Key Takeaways:

- A cash register is a basic device mainly for recording sales and storing cash; it suits small businesses with simple transaction needs.

- A POS system is a comprehensive tool that handles transactions plus inventory management, sales analytics, customer profiles, and employee management.

- Choosing between them depends on your business size, needs, and budget: cash registers are cost-effective for simple setups; POS systems drive efficiency and growth with modern, scalable capabilities.

We all remember the days of clunky, nostalgic cash registers. Times have changed, and we’re now in the age of sleek, touchscreen point of sale systems. What is the difference between cash registers and POS systems anyway? And what changed when we transitioned?

Whether you’re a small business owner pondering an upgrade to POS or a tech enthusiast exploring the evolution of retail, we hope this post will help you learn something valuable.

Differences Between a POS System and a Cash Register: At a Glance

This chart offers a comprehensive overview of the key similarities and differences between a cash register and a POS system:

Feature | Cash Register | POS System |

Hardware | Usually consists of a drawer, keyboard, and display. | Includes a computer, touchscreen monitor, barcode scanner, receipt printer, and often a cash drawer. |

Transaction Processing | Basic functionality limited to cash transactions and manual entry of prices. | Processes various payment types, including cash, credit/debit cards, mobile payments, and more.

|

Inventory Management | No inventory tracking capabilities. | Robust features like real-time tracking, stock alerts, and automatic reordering. |

Reporting | Basic reporting features such as end-of-day sales totals. | Provides detailed reports on sales, inventory levels, employee performance, and more. |

Integration | Can integrate into POS systems. | Integrates with other business systems such as accounting software, CRM tools, and more. |

Scalability | Limited scalability for growing businesses. | Scalable to accommodate the needs of growing businesses, including multiple locations. |

Cost | Generally lower initial cost but may require ongoing maintenance. | Higher initial investment offers long-term savings in the long run through increased efficiency. |

User Interface | Usually limited to physical buttons and a small display. | Offers intuitive touchscreen interfaces with customizable layouts for ease of use. |

Customer Management | No customer management features. | Can store customer data, track purchase history, and implement loyalty programs. Add New |

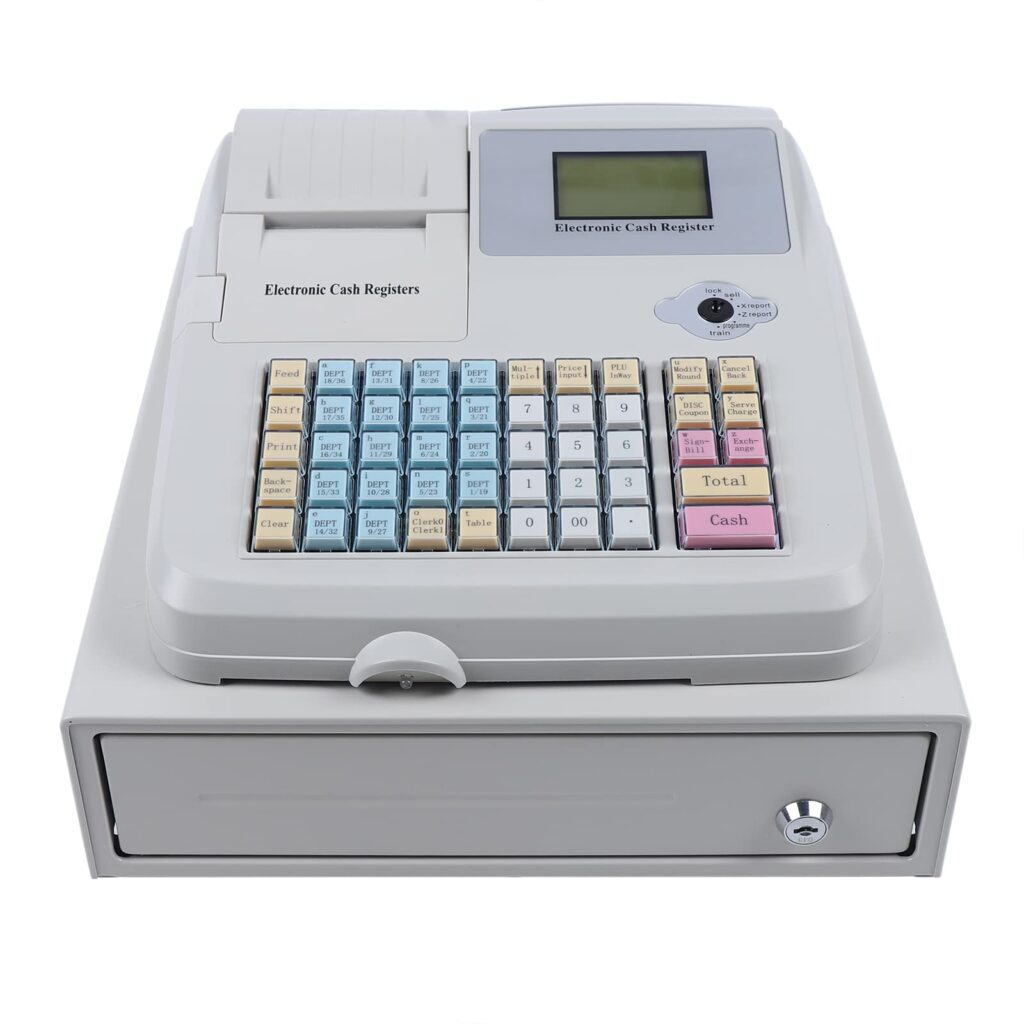

What Is a Cash Register?

The cash register emerged in the late 19th century as a mechanical device to record sales transactions. It serves as a basic point-of-sale terminal, facilitating the exchange of goods and services for payment.

Despite technological advancements, cash registers remain valuable for small businesses and environments with simple transaction needs.

How Does a Cash Register Work?

Cash registers can ring up and process transactions and complete rudimentary calculations like tax and change. They can also:

- Record sales transactions: Cash registers tally the cost of items purchased, calculate the total amount owed, and process payments, whether in cash, card, or other forms. They also compile simple end-of-day (EOD) reports.

- Manage cash: Cash registers store money securely in designated compartments, allowing cashiers to give change to customers and maintain accurate cash balances throughout the day.

- Generate receipts: Cash registers print itemized receipts for customers, recording their purchases and serving as proof of transaction for returns or exchanges.

Key Features of a Traditional Cash Register

While simpler than modern POS systems, cash registers offer essential functionality for businesses with straightforward needs. Below are the key features of a traditional cash register:

Cash Drawer for Secure Storage

The cash drawer is a core component of a traditional cash register, typically divided into compartments for bills and coins. It stores cash, checks, and sometimes receipts during business hours.

The locking drawer is critical for cash-only businesses because it organizes funds and minimizes the risk of theft or mismanagement.

Keypad or Button Interface

Traditional cash registers feature a physical keypad or buttons for entering transaction amounts, selecting product categories, and performing functions such as calculating totals and issuing refunds.

Some registers include dedicated keys for specific items or tax calculations, which streamline repetitive tasks.

Basic Sales Recording

Cash registers record sales by storing transaction data, typically in a basic internal memory or on a paper receipt tape.

While not as advanced as POS analytics, this feature provides sufficient data for businesses with low transaction volumes.

Receipt Printing Capability

Most traditional cash registers include a built-in thermal or impact printer to generate customer paper receipts. The receipt typically includes the transaction amount, date, and sometimes a store name or basic itemization.

Basic Calculation Functions

Cash registers perform basic arithmetic, such as adding up items, calculating tax, and determining change owed to customers. This feature eliminates manual calculations, reducing cash-handling errors.

Manual Override and Offline Operation:

Unlike digital POS systems that rely on internet connectivity, traditional cash registers operate offline and often include manual override options (e.g., a key to open the cash drawer).

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

Benefits of Cash Registers

Below are the key benefits of using a cash register, elaborated with practical applications and advantages:

Low Cost and Minimal Maintenance:

Cash registers are a one-time purchase with significantly lower upfront costs than POS systems, which often require hardware, software subscriptions, and ongoing updates. A basic cash register can cost as little as $100–$500, making it accessible for small businesses or startups with limited budgets.

Maintenance is minimal, typically involving only occasional cleaning or replacing receipt paper.

Ease of Use and Minimal Training

The straightforward design of cash registers requires little to no training, making them ideal for businesses with high staff turnover or temporary workers. The intuitive keypad allows employees to quickly learn to input transactions, calculate totals, and issue change.

Compact and Portable Design

Traditional cash registers are compact and require minimal counter space, making them ideal for small or temporary setups such as pop-up shops, market stalls, or DIY events. Their portability allows businesses to move them easily between locations.

For businesses that exclusively accept cash, such as certain food stalls or niche retail, a cash register provides all necessary functionality without the added cost of payment processing hardware for cards or digital wallets.

Limitations of Cash Registers

- Limited functionality – Cash registers lack advanced features such as inventory management, sales analytics, and digital payment processing, hindering business operations and growth.

- Manual processes – Transactions and calculations on a cash register are typically performed manually, increasing the risk of human error and requiring more time for reconciliation and accounting tasks.

- Lack of integrations – Cash registers often do not integrate seamlessly with other business tools and software solutions, making it challenging to streamline operations and maintain data consistency across different aspects of the business.

Cash Registers Cost Overview

Cash registers in 2026 vary widely in cost depending on type and features. Basic models cost around $150–$600.

What Is a POS System?

The modern POS incorporates all the elements of the traditional cash register and offers extensive additional features. It comprises several key elements that streamline sales operations and enhance overall business productivity.

POS Software vs. Hardware

- POS Software – POS software enables businesses to process transactions, manage inventory, generate reports, and more. The software often includes user-friendly interfaces for cashiers and managers, making it easy to navigate and utilize.

- POS Hardware – POS hardware typically includes a computer or tablet, a touchscreen monitor, barcode scanners, receipt printers, and cash drawers. Point of sale hardware components work together to facilitate transactions.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

How a POS System Works?

POS systems are celebrated for their user-friendliness and modern capabilities. These systems offer:

- Payment Processing: POS systems are equipped to accept various forms of payment, including cash, credit/debit cards, mobile payments, and electronic transfers. Integrated payment processing capabilities ensure secure and convenient customer transactions. Our in-depth guide explains the differences between POS systems and payment processors.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

- Inventory Management: POS systems make inventory management straightforward and automatic. Businesses can use their POS to track stock levels in real time, receive alerts for low inventory, automate reordering processes, and generate reports to optimize inventory control.

- Reporting and Analytics: POS systems offer robust reporting and analytics tools that give users insights into sales performance, inventory turnover rates, employee productivity, and more.

Key Features of a POS System

Modern POS systems are digital platforms that go beyond basic transaction processing, offering advanced tools to streamline operations, enhance customer experiences, and support business growth.

Below are the key features of a typical POS system, elaborated with their functionality and practical applications:

Multi-Payment Processing

POS systems support various payment methods, including cash, credit/debit cards, contactless payments (e.g., Apple Pay, Google Wallet), mobile apps, and QR codes. They often include EMV chip readers and NFC capabilities for secure transactions.

This feature ensures compliance with modern payment standards and reduces the risk of fraud through encrypted processing.

Inventory Management

POS systems track stock levels in real time, automatically updating inventory when items are sold or restocked. They allow businesses to set low-stock alerts, manage product variants (e.g., sizes, colors), and track supplier details.

Advanced systems sync inventory across multiple locations or online stores, ensuring consistency for omnichannel businesses.

Inventory management a headache?

KORONA POS makes stock control easy. Automate tasks, generate custom reports, and learn how you can start improving your business.

Sales Analytics and Reporting

POS systems generate detailed reports on sales performance, including daily totals, top-selling items, peak sales hours, and customer buying patterns. These insights help businesses make data-driven decisions, such as optimizing product placement or targeting promotions.

Customizable dashboards allow owners to filter data by date, product, or location.

Customer Relationship Management (CRM)

Many POS systems include CRM tools to store customer data, such as purchase history, contact details, and preferences. These features enable businesses to create loyalty programs, send targeted promotions, or track customer interactions.

Employee Management

POS systems often include features to track employee performance, manage schedules, and assign roles. They can monitor sales by staff member, track hours worked, and calculate commissions.

Access controls ensure only authorized staff can perform sensitive tasks like issuing refunds or accessing financial reports.

Integration with Third-Party Tools

POS systems integrate with accounting software (e.g., QuickBooks, Xero), eCommerce platforms (e.g., Shopify, WooCommerce), and delivery services (e.g., DoorDash, Uber Eats). This connectivity streamlines operations by syncing financial data, online orders, or delivery logistics.

Table Management and Order Customization (for Restaurants)

Restaurant-specific POS systems offer table mapping, order customization, and kitchen display system (KDS) integration. These features allow staff to instantly assign orders to tables, split bills, or send special requests (e.g., “no onions”) to the kitchen.

Cloud-Based Accessibility

Many POS systems are cloud-based, allowing owners to access real-time data from anywhere via mobile apps or web browsers. This feature is ideal for multi-location businesses or owners who manage remotely. Cloud systems also provide automatic backups, reducing the risk of data loss.

Free printable templates and checklists to help you manage retail operations with ease

Appointment Scheduling (for Service-Based Businesses)

POS systems for salons, spas, or gyms often include booking tools to manage appointments, send reminders, and store client profiles.

Benefits of POS Systems

POS systems offer significant advantages for businesses seeking efficiency, scalability, and enhanced customer experiences. Below are the key benefits, elaborated with practical examples and their impact on business operations:

Remote Management and Real-Time Insights

Cloud-based POS systems allow owners to monitor operations remotely, providing flexibility for busy entrepreneurs. Real-time updates ensure quick responses to issues like low stock or staffing shortages.

Enhanced Customer Experience

POS systems cater to modern customer expectations by supporting multiple payment methods and offering features such as loyalty programs and personalized promotions. Faster checkout processes and accurate order handling (e.g., through KDS in restaurants) further improve service quality.

Data-Driven Decision Making

The analytics provided by POS systems enable businesses to optimize strategies using real-time data. Sales trends and customer behavior insights help businesses adjust pricing, inventory, or marketing efforts, driving profitability and competitiveness.

Limitations of POS Systems

POS can work for most businesses. But they’re not for everyone—especially small businesses that don’t require advanced features at their point of sale. The limitations of POS systems are as follows:

Complexity and Learning Curve

POS systems can be more complex to set up and operate than cash registers, requiring staff training and learning curves.

Cost

While POS systems offer advanced features, they often come with higher upfront costs and ongoing subscription fees, making them less accessible to small businesses with limited budgets.

Dependence on technology

POS systems rely on internet connectivity and hardware components, making them susceptible to downtime or technical issues that can disrupt business operations. Cloud-based POS systems are more reliable but still require a wi-fi connection.

POS Systems Cost Overview

In 2026, the cost of POS systems varies widely based on business size, industry, and features:

- Startups and small shops: Basic POS setups can cost $70 to $250 total, often using mobile hardware and free software plans.

- Small to medium businesses: Expect $570 to $3,150 for more complete setups with hardware, software, and installation.

- Medium to large retailers: Range between $940 and $5,200+, especially for advanced features or multiple locations.

- Large enterprises: Costs may reach $1,300 to $19,000+ based on scale and customization.

Software fees range from free to $150+ per month. Hardware varies from minimal (mobile card readers at $0 to $50) to $2,000+ for full countertop kits. Payment processing fees typically range from 1.5% to 3.5% per transaction. Additional costs may include installation, add-ons, PCI compliance, and cancellation fees.

Square POS

Shopify POS

Clover POS:

What is a POS Cash Register?

A POS cash register integrates both systems’ functions to streamline sales transactions and cash handling in a retail or hospitality setting.

The POS system serves as the central hub for managing sales, inventory, and payment processing, while the cash register securely handles cash transactions. Together, they ensure that all cash-related transactions are documented and secure while generating real-time sales, cash flow, and inventory reports.

How to Choose Between a POS and a Cash Register?

Choosing between a modern point-of-sale (POS) system and a traditional cash register depends on factors such as business type, operational needs, budget, and customer experience goals. Below, we outline key considerations to help businesses decide which option best suits their needs.

Best for POS Systems: Businesses Needing Advanced Functionality

Due to their robust features, POS systems thrive in retail stores, restaurants, and salons. If your business handles high transaction volumes, accepts diverse payment methods (e.g., cards, mobile payments), or requires data-driven insights, a POS system is essential for scalability and improved customer experiences.

Best for Cash Registers: Businesses Prioritizing Simplicity and Low Cost

Cash-only businesses often prefer cash registers for their straightforward functionality and nostalgic appeal. Other businesses with low transaction volumes might not need advanced features like inventory tracking or digital payment processing.

Cash registers are budget-friendly, requiring only a one-time purchase without ongoing subscription costs, making them ideal for micro-businesses or short-term operations.

Making the Decision

Choose a POS system if your business needs efficiency, scalability, or modern payment options. They’re perfect for retail, food service, or service-based businesses aiming to streamline operations and grow.

Opt for a cash register if you run a cash-only, low-volume, or temporary operation where simplicity and minimal investment are priorities.

Evaluate your transaction needs, customer payment preferences, and long-term goals to select the system that aligns with your business’s unique demands.

Looking for a Better Solution? Try KORONA POS

If you’re ready to move beyond a traditional cash register, KORONA POS offers a smarter, more versatile solution. With a wide range of POS hardware options, KORONA POS adapts to the needs of different industries—whether you’re running a liquor stores, wineries, vape shops, dispensaries, multi-store operations, convenience stores, ticketing services, and beyond. .

Unlike many systems, KORONA POS is processing agnostic, meaning you’re free to choose the payment processor that works best for your small business. Click the link below to learn more about how KORONA POS can help you optimize your business.

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. There’s no commitment or credit card required.

FAQs

Do people still use cash registers?

People still use cash registers, particularly in small businesses and certain industries where cash transactions remain common. Their simplicity and affordability make them especially appealing for companies with limited budgets or those operating in environments where digital systems may be impractical. Nonetheless, most retailers use modern POS systems incorporating cash drawers into their hardware.

Is POS the same as a cashier?

A POS (Point of Sale) system is different from a cashier. A cashier is the person who operates the POS system, which is a combination of hardware and software used to process sales, manage transactions, track inventory, and handle payments efficiently.

What are cash registers called now?

Cash registers are now commonly called POS systems, checkout terminals, electronic cash registers (ECRs), or simply tills in retail, reflecting their advanced digital functionalities beyond simple cash handling.