In this comparison, we’ll explore the nuances of Square POS and Clover POS, examining their key features, advantages, and potential drawbacks for various business needs.

We’ll scrutinize everything from cost structures and hardware options to software capabilities and user-friendliness, offering a thorough analysis to guide your decision-making process.

Whether you’re a small retailer seeking powerful sales tracking tools, a café owner needing efficient table management, or a mobile business requiring a versatile POS solution, this guide will highlight the crucial aspects that should shape your choice between Square and Clover.

By the conclusion, you’ll have a clear picture of which POS system best suits your unique business requirements, enabling you to streamline operations, elevate customer satisfaction, and fuel your company’s expansion.

Square vs. Clover: Product Roundup Table

The table below offers an overview of Square and Clover’s comparison. This comparison will help you understand how these systems compare regarding the industries they serve, key features, pros and cons, user ratings, and the availability of free trials.

Features | Square POS | Clover POS |

Hardware options |

|

|

Software features |

|

|

Free trial |

|

|

Monthly fees |

|

|

Payment processing |

|

|

Transaction fees |

|

|

Integrations |

|

|

Setup and ease of use |

|

|

Industry focus |

|

|

Looking for an alternative to Square POS System or Clover POS?

Try KORONA POS, a powerful solution for your business needs. Speak with a product specialist and learn how KORONA POS can power your business.

Square vs. Clover POS: Quick Facts

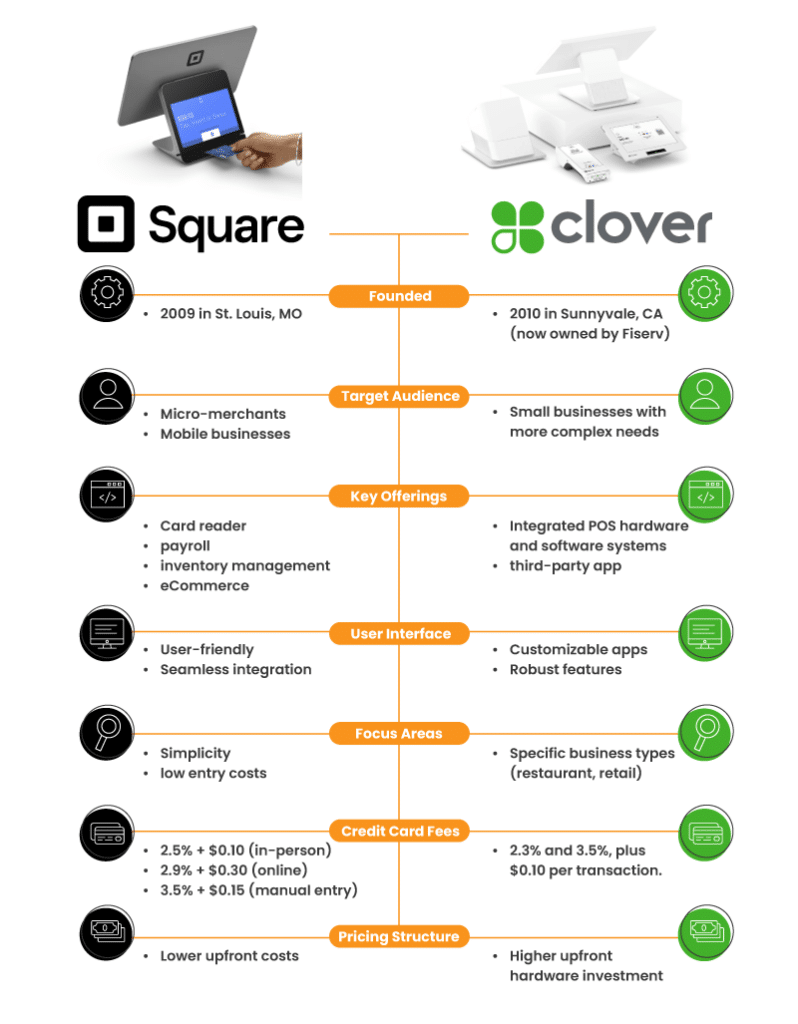

Square and Clover are both prominent players in the mobile point of sale industry, offering solutions for small businesses to accept payments.

Square, founded in 2009, is known for its iconic square-shaped card reader and comprehensive ecosystem of business tools.

It offers a wider range of services, including payroll, inventory management, and eCommerce solutions.

Clover, launched in 2012 and now owned by Fiserv, focuses more on providing integrated POS hardware and software systems tailored for specific business types.

While Square generally appeals to micro-merchants and mobile businesses with its simplicity and low entry costs, Clover targets slightly larger small businesses with more complex needs. Both offer competitive credit card transaction fees, but their pricing structures differ, with Clover often requiring more upfront investment in hardware.

Square is typically praised for its user-friendly interface and seamless integration across its services, while Clover is noted for its customizable apps and robust features for restaurant and retail environments.

Square POS vs. Clover: A More Detailed Comparison

We will examine Square POS and Clover POS’s fundamental features, pricing schemes, integrations, and user feedback, offering a thorough analysis to assist in your decision-making process.

Square POS: Our Assessment

In this section, let’s take a brief look at Square POS. We’ll look at some of the software’s features, its advantages and disadvantages, and other important aspects to know before you consider using it. If you’d like to learn more about Square POS, visit our Square POS Review.

Square POS: Our Verdict

Square POS presents an accessible and budget-friendly option for small to medium-sized businesses. It includes key functionalities like payment processing, inventory tracking, and sales reporting. With its user-friendly interface and simple setup, Square POS caters to businesses of various sizes.

Additionally, its competitive pricing and clear fee structure are particularly attractive to cost-conscious business owners.

However, companies needing more advanced features or extensive assistance might find Square’s customer support and feature set less comprehensive compared to other POS solutions available.

Processing: Starting at 2.6% plus $0.10 per transaction

Best For: Start-up Retailers; Small restaurant and appointment businesses

Pros

- Simple, user-friendly interface

- Versatile with mobile hardware

- Streamlined self-service account initiation

Cons

- Lacking payment processing flexibility

- Less in-depth reporting and analytics

Pricing

Square Free

$0/mo

- POS app for any payment

- Online site

- Item library

Square Plus

$49/Custom

- POS features for every industry

- Lower processing fees

- Loyalty rewards program

Square Premium

$149/mo

- 24/7 priority support

- More text message marketing

- No gift card load fees

Clover POS: Our Assessment

Square vs. Clover: Pricing, Costs, Fees, and Contracts

Let’s examine how Square POS and Clover POS compare regarding pricing offerings.

Square Pricing

Square provides a range of hardware, from basic card readers to full POS systems. Square POS pricing offers optional monthly subscriptions for advanced features, which can increase the cost for businesses requiring these tools.

Square Monthly Subscription Plan

Free Plan

Best for new or very small businesses with lower sales volumes and basic needs. You pay only transaction fees.

POS app and payments

Website builder with SEO tools

Courses

Item library

Plus ($49/month)

Ideal for growing businesses that need essential tools to manage a team, optimize their website, and want the benefit of a slightly lower in-person transaction rate (2.5% ).

Staff management

Expanded site customization

Loyalty rewards program

Premium ($149/month)

The most cost-effective option for high-volume sellers due to the lowest in-person transaction fee (2.4%) and the included features like 24/7 dedicated support and waived gift card load fees, which can add up to significant savings.

Advanced reporting

No gift card load fees

24/7 phone support

Payment Processing Fees

Square’s Point of Sale (POS) system is known for its simple, flat-rate pricing structure. These fees apply to all major credit cards (Visa, Mastercard, American Express, and Discover) at the same rate.

Transaction Type | Standard Rate (US) | Key Information |

In-Person (Tap, Dip, or Swipe) | 2.6% + 10¢ to 15¢ | Applies when the customer's card is physically present and used with a Square Reader, Terminal, or Register. |

Online (eCommerce API, Square Online Store) | 2.9% + $0.30 to 3.3% + 30¢ | A higher rate due to the increased risk associated with card-not-present transactions. |

Manually Keyed-In / Card on File | 3.5% + 15¢ | The highest rate typically applies to payments entered into the Virtual Terminal or saved on file, as they carry the highest fraud risk. |

ACH Bank Transfer (via Invoice) | 1% (Min. $1) | For payments made directly from a customer's bank account. |

Afterpay (Installments) | 6% + $0.30 | Square pays you the full amount upfront, and the customer pays over time. |

PRO TIP

For the most up-to-date details, please visit Square’s pricing page for your country or contact our support team.

Hardware Costs

Square offers a range of hardware solutions to suit different business needs:

Square Reader for Magstripe: The reader allows you to accept Magstripe card payments using a mobile device. Square offers the first reader for free.

Square Reader for Contactless and Chip (2nd Generation): This reader, available for $59, supports contactless payments and EMV chip cards.

Square Terminal: At $299 or $27/mo over 12 months, this all-in-one device enables you to accept payments, print receipts, and manage transactions without additional hardware.

Square Register: Starting at $799 or $39/mo over 24 months, it is a fully integrated POS system that features a customer-facing display and is designed for seamless payment processing.

Square Stand: For $149 or $14/mo over 12 months. The Square Stand transforms your iPad into a professional POS system that supports various payment methods.

Additional Fees and Information

- Monthly Fees: Square’s POS software is free to use, but depending on the options and the type of business you run, it can cost between $29 and custom pricing.

- No Long-Term Contracts: Square does not require long-term contracts or charge equipment fees, providing business flexibility.

- Custom Pricing: Square offers custom pricing for businesses that process over $250,000 in card sales annually. Interested companies can contact Square’s sales team for more information.

- Afterpay Fees: Square charges a fee of 6% + $0.30 per transaction for transactions using Afterpay.

Let’s explore these options, along with details on equipment costs and other potential expenses.

Clover POS Pricing

Clover POS offers different pricing for various industries. They have plans for full-service dining, quick-service restaurants, retail, professional services, personal services, and home & field services. You can choose to pay monthly for at least 3 years or pay more upfront with a lower monthly rate. Here’s a breakdown of the costs for each Clover solution:

Software Plans and Pricing by Industry

Retail Pricing

Monthly Cost

$349/mo or bundled at $16/mo for 36 months with hardware. Starting at 2.6% + $0.10 for in-person transactions, 3.5% + $0.10 for keyed-in transactions; Compact terminal system with 3.6″ screen

Best For

Small retail shops with minimal inventory needs

Key Features

• Basic payment acceptance

• Sales tracking

• Limited access to App Market

Monthly Cost

$1,899 + $84.95/mo or $180/mo bundled with hardware for 36 months;

Best For

Growing restaurants that need more substantial management capabilities

Key Features

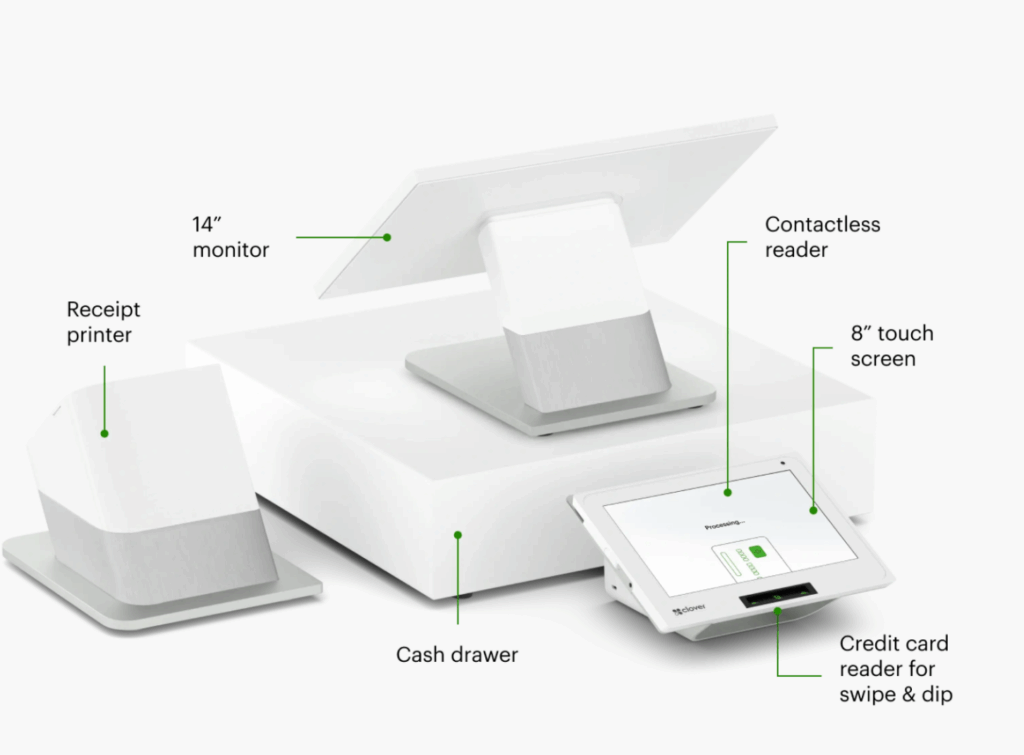

• Enhanced inventory management, Station Duo – 14″ merchant-facing POS with 8″ customer screen

• item or order-level discounts

• real-time sales tracking

Monthly Cost

$2,648 + $104.90/mo or $240/mo bundled with hardware for 36 months; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Large retail with complex inventory and reporting needs

Key Features

• Advanced reporting

•Weight scale integration

• Station Duo +; 14″ and 8″ countertop displays

• Unlimited launch and consultation services

Full-Service Dining

Monthly Cost

$1,799 + $89.95 or $179/month for 36 months with hardware. Starting at 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions; Compact terminal system with 3.6″ screen

Best For

Small retail shops with minimal inventory needs

Key Features

• Online ordering

• Order management

• Limited access to App Market

Monthly Cost

$2,548 + $109.90/mo or $239/month for 36 months with hardware; Station Duo – 14″ merchant-facing POS with 8″ customer screen

Best For

Growing restaurants that need more substantial management capabilities

Key Features

• Flex – Handheld POS with an 8-hour battery life and built-in receipt printer

• Table mapping, bill splitting, pick-up, and delivery order types

• Employee management

Monthly Cost

$4,447 + $129.85/mo or $354/month for 36 months with hardware; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Large or multi-location restaurants

Key Features

•multi-location support

•Advanced POS analytics

•custom integrations

Quick-Service Dining

Monthly Cost

$849+ $89.95/mo or bundled at $135/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions;

Best For

Cafes, food trucks, or bakeries

Key Features

• Quick order processing

• Online ordering

• Basic inventory

Monthly Cost

$1,899 + $89.95/mo or $185/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Growing quick-service businesses

Key Features

• Order modifiers

• Employee scheduling

• Customer loyalty

Monthly Cost

$2,648 + $109.90/mo or $245/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

High-volume quick-service restaurants

Key Features

• Kitchen printer integration

• Advanced POS analytics and customer insights

•Weight scale integration

Professional Services

Monthly Cost

$0+ $29.95/mo; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions;

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• Basic reporting

Monthly Cost

$749+ $84.95/mo or bundled at $125/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• inventory tracking

• Clover Mini

Monthly Cost

$1,799 + $84.95/mo or $174/month for 36 months with hardware; 3.5% + $0.10 for keyed-in transactions;

Best For

Larger service businesses with complex operations

Key Features

• Station Duo

• Advanced client management

• Multi-device support

Home/Field Services

Monthly Cost

$0+ $29.95/mo, 3.5% + $0.10 for keyed-in transactions

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• Basic reporting

Monthly Cost

$199+ $29.95/mo; Starting at 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• Go-Phone paired mobile card reader

• App Market Access

Monthly Cost

$749+ $84.95/mo or $125/month for 36 months with hardware; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions.

Best For

Larger service businesses with complex operations

Key Features

• Advanced client management

•Flex – Handheld POS

• Multi-device support

Personal Services

Monthly Cost

$349 or $16/mo for 36 months; 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• PayPal and Venmo

Monthly Cost

$849+ $84.95/mo or bundled at $130/month for 36 months with hardware; 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• App Market access

• Clover Mini

Monthly Cost

$1,899 + $84.95/mo or $180/month for 36 months with hardware; 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Larger service businesses with complex operations

Key Features

• Station Duo

•Advanced client management

• multi-device support

Hardware Costs

Clover’s proprietary hardware is required for in-person payments. It’s considered one You can pay upfront or opt for a payment plan (typically 36 months). Key options of Clover’s hardware include:

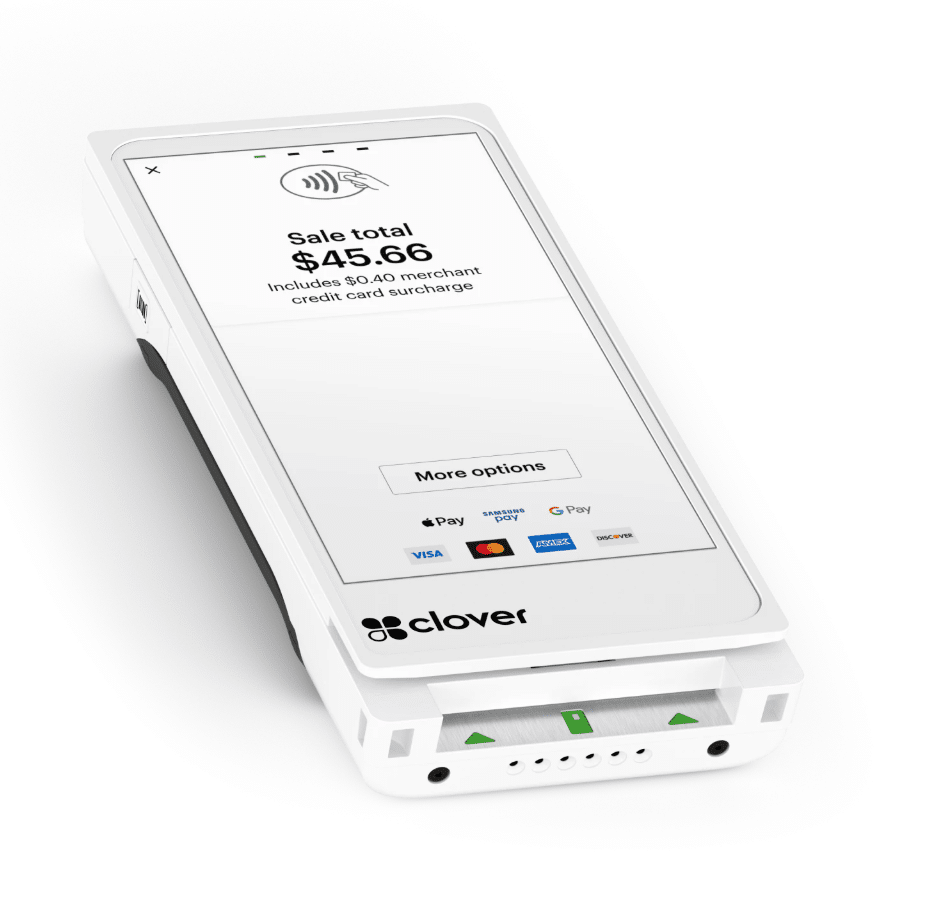

Clover Go: $199 (mobile card reader for swipe, dip, tap)

Clover Flex: $749 or $40/mo (handheld POS with receipt printer, scanner)

Clover Mini: $849 or $45/mo (compact countertop POS with an 8-inch touchscreen)

Clover Station Solo: $1,799 or $174/mo (14-inch touchscreen, cash drawer, printer)

Clover Station Duo: $1,899 or $180/mo (adds 8-inch customer-facing screen)

Clover Flex Pocket: $699 or $35/mo (handheld POS device made of durable plastic and a touchscreen interface)

Clover Kiosk: $3,499 + $34.95/mo per device (24″ touchscreen with anti-glare glass, built-in printer)

Clover Kitchen Display System: Available in 14″ and 24.” KDS 24” is $899 + $25/mo per device; KDS 14” is $799 + $25/mo per device

Add-Ons

- Scales, barcode scanners, kitchen printers, or PIN pads cost $100–$500 each

- Additional devices incur a $14.95/mon software fee per device

Transaction Fees

- In-Person: Starting at 2.3%–2.6% + $0.10, depending on the plan

- Keyed-In/Online: 3.5% + $0.10 across all plans

- Rapid Deposit: An additional 1.75% of the transaction for instant fund access (optional)

Additional Costs

- App Market Add-Ons: Many apps (e.g., QuickBooks integration) have separate fees, ranging from free to $20+/month.

- Contracts: Most plans require a 36-month commitment. Early termination fees apply, calculated based on the remaining contract value.

Key Considerations

- No Free Plan: Unlike Square, Clover doesn’t offer a free tier for full POS features, though the $14.95 virtual terminal plan is low-cost for basic needs.

- Proprietary Hardware: You must use Clover’s hardware, which increases upfront costs compared to systems like Square or Shopify or KORONA POS.

- Industry-Specific Features: Plans are tailored (e.g., table mapping for restaurants, appointment scheduling for services), so choose based on your business type.

- Third-Party Vendors: Buying from resellers may lower hardware costs but involve higher processing fees or more extended contracts. Clover is almost exclusively sold through third-party vendors, so always compare terms and get different quotes.

- Transparency: Clover’s website discloses pricing upfront, but total costs depend on hardware, add-ons, and transaction volume.

- Free trial: A 90-day free trial is available.

- Contract: Clover requires a 3-year agreement.Activation Requirements: Submit at least $25 in sales within 30 days of account approval; Process $10,000 or more in card transactions within the first four billing cycles.

All plans have processing fees ranging from 2.3% to 3.5%, plus a $0.10 per-transaction fee. You can see a comparison of Clover vs. Square processing fees and rates.

Remember: You can’t cancel subscriptions or get refunds once you start. You can only end a subscription by buying out or upgrading. You can upgrade to a different device or a newer version of your current device. For more information on how Clover compares to Revel POS, check out our detailed guide.

Square vs Clover: Strengths and Weaknesses

Both platforms offer a suite of features to streamline operations, but they cater to different business needs and preferences. Let’s dive into their strengths and weaknesses.

Pros of Square POS

- Simple and intuitive design: The Square POS platform boasts a user-friendly layout, making it easy for employees to learn and operate, regardless of their technical expertise.

- Portability and versatility: The system’s compatibility with smartphones and tablets allows for transaction processing on various devices, ideal for businesses that need flexibility, such as temporary shops or event vendors.

- Detailed business insights: Square POS delivers comprehensive sales data and analytics, enabling companies to monitor performance, identify trends, and make strategic choices to expand their operations.

- Stock control capabilities: The platform includes basic inventory tracking features, assisting businesses in managing product levels, organizing items, and receiving notifications when supplies run low.

- Seamless tool integration: Square POS connects with various business applications, including accounting software and online storefronts, streamlining operations through automated processes and synchronized information across different platforms.

Cons of Square POS

- Additional cost for marketing tools: Square’s loyalty and rewards programs, as well as email and marketing tools, are not included in the standard packages. These customer relationship management (CRM) tools are available in tiered POS pricing plans based on email, text, and customer volumes.

- Fund-holding policies: One major concern with Square is its practice of holding funds. Without a traditional underwriting process, accounts can be opened quickly, but larger or unusual transactions may trigger a hold on funds until Square deems them safe.

- Higher transaction fees: Square’s flat-rate pricing can become expensive as a business grows. The transaction fees are higher than those of many other payment processors, which can add up for businesses with high sales volumes.

- Limited customer support: Many users have reported issues with Square’s customer support. The basic plan does not include phone support and only offers limited chat support. Email support is available but response times can be slow, leaving businesses without timely solutions during technical issues.

Do you have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us now at 833.200.0213 to see for yourself.

Pros of Clover POS

- Hardware flexibility: Clover offers a range of POS devices to accommodate various business requirements and price points. These include portable units like Clover Flex for mobile sales, desktop terminals for conventional checkout areas, and even customer-operated kiosks.

- Extensive add-on ecosystem: Clover’s comprehensive App Market features numerous third-party software integrations, enabling users to enhance their system’s capabilities.

- Web-based infrastructure: As a cloud-powered solution, Clover POS enables remote data storage and access, eliminating the need for in-house servers or complex IT setups.

Cons of Clover POS

- Opaque pricing structure: Some users report unexpected costs and concealed fees, particularly related to the App Store. They also complain about price increases for continued access to certain features.

- Compatibility issues: Businesses have faced challenges integrating specific industry software, such as salon online booking systems, with Clover POS.

- Limited payment processing options: Clover POS is exclusively linked to First Data (now Fiserv) for transaction processing, which may restrict flexibility for some businesses.

Are payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

- Subpar customer support: Multiple users describe unsatisfactory experiences with Clover’s customer service, citing extended wait times, communication barriers, and unresolved issues.

- Contentious transaction fees: Some merchants feel the credit card processing charges imposed on their customers are excessive, potentially straining client relationships.

- Confusing billing practices: Users mention problems with Clover’s invoicing, including unexpected charges and difficulties obtaining clarification or resolving disputes.

- Basic reporting tools: While sufficient for smaller enterprises, Clover’s analytics capabilities may not meet the needs of larger businesses requiring more sophisticated reporting options.

Square vs. Clover: Conclusion

Square POS stands out with its intuitive interface, transparent pricing model, and versatile features that cater to a wide range of business types. These features make it an attractive option for small—to medium-sized enterprises seeking flexibility and ease of use.

However, its simplicity may come at the cost of more advanced functionalities required by larger operations.

Conversely, Clover POS offers a robust app marketplace, sleek hardware designs, and customizable solutions that appeal to businesses looking for a more tailored approach to their point of sale needs.

While Clover may have higher upfront costs and a steeper learning curve for some of its advanced features, its scalability and integration options make it well-suited for growing businesses with specific requirements.

Ultimately, your choice between Square POS and Clover POS should depend on your business’s unique needs, prioritizing either Square’s straightforward approach and broad applicability or Clover’s customization potential and complete hardware setups.

If you’re looking for alternatives to Clover and Square POS, click below to learn more about how KORONA POS can help your business.