Square POS: Our Verdict

Square POS offers a user-friendly and cost-effective solution for small to medium-sized businesses. It provides essential features such as payment processing, inventory management, and sales analytics. Its intuitive interface and straightforward setup make it accessible to businesses of all sizes, while its affordable pricing structure and transparent fee system appeal to budget-conscious entrepreneurs.

However, businesses requiring more advanced features or extensive customer support may find Square’s offerings somewhat limited compared to other more comprehensive POS solutions on the market.

Processing: 2.6% plus $0.10 per most transactions

Best For: Start-up Retailers

Pros

- Simple, user-friendly interface

- Versatile with mobile hardware

- Streamlined self-service account initiation

Cons

- Lacking payment processing flexibility

- Less in-depth reporting and analytics

Monthly Pricing

Restaurant

$0/$60/Custom

- Menu management

- Kitchen display

- Tabel management

Retail

$0/$89/Custom

- Inventory management

- eCommerce

- Employee tracking

Appointment

$0/$29/$69

- Scheduling

- Marketing

- Multilocation

Full Square POS Review

Most startup retailers seek a straightforward, user-friendly POS to simplify their everyday workflow. In many ways, Square POS is a solid solution with minimal onboarding requirements and a turnkey setup.

Nonetheless, a thorough Square review shows that while the platform offers an array of basic tools for smaller brick-and-mortar businesses, some limitations remain to consider. For example, most of its setups do not allow new users to interact with humans.

In addition, their built-in payment processing does not allow retailers to shop around for more competitive rates. Finally, some advanced inventory management features are not as dynamic as other alternatives in the field.

Read on for a more in-depth review and explanation of what this provider offers and whether it is a good fit for your retail business.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

What Business Types Is Square POS For?

Square is a great fit for certain business niches but not all. In general, it’s best for smaller operations needing a simple solution for checking out customers and processing payments.

Small Retail Stores

Square’s user-friendly interface and affordable pricing make it an excellent choice for small retail businesses. However, businesses with complex inventory needs may find Square’s inventory management features somewhat lacking.

Food & Beverage

Square is popular among cafes, food trucks, and small restaurants due to its seamless integration with kitchen printers and flexible menu customization. This makes it a viable option as a quick-service POS system.

Service-Based Businesses

Square is well-suited for service-based businesses such as salons, spas, and consulting firms, offering appointment scheduling and invoicing features that streamline operations and enhance customer experience. Its interface enables businesses to manage appointments, track client preferences, and send automated reminders efficiently.

Pop-Up Shops and Events

Square’s mobility and versatility make it ideal for pop-up shops, markets, and events, enabling businesses to accept payments anywhere. However, businesses participating in high-volume events may encounter limitations in processing transactions efficiently due to potential network connectivity issues.

What is Square POS Best For?

- Startup businesses who want simplicity: Square provides an intuitive platform that streamlines payment processing, inventory management, and analytics without the complexity often associated with many other POS systems.

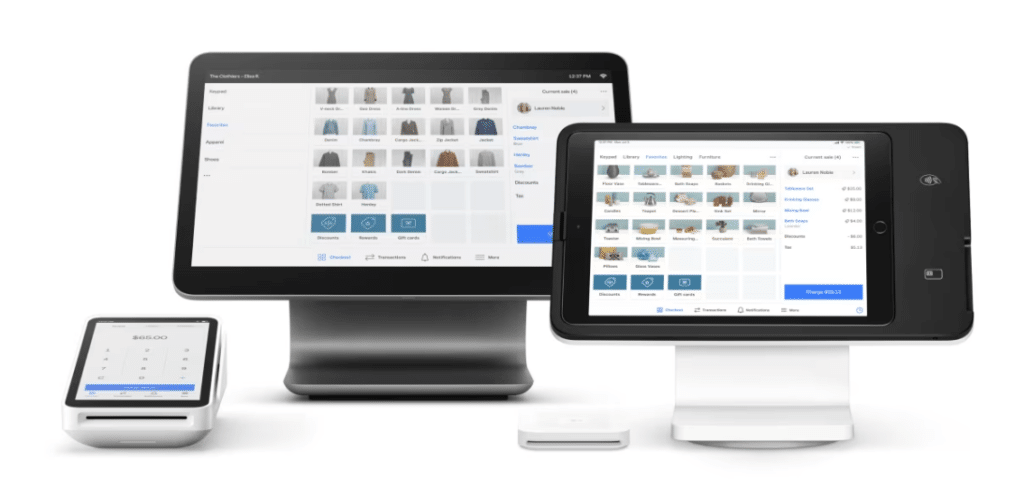

- Flexibility with mobile devices: Small-scale retailers can run Square with mobile devices like smartphones and tablets, making it ideal for on-the-go operations.

- Retailers who want integrated payments: With Square, every aspect of payment processing is built in. While this may streamline checkout processes, it restricts retailers to higher processing fees.

Square Pricing

Square POS pricing includes three main structures: Square Restaurant, Square Retail, and Square Appointments. Here’s a breakdown of each, plus more information on hardware and additional costs.

Square Restaurant

Square Restaurant offers three different pricing. Square Restaurant can also be considered one of the best POS systems for quick-service restaurants as it supports businesses like bakeries, coffee shops, food trucks, etc.

Free Plan:

- Monthly Fee: $0

- Processing Fees: 2.6% + $0.10 for in-person transactions; 2.9% + $0.30 for online transactions; 3.5% + $0.15 for manually entered transactions

- Features: Essential POS system features, including menu management, tipping support, basic reporting tools, and the ability to show servers if an item is out of stock

Plus Plan:

- Monthly Fee: $60 per location

- Processing Fees: Same as the Free plan

- Features: Advanced POS functionalities such as floor plan creation, table management, live sales reports, and kitchen display system (KDS) integration at no extra cost

Square Restaurant Essentials Bundle:

- Monthly Fee: Custom pricing generally starts at $153 and up, depending on the features and volume required

- Processing Fees: The same as the Free and Plus Plans, but 2.6% + 30 cents for online transactions

- Features: Includes all Plus Plan features with additional capabilities tailored for larger operations or those needing more advanced tools

Square POS Retail

Square for Retail differs from Square POS and offers a pricing structure that includes both free and paid plans, catering to businesses of various sizes. Here’s a detailed breakdown:

Free Plan:

- Monthly Fee: $0

- Transaction Fees: 2.6% + $0.10 per in-person transaction, 3.5% + $0.15 for manually keyed-in transactions, and 2.9% + $0.30 for online transactions

- Features: Basic inventory management, point of sale functionalities, and the ability to create a simple eCommerce site

Plus Plan:

- Monthly Fee: $89 per location

- Transaction Fees: 2.5% + $0.10 per in-person transaction, 3.5% + $0.15 for manually keyed-in transactions, and 2.9% + $0.30 for online transactions

- Features: Advanced inventory management, purchase order management, barcode printing, employee management (with Team Plus included), and reorder forecasting

Premium Plan:

- Monthly Fee: Custom pricing (for businesses processing over $250,000 annually)

- Transaction Fees: Typically 2.5% + $0.10 per in-person transaction, but may vary based on negotiated terms

- Features: Includes all Plus Plan features with additional personalized support and custom solutions

Square POS Appointment

Square Appointments offers a tiered pricing structure with three plans: Free, Plus, and Premium, each tailored to different business needs. Square Appointments is one of the best salon POS system for salon businesses, nail shops, and other similar businesses. Below is an overview of its pricing:

Free Plan:

- Cost: $0 per month

- Features: Basic scheduling, online booking site, unlimited appointments, automatic reminders, and basic reporting

- Suitable for: Single-location businesses that need essential scheduling and booking functionalities

Plus Plan:

- Cost: $29 per month per location

- Additional Features: Advanced reporting, no-show protection, multiple staff scheduling, and integration with Square Marketing for automated campaigns

- Suitable for: growing businesses that need more advanced tools to manage multiple staff and improve operational efficiency

Premium Plan:

- Cost: $69 per month per location

- Additional Features: All Plus features, resource management, custom staff commissions, advanced access permissions, and Square Shifts for comprehensive time tracking and payroll integration

- Suitable for: Larger businesses or those with multiple locations that require extensive team management and resource allocation capabilities

Square POS Hardware Costs

- Square Reader: $49 and up for contactless and chip card readers

- Square Stand: $149 or $14/mo over 12 months

- Square Terminal: $299 or $27/mo over 12 months

- Square Register: $799 or $39 per month over 24 months

You can learn more about Square hardware information here.

Additional Fees

Manually entered

- When you manually key in your customer’s card details or use a card on file, the fees increase to 3.5% + $0.15 per transaction.

Invoices

- Square charges 3.3% + $0.30 per transaction if an invoice is required.

Square POS Top Features

Feature | Details |

Cloud Based | Square is a cloud-based solution. Your data is stored offsite, and your updates will be automatic. |

Payment Processing | Square has its own built-in payment processing. It accepts various payment methods, including credit cards, debit cards, and contactless payments. |

Inventory Management | Track inventory levels, setting up low-stock alerts, and managing item variations. Square has tools for barcode labeling, generating reports, and importing product lists from spreadsheets. |

Sales Analytics | Provides insights into sales trends, customer behavior, and employee performance. Break down complicated sales data into useful information to drive marketing and merchandising decisions. |

Customer Management | Square has solid CRM capabilities for creating customer profiles, tracking purchase history, and sending personalized offers. Includes email marketing, SMS outreach, and customer loyalty. |

Employee Management | "Team Management" features help with employee permissions, tracking hours worked, and generating payroll reports. Custom-control individuals' access and permissions. |

Customizable Settings | Customization options for receipts, taxes, and discounts to fit specific business needs. Dashboard widgets are also customizable to cater to each shop. |

Offline Mode | Process transactions when the internet connection is temporarily unavailable. Payments will go through once reconnected to the internet. |

Integrations | Integrate with various third-party apps for accounting software, eCommerce platforms, and dozens more. |

Secure Transactions | Ensures secure transactions through encryption, compliance with PCI Data Security Standards, 2-step verification, and other anti-fraud measures. |

Pros of Square POS

- User-friendly interface

Square POS features an intuitive interface, facilitating quick onboarding and ease of use for staff members of all skill levels.

- Affordable pricing structure

With transparent pricing and no long-term contracts, Square POS offers cost-effective solutions suitable for businesses of all sizes, especially beneficial for startups and small businesses with limited budgets.

- Mobile compatibility

Square’s compatibility with mobile devices enables businesses to process transactions on smartphones or tablets, providing flexibility for on-the-go sales environments such as pop-up shops and events.

- Comprehensive reporting and analytics

Square POS provides adequate sales reports and analytics, empowering businesses to gain insights into their performance, track sales trends, and make informed decisions to drive growth.

- Inventory management

Square POS offers basic inventory management features, helping businesses track stock levels, manage products, and receive low-stock alerts to avoid stockouts.

- Integrated ecosystem

Square POS integrates with other business tools and services such as accounting software, payroll systems, and eCommerce. This asset enhances efficiency through automation and data synchronization across platforms.

Cons of Square POS

- Customers complain of Square withholding funds

When considering Square as a point of sale system, one of the biggest things to be aware of is its fund-holding policies. There is no traditional underwriter process, and accounts can be opened without human interaction.

Although this is beneficial in terms of efficiency and avoiding pushy salespeople, there is a risk that the first time you receive significant funds or a one-time larger payment, Square can put your money on hold until they deem it safe.

- Higher fees on sales

As mentioned, Square POS’s flat rate pricing structure can become costly as businesses scale up and grow. The system charges a higher percentage on transactions than many other payment processing solutions.

For businesses that process high volumes of transactions, these fees can add up quickly.

- Lack of customer support and service

Numerous complaints about Square’s lack of support and customer service have been made public. Square POS does not offer phone support (and only limited chat support for their basic plan), which can be a significant issue for businesses that experience technical difficulties or face unexpected disruptions like a square pos outage.

While the company does offer email support, response times can be slow, leaving businesses without a solution for hours or even days.

When comparing customer support between Square POS vs. Shopify POS or KORONA POS with their 24/7 POS support, Square’s customer service can be found lacking in comparison.

The more I learn to use KORONA POS, and with the help of awesome customer support, the more I believe this POS system could be a very good fit for many types of businesses out there. What I love the most about this software is the 24/7 customer service and reporting function which are very easy to use.

-Kevin L.

Square POS Frequently Asked Questions

Below are a few commonly asked questions regarding Square’s POS system. To learn more, visit Square’s website.

Is Square a good payment system?

Square is widely regarded as a reliable and effective payment system, offering businesses a user-friendly platform to accept various forms of payment. Its intuitive interface, seamless integration with mobile devices, and comprehensive reporting capabilities make it a popular choice among small to medium-sized businesses seeking simplicity and flexibility in managing transactions. However, businesses with complex needs or high transaction volumes may have limitations in Square’s features, processing fees, and customer support.

What is the downside of Square?

One downside of Square is its relatively limited customer support options. It primarily relies on email, online forums, and social media for assistance, which may not always provide immediate resolutions for urgent issues. Additionally, while Square offers basic inventory management features, businesses with complex needs may find these capabilities lacking compared to more specialized systems. Finally, some users have reported occasional account holds or sudden terminations by Square, highlighting potential risks for businesses reliant on the platform for payment processing.

How much does Square cost per month?

Square’s pricing varies based on the specific products and services businesses use. Square charges a flat fee per transaction for its basic payment processing service, typically around 2.6% + 10¢ for in-person transactions and 2.9% + 30¢ for online transactions. However, Square also offers additional services such as Square for Retail or Square Appointments, which may incur separate monthly subscription fees depending on the features required by the business.

Conclusion

In conclusion, Square POS is a versatile and adaptable solution for most small business retailers. Its user-friendly interface, seamless integration with eCommerce, and flexible hardware options make it a top choice for retailers and service providers.

Nonetheless, advanced features and customer support may be limited. KORONA POS is a great option for retail point of sale owners seeking a more comprehensive inventory management platform and advanced in-house technical support. Click the link below to learn more about KORONA POS and sign up for a free trial with zero obligations.