The marijuana industry continues to gain more and more momentum with increasing state legalization. In 2016, the total nationwide sales for legal cannabis was $6.7 billion. In the span of just five years, this number grew to $25 billion in 2021. Interestingly, most of that $25 billion in sales was handled in cash.

So why don’t dispensaries take card? With marijuana still illegal at the federal level, major banks and credit companies will not allow cannabis retail establishments to execute transactions with cards. There are, however, some mobile apps, workarounds, and proposed law changes that could shape the future of dispensary payments. Read on for a more detailed explanation of why dispensaries don’t take cards and what the future of payments in the cannabis industry looks like.

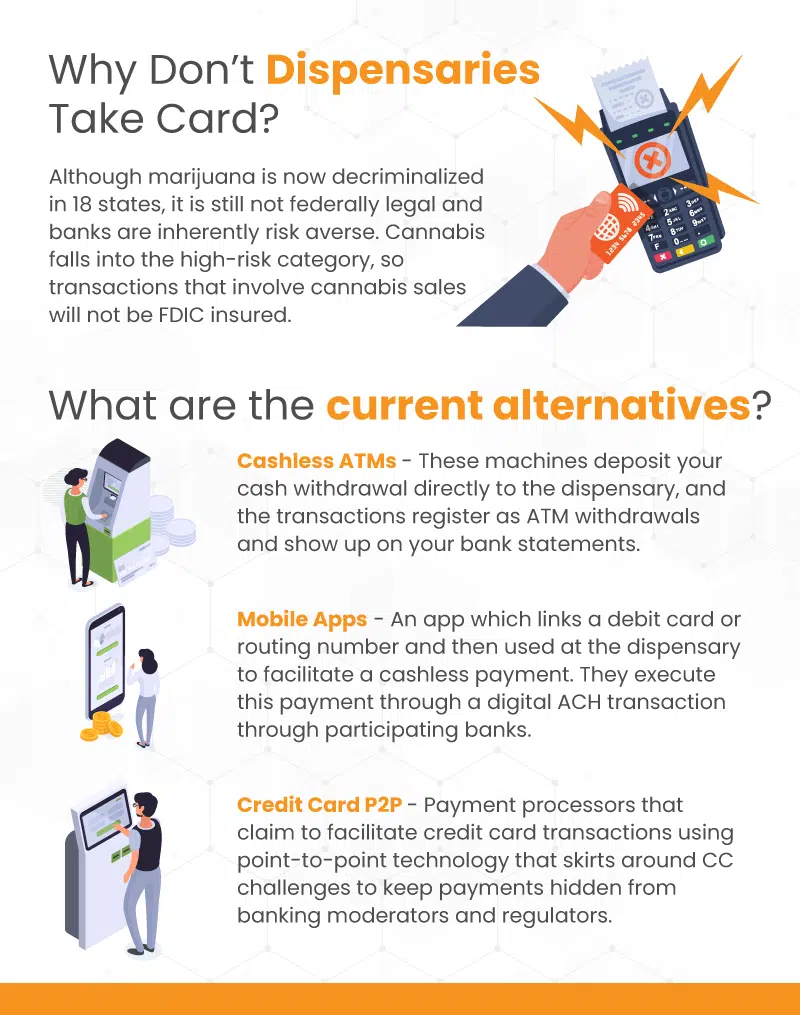

Illegality And Risk

Banks are inherently risk-averse. Thus, they tend to avoid working with retail businesses involved in industries like tobacco, firearms, pornography, etc. For the big financial institutions, cannabis fits into this type of high-risk category.

Recreational marijuana is decriminalized in 18 states, but it is still illegal at the federal level. Therefore, transactions that involve cannabis sales will not be FDIC-insured. Unsurprisingly, the Chase banks and Capital Ones of the world are unwilling to allow cannabis businesses to use credit cards for businesses that sell federally banned substances.

The House of Representatives passed the SAFE Banking Act in 2021, but the bill didn’t make it through the Senate. The act aims to reduce the liability for financial institutions to be penalized for serving marijuana related businesses. There are contrary opinions as to how this act would affect the trade as a whole. Some industry leaders argue that it would function more symbolically rather than making real tangible changes on the ground. Either way, it’s clear that even at the federal level, there is a noticeable push to further open up and decriminalize the industry.

Accepting Exclusively Cash Presents Problems

While it might seem advantageous for companies to be cash-only, in an industry like cannabis, it presents some serious issues. From security problems to reduced basket value, not having the credit card access that other retail businesses enjoy is stifling for dispensaries.

Cash Security Risk

First, dispensary owners must worry about how to properly secure the immense amounts of cash that they accumulate through dispensary sales. There are a substantial number of robberies that occur at cannabis retail establishments, as well as hijackings and attacks on cash that is being transported. There have been 80 dispensary robberies in 2022 in Washington State alone.

Reduced Spending Per Customer

High-quality cannabis is expensive! Hence, it’s easiest for consumers to be able to use their credit cards to purchase flowers, edibles, and cartridges. In fact, most behavioral science studies argue that customers are likely to spend more when using credit cards rather than cash. This suggests that if and when dispensary clients are allowed to use credit cards, their basket values will increase significantly.

Do Any Dispensaries Take Credit?

As of now, the only way that a dispensary could take credit cards is if they set up an illegal workaround. This method creates a different company as the merchant so that payments are technically processed by a non-cannabis business.

For example, “XYZ Cannabis Dispensary” will set up a merchant account under “ABC Wellness Company’.’ Then they would process disguised transactions without their payment processor realizing what the business actually sold. This type of setup is deemed as fraud in the eyes of financial institutions and can lead to shut downs and headaches.

What Alternatives Currently Exist?

So the question remains, what options do dispensary owners and customers have as far as making non-cash transactions. Here are some methods that dispensaries have implemented to add increased payment choices for shoppers.

Cashless ATMS

When dispensaries say that they take debit cards, what they really mean is that they have cashless ATMs. These machines deposit your cash withdrawal directly to the retail shop. The transactions register as ATM withdrawals as far as the bank is concerned and show up on your bank statement as such. Cashless ATMs are now a $7 billion dollar business.

Dispensaries use third-party software to appear as though the withdrawal is a legit ATM. If you go to purchase a $35 dollar 8th of cannabis flower and use your debit card, the cashier will likely hand $5 back to you. Then the transaction will show up as a $40 withdrawal.

This type of cashless ATM usage is both illegal federally and breaks the policies of most payment processors. Still, it is widely used by legitimate and well-known dispensaries around the country because there have been a relatively small number of instances where they have been shut down or fined for using them.

The leading payment tech company in this space is Paybotic. They claim to have 10 years of experience that guarantees compliance and security for dispensary debit card transactions. However, their setup is basically a more credible cashless ATM. We are likely to see more of these cannabis debit card processing companies pop up as long as marijuana isn’t federally legalized.

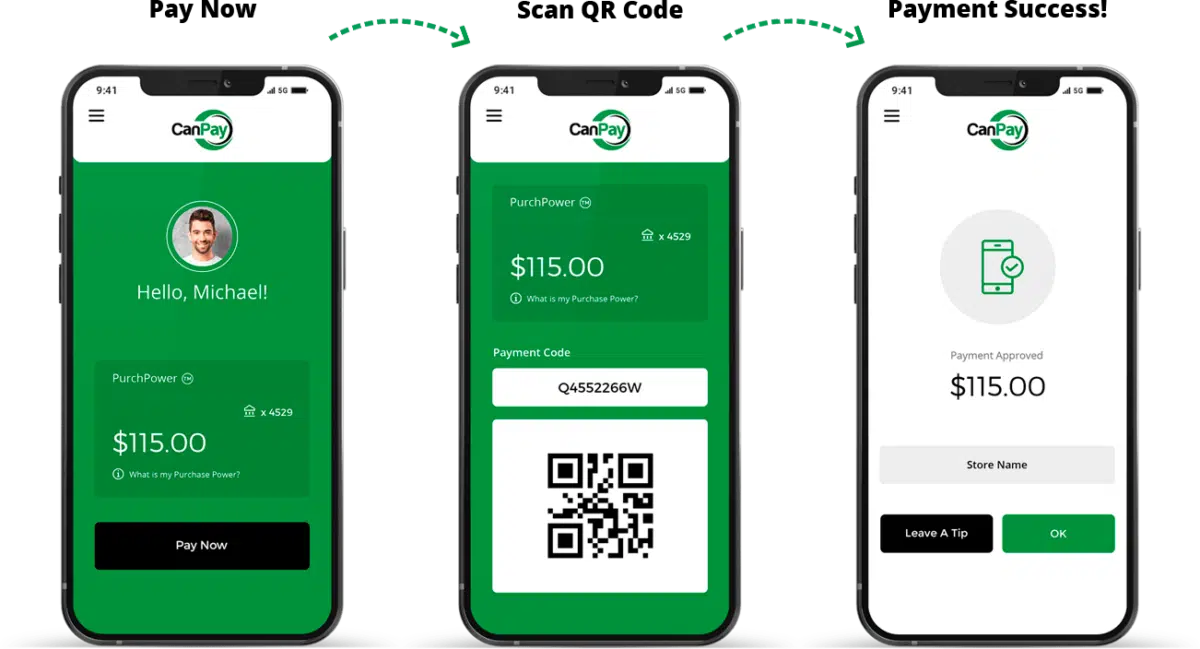

Mobile Apps

Similar to Zelle, Paypal, and Venmo, there are now digital transfer apps specifically for paying for cannabis products in-store. The shopper simply downloads the app, links a debit card or routing number, and then uses that app at the dispensary to facilitate a cashless payment. This payment is executed through a digital ACH transaction through participating banks.

The biggest player providing this type of service is Colorado-based company Canpay. They now serve 800 dispensary locations across the country, including 10 multi-state cannabis retail operators. Last year, they surpassed $500M in facilitated transactions.

There are several other bank-to-bank transfer apps that currently compete with Canpay for market share and, more or less, offer the same type of service. One is Arizona-based payment processor Hypur. Another is Chicago-based tech company Aeropay, which offers more intricate sales data analytics.

Credit Card P2P

Finally, there is an emerging category of payment processors that claim to facilitate credit card transactions using point-to-point technology. Similar to cashless ATMs, this method skirts around the credit card rails to keep the payment effectively hidden from banking moderators and regulators. A leader in this niche is Shift Processing. They offer credit card processing options for marijuana-related businesses. Keep in mind, however, that the fees for these types of transactions are much higher. Added on top of taxes, these fees could potentially dissuade customers from wanting to choose this option.

Payment Apps Offer The Best Cashless Option For Now

Payment apps are certainly here to stay in cannabis as long as traditional credit and debit card transactions aren’t allowed. Bank-to-bank transfer apps seem to be the best option for dispensary owners that want to offer cashless payments without using risky cashless ATMs that could potentially cause them to get shut down or or have to pay heavy fines. In addition, they offer customers an alternative that will enhance their dispensary experience.

Click here to listen to the podcast discussing the evolution and future of the cannabis industry with he CEO of KORONA POS

KORONA POS is not connected to a processor company. While taking advantage of any new processing company that offers a better rate. I get a real person to talk to in less than a minute every time I call with a question. No Contract, month to month. Can’t lose to try.

-Aaron F.

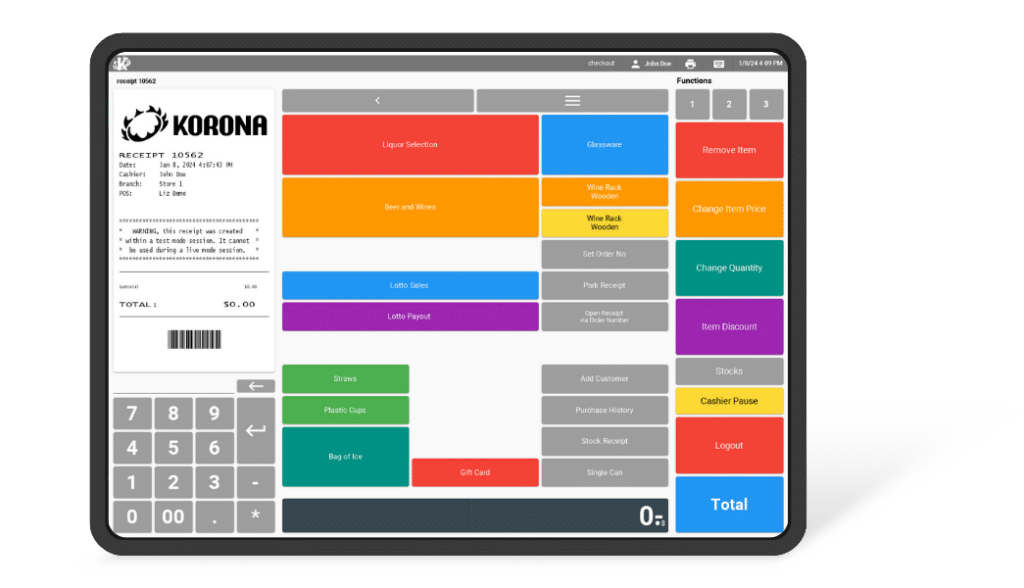

Protect Your Cash With KORONA POS

For now, cash is king in the dispensary world. Cannabis retail shops nationwide will collect their revenue in paper bills, even if the shopper chooses to use a cashless ATM. It’s crucial to take all of the necessary steps to protect your dispensary revenue.

Luckily KORONA POS offers a built-in immutable ledger for dispensaries. Our dispensary clients enjoy a perpetual cash count system. With this feature, you can monitor and track your money from the moment of purchase through the cash being dropped into the bank vault.

Give us a call today to learn more about the best dispensary point of sale in the industry!

FAQs: Why Dispensaries Don’t Take Cards

Dispensaries can’t use cards because cannabis is still illegal at the federal level. This means that banks and credit card companies won’t allow marijuana-related transactions to be facilitated over their network. Nonetheless, there are several workarounds and bypass options that cannabis retail companies have employed, such as cashless ATMs and smartphone payment apps.

Dispensaries actually can use banks for certain things. To be sure, marijuana-related businesses cannot use banks like most retail businesses, such as for acquiring financing and executing normal transactions. However, they do have the option of depositing cash in local credit unions and cannabis-friendly financial institutions.

Dispensaries should handle cash with extreme care and security. This should include a plan for a standard operating procedure for employees, as well as a reinforced vault in which to drop daily revenue. Using a modern, robust dispensary point of sale system with intuitive cash protection is also a must.

Sometimes you can use debit cards at dispensaries. But, officially, the answer is no. There are several methods of working around the prohibition of marijuana-related businesses by banks. These workarounds involve using cashless ATMS that deposit directly to the dispensary, or apps that transfer funds via ACH.