Key Takeaways: Point Of Sale System Cost

- Varied Pricing Models: The cost of a retail point of sale (POS) system can vary significantly based on several factors, including the provider, features, and scalability.

- Software vs. Hardware Costs: Typically, POS systems entail both software and hardware expenses. Software costs are often subscription-based, while hardware includes terminals, scanners, and printers.

- Customization and Integration: Additional costs may arise from customization needs or integration with other business systems, such as retail inventory management or accounting software.

- Payment Processing: Depending on sales volume and various considerations, businesses may opt for an integrated payment processing solution or explore third-party providers to suit their specific needs.

Selecting a point of sale system is a big decision. It’s important for businesses, no matter how big or small, to understand what kind of financial investment they are making when implementing such technology.

From initial setup expenses to ongoing monthly fees, the total cost of a retail POS system encompasses various factors that can significantly impact a company’s budget.

This article aims to shed light on the estimated expenses involved in adopting a retail POS system, accounting for both the upfront costs and the recurring monthly expenditures essential for its operation.

POS System Pricing Compared

Price just might be the deciding factor when choosing a POS system. Today’s web-based market can make it difficult to decipher pricing terms and understand hidden fees. Use our price comparison chart to understand upfront, ongoing, and miscellaneous costs for each POS system.

POS System | Account Type | Monthly Fees | Annual Fees | Additional Details |

| KORONA POS Core | $59/month | N/A | Pricing based on custom quotes; advanced features may incur extra costs. |

Korona POS Retail | $79/month | |||

| Basic Plan | Free | N/A | Excludes transaction fees, hardware costs, and add-on costs. |

Square for Retail | $89 – $299+/month per location | |||

Square for Restaurants | $69 – $165/month per location | |||

Square Appointments | $29 – $69/month per location | |||

| Retail | $11 – $190/month per location | OR $279 – $2,398 upfront plus monthly fees | Prices depend on hardware purchased. Transaction fees apply. |

Quick-Service Restaurant | $105 – $200/month per location | OR $799 – $2,399 upfront plus monthly fees | ||

Full Service Dining | $165 – $325/month per location | OR $1,499 – $4097 upfront plus monthly fees | ||

Professional Services | $14.95 – $125/month per location | OR $0 – $1,699 upfront plus monthly fees | ||

| Basic | $99 – $120/month plus setup fees | N/A | Revel requires a minimum three-year contract and a minimum purchase of two POS terminals. A flat fee of 2.49% is charged on all in-person transactions. |

Standard | $120 – $160/month plus setup fees | |||

Advanced | $160 – $200+/month plus setup fees | |||

| Basic | $39/month | OR $29/month billed once yearly | Additional monthly fees for POS Pro features. Prices exclude transaction fees. |

Shopify | $105/month | OR $79/month billed once yearly | ||

Advanced | $399/month | OR $299/month billed once yearly | ||

In-Person Retail | $89/month | OR $79/month billed once yearly | ||

| Retail | $89 – $239/month | OR $799 – $3,588/year | Excludes hardware, setup, and payment processing fees. |

Restaurant | $69 – $399/month | OR $799 – $3,588/year | ||

Hospitality | Custom Pricing | Custom Pricing | Custom pricing for large-scale or complex hospitality needs. |

How Much Does a Cloud Retail POS System Cost?

Technically, some POS systems offer “free” subscriptions. With such free subscriptions come higher credit card processing fees and limited hardware and software features. We will get into more detail about this later in this post.

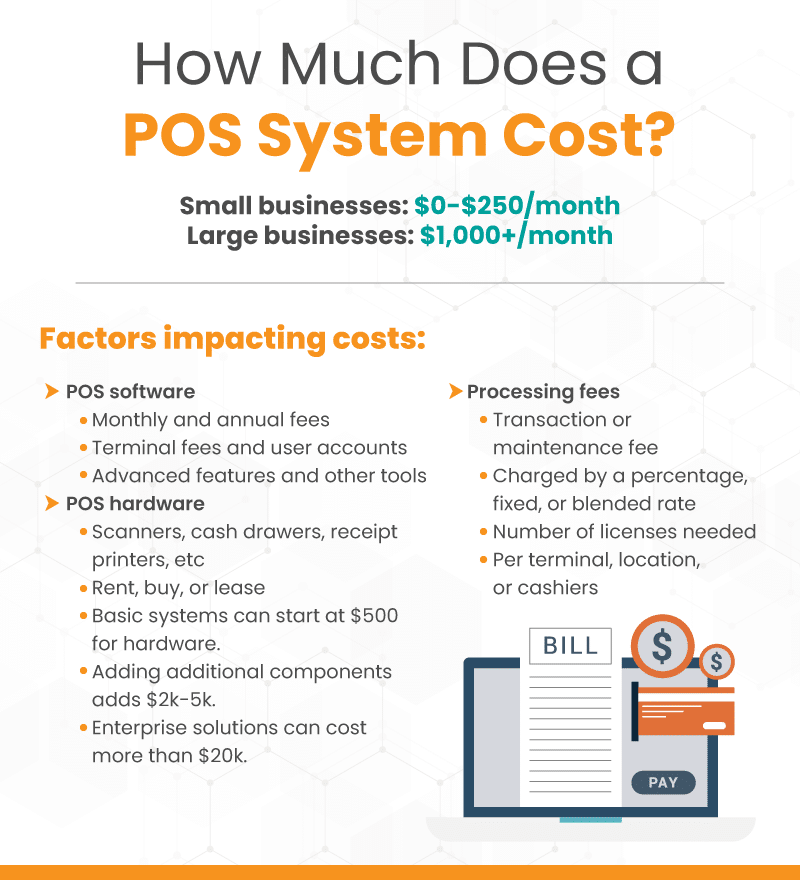

Nevertheless, fully equipped POS systems for most retail stores will cost the following:

- Getting Started: $100 – $5,000

- Monthly Subscriptions: $50 – $200

- Processing Costs: 2-4% on all credit and debit sales

Legacy System Cost

Legacy POS systems rely on on-premise hardware and software. They require substantial upfront investments and ongoing maintenance costs.

Legacy POS systems often prove more expensive than their cloud-based counterparts due to various factors:

- Hardware Maintenance: Legacy systems typically require expensive hardware components that need regular maintenance and upgrades to remain functional, driving up costs over time.

- Software Licensing Fees: Many legacy POS systems involve costly software licensing fees for updates and patches, which can accumulate significantly over the system’s lifespan.

- Limited Scalability: They often lack the scalability of cloud-based solutions, requiring costly upgrades or replacements when a business expands or diversifies its operations.

- Integration Challenges: Integrating legacy POS systems with newer technologies and third-party applications can be complex and expensive, leading to additional customization costs.

- Data Security Risks: Outdated security features in legacy systems increase the risk of data breaches, potentially resulting in costly fines, legal fees, and damage to the brand’s reputation.

- Inefficient Reporting and Analytics: These typically lack robust reporting and analytics capabilities, making it challenging for businesses to make informed decisions and optimize operations effectively.

- Downtime Costs: Legacy systems are more prone to downtime due to hardware failures or software glitches. This results in lost sales and productivity, along with the associated costs of troubleshooting and repairs.

These cumulative factors highlight why transitioning to cloud-based POS systems can offer businesses significant cost savings and operational efficiencies in the long run.

Average cost to get started: $3,000 to $10,000

Modern Cloud-Based Software Subscription Costs

Modern POS is cloud-based. Unlike traditional POS systems, which rely on on-premise hardware and software, cloud-based POS solutions store data securely in remote servers. They offer flexibility, scalability, and accessibility from anywhere with an internet connection.

Cloud-based point of sale software can cost as little as $0 upwards of about $250 per month, depending on your desired features. A basic point of sale system with a card reader will be much less expensive than point of sale terminals spread across different points and locations.

In addition, most POS software has monthly or annual fees and different subscription levels at different prices. Unsurprisingly, the less expensive options typically offer less advanced capabilities. They also often charge higher transaction fees for each purchase made at the POS.

Ensure the POS system you choose has the built-in features you need to run your business, such as inventory management, reporting and analytics, and an eCommerce integration platform.

Below is a table outlining different popular POS software providers, along with their verticals served and included features. Use this and our price comparison chart to make an informed decision for your business:

POS Provider | Verticals Served | Included Features |

Retailers, Entertainment & Leisure, Ticketing, & Professional Services |

| |

Retailers, Restaurants, Professional Services, eCommerce, Events, & Healthcare |

| |

Retailers, Restaurants, Professional Services, & Healthcare |

| |

Retailers, Restaurants, Bars & Nightclubs, Cafes & Coffee Shops, Food Trucks, Gyms & Fitness Centers |

| |

Retailers, Restaurants, Digital Products, & B2B Sales |

| |

Retailers, Restaurants, eCommerce, Hospitality, & Fitness |

|

Hardware Costs

Different businesses demand different hardware options to optimize their store. For instance, if you are starting a food truck, you will have different needs than if you were opening a grocery store.

Each POS provider offers hardware options at varying prices. Some will allow retailers to use hardware that they already have. Others will include some hardware packages in their monthly subscription.

Depending on the type of business you own, you might need a variety of hardware components to get up and running with a POS system.

Many POS providers allow you to buy, rent, or lease POS hardware bundles. Components such as barcode scanners, cash drawers, customer displays, and printers are all important for most types of businesses. You might also want to consider more specialized pieces of hardware, such as tablet stands or interactive kiosks.

Processing Fees

Remember that part of your point of sale costs include processing fees. All businesses must pay fees for credit card transactions.

Payment processing fees can vary greatly. Before signing any contracts, you must understand what types of fees you can expect for transaction costs or monthly maintenance fees. Depending on the payment method used by your customer, some providers have variable rates while others charge a set fee.

We always suggest going with interchange plus rates as they are more transparent, predictable, and fair. Plus, you can be rest assured knowing that you won’t be surprised by anything on your bill.

These fees will vary month-to-month based on your total sales, but they will always indicate exactly where every penny of your processing fees goes.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Built-In Processing

There are many POS providers that also operate as payment processors. In other words, they require that you use their own payment processors and transaction fees if you want to sell their point of sale system.

Built-in processing can provide convenience and, in some instances, simplify operations. But the disadvantage with this model is that you do not have the leeway to integrate third-party payment processors in case you want to find more favorable rates.

This can cost you a substantial amount, as well as add a lot of stress and time. For instance, Square’s pricing starts at 2.6% + $0.10 per transaction but this rate can increase substantially based on several factors.

Processing Agnostic POS Solutions

Alternatively, merchants may opt for a POS solution that is agnostic to payment processing. In this model, the POS software is separate from the payment processing, allowing merchants to choose their preferred third-party payment processor.

This gives merchants more flexibility and control over their payment processing relationships, potentially allowing them to shop around for better processing rates or negotiate custom pricing based on their specific needs.

Examples of Processing Fees

Some examples of processing rates from popular POS companies include:

POS Provider | Processing Fees |

Allows clients to shop around for the lowest fee | |

2.6% + $0.10 per transaction for most purchases | |

2.3% + $0.10 to 2.6% + $0.10 per transaction for in person purchases | |

1.5% to 3.5% + $0.10 to $0.30 per transaction | |

2.4% to 2.6% + $0.10 per transaction for in-person purchases | |

2.6% + $0.10 per transaction for in person purchases |

Learn more about how credit card processing works and save your business money in this free eGuide.

Choosing a POS for Your Business: Needs and Costs

Many retail businesses will require add-ons and specialized tools in order to maximize their efficiency through the POS. Some of these might include:

Multiple Locations

Consider if your business operates across multiple physical locations and requires a multi-location POS system capable of centralizing operations, managing inventory across locations, and providing consolidated reporting.

Average Estimated Cost: $100 – $300 per additional location

Multiple Checkout Lanes

If your business has high foot traffic or multiple checkout lanes, opt for a POS system that supports efficient checkout processes, including split payments, fast transaction processing, and integration with hardware like barcode scanners and receipt printers. Korona’s self checkout POS system is also useful if you want self checkout options in your business.

Average Estimated Cost: $50 – $200 per additional checkout lane

RFID

Businesses dealing with high-volume inventory may benefit from RFID technology for efficient inventory management, accurate stock tracking, and streamlined checkout processes. Ensure your chosen POS system supports RFID integration if this technology aligns with your business needs.

Average Estimated Cost: $500 – $1,500 for RFID integration

eCommerce Integration

For businesses with an online presence, seamless integration between the POS system and eCommerce platform is essential. Look for a POS solution that offers robust eCommerce integration capabilities, allowing for synchronized inventory management, order processing, and customer data management across online and offline channels.

Average Estimated Cost: $200 – $500 for eCommerce integration

Other Specialized Integrations

Identify any specialized integrations or third-party software solutions crucial to your business operations. This could include accounting software, CRM systems, loyalty programs, or industry-specific tools. Another popular add-on is payroll, which are sometimes native to the POS system but costs a bit more to use.

Average Estimated Cost: $100 – $500 per integration

How to Bring Down Overall Costs

While POS is certainly a significant investment, there are some strategies to lower your costs. Here are some you can try:

- Negotiate Lower Fees for High-Volume Sellers

- If your business is higher volume, leverage this as a bargaining chip to negotiate lower processing fees.

- Request custom pricing or volume-based discounts tailored to your business’s transaction volume and payment processing needs.

- Many providers are willing to negotiate fees to secure long-term partnerships with high-volume merchants.

- Shop Around for Lower Fees

- Research and compare different POS providers to identify those offering competitive processing fees and pricing structures.

- Look beyond the advertised rates and consider factors such as transaction volume discounts, hidden fees, and additional services included in the package.

- Seek quotes from multiple providers and negotiate for lower fees for POS or additional benefits based on your business’s specific needs and bargaining power.

- Explore alternative payment processors and payment gateway providers to find the most cost-effective solution without compromising on service quality or reliability.

- Consider Paying Yearly Subscriptions

- Many POS providers offer discounted rates or incentives for businesses opting for annual billing.

- Evaluate whether paying an annual subscription upfront can result in cost savings compared to monthly subscription plans.

- Calculate the total cost of ownership over the course of a year, including any discounts, incentives, or additional benefits associated with annual subscriptions.

- Assess your business’s cash flow and budgeting preferences to determine whether paying a lump sum upfront for an annual subscription aligns with your financial goals and constraints.

Avoidable Costs to Look Out For

Cancellation Fees

Some POS providers may include cancellation fees in their contracts, which are charged if a business decides to terminate its agreement before the contract term expires. Cancellation fees can vary widely in amount, ranging from a flat fee to a percentage of the remaining contract value.

To avoid unexpected costs, carefully review the terms and conditions of their POS contracts, particularly regarding cancellation policies, before signing.

Extra Support Fees

While many POS providers offer basic support services as part of their packages, additional support options may incur extra fees.

These fees could apply to services such as extended support hours, priority access to customer service representatives, or onsite technical assistance.

Do you have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us now at 833.200.0213 to see for yourself.

Hidden Processing Fees

In addition to transparent transaction fees charged by payment processors, some POS providers may impose hidden processing fees that are not clearly disclosed upfront.

These hidden fees could include markups on interchange rates, non-compliance fees, or incidental charges for services like chargebacks or refunds.

Thoroughly review their POS agreements and seek clarification on any potential hidden fees before signing.

Long-Term Contracts

Many POS providers require businesses to commit to long-term contracts, typically ranging from one to five years.

Long-term contracts can lock businesses into agreements with fixed terms and limited flexibility, making it difficult to switch providers or adjust services as needed.

Before entering into a long-term contract, carefully consider factors such as scalability, performance guarantees, and exit strategies to mitigate the risks associated with commitment.

FAQs: How Much Does a POS System Cost

A basic POS system is generally priced between $500 to $2,000, depending on the manufacturer, features, and size of your business. For larger businesses, more robust solutions often cost more.

Aside from the cost of the actual system, you should consider any installation fees, additional hardware costs, credit card processing fees, system training, and ongoing maintenance costs.

Typically, the cost of a POS system depends on the features and functionality needed for your business. Technology, hardware, software, peripherals, and service contracts can also influence costs.

Yes! You can reduce the cost of a POS system by opting for basic software and hardware solutions, using a cloud-based system, researching different manufacturers, and shopping around for bundle packages or discounts.

Conclusion

Navigating the costs of a point of system is crucial for businesses aiming to streamline operations and maximize profitability. From initial setup investments to ongoing monthly expenses and potential add-ons, understanding the full spectrum of expenses is essential.

By evaluating features, negotiating fees, and considering long-term sustainability, businesses can make informed decisions to optimize their POS investment.

Ultimately, with careful planning and strategic decision-making, businesses can leverage their POS investment to drive growth and success.

To learn more about KORONA POS’ transparent pricing and agnostic credit card processing, click the link below!