In this comprehensive comparison, we’ll explore the nuances of Square POS and Clover POS, examining their key features, advantages, and potential drawbacks for various business needs.

We’ll scrutinize everything from cost structures and hardware options to software capabilities and user-friendliness, offering a thorough analysis to guide your decision-making process.

Whether you’re a small retailer seeking powerful sales tracking tools, a café owner needing efficient table management, or a mobile business requiring a versatile POS solution, this guide will highlight the crucial aspects that should shape your choice between Square and Clover.

By the conclusion, you’ll have a clear picture of which POS system best suits your unique business requirements, enabling you to streamline operations, elevate customer satisfaction, and fuel your company’s expansion.

Square vs. Clover: Product Roundup Table

The table below offers an overview of Square and Clover’s comparison. This comparison will help you understand how these systems compare regarding the industries they serve, key features, pros and cons, user ratings, and the availability of free trials.

Features | Square POS | Clover POS |

Hardware options |

|

|

Software features |

|

|

Free trial |

|

|

Monthly fees |

|

|

Payment processing |

|

|

Transaction fees |

|

|

Integrations |

|

|

Setup and ease of use |

|

|

Industry focus |

|

|

Looking for an alternative to Square POS System or Clover POS?

Try KORONA POS, a powerful solution for your business needs. Speak with a product specialist and learn how KORONA POS can power your business.

Square vs. Clover POS: Quick Facts

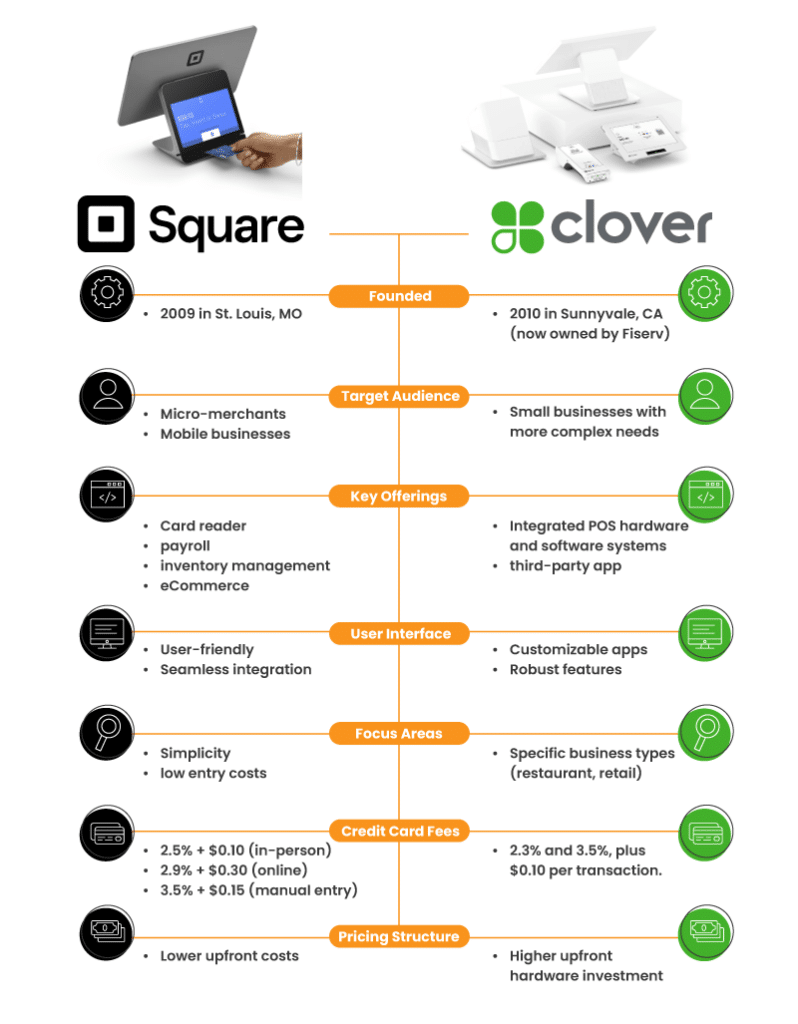

Square and Clover are both prominent players in the mobile point of sale industry, offering solutions for small businesses to accept payments.

Square, founded in 2009, is known for its iconic square-shaped card reader and comprehensive ecosystem of business tools.

It offers a wider range of services, including payroll, inventory management, and eCommerce solutions.

Clover, launched in 2012 and now owned by Fiserv, focuses more on providing integrated POS hardware and software systems tailored for specific business types.

While Square generally appeals to micro-merchants and mobile businesses with its simplicity and low entry costs, Clover targets slightly larger small businesses with more complex needs. Both offer competitive credit card transaction fees, but their pricing structures differ, with Clover often requiring more upfront investment in hardware.

Square is typically praised for its user-friendly interface and seamless integration across its services, while Clover is noted for its customizable apps and robust features for restaurant and retail environments.

Square POS vs. Clover: A More Detailed Comparison

We will examine Square POS and Clover POS’s fundamental features, pricing schemes, integrations, and user feedback, offering a thorough analysis to assist in your decision-making process.

Square POS: Our Assessment

In this section, let’s take a brief look at Square POS. We’ll look at some of the software’s features, its advantages and disadvantages, and other important aspects to know before you consider using it. If you’d like to learn more about Square POS, visit our Square POS Review.

Square POS: Our Verdict

Square POS presents an accessible and budget-friendly option for small to medium-sized businesses. It includes key functionalities like payment processing, inventory tracking, and sales reporting. With its user-friendly interface and simple setup, Square POS caters to businesses of various sizes.

Additionally, its competitive pricing and clear fee structure are particularly attractive to cost-conscious business owners.

However, companies needing more advanced features or extensive assistance might find Square’s customer support and feature set less comprehensive compared to other POS solutions available.

Processing: Starting at 2.6% plus $0.10 per transaction

Best For: Start-up Retailers; Small restaurant and appointment businesses

Pros

- Simple, user-friendly interface

- Versatile with mobile hardware

- Streamlined self-service account initiation

Cons

- Lacking payment processing flexibility

- Less in-depth reporting and analytics

Pricing

Restaurant

$0/$60/$153/mo

- Menu management

- Kitchen display

- Tabel management

Retail

$0/$89/Custom

- Inventory management

- eCommerce

- Employee tracking

Appointment

$0/$29/$69/mo

- Scheduling

- Marketing

- Multilocation

Clover POS: Our Assessment

Square vs. Clover: Pricing, Costs, Fees, and Contracts

Let’s examine how Square POS and Clover POS compare regarding pricing offerings.

Square POS Pricing

Square offers three distinct pricing plans tailored to specific business types: one for restaurants, another for retail establishments, and a third for appointment-based services.

Let’s explore these options, along with details on equipment costs and other potential expenses.

Square Restaurant Pricing

Square Restaurant’s point of sale system offers three pricing tiers, which is well-suited for quick-service establishments like bakeries, coffee shops, and food trucks. If you own a restaurant business, you may also want to check our guide talking about the best pos system for restaurants.

Free Plan ($0/mo):

- No monthly fee

- Transaction fees: 2.6% + $0.10 (in-person), 2.9% + $0.30 (online), or 3.5% + $0.15 (manual entry)

- Includes basic POS features such as menu management, tipping, basic reporting, and inventory tracking

Plus Plan ($60/mo):

- $60 per month per location

- Same transaction fees as the Free Plan

- Offers advanced features like floor plan creation, table management, live sales reports, and kitchen display system integration

Square Restaurant Essentials Bundle ($153/mo):

- Custom pricing starts around $153 per month, varying based on features and volume

- Transaction fees match the Free and Plus Plans, except for online transactions at 2.6% + $0.30

- Encompasses all Plus Plan features with additional tools for larger operations

- This tiered system allows restaurants to choose a plan that best fits their size and needs, from basic functionality to more comprehensive solutions.

Square Retail Pricing

Square POS Retail offers three pricing tiers for businesses:

Free Plan ($0/mo):

- No monthly cost

- Transaction fees: 2.6% + $0.10 (in-person), 2.9% + $0.30 (online), or 3.5% + $0.15 (manual entry)

- Basic features include simple inventory management and eCommerce capabilities

Plus Plan ($89/mo):

- $89 per month per location

- Transaction fees: 2.5% + $0.10 (in-person), 2.9% + $0.30 (online), or 3.5% + $0.15 (manual entry) – Learn more about the cheapest credit card processing

- Advanced features like enhanced inventory management, purchase orders, and employee management

Premium Plan (Custom pricing):

- Custom pricing for high-volume merchants (over $250,000 annual processing)

- Transaction fees typically 2.5% + $0.10 for in-person sales, subject to negotiation

- Includes all Plus Plan features with added personalized support and tailored solutions

- Each plan accommodates different business sizes and needs, from small startups to large-scale retail operations

Square Appointments Pricing

Square Appointments, one of the best for salon POS systems, offers three pricing tiers designed to meet various business needs. The options are:

Free Plan ($0/mo):

- Ideal for single-location businesses

- Includes basic scheduling, online booking, unlimited appointments, automatic reminders, and simple reporting.

Plus Plan ($29/mo):

- Suited for growing businesses

- Adds advanced reporting, no-show protection, multi-staff scheduling, and Square Marketing integration

Premium Plan ($69/mo):

- Perfect for larger or multi-location businesses

- Encompasses all Plus features, plus resource management, custom staff commissions, advanced permissions, and Square Shifts for time tracking and payroll

- Each tier progressively offers more sophisticated tools for appointment management, staff coordination, and business operations

Clover POS Pricing

Clover POS offers different pricing for various industries. They have plans for full-service dining, quick-service restaurants, retail, professional services, personal services, and home & field services. You can choose to pay monthly for at least 3 years or pay more upfront with a lower monthly rate. Here’s a breakdown of the costs for each Clover solution:

Clover Full-Service Restaurant Pricing

- Starter: $165/mo for 3 years or $1,699 upfront plus $89.95/mo – no hardware included

- Standard: $220/mo for 3 years or $2,298 upfront plus $109.90/mo – includes a handheld Clover Flex device

- Advanced: $325/mo for 3 years or $4,097 upfront plus $129.85/mo – includes Clover Station Duo with customer screen

Clover Quick-Service Restaurant Pricing

- Starter: $105/mo for 3 years or $799 upfront plus $59.95/mo – includes a small touchscreen tablet

- Standard: $145/mo for 3 years or $1,799 upfront plus $59.95/mo – includes a full counter POS device

- Advanced: $200/mo for 3 years or $2,398 upfront plus $79.90/mo – includes Clover Flex for tableside orders

Clover Retail Pricing

- Starter: $60/mo for 3 years or $799 upfront plus $14.95/mo – includes a countertop tablet

- Standard: $135/mo for 3 years or $1,799 upfront plus $49.95/mo – includes a touchscreen terminal and customer tablet

- Advanced: $190/mo for 3 years or $2,398 upfront plus $69.90/mo – adds Clover Flex handheld device

Clover Professional Services Pricing

- Starter: $14.95/mo for basic payment and invoice management

- Standard: $50/mo for 3 years or $599 upfront plus $14.95/mo – includes handheld POS

- Advanced: $125/mo for 3 years or $1,699 upfront plus $49.95/mo – includes Clover Station Solo with a 14-inch screen

Clover Personal Services Pricing

- Starter: $50/mo for 3 years or $599 upfront plus $14.95/mo – includes Flex-Handheld POS

- Standard: $95/mo for 3 years or $799 upfront plus $49.95/mo – includes 8″ countertop POS

- Advanced: $135/mo for 3 years or $1,799 upfront plus $49.95/mo – includes 14″ terminal and 8″ customer display

Clover Home & Field Services Pricing

- Starter: $50/mo for 3 years or $599 upfront plus $14.95/mo – includes Flex-Handheld POS

- Standard: $95/mo for 3 years or $799 upfront plus $49.95/mo – includes 8″ countertop POS

- Advanced: $135/mo for 3 years or $1,799 upfront plus $49.95/mo – includes 14″ terminal and 8″ customer display

All plans have processing fees between 2.3% and 3.5%, plus $0.10 per transaction. You can see a comparison of Clover vs. Square processing fees and rates.

Remember: You can’t cancel subscriptions or get refunds once you start. You can only end a subscription by buying out or upgrading. You can upgrade to a different device or a newer version of your current device. For more information on how Clover compares to Revel POS, check out our detailed guide.

Square vs Clover: Strengths and Weaknesses

Both platforms offer a suite of features to streamline operations, but they cater to different business needs and preferences. Let’s dive into their strengths and weaknesses.

Pros of Square POS

- Simple and intuitive design: The Square POS platform boasts a user-friendly layout, making it easy for employees to learn and operate, regardless of their technical expertise.

- Portability and versatility: The system’s compatibility with smartphones and tablets allows for transaction processing on various devices, ideal for businesses that need flexibility, such as temporary shops or event vendors.

- Detailed business insights: Square POS delivers comprehensive sales data and analytics, enabling companies to monitor performance, identify trends, and make strategic choices to expand their operations.

- Stock control capabilities: The platform includes basic inventory tracking features, assisting businesses in managing product levels, organizing items, and receiving notifications when supplies run low.

- Seamless tool integration: Square POS connects with various business applications, including accounting software and online storefronts, streamlining operations through automated processes and synchronized information across different platforms.

Cons of Square POS

- Additional cost for marketing tools: Square’s loyalty and rewards programs, as well as email and marketing tools, are not included in the standard packages. These customer relationship management (CRM) tools are available in tiered POS pricing plans based on email, text, and customer volumes.

- Fund-holding policies: One major concern with Square is its practice of holding funds. Without a traditional underwriting process, accounts can be opened quickly, but larger or unusual transactions may trigger a hold on funds until Square deems them safe.

- Higher transaction fees: Square’s flat-rate pricing can become expensive as a business grows. The transaction fees are higher than those of many other payment processors, which can add up for businesses with high sales volumes.

- Limited customer support: Many users have reported issues with Square’s customer support. The basic plan does not include phone support and only offers limited chat support. Email support is available but response times can be slow, leaving businesses without timely solutions during technical issues.

Do you have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us now at 833.200.0213 to see for yourself.

Pros of Clover POS

- Hardware flexibility: Clover offers a range of POS devices to accommodate various business requirements and price points. These include portable units like Clover Flex for mobile sales, desktop terminals for conventional checkout areas, and even customer-operated kiosks.

- Extensive add-on ecosystem: Clover’s comprehensive App Market features numerous third-party software integrations, enabling users to enhance their system’s capabilities.

- Web-based infrastructure: As a cloud-powered solution, Clover POS enables remote data storage and access, eliminating the need for in-house servers or complex IT setups.

Cons of Clover POS

- Opaque pricing structure: Some users report unexpected costs and concealed fees, particularly related to the App Store. They also complain about price increases for continued access to certain features.

- Compatibility issues: Businesses have faced challenges integrating specific industry software, such as salon online booking systems, with Clover POS.

- Limited payment processing options: Clover POS is exclusively linked to First Data (now Fiserv) for transaction processing, which may restrict flexibility for some businesses.

Are payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

- Subpar customer support: Multiple users describe unsatisfactory experiences with Clover’s customer service, citing extended wait times, communication barriers, and unresolved issues.

- Contentious transaction fees: Some merchants feel the credit card processing charges imposed on their customers are excessive, potentially straining client relationships.

- Confusing billing practices: Users mention problems with Clover’s invoicing, including unexpected charges and difficulties obtaining clarification or resolving disputes.

- Basic reporting tools: While sufficient for smaller enterprises, Clover’s analytics capabilities may not meet the needs of larger businesses requiring more sophisticated reporting options.

Square vs. Clover: Conclusion

Square POS stands out with its intuitive interface, transparent pricing model, and versatile features that cater to a wide range of business types. These features make it an attractive option for small—to medium-sized enterprises seeking flexibility and ease of use.

However, its simplicity may come at the cost of more advanced functionalities required by larger operations.

Conversely, Clover POS offers a robust app marketplace, sleek hardware designs, and customizable solutions that appeal to businesses looking for a more tailored approach to their point of sale needs.

While Clover may have higher upfront costs and a steeper learning curve for some of its advanced features, its scalability and integration options make it well-suited for growing businesses with specific requirements.

Ultimately, your choice between Square POS and Clover POS should depend on your business’s unique needs, prioritizing either Square’s straightforward approach and broad applicability or Clover’s customization potential and complete hardware setups.

If you’re looking for alternatives to Clover and Square POS, click below to learn more about how KORONA POS can help your business.