A point of sale (POS) system used to be a cash register that simply recorded the day’s sales and organized your cash into sections. With today’s technology, however, a POS system does so much more.

With new tools and technology comes a learning curve. So, let’s cover some basics: What is a POS system? What are POS transactions? And how does a POS system work, anyway?This blog will answer each of these questions and more. Read on to learn more.

Key Takeaways: What Is a POS System?

- POS systems streamline transactions, manage inventory, and track purchases over time.

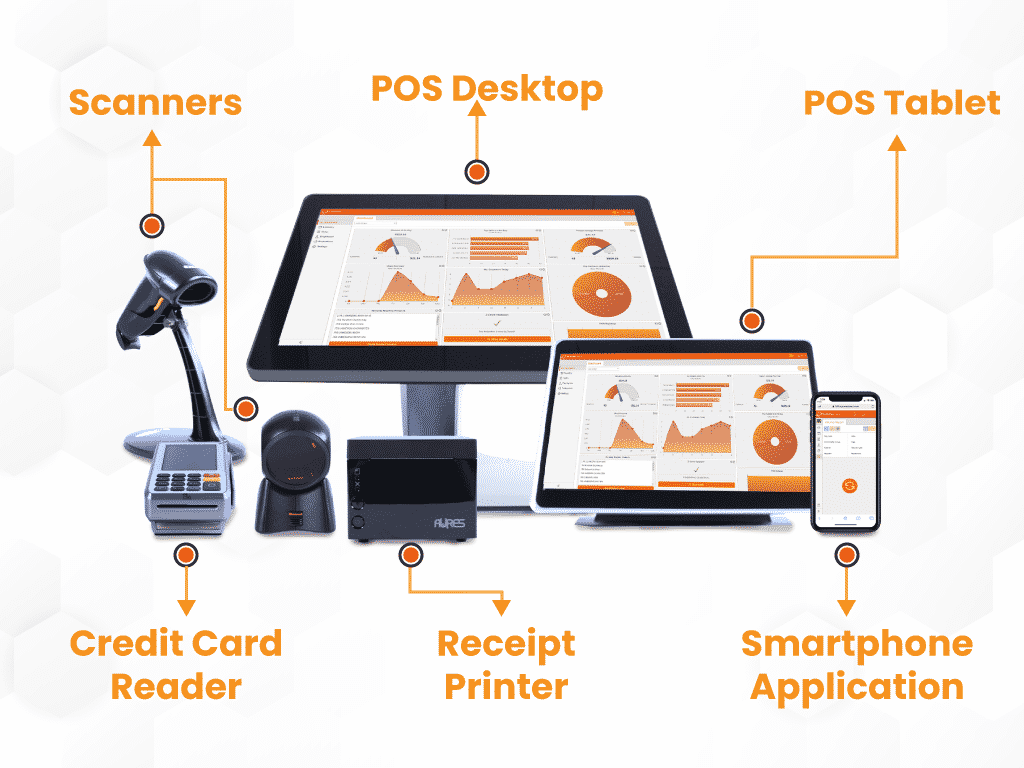

- The hardware components of a POS system include terminals, card readers, printers, and barcode scanners.

- Transaction processing in a POS system involves initiating the transaction, item recognition, pricing, payment processing, receipt generation, inventory management, and reporting.

- Compared to traditional cash registers, POS systems offer enhanced efficiency, customer insights, integration capabilities, and stronger security.

What Is a POS System?

A POS system is the mechanism through which a transaction occurs. You might also see it called the point of purchase or the checkout area.

A modern retail POS system offers businesses many operational features that facilitate each transaction. It’s the heart of all business operations, where retailers process purchases, handle inventory management, and bridge communication between shoppers and employees.

How Does a POS System Work?

POS systems have many functions that help optimize retail workflows. Here’s how they work:

1. Transaction Initiation

- The cashier or customer selects items for purchase

- Items are scanned or manually entered into the POS system

2. Item Recognition & Pricing

- POS system identifies each item based on its barcode or entered SKU

- Prices are retrieved from the system’s database or programmed into the system

3. Calculation of Total Cost

- The POS system calculates the total cost based on the prices of selected items

- It may apply for discounts, taxes, or promotions as programmed

4. Payment Processing

- The customer chooses a payment method (cash, credit card, debit card, etc.)

- POS system processes the payment securely, often integrating with payment gateways or card readers

5. Receipt Generation

- The system generates a receipt detailing the purchased items, prices, taxes, and payment method

- Receipts can be printed, emailed, or sent via text based on customer preference

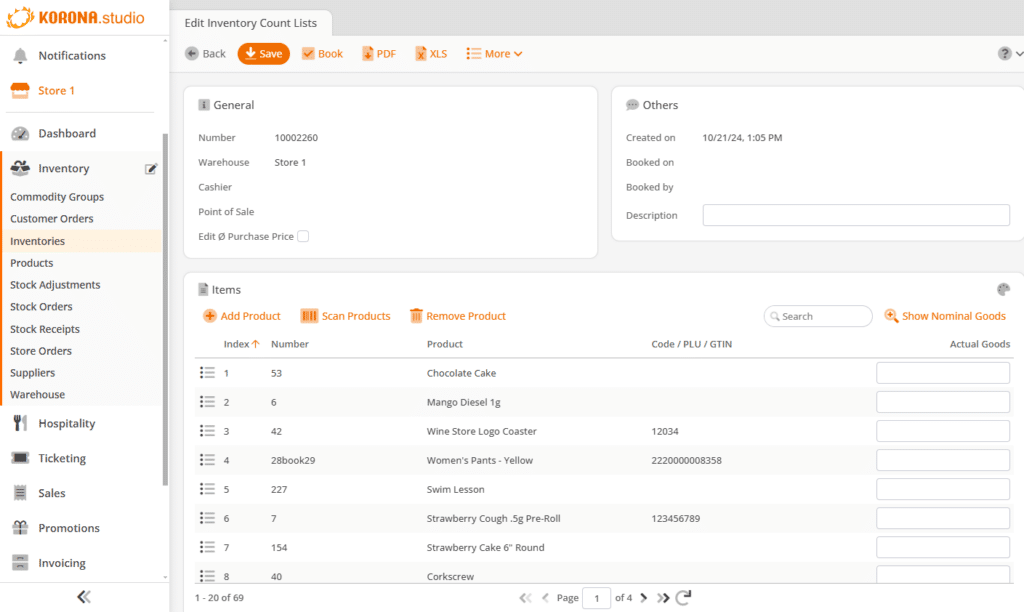

6. Inventory Management

- The POS system updates inventory levels in real-time as items are sold

- It can provide alerts for low stock and generate purchase orders for replenishment

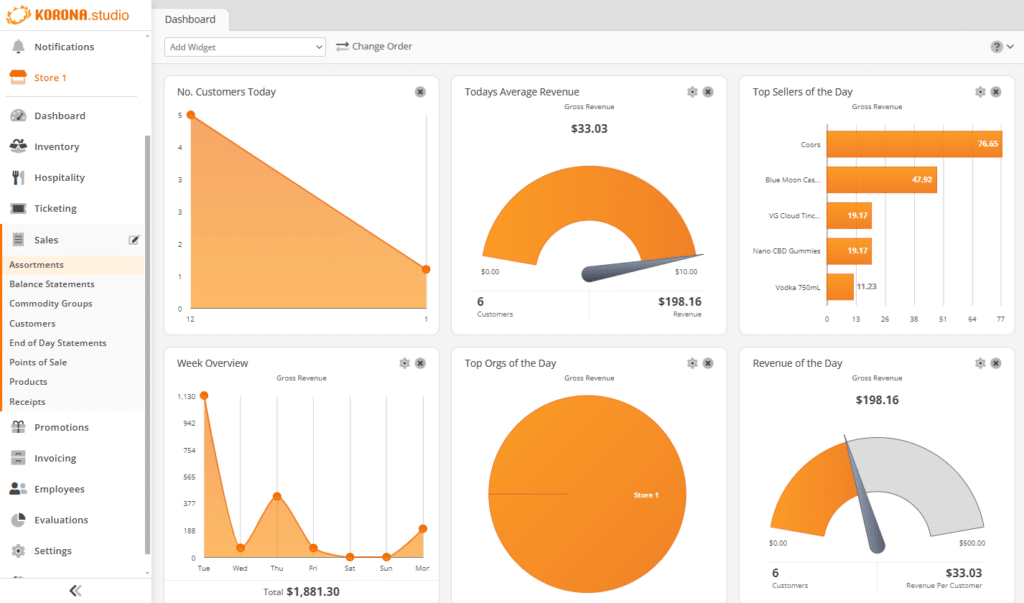

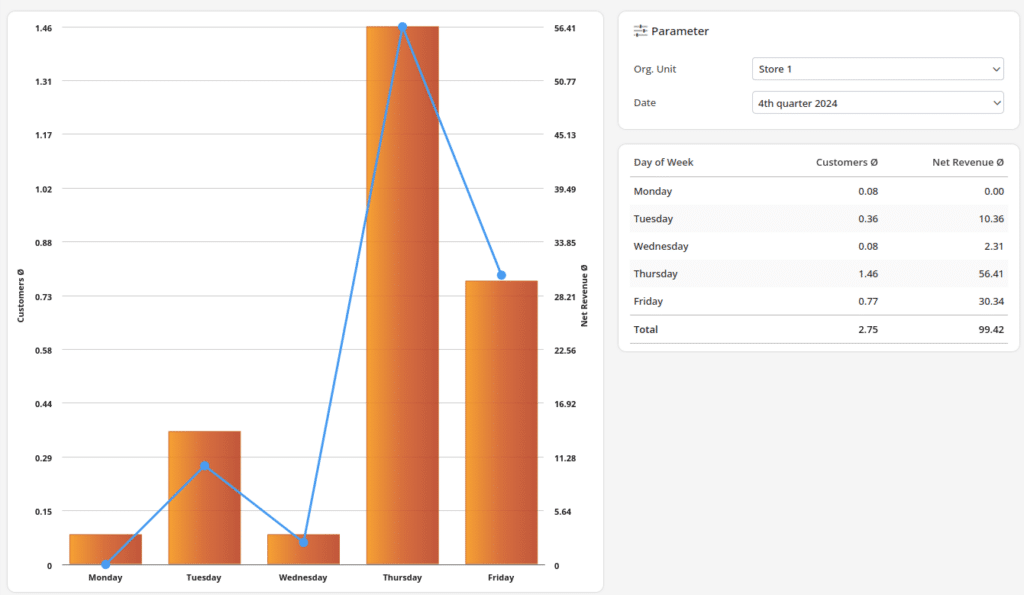

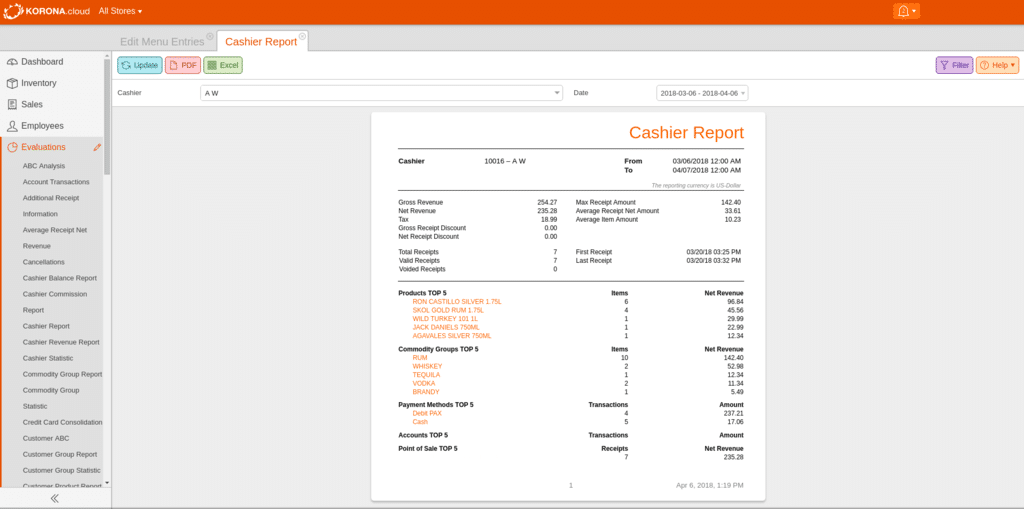

7. Reporting & Analytics

- The POS system compiles transaction data for reporting and analysis purposes

- Business owners can track sales, trends, and performance metrics to inform decision-making

8. Customer Management

- The purchase information is stored for that customer’s profile

- This information can be used for future suggestive selling, targeted marketing efforts with a POS system, and loyalty and rewards

A POS system streamlines the entire sales process, from item selection to payment and beyond, while providing valuable business management insights.

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. And there’s no commitment or credit card required.

What’s Included in POS Software?

Modern POS software typically offers the following:

- User Interface

- Intuitive interface for easy navigation and operation by cashiers

- Clear layout for item selection, payment processing, and other functions

- Inventory Management

- Tools for tracking stock levels in real-time

- Alerts for low stock and generate purchase orders

- Inventory organized by categories, attributes, or SKUs for efficient management

- Sales Reporting and Analytics

- Reporting tools to assess sales performance, trends, and inventory turnover

- Data to identify best-selling items, peak sales periods, and customer preferences

- Suggestions for pricing, promotions, and inventory management

- Transaction Processing

- The ability to process various payment methods, including cash, credit/debit, mobile, and gift cards

- Tools for calculating totals, applying discounts and taxes, and handling refunds

- Secure payment processing and compliance with payment industry standards

- Customer Relationship Management (CRM)

- Capture customer information and purchase history for targeted marketing campaigns

- Loyalty program integration to reward repeat customers and encourage retention

- Personalize customer experiences through tailored promotions and offers

- Integration Capabilities

- Integration with other business systems such as accounting software, eCommerce, and loyalty programs

- Seamless data flow between different systems

- Customization Options

- Tailorable settings, menus, and workflows to suit specific business needs

- Configurable tax rates, discounts, and pricing rules according to regional requirements or promotional strategies

- Security Features

- User authentication and permission levels to control access to sensitive functions

- Encrypted sensitive data such as payment information for retail loss prevention.

- Safeguards against retail fraud or theft

- Regular updates and patches to address security vulnerabilities and ensure compliance with industry regulations

- Cloud-Based Deployment

- Remote access to the POS system from any location with internet connectivity

- Scalability to accommodate business growth without hardware limitations

- Automatic backups and data synchronization across devices for data integrity and disaster recovery

What’s Included in POS Hardware?

The right POS hardware facilitates a speedy checkout and business operations across the board. Popular components of POS hardware include:

- Terminals

- Primary devices where transactions are processed

- Typically include a screen, input device (keyboard or touchscreen), and processing unit

- Can be stationary countertop or mobile for flexibility in different business settings

- Credit/Debit Card Readers

- Devices that read payment cards’ magnetic stripes or chip information

- Enable secure processing of card payments

- Often integrated into the POS terminal or available as standalone units

- Display Screens (Customers/Self-Ordering)

- Customer-facing screens for viewing items, prices, and promotions during checkout

- Self-ordering screens for customers to select items and customize orders in restaurants or retail environments

- Printers

- Receipt printers for generating transaction receipts

- Kitchen printers for printing order tickets in restaurants

- Barcode printers for printing labels for inventory management

- Scanners

- Barcode scanners for quickly scanning item codes during checkout

- Can be handheld or built into the POS terminal

- Cash Drawers

- Secure compartments for storing cash and coins during transactions

- Connected to the POS terminal and only accessible through authorized actions

- Keyboards/Touchscreens

- Input devices for entering item codes, quantities, or other transaction details

- Touchscreens offer intuitive interfaces for more straightforward navigation

- Customer Displays

- Secondary screens facing customers to view transaction details and totals

- Provide transparency and enhance trust during the checkout process

- Can display promotional messages or advertisements to engage customers

How Much Does a POS System Cost?

Costs associated with a POS system can vary based on several factors, including the type of business, scale of operations, and specific requirements. Here’s an overview of the typical costs broken down into hardware, software, and payment processors:

Hardware costs

- Depending on the brand and features, POS hardware costs can range from a few hundred to several thousand dollars per terminal

- Initial hardware investment includes terminals, tablets, barcode scanners, receipt printers, and cash drawers

- Additional expenses may include accessories like stands, mounts, and cables

Software costs

- Subscription-based models (SaaS) usually range from $50 to $200 per month per terminal, depending on the complexity of features and support offered

- Software costs are typically recurring monthly fees or one-time licenses

- Customizable or enterprise-level solutions may have higher upfront costs or bespoke pricing structures

transaction fees

- Transaction fees are a significant component, typically ranging from 2% to 4% of each transaction’s value

- Some processors charge additional flat fees per transaction or a monthly service fee

- Consideration should be given to potential penalties or fees for chargebacks or early contract termination

While POS systems can streamline operations and improve efficiency, these costs must be factored in to determine the system’s overall affordability and suitability for the business.

POS System Vs. Cash Register

We’ve said it before: POS systems are the modern, high-tech relatives of an old school cash register. But how exactly do they differ? Let’s compare a modern POS system with a traditional cash register to highlight the significant differences between the two.

POS System | Cash Register |

Versatility Offers advanced features like inventory management, sales reporting, and integration with other business systems | Simplicity Basic functionality for cash transactions |

Efficiency Features barcode scanning, touchscreen interfaces, and automated processes | Cost-Effectiveness Initial setup costs are lower than POS systems, making them suitable for smaller businesses with tighter budgets |

Customer Insights Captures customer purchasing and preferences data, enabling targeted marketing strategies and customized customer experience | Limited Features Lacks advanced features like inventory tracking and detailed reporting, limiting insights into business operations |

Scalability Adaptable to the needs of growing businesses, with the ability to add terminals and second locations or integrate additional features | Manual Processes Relies on manual entry for transaction details, increasing potential for errors and inefficiencies |

Enhanced Security Utilized encryption and compliance measures to protect sensitive transaction data | No Integration Operates independently with no integration capabilities with other business systems |

Legacy Vs. Cloud-Based POS Systems

Retailers can choose from either a legacy-style (otherwise known as on-premise) POS system or a modern cloud-based system. Legacy systems are the older/outdated versions of POS technology that were widely used before the advent of modern, cloud-based POS solutions. The best modern POS systems are cloud-based.

Let’s take a look at the difference between legacy and cloud-based POS systems:

Cloud-Based POS | Legacy POS |

Cloud-Based Servers Run on applications that store information and function through cloud-based servers | Onsite Servers Have local servers that process and store all inventory and sales information in-house |

Lower Upfront Costs Are generally much less expensive to implement and install than legacy POS systems. The bulk of the cost comes from monthly subscription fees | High Upfront Costs Cost much more money to purchase and install |

Remote Access Allows companies with multiple locations to troubleshoot issues and process and store all their inventory, sales, and employee management data from anywhere | Onsite IT Person Require an onsite IT person to install the hardware and software for the POS to operate |

Flexible Infrastructure Can be used on a proprietor's own computer or tablet or on less costly hardware for purchase or lease | Bulky Infrastructure Are often bulky and require separate installation and hardware systems for each retail location |

Automatic Updates Software updates occur automatically without businesses needing to monitor them | Manual Updates Depend on the retailer to manually update software (updates don't occur automatically) |

What Can a Modern POS System Do for You?

Implementing a point of sale system offers numerous benefits for businesses of all sizes. Here are some key advantages of modern retail POS systems:

Tracking Sales

Built-in performance indicators, conversion rates, and product reports provide key data and sales trends. These tools are integrated into Quickbooks Online. They provide various information, including identifying struggling products or measuring performance between different store locations.

In concert with other programs, this information assists business owners in showing seasonal trends and so much more. Analyzing the past can help you predict the future.

Loyalty Programs and CRM

While POS software facilitates sales, it can simultaneously track who purchases what items and how frequently. Cloud-based systems like KORONA POS can be easily integrated with customer relationship management (CRM) databases such as bLoyal to build reward programs, target specific customers, and reach out to lapsed clientele to get them back in the store.

Inventory Management

A cloud-based POS system can automatically account for all items within a company’s inventory across multiple brick-and-mortar locations and eCommerce sales. Tracking key performance indicators (KPI) and conducting ABC analysis allows businesses to optimize their efficiency and fully understand their inventory. Smart tools such as automatic reordering save time and energy for business operators.

Built-in Credit Card Processing

Many cloud-based systems offer pre-integrated credit card processing, eliminating the need for a separate processing solution. This can be a good fit for some businesses, particularly those with very few transactions or looking to save money upfront on hardware costs.

When the POS and processing solutions are often bundled, the processing rates will be artificially inflated above the market price. Some cloud-based POS systems, though, are called “agnostic” and will allow you to use the most affordable third-party processor you can find.

Employee Management

The same POS screen used to execute sales can also allow people to clock in and out. Employee data collection can easily track sales and efficiency for specific workers.

Multiple custom security features are available. Managers may check records of void or sale cancellations to protect the cash register and tapered permission levels to tailor the access of individual workers.

KORONA POS has exceeded my expectations in every way. It’s a powerful, adaptable solution that has transformed our operations for the better.

-James B.

What Should I Look for When Shopping for a POS?

Choosing a POS system is a huge investment—it’s central to operating your business. Plus, it is a significant expense. Thus, you should perform thorough research before deciding on a solution. Here are some pointers to keep in mind:

1. Long Contracts and Initiation Charges

Before deciding on your POS, make sure you gather as much information about the features, full yearly and future costs, any contracts or additional fees, and how their customer support system works. Some systems have greater start-up and installation fees, while others work on a month-to-month subscription as a service setup.

2. Point of Sale Credit Card Processing Fees

Be sure to compare processing fees when looking for a POS provider. Credit card processing is one of the biggest and most important expenses for small businesses. The difference between a 2.25% and 2.75% processing fee can add up to tens of thousands of dollars in sales over the course of a year.

Be careful with POS solutions that bundle credit card processing, as they usually have higher rates and won’t allow you to shop around for the best available rates. A credit card agnostic POS system like KORONA POS will allow you to choose the best rate you can find.

3. Customer Support for Your POS

What kind of customer support does the POS system offer? Can you get in touch with a knowledgeable representative quickly and easily if you run into software issues? Do they offer assistance during your working hours?

You can even test these questions out by calling the help number companies offer to see what kind of support you get. For example, businesses using Heartland POS Customer Service can evaluate their response times and problem-solving efficiency by reaching out with specific inquiries. Ask questions!

4. Software Product Demos and Free Trials

Finally, try it out! Many POS companies offer trial periods for businesses to try their product and win them over. If a system will work for you, it should be intuitive, tailored to your needs, and streamlined. Get a feel for how the system operates, and whether the features are right for your business.

Speak with a product specialist and learn what KORONA POS can do for your business.

5 Tips on Operating a POS System

Operating a POS system correctly enables smooth transactions, accurate record keeping, and enhanced customer satisfaction. The following tips will help you make the most of your POS system:

Tip 1: Regular Staff Training and System Updates

Invest time in comprehensive staff training and stay current with system updates. Ensure all employees understand POS functionalities, shortcuts, and troubleshooting techniques. Regular training reduces errors, increases transaction speed, and helps staff navigate system features confidently.

Tip 2: Regularly Update Your Software

Keep your POS software updated to ensure access to the latest features, security patches, and compatibility improvements. Regular updates protect against vulnerabilities and help your system run faster. Schedule updates during non-business hours to avoid disrupting operations.

Tip 3: Leverage Inventory Management Features

Use your POS system’s inventory management tools to track stock levels in real-time. This helps prevent overstocking or stockouts, improving cash flow and customer satisfaction. Set up alerts for low inventory and use sales reports to identify best-selling products and make informed purchasing decisions.

Tip 4: Regular Hardware Maintenance

Routine maintenance ensures that all hardware components, such as scanners, printers, and card readers, are functioning properly. Clean devices regularly and inspect them for wear or damage. Proactive maintenance reduces downtime, so your business can avoid transaction delays and maintain operations.

Tip 5: Customize Your System to Fit Your Business

Tailor your POS system to meet your specific business needs by configuring menus, setting up user permissions, and integrating third-party tools. Customization aligns the system with your workflows, making day-to-day operations faster and more intuitive for your staff.

FAQs: What Is a POS and How Does It Work?

How is a POS purchase or POS transaction completed?

A purchase or transaction is typically initiated by the customer presenting their chosen items to the cashier at the checkout counter. The cashier then scans each item’s barcode or manually enters the item’s details into the POS system. Finally, the customer pays for their selected items using a payment method accepted by the store, such as cash, credit/debit card, or mobile payment, and receives a receipt confirming the transaction.

Do POS systems require an internet connection to work?

Most POS systems rely on an internet connection for cloud-based features like real-time reporting, payment processing, and integrations. However, many systems offer offline modes, allowing businesses to process sales and sync data later when the connection is restored, ensuring uninterrupted operations during internet outages.

What types of payments should your POS accept?

Business owners accept EMV cards, which use chips to provide more secure transactions. Mobile payments, often made from smartphones, are now an essential feature of modern POS systems.

What Is the back-end of your POS?

Your POS system should include analytics and reporting capabilities, such as ABC analysis, which allow you to make sound business decisions about your product. These capabilities can break down large amounts of data into more accessible takeaways. The portal to this information is often called the “back-end.” The name comes from legacy systems, which you must go from the back of your store to the central computer. For cloud systems, this means accessing information that is not visible to the cashier or customer.

Is it difficult to train staff to operate a POS system?

Training staff to operate a POS system is not difficult if the system is user-friendly and training is thorough. Modern POS systems are designed with intuitive interfaces, and with proper guidance and hands-on practice, employees can quickly learn essential functions like processing sales, managing inventory, and generating reports.

Final Thoughts

A great point of sale can be an integral part of your business. Knowing what you’re shopping for and what to expect is essential. To find out more, drop us a line. Our team is here to answer any questions you might still have. Click below to learn more about how to get started with KORONA POS.