Small businesses must find ways to save money without sacrificing quality. Nowhere is this truer than credit card processing. Businesses need to find the best rate without worrying about insufficient product.

This blog post explores how a credit card processing fee comparison can help businesses save money by comparing rates and finding the best processing solution.

KORONA POS can assist in this process by integrating with major credit card processors and setting up rate comparisons to provide complete transparency.

? Key Takeaways:

- Understand Interchange Fees: These are baseline fees set by card networks, typically comprising a percentage of the sale plus a fixed amount.

- Use Fee Calculators: Tools like KORONA POS’s calculator help estimate processing costs based on sales and rates.

- Evaluate Pricing Models: Interchange-plus pricing offers transparency by adding a fixed markup to the interchange rate, potentially leading to cost savings.

- Compare Processors: Assess various credit card processing solutions to find the best fit for your business needs.

- Regularly Review Statements: Consistent audits can identify hidden fees or discrepancies, ensuring accurate billing.

Credit Card Processing Fee Comparison Table

Processor

Pricing

In-Person Fees (starting at)

Online Fees (Starting at)

Industries Served

Best for:

Interchange-Plus Service

Price:

Interchange + 0.40% + $0.08

Processing Fees:

Interchange + 0.50% + $0.25

Key Feature:

General businesses, including retail and eCommerce

Best for:

Flate-rate

Price:

2.6% + $0.10

Processing Fees:

2.9% + $0.30

Key Feature:

Small to medium-sized businesses, retail, food services

Best for:

Flate-rate

Price:

2.3% + $0.10

Processing Fees:

3.5% + $0.10

Key Feature:

Retail, restaurants, service industries

Best for:

Flate-rate

Price:

2.7% + $0.05

Processing Fees:

2.9% + $0.30

Key Feature:

Online businesses, eCommerce platforms

Best for:

Flate-rate

Price:

2.29% + $0.09

Processing Fees:

2.59%-2.99% + $0.49

Key Feature:

eCommerce, freelancers, small businesses

Best for:

Interchange-plus

Price:

2.95% – 5.00%

Processing Fees:

2.95% – 5.00%

Key Feature:

High-risk industries, including CBD, vape, and liquor

Different Fees in Credit Card Rate Structures?

Regarding the final fees, so many variables contribute to the final tally.

But many small businesses want to know the average transaction fee for their processing. Gauging an average is difficult unless you’re getting a flat-rate structure (which is almost universally NOT recommended).

Some businesses find ways to get their processing average to as little as 2%, while others pay 5%! It will vary based on several factors combined with your final processing total. For example, a high-risk merchant account won’t pay the same fees as other businesses.

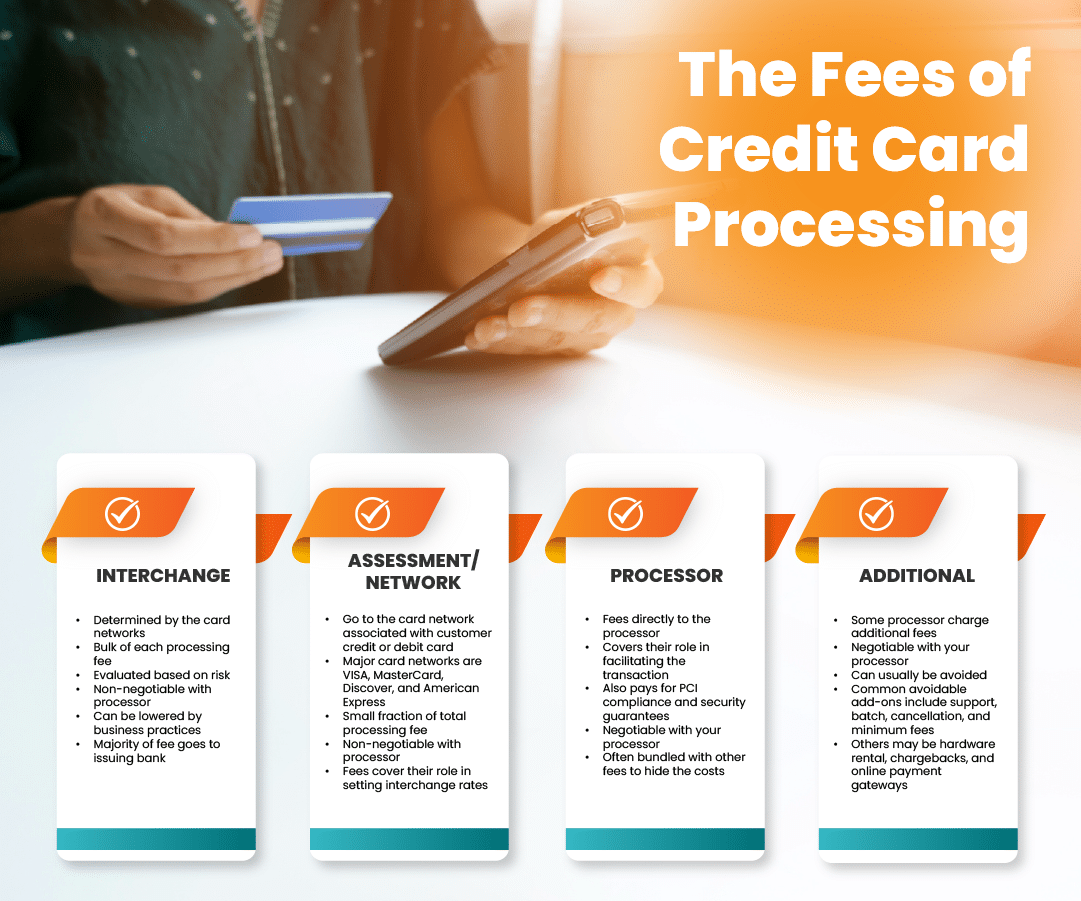

Interchange Rate

The interchange rate is the largest portion of the processing fee for any transaction. These rates, which are determined by the major card networks and given to the issuing bank, cover the risk of processing transactions. Riskier transactions will have higher interchange rates.

Each card network determines its own interchange rates based on factors including the type of card, how the card information was entered, the transaction amount, and the type of business. American Express and Discover typically have higher rates, which is why some retailers don’t accept them.

While interchange rates can’t be negotiated with your processor or the card networks, they can be reduced by your store’s policy. For example, you can choose not to accept certain cards or allow keyed transactions, as these are higher-risk transactions with higher fees. For a more in-depth look, check out our guide to interchange fees.

Assessment/Network Fees

While the interchange fees go to the consumer’s bank, the card networks also take a small cut of every transaction for their role in regulating the industry and setting the interchange standards.

These fees are the smallest of any transaction and are non-negotiable.

Your credit card processor has no control over these rates. For instance, the assessment fees for MasterCard, Discover, and VISA range between .11% and .13%.

Processor Fees

The credit card processor will also take a small percentage of any transaction they facilitate. Your processor is responsible for ensuring that all parties communicate and that the transaction is quickly and successfully approved or denied.

Your processor is also responsible for ensuring that the transaction follows all industry standards, including PCI compliance. These fees are negotiable and vary widely by each processor.

Businesses can request lower rates from competing processors. These are major components of finding the cheapest merchant services solution.

Additional Fees

Tied to your processor fees can be many additional or hidden fees. Not every processor charges their merchants for all of these, and the best don’t charge for any of them.

In our cost comparison, we’ll show you each of these potential fees, too, so you can see if you’ll be hit down the road with extra bills. Below is a list of potential additional charges some processors tack on the final total.

- Chargeback – For transactions that get a chargeback request

- Payment gateway – Providing an eCommerce payment gateway

- PCI compliance – Extra fees for following PCI rules

- Hardware rental – For those that rent or lease hardware, these fees will be bundled into your total

- Batch – Surcharges for daily batching

- Support – Some processors don’t include customer support or only include a certain amount and charge for additional use

- Minimums – Card minimums, such as an additional fee for any transaction less than $5, ensure the processor makes a profit on every transaction

- Cancellation – Fees for canceling are entirely avoidable

- Wireless access – Additional charges for providing cloud access to the payment machines

Processors that charge a flat rate for their service advertise themselves as void of any of these fees. In reality, these are bundled into a flat rate percentage that is far higher than a typical interchange rate, plus normal processor and network fees. More on that below.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Calculate Your Credit Card Processing Fees

Calculating credit card processing fees is crucial for businesses to manage costs and set accurate pricing.

A credit card processing calculator simplifies this by quickly estimating fees based on transaction amounts and processor rates, helping businesses optimize profits and avoid unexpected expenses.

Find out how much you’re spending.

Ways to Reduce Credit Card Processing Fees

Credit card processing fees can significantly impact a business’s profitability, especially as consumer preferences shift towards cashless transactions.

These fees, typically ranging from 2% to 3.5% per transaction, can accumulate rapidly, affecting the bottom line. Implementing strategies to reduce these costs is critical for maintaining financial health.

Negotiate with Your Payment Processor

As your business grows and transaction volumes increase, leverage this growth to renegotiate lower fees with your payment processor. Regularly reviewing and discussing your account can lead to more favorable rates.

Choose the Right Pricing Model

It’s so important to start by selecting a pricing structure that aligns with your business model. Interchange-plus pricing, where you pay the exact interchange rate plus a fixed markup, often offers greater transparency and can be more cost-effective for businesses with high transaction volumes.

Enhance Security Measures

Implementing robust security protocols, such as EMV-compliant terminals and PCI DSS compliance, can reduce the risk of fraud. A lower risk profile may qualify your business for reduced processing fees.

Settle Transactions Promptly

Processing and settling transactions within 24 hours can help secure the best interchange rates, as delays may lead to higher fees.

Regularly Audit Statements

Reviewing your processing statements can help identify and address hidden fees or discrepancies, ensuring you’re not overpaying.

Avoid Frequent Processor Switching

While seeking lower rates is important, frequently changing processors can lead to unforeseen costs. Negotiating with your current provider is often more beneficial than switching.

Implement Surcharging Where Legal

Adding a surcharge (often called “dual pricing”) to credit card transactions in regions where it’s permitted can offset processing costs. However, before implementing this strategy, it’s essential to consider customer perception and legal implications.

Learn more about how credit card processing works and save your business money with this free eGuide.

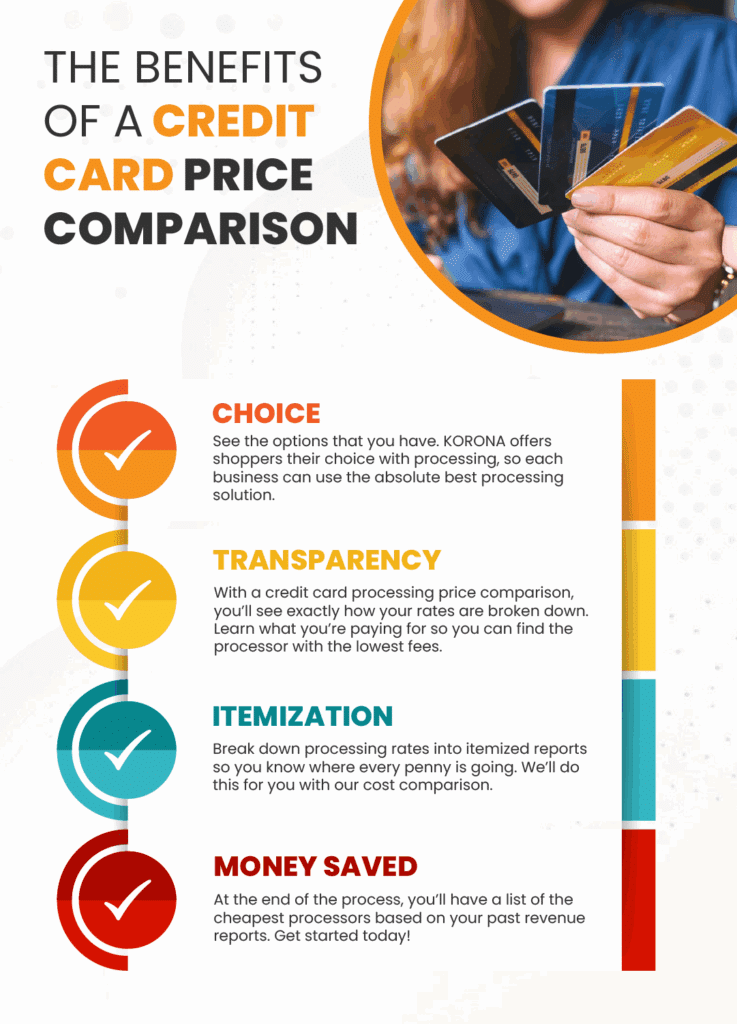

Other Ways to Get a Credit Card Processing Rate Comparison

Well, you can always reach out to us at KORONA POS! Whether you’re an existing customer or shopping for a new POS system, we’ll break down your current rate against various major processing companies. The goals are to find the cheapest credit card processing solution for your business and provide absolute transparency in the pricing structure. Through this process, we offer our users several major advantages:

Credit Card Processing Choice

Since KORONA POS is not a payment processor, the solution integrates with all major merchant service providers so our customers can process credit and debit payments.

This, in turn, allows you to find the most cost-effective solution on the market.

We’ll take your current processing volume and run it through simulations with numerous processors to find the cheapest annual option.

Transparency

Payment processors are notorious among business owners for slipping in additional fees and surcharges. This won’t happen under our watch.

We only work with merchant services that provide their users with complete transparency, meaning you’ll see what every charge is for.

Many factors go into your final processing rate, including interchange fee, processor fee, network fee, and more, so it’s important to have it all laid out for you.

Charge Itemization

Similar to transparency, we’ll break down your charges by item rather than give you a bundled final price.

Many processors will offer a flat-rate pricing structure or just charge a simple per-transaction fee. While this keeps it simple, it hides the actual charges that went into each transaction.

Since the final price you pay for any debit or credit purchase varies depending on several factors, it’s critical to be charged appropriately.

Saving Money on Your Merchant Services

And at the end of the process, you’ll have a solution that will save your business money. In some cases, a whole lot of money.

For many of our customers, we can even offset the price of your POS subscription with the savings you’ll receive from a new processing solution.

While a fraction of a percent might not seem like much, check out our breakdown of Square’s new processing rates to see how they can have a major impact on your total annual processing costs. If you use Square or are willing, check out the Square Fee Calculator to calculate your processing costs.

Why Does Credit Card Processing Cost Merchants Money?

Simply put, merchants pay for a complicated service that is integral to their business operations. Numerous parties facilitate each debit and credit transaction your business accepts.

While it may be frustrating to have a fraction of each sale deducted from your profits, it’s a service that a business must pay for, like any other.

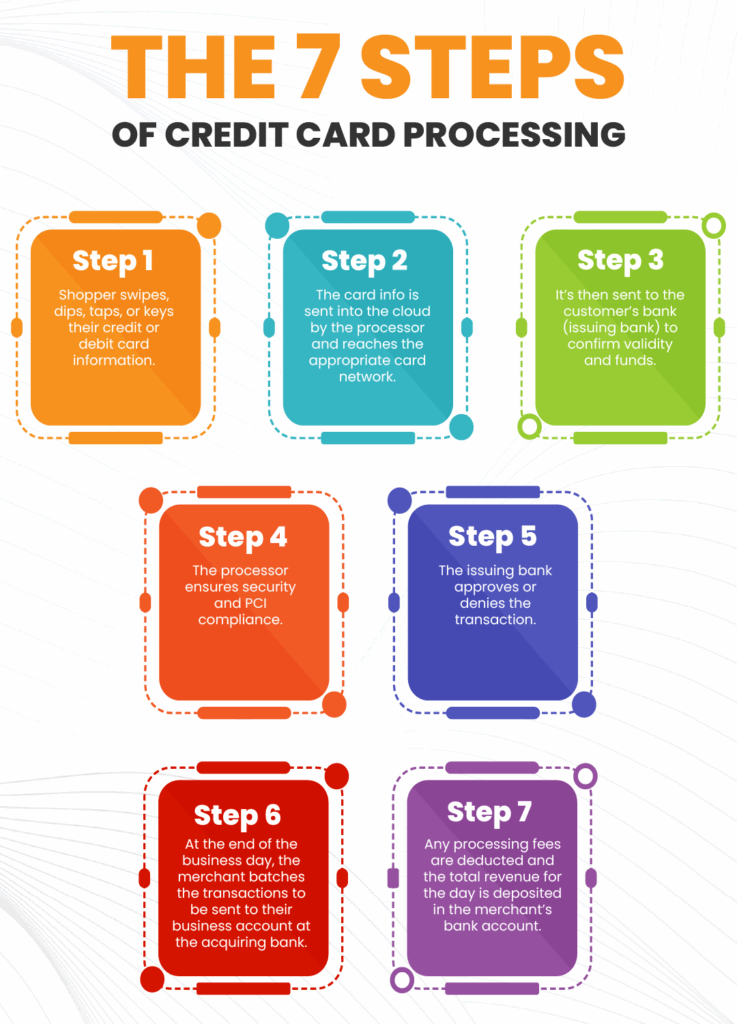

So, what happens during a credit card transaction, anyway? And why must merchants pay a fee for it? Even though it only takes a few seconds, a lot is happening.

- Step 1: First, shoppers choose their payment method and, if in a brick-and-mortar store, either swipe, dip, or tap their card or mobile device in the credit card hardware. For eCommerce shoppers, they’ll manually key their card information into your online payment gateway. For example, Shopify and Clover are known for offering some of the best solutions for online retailers.

- Step 2: The processor sends the card information to the cloud. It first reaches the appropriate card network, such as VISA or MasterCard, to have its interchange fee assessed.

- Step 3: The card info is also sent to the shopper’s bank to determine whether the transaction is valid and sufficient funds are available.

- Step 4: The credit card processor is responsible for ensuring proper security during the transaction and following all standard PCI compliance rules.

- Step 5: Once the issuing bank assesses the transaction’s validity, it sends an approved or declined message through the processor back to the credit card machine.

- Step 6: At the end of the business day, the merchant batches all transactions to deposit them from the shopper’s account to their business account, called the acquiring bank.

- Step 7: All fees assessed by the processor on each transaction will be automatically deducted from the final amount deposited in the business account.

When a card is used as payment, a transaction isn’t simply between you and the consumer. Instead, it requires your processor, two different banks, and a major card network. These parties not only process the transaction but also keep it secure. This protects consumers from having money stolen from their accounts and merchants from accepting fraudulent transactions.

What Are the Different Rate Structures?

Again, the interchange rate and network fees are non-negotiable. You’ll also see them referred to as wholesale fees. These are fixed and will not change based on your choice of processor.

Processing rates and any of the aforementioned additional fees are negotiable. These are sometimes referred to as markup fees. You should focus on these when finding the best processing fit. Any markup fees should be transparent in your processing bill.

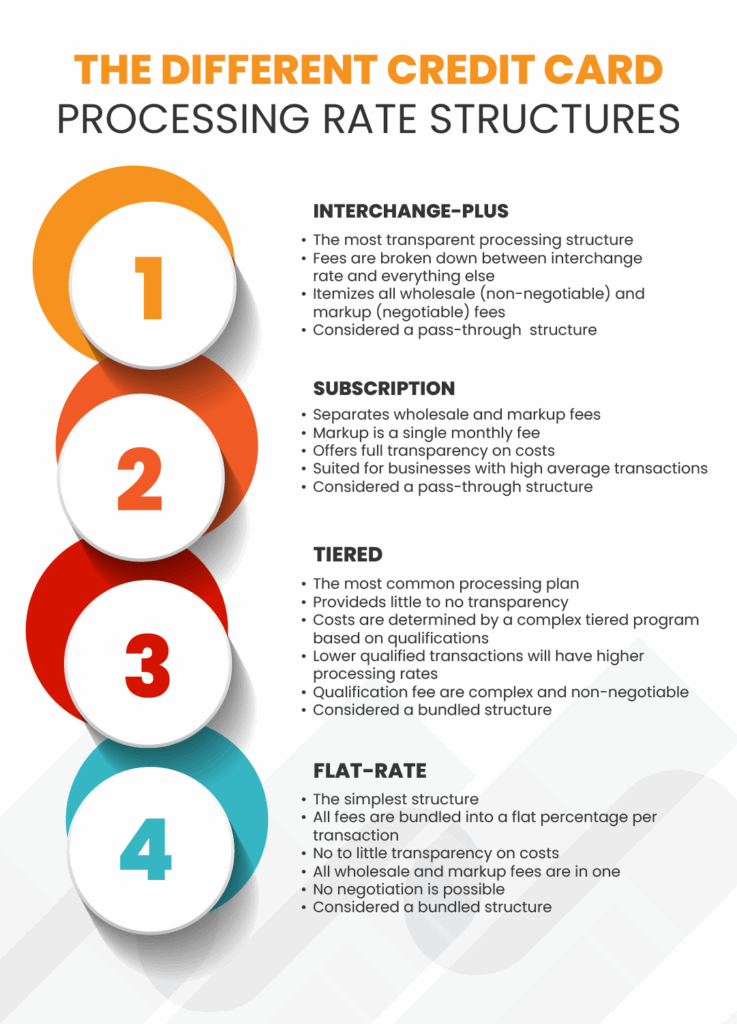

When it comes to your processing rate models, there are two main categories: pass-through and blended. Pass-through rate structures offer more transparency to users, while blended models combine all fees into one.

Interchange-Plus (Pass-Through)

Each card network determines its interchange rates based on factors including the type of card, how the card information was entered, the transaction amount, and the type of business. American Express and Discover typically have higher rates, which is why some retailers don’t accept them.

While interchange rates can’t be negotiated with your processor or the card networks, they can be reduced by your store’s policy.

For example, you can choose not to accept certain cards or allow keyed transactions, as these are higher-risk transactions with higher fees. For a more in-depth look, check out our guide to interchange fees.

Subscription (Pass-Through)

Like interchange-plus, this separates the wholesale costs of each transaction from all markup fees. The markup comes as a simple monthly fee that is your subscription or membership in addition to the non-negotiable interchange and network fees.

If you check Shopify POS pricing or Square POS pricing, you’ll realize these two solutions fall into that category.

This model offers the same transparency as interchange-plus but is better suited for businesses that process large average transactions.

Tiered (Blended)

Sadly, most businesses are on a tiered processing plan. These plans have many ways of manipulating their pricing to gouge small businesses.

The structure’s opaqueness allows them to increase the rates for numerous reasons that only the most informed business owners will know.

The tiered aspect of this plan means that each transaction will fall under a certain pricing tier, with “qualified” transactions having the lowest rates. Conveniently, what makes a qualified transaction is anyone’s guess.

Flat-Rate (Blended)

Flat-rate pricing is slightly more transparent than tiered. It bundles all fees together but doesn’t use the dubious tiered system. Instead, each transaction is assigned the same percentage rate, or percentage plus a flat fee, no matter the wholesale costs (interchange and network fees).

These flat rates seem simple and low, but they’re not. For most transactions, the wholesale fees are a small percentage of the flat rate, leaving the processor with a large portion of each fee. The breakdown is never given to customers on monthly statements.

What About the Credit Card Hardware Devices?

Finally, any brick-and-mortar merchants will need credit card hardware (eCommerce stores will only need an online payment gateway). It’s important to factor in the cost of credit card machine when budgeting, as this hardware must integrate with your POS system and credit card processor.

It’s important that all businesses now accept modern forms of payment, including EMV and contactless options. This has two benefits: it protects your business against fraudulent transactions and offers your shoppers more choice in how they pay.

For more information on POS hardware options, give us a call. KORONA POS integrates with all modern payment hardware, leaving businesses with a choice. Set up your free cost comparison consultation today! You can also choose the hardware you’re looking for by clicking below, and we’ll get back to you as soon as possible.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

We’re here to help businesses succeed and save you money. And since we’re not a processor, our only goal is to find each business a reliable and fair processing solution. Click below to schedule a free demo with one of our product specialists who will walk you through KORONA POS.