If you’ve started researching how credit card processing works or been looking into a new merchant service provider, you’ve probably stumbled upon interchange rates. Though processing fees are composed of a number of different factors, interchange rates make up the majority of the fees added to any transaction. So if you’re trying to reduce your credit card processing rates, having the interchange rate explained is a critical step in the process.

Interchange rates are dependent on a number of factors so let’s break it down so you know exactly what you’re paying for.

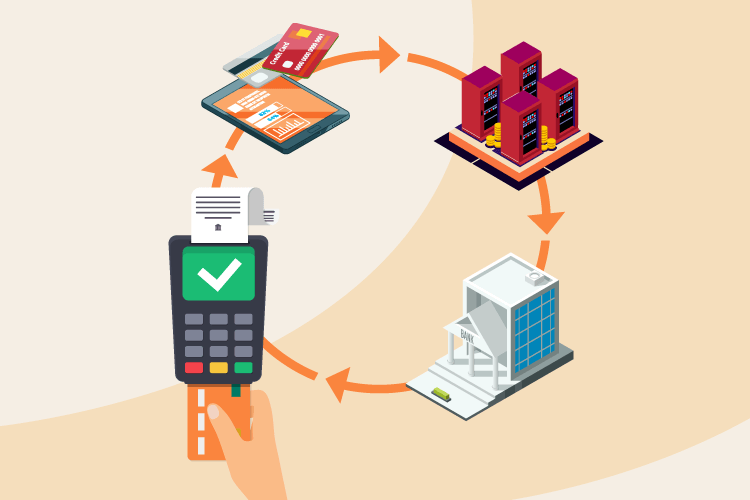

What Is an Interchange Rate?

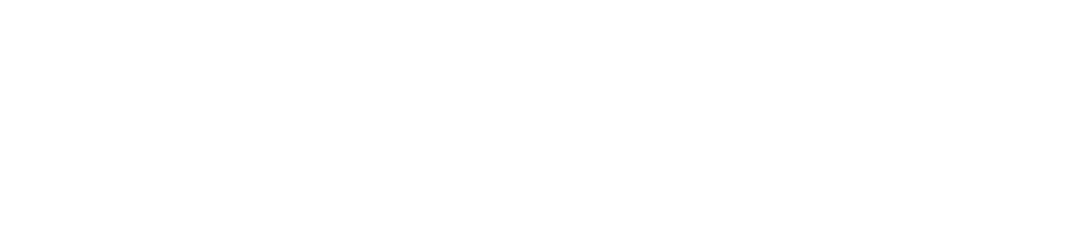

Every credit or debit card transaction goes through a pretty remarkable process before completing the final transaction. For each transaction, money must be transferred from the customer’s account (issuing bank) to the merchant’s (acquiring bank).

There is nearly instantaneous communication among numerous parties across the world, and all of it must be encrypted and secure. For the services provided by the parties that facilitate this, there are various fees that merchants must pay.

A major component of these fees is the interchange rate. This portion of the total fee goes to the credit card networks (VISA, Discover, etc.), who then pay the bank that issued the card that was used for the transaction. The card network also determines exactly what the interchange rates will be.

Are There Other Fees?

Though the interchange fees make up the majority of total processing fees for each transaction, there are several other fees involved.

The card networks charge a network or assessment fee that is much smaller – usually around 0.05%. Though this is a tiny portion of each payment made at your business, collecting millions of them every day is plenty to keep the big card networks in business.

Processor fees go to the merchant service provider. These are often a simple monthly or yearly fee, but some are attached to each individual transaction. The processor is responsible for keeping everyone in communication and making sure the transaction is secure.

The acquiring bank (your merchant account) might also charge markup fees. These rates vary by industry and sales volume. Some services come with additional fees for PCI compliance, chargebacks, or hosting, but these should be bundled into your processor fees.

Finally, watch out for extra convenience fees or surcharges. Some processors will tack on extra fees at the end of the month.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

How Are the Interchange Fees Charged?

There are about 300 separate factors that determine an interchange rate. The fees, however, are usually bundled into a single percentage rate for each transaction.

Most interchange fees are calculated by taking a percentage of the sale plus a fixed fee so that the issuing bank secures an optimal amount they will receive.

When a transaction is completed the fees are collected by the credit card networks, which then distribute it to the issuing bank. The issuing bank accepts the fees for their assumed risk of releasing the funds.

What Factors Can Change Interchange Rates?

Though it’s impossible to eliminate interchange fees, there are certain steps that retailers can take to reduce them. There are several factors which contribute to interchange fees that retailers can control:

Credit vs. Debit: Debit cards that require PIN entry have much lower rates than a credit card, for instance. This is due to the reduced risk of a PIN entry.

Type of Card: High-rewards and business cards come with higher interchange fees. Banks charge this to compensate for the high rewards that they pay out to their customers. In return, retailers can expect those cardholders to spend more at the store.

Industry: Your business’s interchange rate will vary depending on the type of industry that you’re in. Typically, high-volume stores will pay less in interchange fees because they have more negotiating power.

Transaction: Card-not-present (CNP) and keyed transactions will have much higher rates than a swiped, dipped, or tapped transaction with a physical card. Again, this is due to the increased risk of fraud in the former circumstances.

Credit Card Network: Some networks charge more than others. American Express, for instance, charges a higher base fee than the other networks, which is why you’ve probably seen some merchants that won’t accept cards of this brand.

Address Verification Service: If you use an AVS at your eCommerce store, you’ll be charged additionally for every transaction. But, because of the increased security of the transaction, your interchange rate will be lower.

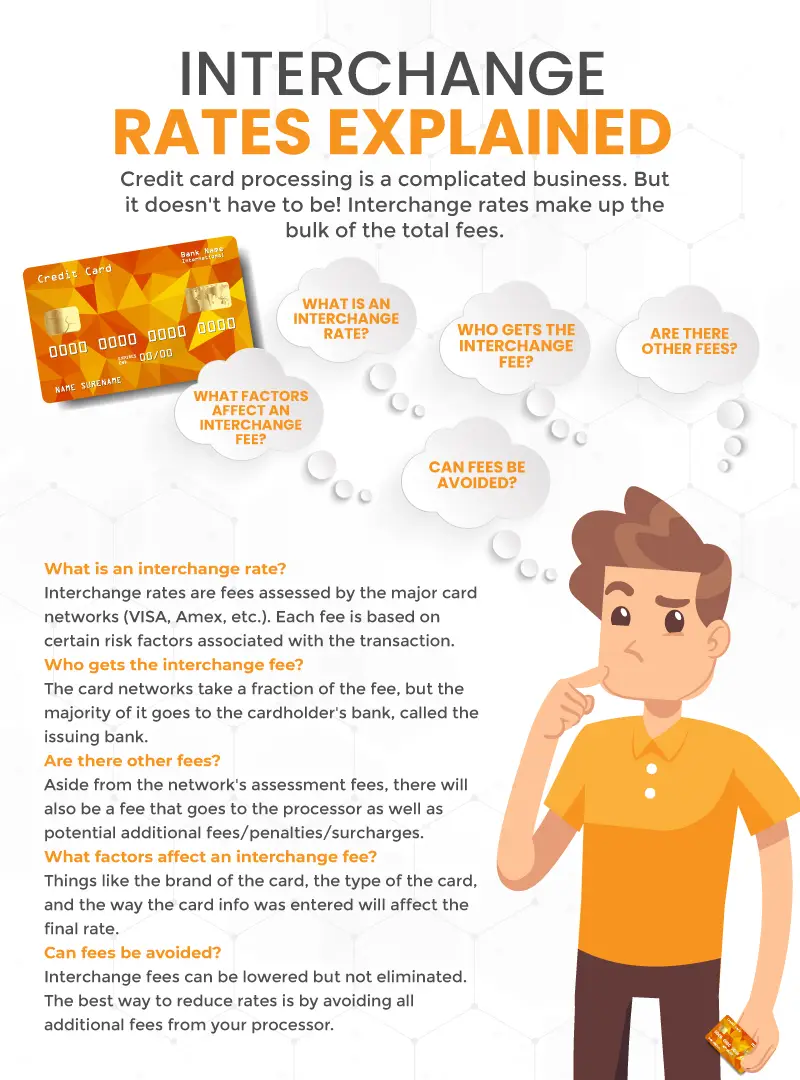

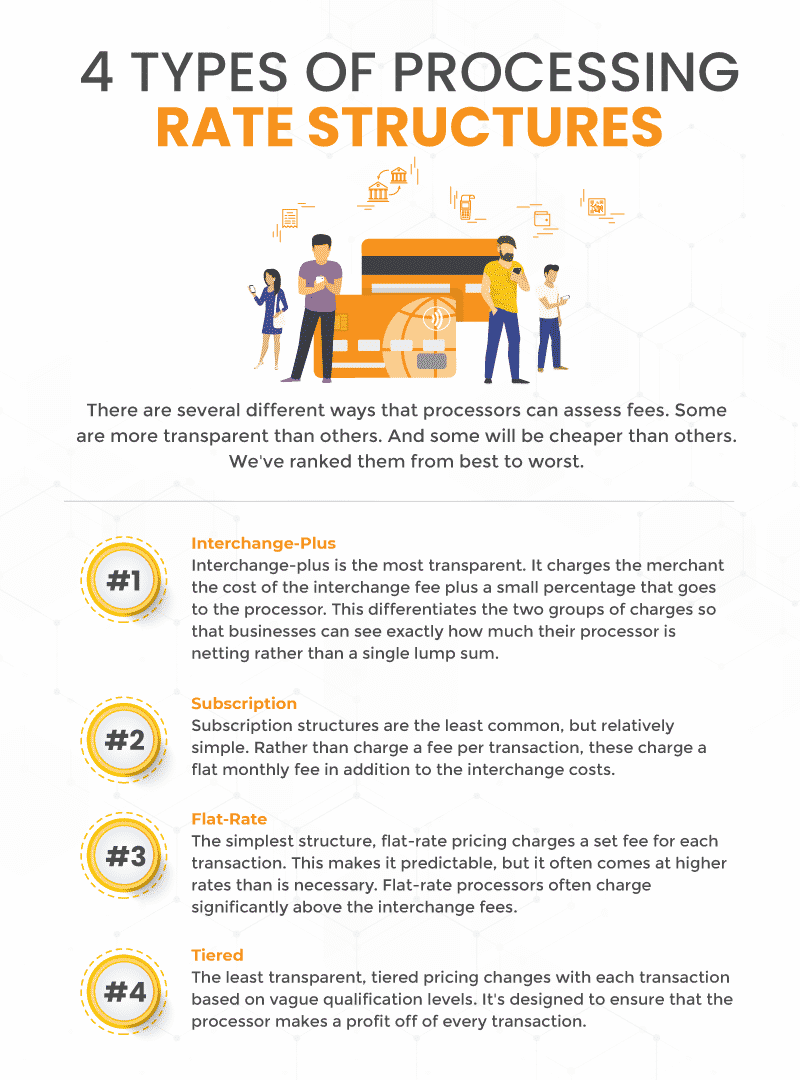

Are There Different Interchange Plans?

There are a few different ways of setting up your processing pricing.

Flat-Rate: This charge comes as just a single, bundled rate. However, flat-rate pricing means that the interchange fees and all additional fees are compiled into one amount, leaving little transparency. Many common payment service providers use this model. Unfortunately, they charge the same amount no matter any of the factors listed above. This leaves the merchant with no room to cut any processing costs. Flat-rate models are only suitable for low-volume retailers.

Tiered: Tiered pricing assigns each transaction as either qualified or unqualified. The two tiers are there to ensure that the processor makes a profit on every transaction. But it’s impossible to know exactly what you’re paying for because you’re most likely paying way too much. Tiered is simply never the recommended route.

Interchange-Plus: If you process over $5,000, interchange-plus is probably the best route to go. It’s the most transparent structure, and all interchange rates are just passed to the merchant with no additional markups or hidden fees. Therefore, the processing cost is added on top of the interchange so that you can see exactly what you’ve paid for. Interchange-plus is a solid solution for most businesses.

Subscription: This also separates the processing costs from the interchange rates. But the processing cost will be a simple monthly fee instead of several individual fees. This would typically be recommended for high-volume businesses.

Interchange Fees Explained with KORONA POS

To learn more about credit card processing and the fees associated with it, give us a call at KORONA. We’re not a processing company, but our POS system integrates with the top processors on the market. We’ll help you find the best solution for your retail store.