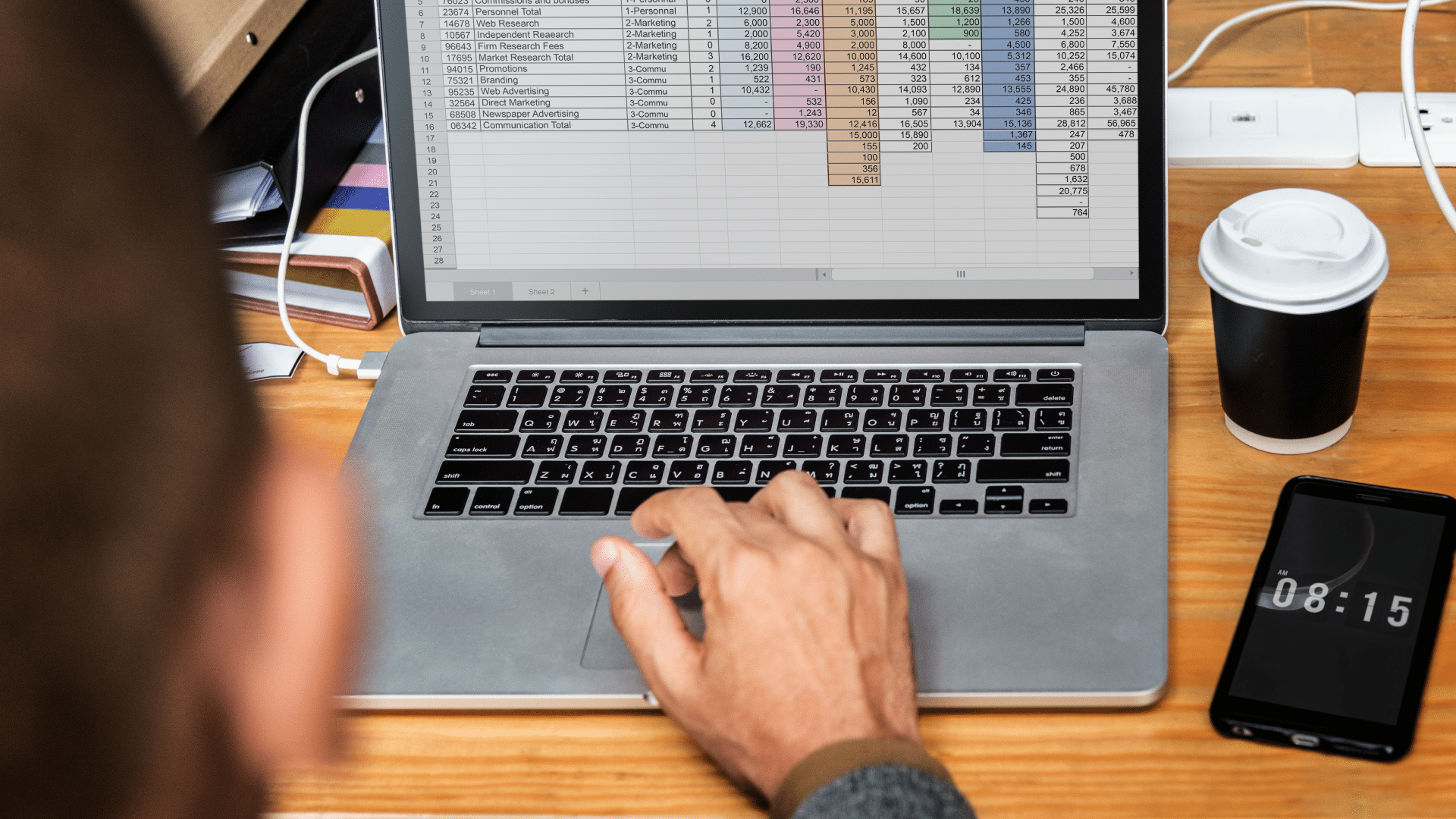

Cost of Goods Sold (COGS) Calculator: Find Out Exactly What Your Products Cost You

The cost of goods sold (COGS) is a key performance indicator (KPI) that determines your gross profit, guides your pricing strategy, and ultimately influences every major business decision you make. ...

Credit Card and Payment Processing

Clover Fee Calculator: Instantly Estimate Your Monthly POS Costs

What Are Clover POS Fees? Below, we explore Clover POS pricing, including Clover’s hardware costs, software subscription plans, payment processing fees, and add-on costs. Clover Hardware Fees Hardware can be ...

Point of Sale Features and Tools

Cost of Goods Sold (COGS) Calculator: Find Out Exactly What Your Products Cost You

The cost of goods sold (COGS) is a key performance indicator (KPI) that determines your gross profit, guides your pricing strategy, and ultimately influences every major business decision you make. ...

Downloadable eBooks and Guides

The KORONA Studio Guidebook—Explore Our Best POS Features

Understanding Credit Card Processing eGuide

A Guide On How To Be A Great Retail Manager

Testimonials

"I’ve never worked with a company that has been as focused on customer service. When we call you guys the response has been phenomenal If I could just choose companies based on how they provide customer service, you’d be the top of my list."

– Jennifer from Duplin Winery

Find the Right POS Solution for Your Business