Product

Best For

Price

Processing Fees

Key Features

Best for:

High-risk retail, like liquor, CBD, tobacco stores, and dispensaries

Price:

From $59/month

Processing Fees:

None

Key Feature:

Payment processing agnostic and reliable customer support

Best for:

Matrix-sized businesses

Price:

From $44/month

Processing Fees:

Yes

Key Feature:

Integrates with hundreds of third-party applications

Best for:

Small businesses and restaurants

Price:

From $0/month

Processing Fees:

Yes

Key Feature:

Has the basics, easy to use, and set up

Best for:

Service-based businesses like salons and spas

Price:

From $14.95/ month

Processing Fees:

Yes

Key Feature:

Offers a variety of hardware configurations

Best for:

eCommerce retailers

Price:

From $29/month

Processing Fees:

Yes

Key Feature:

Omnichannel capabilities to sell in-store and online

Lightspeed POS is a point of sale solution that offers robust features and caters to different businesses like retail stores and restaurants. However, Lightspeed POS is also known for its high cost, often requiring specific hardware that adds to expenses and creates a noticeable learning curve for users.

Additionally, Lightspeed’s customization options are limited compared to other POS systems, and some users have expressed concerns about the responsiveness of its customer support.

Fortunately, there are several alternatives to Lightspeed POS that not only address these pain points but also offer similar functionality at more accessible price points.

We will explore five top alternatives to Lightspeed POS for retail businesses: KORONA POS, Epos Now, Square POS, Clover, and Shopify POS.

1. KORONA POS: Best Lightspeed Alternative for High-Risk Retail Store

KORONA POS overview

KORONA POS is the best alternative to Lightspeed Retail, especially if you own a high-risk retail store like a liquor store, convenience store, CBD, winery, vape and smoke shop.

KORONA POS is also ideal for thrift stores, quick-service restaurants, gift shops, and more. Moreover, it can integrate with any major payment processing solution.

Pros

- Excellent customer support

- ID customer verification

- Multi-store capacities

Cons

- Learning curve

- No fuel integration

Pricing

Core

$59/mo

- Various reporting

- Unlimited users

- Customizable dashboard

Freedom

$69/mo

- Stock management

- Barcode automation

- Price and shelf labels

Adds-on

From $10 to $50/mo

- KORONA integration

- KORONA Plus

- KORONA Invoicing

Key Features

- Smooth inventory management: KORONA POS simplifies inventory management with a robust set of tools to handle SKUs, categories, brands, promotions, and more. The system offers low-stock alerts and easy inventory transfers between locations or warehouses. While most POS systems provide minimum and maximum product levels, KORONA POS takes it further; it automatically sets these levels based on your sales data and ordering patterns. This capability is a game-changer for businesses with large product ranges, saving time and allowing you to focus on other crucial aspects of your operations.

- Streamlined checkout and payment: The intuitive interface of KORONA POS improves the retail checkout counter, making it fast and efficient. The software also supports EMV chip cards and NFC payments like Apple Pay and Google Pay. KORONA POS even incorporates RFID technology to speed up the scanning of multiple items, setting it apart in the market for its advanced capabilities at the point of sale itself. KORONA POS offers integrated payment solutions with any major credit card processor. Lightspeed, on the other hand, charges its users a premium on monthly subscription fees if they opt out of using their processing. Here are some of the benefits of using KORONA POS with a third-party payment processor:

- Lower processing fees: Businesses can often get lower processing fees than if they were locked into a contract with the POS company by choosing their payment processor.

- More flexible payment options: Businesses can offer a wider variety of payment options to their customers.

- Better customer experience: Customers appreciate the option to pay with their preferred payment method, which can increase sales.

Are payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

- Customer loyalty programs and promotions: KORONA POS isn’t just about making your business operation easier; it’s also about enhancing the customer experience. With benefits like customer loyalty programs, gift cards, and coupon redemptions, you can keep your customers coming back for more. The system also allows you to create and manage intricate discounts and promotions effortlessly.

- Comprehensive reporting and analytics: Data-driven decision-making is crucial in today’s competitive retail landscape. KORONA POS offers advanced reporting features that allow you to track sales trends, popular brands, and customer behavior. This invaluable insight helps businesses make informed decisions to boost their profits.

- Unrivaled customer support: Customer service is a cornerstone of KORONA POS. It offers round-the-clock support through phone, email, and chat. It also provides an online knowledge base, free software updates, and optional on-site training, ensuring you’re never left in the dark. You can also experience the seamless efficiency of KORONA POS with dedicated product specialists throughout onboarding. Experts will not only guide you through the installation and deployment of all essential features but also promptly resolve any concerns you may encounter, ensuring a smooth and productive transition to the system.

- Third-Party integrations: KORONA POS’s ecosystem includes numerous third-party integrations, allowing businesses to connect their POS system with other software and services they use, such as accounting software or payroll services. This flexibility enhances the system’s functionality and adaptability to specific business needs. Some third-party integrations with KORONA POS include various eCommerce partners, loyalty solutions, accounting software, time tracking, and more.

Pros

- Strong inventory management: For high-risk retailers dealing with controlled substances or age-restricted items, robust inventory tracking is vital. KORONA POS offers features like inventory control, count tools, and the ability to restrict access to specific items, potentially reducing shrinkage and improving compliance.

Learn how to manage your inventory effectively with this free eGuide.

- Flexibility in payment processing: Unlike some POS systems, KORONA POS isn’t tied to a specific payment processor. High-risk merchants may find this flexibility beneficial as they might have limitations on traditional processors. You can choose a processor that caters to your industry and offers competitive rates.

- 24/7 customer support: Having reliable customer service is important for any business, but even more so for high-risk retailers who might encounter specific issues. KORONA POS offers 24/7 support, providing a safety net for troubleshooting and resolving problems quickly.

Cons

- Weak mobile POS: KORONA POS might not be the best mobile option for retailers. Reviews suggest it might be a secondary feature compared to their traditional POS terminals. This could be a drawback if you require staff to use the system for tasks like tableside ordering or mobile checkout.

- Learning Curve: On the learning curve front, KORONA POS is generally praised for being user-friendly. However, if your business has complex operations or requires in-depth reporting functionalities, there might still be a learning curve for those aspects of the system.

KORONA POS Pricing

KORONA POS’s pricing offers a tiered pricing structure with a flat monthly fee per terminal, with no contracts and no hidden charges. Here’s a breakdown:

Base Plans:

- KORONA Core: This starts at $59 per month per terminal. It provides basic POS functionalities like processing sales, managing inventory, and customer receipts.

- KORONA Retail: Priced at $69 per month per terminal, this plan builds on Core features with features like employee management, loyalty programs, and reporting tools. It includes everything in Advanced, plus features like gift cards, age verification, and advanced inventory controls.

Optional Add-on Modules:

KORONA offers industry-specific modules that add functionalities on top of the base plans. These modules typically range from $10 to $50 per month per terminal. Here are some examples:

- KORONA Food: Ideal for restaurants and cafes, this module adds table service features for an extra $10 per month per terminal.

- KORONA Invoicing: Enables sending invoices for $10 extra per month per terminal.

- KORONA Ticketing: This module is suited for amusement parks and similar businesses, priced at $50 per gate per month. It allows managing admissions, memberships, and online ticketing.

- KORONA Franchise: For managing franchises, this module costs $30 extra per franchise location per month.

- KORONA Integration: This allows integrating KORONA with other business applications for an additional $45 per token per month.

Additional Points:

- KORONA POS offers a free trial to try out the software before committing.

- Hardware costs are separate and depend on your chosen devices (tablets, desktops, etc.)

- KORONA emphasizes that their pricing is transparent and has no surprise fees.

KORONA POS is processing-agnostic, meaning the POS can integrate with any major payment processing solution you choose. It also provides POS hardware from tablets, receipt printers, credit card readers, terminals & cash drawers.

Ready to take your business to the next level?

Boost store performance and improve sales with the advanced features and tools KORONA POS offers.

2. Epos Now: Best Lightspeed Alternatives For Matrix-Sized Store

EPOS NOW Overview

Launched over a decade ago, it boasts a cloud-based system for easy access and management from any device. It is another Lightspeed alternative that caters to a wide range of businesses, including retail, hospitality, and service industries.

Epos Now features hundreds of integrations. From staff and inventory management to delivery services, these integrations enable you to build a workflow that aligns perfectly with your business operations. Below are some of the benefits of using Epos Now.

Pros

- Inventory management

- Great reporting features

- Ideal for spas and some service-based business

Cons

- Locked in contracts

- High transaction fees

- Hardware dependence

- Limited customization

Pricing

Complete system

A one-time cost of $999

- Touchscreen POS terminal

- Cash drawer

- Receipt printer

Tablet system

$599 one-time cost

- iPad or Samsung Galaxy

- Tablet

- Stand

Handheld system pricing

$0 down and $44 monthly

- Mobile ordering

- Complete support

Key Features

- Run with different operating systems: One of the standout features of Epos Now is its cross-platform compatibility. The software works seamlessly across Windows, iOS, and Android operating systems, allowing you to use any compatible device to run your business. If you’ve already invested in hardware, you can easily integrate it with Epos Now’s system.

- Cloud-based POS: Epos Now operates on cloud-based software, ensuring that all critical business data is stored securely in off-site servers. This frees up space in your physical location and adds an extra layer of security against hackers and accidental data loss. The cloud also facilitates access to all major business operations, even when you’re not physically in your stores.

- Simplified payments: Epos Now acts as a payment processing system through its in-house service, Epos Now Payments. Its straightforward pricing model sets it apart, with one flat transaction rate and no long-term contracts. It offers chip-and-pin, contactless, and remote payments and accepts all major payment types. All Epos Now payment terminals are PCI compliant by default through their innovative encryption technology. Their terminals are EMV compliant and support Apple Pay and Google Pay. This transparency eliminates the risk of unexpected charges, offering peace of mind to business owners.

- Comprehensive hardware solutions: Both Epos Now Standard Package and Complete Solution come with a touchscreen, cash drawer, card machine, and receipt printer—all for a $0 upfront cost and a small subscription fee. You also have the option to add extra accessories like barcode scanners and additional card machines, allowing you to customize your setup further.

Pros

- Robust integration capacities: Integrating Epos with existing accounting or inventory management systems is a breeze. The software integrates with hundreds of third-party applications.

- Enhanced inventory management: Epos goes beyond stock tracking. Inventory control features can predict demand, optimize ordering, and minimize stockouts. Imagine receiving automatic alerts when supplies dwindle, allowing you to maintain optimal stock levels and avoid lost sales.

Cons

- Poor setup and technical support: According to some customer reviews, Epos Now has extremely poor customer service, technical incompetence, lack of accountability, and disregard for the customer’s time and business operations.

- Reliance on Technology: Epos systems depend on internet connectivity and software updates. Downtime due to technical issues can disrupt operations. Other alternatives to Epos Now may have more consistent and stable operating systems.

Epos Now Pricing

Epos Now’s pricing structure isn’t entirely transparent on their website. Here’s a breakdown of what we know:

Software Pricing

- Epos Now doesn’t explicitly list software pricing on its website.

- Some reviews and comparisons suggest there might be tiered software plans, but details are scarce.

- It’s best to contact Epos Now sales for a quote on the software plan that fits your business needs.

Hardware Bundles

Epos Now offers two main hardware options:

- Complete system: This starts at a one-time cost of $999 or a monthly fee of $72 for three years. It includes a touchscreen POS terminal, cash drawer, receipt printer, and access to their software.

- Tablet system: This starts at $599 and comes with an iPad or Samsung Galaxy tablet, stand, cash drawer, receipt printer, and the first month of software access.

- Handheld system pricing: Epos Now offers a handheld system, the Epos Pocket, for taking orders on the go. The company provides two plans for the Epos Pocket: Plan One, which requires $0 upfront and $44 per month, and Plan Two, which entails an upfront payment of $189 plus $24 per month.

Payment Processing

- Epos Now offers its own payment processing service, Epos Now Payments, with a low fixed transaction rate (specific rates not advertised on the website).

- You can also choose to integrate with other major payment processors.

Additional Considerations

- Epos Now offers a free 30-day trial for their software.

- There might be potential discounts available, so inquire with their sales team.

- While Epos Now provides hardware bundles, the cost of additional hardware, like barcode scanners, may not be included.

Here’s what to do to get a full picture of Epos Now’s pricing:

- Contact their sales team directly for a quote on the software plan and any hardware you need.

- Inquire about potential discounts or promotions.

- Factor in the cost of payment processing fees (Epos Now Payments or your chosen provider).

- Consider any additional hardware you might need and its cost.

3. Square POS: Best Lightspeed Alternatives For Restaurants

SQUARE POS overview

Square POS, created in 2009, offers a free POS solution for businesses to take payments and manage sales. It’s particularly popular with startups and smaller businesses due to its user-friendly interface and flexible options.

Square POS has become a viable alternative to Lightspeed POS for many merchants. Here are some benefits and cons that make Square POS a popular Lightspeed alternative.

Pros

- Free to use (Basically)

- Flexible payment methods

- Great integration features

Cons

- Not ideal for complex and retail businesses

- Poor customer support

- Not ideal for businesses with high sales volume

- Insufficient reporting metrics

Pricing

Square Free

$0

- POS app and payments

- Website builder with SEO tools

- Courses

- Item library

Square Plus

$49/mo

- Staff management

- Expanded site customization

- Loyalty rewards program

Square Premium

$149/mo

- Advanced reporting

- No gift card load fees

- 24/7 phone support

Key Features

- Ease of use: Square is known for its intuitive and user-friendly interface. Setting up the system, adding products, and processing transactions can be done with minimal training. This ease of use can save businesses time and reduce the learning curve for employees.

- Hardware options: Square POS offers a range of compatible hardware options, from basic mobile card readers to more advanced countertop terminals. This flexibility allows businesses to choose the hardware that best suits their needs, whether for a brick-and-mortar store, pop-up shop, or mobile business.

- Inventory management: Square POS provides robust inventory management tools that allow businesses to track stock levels, set up low-stock alerts, and easily add new products. This feature helps businesses optimize inventory, reduce overstocking or understocking, and make data-driven decisions.

- Multi-location support: Square offers multi-location support, making it suitable for businesses with multiple stores or locations. Users can manage inventory, sales, and employee permissions across different sites from a centralized dashboard. Square is more budget-friendly compared to Lightspeed, with affordable multi-location support.

- Payment flexibility: Square POS supports a variety of payment methods, including credit and debit cards, mobile payments (such as Apple Pay and Google Pay), and even digital gift cards. This versatility ensures that businesses can accommodate a wide range of customer preferences.

- Customizable reporting: Square provides detailed sales reports and analytics that help businesses gain insights into their performance. Merchants can track sales trends, identify top-selling products, and monitor employee performance. Lightspeed offers similar reporting capabilities, but Square’s simplicity and ease of use may make it more accessible to a broader range of users.

- eCommerce integration: Square seamlessly integrates with the Square Online Store, enabling businesses to sell products online. This feature can be especially beneficial for businesses looking to expand their online presence and reach a broader customer base. Lightspeed also offers eCommerce capabilities but may require a separate subscription for its eCommerce platform.

- Customer engagement tools: Square offers tools to engage with customers, such as email marketing and customer feedback collection. These features can help businesses build and maintain customer relationships, driving repeat business and loyalty. While Lightspeed POS has its own set of strengths and may be better suited for certain industries or larger enterprises, Square POS stands out as a cost-effective and user-friendly alternative with a broad range of features that cater to the needs of many businesses, particularly smaller and growing establishments. Ultimately, the choice between Square POS and Lightspeed POS should be based on each business’s specific requirements and priorities.

Pros

- All-in-one system: Square offers a suite of features beyond just processing payments, including inventory management, employee management, and reporting tools.

- Easy to use and set up: Square is known for its user-friendly interface, making it a great option for restaurants with little technical experience. According to some customers, the software is also easy to set up. Even staff with minimal training can quickly get up to speed on taking orders and processing payments.

Cons

- Not ideal for complex orders: Square’s interface might not be ideal for restaurants with complex menus or customization options. Taking orders for large parties or split checks could be cumbersome.

- Limited processing options: Square only offers its own payment processing, so you can’t shop around for potentially better rates from other processors.

- Customer support: Free-tier users have limited access to customer support, which can be frustrating if you encounter problems. Even paid tiers may not offer 24/7 support.

Square POS Pricing

Square POS For Restaurant

Free Plan: This is ideal for day-to-day service and operations.

- Ideal for basic needs

- No monthly fees

- Includes basic features like:

- Point of sale app

- Inventory management

- Sales reporting

Plus Plan ($60 per month, plus processing fees):

- Ideal for growing restaurants that need more features.

- Includes everything in the Free Plan, plus:

- Course management for tracking meal components

- Live sales reporting for real-time insights

- Team management for assigning roles and permissions

- Loyalty programs to reward repeat customers

- Integrations with third-party apps for deliveries, accounting, etc.

Square Restaurant Essentials Bundle ( $153/month plus processing fees):

- Designed for high-volume restaurants with specific needs

- Requires contacting Square for a personalized quote

- Offers:

- Potentially lower processing fees based on transaction volume

- Advanced features tailored to your business

- Dedicated account manager for ongoing support

Additional Considerations:

- Square also charges for optional hardware like:

- Point-of-sale stands

- Receipt printers

- Kitchen Display Systems (KDS)

- Processing fees may vary slightly depending on your location

Square charges a premium for processing for all plans. This starts at 2.6% plus $0.10 per transaction for typical card swipes or dips. If you manually input card numbers, it’s 3.5% plus $0.15 per transaction. Square Plus costs $60 per month per location, with an extra $40 per month for each additional device. Transaction fees get reduced to 2.5% plus 10¢ for in-person sales and 2.9% plus 30¢ for online sales. Keep in mind that these rates can vary based on certain factors. If your business processes a substantial volume of payments, you may qualify for lower rates.

Square POS for Retail

Offers two main pricing structures: a free plan and a paid plan called Square for Retail Plus. Here’s a breakdown of each:

Free:

- Ideal for businesses just starting out or with low transaction volume

- No monthly fees

- Includes basic features like point of sale app, online store builder, and inventory management tools.

- You’ll pay per transaction:

- 2.6% + 10 cents for in-person swiped, dipped, or tapped payments (credit and debit cards)

- 2.9% + 30 cents for online transactions and keyed-in or card-on-file invoices

- 3.5% + 15 cents when you manually key in your customer’s card details, use a card on file or send a payment link with Square Virtual Terminal

Plus:

- Costs $89 per month per location.

- Offers a 30-day free trial.

- Includes all features of the free plan, plus additional benefits like:

- Reduced transaction fees: 2.5% + 10 cents for in-person transactions.

- Advanced inventory management tools like bulk item adding and forecasting.

- Employee management features.

- In-depth sales and customer reports.

Premium

This plan is designed for established businesses. You’ll get a customized plan that helps you scale, fits your exact needs, and includes one-on-one onboarding support.

Square Appointments

Offers three different pricing tiers to cater to businesses of various sizes:

Free:

- Ideal for solopreneurs or businesses with just one staff member.

- No monthly fees.

- Covers the appointment scheduling basics: online booking, appointment management, and basic client communication tools.

- Processing fees apply per transaction:

- 2.6% + 10 cents for in-person payments (swiped, dipped, or tapped).

- 2.9% + 30 cents for online payments and keyed-in transactions.

Plus:

- Cost-effective option for growing teams with multiple staff members.

- $29 per month, per location.

- Includes everything in the Free Plan, along with additional features like:

- Team scheduling and management.

- Group bookings and client packages.

- Automated appointment reminders and confirmations.

- Client communication via text messages.

Premium:

- Designed for businesses with complex booking needs and large teams.

- $69 per month, per location.

- Encompasses all features of the Plus Plan, plus advanced functionalities like:

- Deposit management for appointments.

- Custom intake forms and questionnaires.

- Waitlist management.

- Advanced reporting and analytics.

4. Clover: Best Lightspeed Alternatives For Service-based Businesses

CLOVER overview

Clover, created by Clover Network, is a feature-rich POS system aiming to be a one-stop shop for businesses. It caters to a wide range of industries, from retail stores to restaurants and service providers.

It’s especially the best lightspeed alternative for service-based business. Some of the businesses Clover caters to include hair salons, plumbers, florists, etc.

Pros

- User-friendly interface

- Offline mode

- Robust hardware options

Cons

- Costly hardware

- App costs can add up

- Limited customization

Pricing

Professional services

$14.95-$125/mo for 36 months

- Accept payments and run your business with a compact 8″ countertop POS

Personal Services

$50-135/mo for 36 months

- Offers a paired 14″ touchscreen terminal and 8″ customer‑facing display

Home/Field Services

$14.95–$50/mo for 36 months

- Businesses can extend their reach with a handheld device on top of 14″ and 8″ countertop displays

Key Features

- Flexible hardware: Clover offers a variety of hardware configurations to suit different business needs. Options include a mobile POS tablet, desktop terminals, cash drawers, receipt printers, bar code scanners, and more.

- Robust POS software: Clover software allows businesses to accept various payment types, manage inventory, view sales reports and analytics, manage employees, and customize receipts. Key capabilities include order management, loyalty programs, and integration with accounting software.

- Cloud-based system: Clover utilizes cloud technology so the system can be accessed anywhere with an internet connection. This allows for remote management, reduced hardware costs, automatic updates, and lower risk of data loss.

- Business management tools: Beyond the basics of ringing up sales and accepting payments, Clover provides additional features to manage the business. Examples include employee time tracking for payroll management, customer databases, marketing tools, and accounting software integrations.

- Scalable for growth: Clover is designed to grow with a business. The system can handle complex menus and inventory needs for a large restaurant or accommodate the simplicity of a small retail shop. Clover also offers advanced capabilities for businesses with multiple locations.

- Payment flexibility: Clover POS accepts a wide range of payment methods, including credit/debit cards, mobile payments, and cash, thereby offering customers multiple payment options.

Pros

- User-friendly: Clover runs on Android, making it familiar and easy for most staff to learn and minimizing training time.

- Hardware options: Clover offers a variety of POS hardware devices to suit your business needs, from sleek countertop stations to mobile minis for on-the-go sales.

Cons

- Vendor lock-in: Clover hardware is locked to the processor from which you purchase it. If you switch providers, you’ll likely need new hardware, adding another layer of cost.

- eCommerce limitations: While Clover offers online ordering, its features are less robust than those of dedicated eCommerce platforms like Shopify.

Clover Pricing

Clover POS offers tiered pricing for service-based businesses, which includes professional services, personal services, and home and field services. On top of the monthly fee, you’ll also pay per transaction. Clover uses a tiered pricing model for transactions, with separate rates depending on whether the card is swiped or keyed in and your subscription plan. Here’s a breakdown of the costs:

Professional Services :

- STARTER: $0+ $14.95/mo $14.95 per month

- STANDARD: $50/mo for 36 months or $599+ $14.95/mo

- ADVANCED: $125/for 36 mo or $1,699+ $49.95/mo;

Personal Services:

- STARTER PLAN: $50/mo or 36 months or $599+ $14.95/mo

- STANDARD: $95/mo or 36 months or $799+ $49.95/mo

- ADVANCED: $135/mo for 36 months or $1,799+ $49.95/mo

Home/Field Services:

- STARTER PLAN: $0+ $14.95/mo

- STANDARD: $49+ $14.95/mo

- ADVANCED: $50/mo for 36 months or $599+ $14.95/mo

Transaction Processing Fees:

Clover charges per-swipe fees for credit and debit card transactions. For the starter pricing plan, Clover will charge you for card-present transactions 2.6% + 10¢ and 2.3% + 10¢ for the standard and advanced plans. For keyed‑in transactions on all plans, Clover charges 3.5% + 10¢.

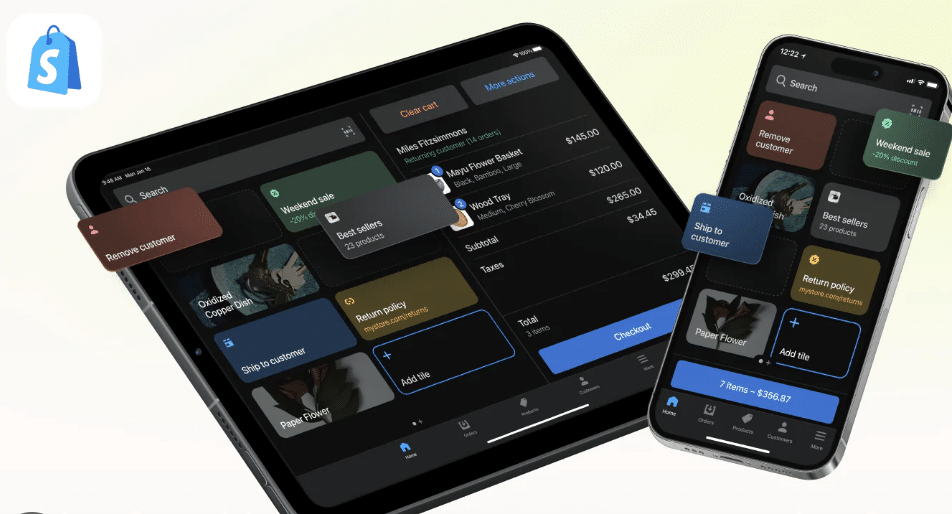

5. Shopify POS: Best Lightspeed Alternatives For Online Retail Businesses

shopify POS overview

Shopify POS is a cloud-based point of sale system designed for online retail businesses of all sizes. It offers many features that help businesses manage inventory, accept payments, and track sales. Shopify POS is also integrated with Shopify’s eCommerce platform, meaning businesses can sell in-store and online.

Pros

- Seamless omnichannel integration

- Robust inventory management

- Robust customer management features

Cons

- Short trial period

- Advanced features cost more

- Dependence on internet

- Can be expensive for businesses with low sales volume

- eCommerce focus

Pricing

Basic

$19/mo

- For “solo entrepreneurs”

- Shipping discounts

- 24/7 support

Shopify

$54/mo

- For “small teams”

- Additional staff logins

- Lower processing rates

Advanced

$299/mo

- For scaling a business

- Custom reporting

- Enhanced support

Plus

$2300/mo

- For “more complex businesses”

- Unlimited staff accounts

- Customizable checkout

Key Features

- User-friendly interface: One of the most striking features of Shopify POS is its user-friendly interface. Unlike other systems that require a steep learning curve, Shopify POS is designed to be intuitive. This means your staff can get up to speed quickly, reducing training time and costs.

- Scalability: Shopify POS is built to grow your business. Whether you are a small retailer with a single store or a large enterprise with multiple locations, Shopify POS can scale to meet your needs. This flexibility makes it a long-term solution, unlike other systems that may require a complete overhaul as your business expands.

- Inventory management: Effective inventory management is crucial for any retail business, and Shopify POS excels in this area. The system allows for real-time inventory tracking, automated reordering, and seamless integration with your online store if you have one. This ensures you never miss a sale due to stock-outs and can manage your inventory efficiently.

- Omnichannel capabilities: In today’s retail environment, an omnichannel approach is more important than ever. Shopify POS allows you to integrate your in-store and online sales channels effortlessly. This means you can offer services like click-and-collect, or easily manage returns and exchanges across platforms, providing a seamless customer experience.

- Customization and integrations: Shopify POS offers various customization options and third-party integrations. From accounting software to customer relationship management (CRM) systems, you can tailor the POS to fit the unique needs of your business. This level of customization is often missing in other systems like Lightspeed Retail.

Pros

- Omnichannel retail: Shopify POS shines in uniting your online and physical stores. Inventory syncs seamlessly, and you can manage customer data across platforms. Features like curbside pickup bridge the gap.

- Inventory management: Shopify POS offers robust inventory management tools. You can track stock levels across locations, receive automatic low-stock alerts, and generate reports to optimize ordering.

- Integrated payment processing: Shopify Payments is built right in, offering flat-rate fees and compatibility with various payment methods like credit cards, Apple Pay, and Google Pay.

- Scalability: Whether you’re a small boutique or a growing chain, Shopify POS can adapt. It offers features for managing multiple locations, staff permissions, and advanced reporting as your business expands.

Cons

- Cost: Shopify POS isn’t the cheapest option, especially for larger plans with advanced features. The monthly subscription fees combined with payment processing rates can add up. Consider your needs and budget carefully.

- Customization: While user-friendly, Shopify POS offers limited customization options. The interface and functionalities are what they are, and extensive design changes aren’t possible. This may not suit businesses seeking a highly personalized POS experience.

Shopify Pricing

Shopify offers three pricing plans for retail businesses: Basic, Shopify, and Advanced.

Basic Plan:

Designed for solo entrepreneurs, with a monthly subscription of $32 USD. Features include card rates starting at 2% for 3rd-party payment providers, 10 inventory locations, 24/7 chat support, localized global selling in 3 markets, and POS Lite.

Shopify:

Geared towards small teams at a monthly subscription price of $92 USD. Features include card rates starting at 1% for 3rd-party payment providers, 5 additional staff accounts, and POS Lite.

Advanced:

Ideal for scaling businesses, with a monthly subscription of $399 USD. Features include custom reports and analytics, 10 inventory locations, enhanced 24/7 chat support, localized global selling in 3 markets (with the option to add more for $59 USD/mo each), 15 additional staff accounts, 10x checkout capacity, POS Lite, and 0.6% card rates for 3rd-party payment providers.

Plus:

Tailored for complex businesses, starting at $2,300 USD/month on a 3-year term. Features include competitive rates for high-volume merchants, custom reports and analytics, 200 inventory locations, priority 24/7 phone support, localized global selling in 50 markets, unlimited staff accounts, and fully customizable checkout.

Additionnal information

- Start with a free trial: You can try Shopify for free for 3 days, and no credit card is required.

- Flexible subscription plans: After the trial, you select a plan that matches your business’s size and stage. Most plans operate on a month-to-month basis, but yearly plans are available.

- Shopify Plus option: Shopify Plus offers 1- or 3-year terms. With these plans, you can cancel at the end of your commitment period.

- Discounts for yearly subscriptions: Enjoy a 25% discount on Basic, Shopify, or Advanced plans with a yearly subscription.

- Special benefits for Shopify Plus: Opting for a 3-year Shopify Plus plan provides monthly discounts and reduced online variable platform fees.

Best Retail Lightspeed Alternatives: Wrapping Up

KORONA POS, Epos Now, Square POS, Clover, and Shopify POS have unique benefits that make them strong contenders as Lightspeed POS alternatives for retail businesses.

For retail businesses operating in high-risk verticals such as liquor stores, superstores, vape shops, and tobacco shops, KORONA POS offers a superior solution compared to Lightspeed POS. KORONA’s platform is specifically designed to cater to the unique needs of these industries, providing robust security measures, comprehensive inventory management, and seamless compliance with industry regulations.

Moreover, KORONA POS distinguishes itself as a processing-agnostic system, allowing businesses to integrate with any major payment processing solution of their choice. Click below to learn more about how KORONA POS is the perfect solution for your retail store!