Finding the right point of sale technology for your store can be a bit overwhelming. Each vertical and individual business has different needs and requirements to optimize efficiency and competitiveness. This article will explain how to choose a POS, highlighting all the criteria retailers should consider.

Before making any decision about which company or package to go with, it’s important to investigate exactly what they offer. Many businesses consult POS resellers to get insights and recommendations based on their industry-specific needs. Here are 10 things to consider when shopping for a new POS system.

Key Takeaways:

- Selecting the right POS system is crucial for businesses aiming to boost efficiency and competitiveness.

- Each business has unique needs, so retailers must carefully assess factors like pricing, inventory management, payment processing, and customer service.

- Tailored POS solutions offer specialized features catering to specific industries, enhancing operational effectiveness.

- Modern cloud-based POS systems provide advanced analytics, seamless integrations, scalability, and more.

How Choosing the Right POS System Helps Businesses

- Tailored benefits for different verticals

Many businesses need industry-specific features like customer-facing displays for coffee shops or pre-order scheduling options for bakeries. Different types of POS setups offer tools to help cater to each business, ultimately boosting efficiency and competitiveness.

- Improved customer experience

Providing modern payment options enhances customer convenience. Integration with loyalty programs and CRM tools allows businesses to personalize interactions.

- Enhanced efficiency

The right POS system works effortlessly to streamline transactions, reducing customer wait times and allowing staff to focus more on delivering exceptional service. With features like barcode scanning and automatic inventory updates, businesses can minimize manual errors and optimize their operations.

- Accurate inventory management

Accurately tracking stock levels and sales data in real-time helps businesses prevent stockouts, reduce overstocking, and optimize purchasing decisions.

- Better decision-making

Advanced reporting and analytics capabilities offered by modern POS systems provide valuable insights into sales trends, customer preferences, and operational performance.

- Tighter security

A robust POS system with built-in security features such as encryption and user authentication protects sensitive customer data and prevents unauthorized access or fraudulent transactions.

- Streamlined scalability and integration

Businesses need operational scalability, whether that means expanding to new locations or adding new products and services. Integration with other business tools, such as accounting software and marketing automation, ensures seamless data flow.

Choosing a POS System: Key Features to Consider

Point of sale systems are integral for modern businesses, offering a myriad of features to streamline transactions, manage inventory, and enhance customer experiences. Here are some essential functionalities that empower businesses across industries, from inventory tracking and reporting to payment processing and customer relationship management.

1. Powerful inventory management

A great point of sale system will offer built-in inventory management to ensure you always know exactly what stock levels you have across all products. From the moment you receive your stock from your suppliers, you should be able to input inventory data into your system via mobile app, point of sale, or back office.

Even if you have large format spreadsheets from your wholesalers, make sure you can import vendor lists in any format.

Once those products are entered into your system, the inventory management system will track their location and counts via perpetual inventory. This omnichannel format keeps track of sales and returns through all channels, including any eCommerce channels, so you can be notified when you need to reorder specific items.

Too many products to deal with? No problem, KORONA POS offers an automated predictive reordering system, so you don’t have to worry about stockouts.

Ready to take your business to the next level?

Boost store performance and improve sales with the advanced features and tools KORONA POS offers.

2. Specialized hardware

Most businesses will need receipt printers, some kind of scanner, a touchscreen display, and a cash drawer. However, some more specialized POS hardware caters to different types of businesses.

Many retailers and verticals have unique needs, influencing their choice of POS hardware. For instance, a small boutique might prioritize compact mobile terminals (mPOS) for flexibility during peak times. On the other hand, a furniture store will probably prefer a remote barcode scanner to ring up cumbersome items. Others, like a museum or theme park, are likely to require a POS system with self-checkout or ticketing kiosks.

Ultimately, the selection of POS hardware hinges on factors like business size, industry regulations, and specific operational requirements.

3. Intuitive eCommerce integration

Options like buy now pick up later, and curbside pick-up, have become increasingly popular. Opening up as many channels as possible to increase your sales is a clear benefit for any retailer. Consequently, it’s imperative to pair a synchronized eCommerce platform with your point of sale.

Omnichannel retail means that your POS data will be fed with all of the data from your eCommerce sales. It also means your inventory levels will be automatically updated across all channels in real-time.

KORONA POS offers custom eCommerce solutions for retailers. The integration offers businesses complete websites with no need for developers.

4. Real-time remote access

Legacy point of sale systems that require large hardware devices to store data in-house are a thing of the past. With the bandwidth capabilities and the vast array of web applications and software services now available, retail POS systems are now cloud-based. Therefore, before you choose a point of sale provider, make sure that you can access and monitor all of your retail sales data remotely.

With KORONA POS, you can access all of your back-end software to monitor your brick-and-mortar locations from the comfort of your home or while on-the-go. If you run more than one retail location, you can easily keep track of all activities across multiple stores, allowing you to react to any situations that need to be addressed quickly.

5. Scalability

One of the advantages of cloud-based systems is that they are meant to encourage scalability and serve multi-location businesses. Essentially, all you have to do as a business owner is quickly set up your hardware and log into your system. Then, any products from different locations will be automatically compiled on a single dashboard.

KORONA POS is fully scalable, offering multi-location inventory management and promotional discounts that, depending on your needs, can be catered to specific stores and regions or applied to every location. Similarly, the system can automatically generate dozens of unique reports, allowing you to make more informed decisions for your business.

6. Hands-on emergency support

Many point of sale providers purport to offer 24/7 technical support. But often, that means email correspondence only, long hold times, or extra fees. A great software provider should provide hands-on assistance whenever their customers need it.

Ensure that this support is included in your monthly SaaS subscription. The support team at KORONA POS is always there to answer the phone and offer in-house customer service.

All KORONA POS support staff have extensive experience and working knowledge to help troubleshoot or explain any hiccups you run into, whether you are setting up, trying to generate reports, to having trouble completing a payment.

7. Integrations for CRM and loyalty

Software integration is a huge aspect of a modern-day POS. Choosing a system that works seamlessly with all additional applications makes running your business operations much easier.

For retailers, a points-based loyalty program is the most important. It’s no great secret that acquiring customers is one of the biggest challenges in the retail industry. Hence, making the most of your current clientele will increase your sales.

KORONA POS integrates with many CRM and loyalty programs across different sectors, including bLoyal, Astro Loyalty, Bottlecapps, and springbig. Utilize your sales data to tailor your marketing to specific clientele and keep your customers returning.

8. Straightforward costs and automatic updates

Writing a budget and including it in your business plan is hard work. Underestimating your costs due to hidden fees and confusing language can reduce your bottom line in the long run. Try to get a realistic quote for monthly or annual POS costs.

Most companies will offer tiered pricing plans. These plans vary based on the size of your business, amount of locations, integrations, tracking, and more. Take time to compare all available options on the market depending on what your business demands.

Modern points of sale operate on a software–as-a-service model (SaaS). This means you pay monthly fees to the provider, and they take care of all of the rest.

A cloud-based point of sale like KORONA POS automatically updates when your retail location is closed overnight. These updates mean that your point of sale software is always up-to-date with the latest security, payment processing, sales reporting, and other features.

9. Competitive credit card processing

Your credit card processing decision is quietly one of the most important. Credit card processing fees, though a small percentage of the overall sale, can be a huge amount at the end of each year. And one that offers 2.25% instead of 2.75% can save a retailer tens of thousands of dollars.

Remember that you can shop around for the best rates. Beware of POS companies that are also payment processors. These solutions will lock your business into higher rates, even though they may offer a free tablet or no monthly software licensing fees.

KORONA POS is credit card agnostic. This means that if you are an established retail business with a great payment processor, you can keep that relationship going. Our tech support team will ensure your credit card processing setup works seamlessly with our software.

Learn more about how credit card processing works and save your business money in this free eGuide.

10. Reporting and analytics

A powerful POS comes with built-in analytics and reporting capabilities. These include inventory tools like ABC analysis to show what products are doing the best and which are struggling. KORONA POS offers a fully customizable KPI dashboard so that you can choose which indicators you want to monitor for your business.

In addition, end-of-day reports include information about every action employees took during that business day. The ability to review these employee actions helps reveal irregularities regarding cash reconciliation or misuse of voids.

These tools illuminate performance levels in all aspects of your business, acting as an ongoing self-audit system driven by actionable data and in-depth analyses.

Get a complete picture of your sales data.

Speak with a product specialist and learn how KORONA POS can power your business needs.

Tips On How To Align Your POS Selection With Your Business Needs

Consider factors such as industry-specific requirements, integration capabilities for verticals, and real-life evidence of POS client support through online reviews. Tailor your choice to match operational demands, ensuring seamless transactions and efficient management of inventory, sales, and customer interactions.

Tip #1: Choose a cloud-based solution

Choose a POS system that operates in the cloud for enhanced flexibility and accessibility. The best cloud-based POS solutions offer real-time data access from anywhere with an internet connection, enabling remote management and scalability.

They also typically entail lower upfront costs and automatic software updates, reducing the burden of maintenance. This ensures your business stays agile and can adapt to evolving technology, integrations, and security patches.

Tip #2: Ask your POS sales rep specific questions

Prepare specific queries about day-to-day real retail situations. Seek clarification on how the system handles unique processes you may want or need, such as inventory management, order fulfillment, or customer loyalty programs.

Addressing these specifics, you’ll gain insights into the system’s suitability for your business. If the provider has current clients in your vertical that are successfully using the system, these answers should be easy and straightforward. And always inquire about customer support. Excellent customer service is a critical aspect of any great point of sale solution.

Tip #3: Take advantage of free trials

Before committing to a new POS system, use any free trial offers to evaluate its compatibility with your business operations. Use this opportunity to test key features, such as transaction processing and reporting.

Engage your staff in the trial process to gather feedback on usability and functionality. Ensure the selected POS solution aligns seamlessly with your business needs and workflow requirements.

Tip #4: See how supportive the support actually is

Reach out with queries or concerns during the trial period. Evaluate the responsiveness and effectiveness of customer support services offered.

Do they actually pick up the phone? Respond to emails? Consider factors like availability, response time, and quality of assistance provided.

A supportive support team can make all the difference in resolving issues promptly and ensuring the smooth operation of your software. You don’t want to run into a problem on a busy shopping day and be unable to process transactions.

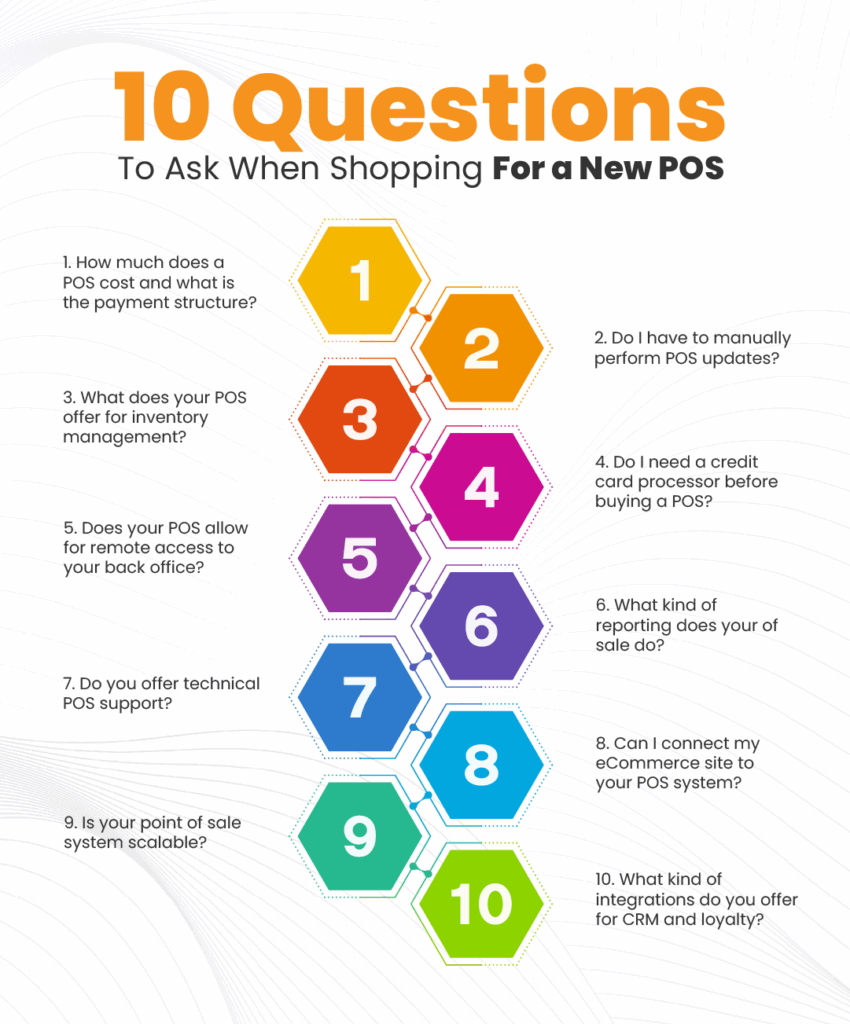

Recap: Questions To Ask Yourself Before Choosing A POS

- How much does a POS cost, and what is the payment structure?

- Do I have to manually perform POS updates?

- What does your POS offer for inventory management?

- Do I need a credit card processor before buying a POS?

- Does your POS allow for remote access to your back office?

- What kind of reporting does your point of sale do?

- Do you offer technical POS support?

- Can I connect my eCommerce site to your POS system?

- Is your point of sale system scalable?

- What kind of integrations do you offer for CRM and loyalty?

How Will KORONA POS Meet Your Expectations?

KORONA POS has been built to cater to many retailer verticals. The cost is simple and transparent, and the product is second to none. With the fastest and most reliable cloud-based point of sale in the industry, KORONA POS offers an excellent product and service for all brick-and-mortar retailers.

The software includes all of the best integrations across various retail industries with fully customizable workflows and key performance indicators. Best of all, we are credit card agnostic, meaning you can choose whichever credit card processor makes the most sense for you.

Finally, KORONA POS comes with the best customer support in the business. When you call, our in-house technicians answer. Every time.

Ready to take your business to the next level?

Boost store performance and improve sales with the advanced features and tools KORONA POS offers.

FAQs

- What makes a good point of sale system?

A good point of sale (POS) system should offer an intuitive user interface and easy navigation to streamline transactions, reducing checkout times and improving customer satisfaction. It should also integrate seamlessly with other platforms, such as inventory management and accounting software.

Lastly, reliability and security are paramount, ensuring that transactions are processed safely and without interruption, safeguarding customer data and business operations.

- What are the biggest benefits a point of sale system can provide?

POS systems can significantly enhance operational efficiency by automating tasks like inventory management, sales tracking, and reporting, ultimately saving time and reducing errors. They also enable businesses to gain valuable insights into customer behavior and preferences through data analytics, empowering informed decision-making and targeted marketing strategies with a POS system.

Moreover, a POS system enhances the overall customer experience by expediting transactions, facilitating various payment options, and maintaining accurate records for smoother interactions.

- How to choose a POS system for a small business?

When selecting a POS system for a small business, consider factors such as ease of use, affordability, and scalability to accommodate future growth. Look for features tailored to your specific industry needs, such as inventory management, eCommerce integration, or loyalty programs. For example, a vape shop POS system, will likely use differing features than a bakery POS. Additionally, ensure the chosen system offers reliable customer support and flexible payment processor options.

Final Thoughts

In summary, choosing the right point of sale is vital for businesses that want to succeed amongst the competition. Remember, different industries have different needs, so retailers must look closely at things like cost, inventory management, credit card processing, and technical support.

Modern POS systems provide tools to improve decision-making and enhance customer experiences. By aligning POS selection with business needs, retailers can maximize productivity and drive sustainable growth.

KORONA POS is the answer to your question. Our platform provides retailers with all of the best tools for modern commerce, whether you’re looking for a POS with franchise and multi-location support, or a POS for a hobby store. Click the link below to learn more about our software solution!