Toast POS has announced an increase in its credit card processing rates effective September 1, 2024. This change, which introduces an additional 0.23% processing fee per transaction, could impact how many businesses manage their finances and operations to stay afloat.

In this post, we’ll explore Toast’s 2024 rate hike, what it means for your business, and offer tips on either adapting to the new costs or choosing an alternative to Toast.

Key Takeaways:

- Toast POS’s upcoming 0.23% increase in credit card processing rates will raise transaction costs across its user base.

- Businesses will need to adjust their budgets and operations to account for increased fees.

- Exploring alternative point of sale providers, such as processing agnostic POS systems, could be a game-changer if the higher fees prove detrimental to your business.

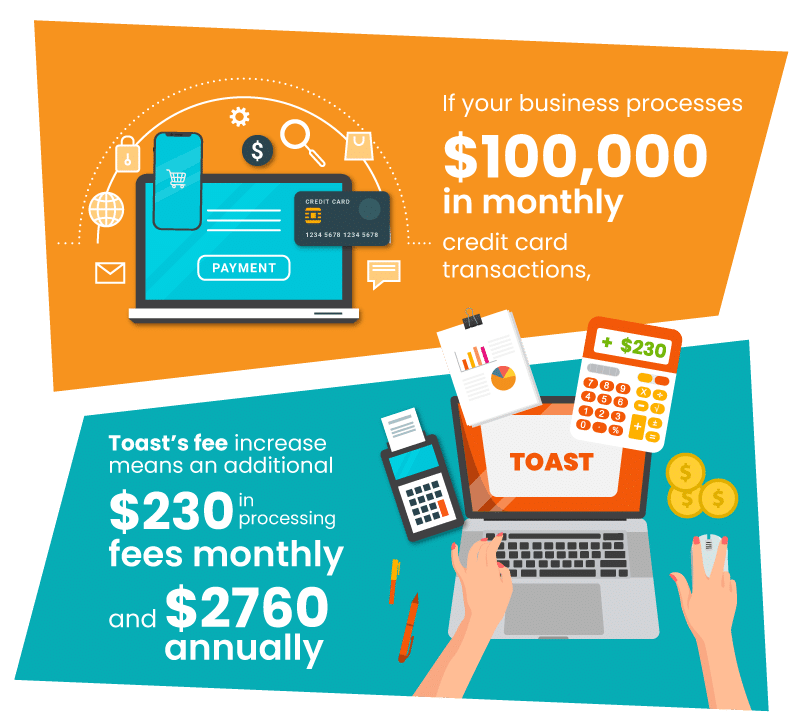

- For example, if a business processes $100,000 in monthly sales, this change results in an additional $2,760 in annual processing fees.

Understanding the Toast POS Rate Increase

Effective September 1, 2024, Toast POS will implement a 0.23% increase in credit card processing rates. The adjustment means businesses will incur 0.23% in fees on top of Toast’s current rates for every transaction processed through its payment system.

Why Is Toast Increasing Its Processing Fees?

We know Toast is adjusting its credit card processing rates, but why? Here’s what we can assume:

- Rising Operational Costs: As technology improves and operational expenses increase, companies like Toast may need to adjust their fees to maintain service quality and cover these costs.

- Enhanced Security Measures: With growing concerns over data breaches and fraud, increased investment in security technologies can lead to higher processing fees.

- Market Adjustments: Periodic adjustments are commonplace in the payment processing industry to stay competitive and align with industry trends.

How Toast’s Processing Fee Increase Affects Your Business

Toast’s upcoming increase in credit card processing fees will impact businesses nationwide. Let’s take a look at how increased fees could affect yours:

Direct impact on transaction costs

The 0.23% increase may seem small on a per-transaction basis, but it can add up dramatically depending on the volume of transactions your business processes.

Suppose your business processes $100,000 in monthly credit card transactions. Toast’s increase translates to an additional $230 in monthly processing fees and $2,760 annually.

Opting for a credit card processing agnostic POS system could help you save substantial money with lower processing rates.

Budgeting for the change

It’s important that your business adjusts its budget to mitigate the impact of Toast’s processing fee increase. Evaluate your current processing costs and forecast the additional expenses to ensure you hit your monthly numbers. Incorporating the updated fees into your financial planning will help you stay on track and in control of your business’s financial situation.

Potential impact on pricing strategies

With higher processing fees, you may choose to adjust your pricing strategies. Passing some of these costs onto your customers may be feasible depending on your industry and customer base. However, it’s critical to approach this carefully to avoid upsetting your clientele.

Want to know exacTLy what you’ll spend with toast POS?

Check out our Free Toast POS Cost Calculator and run the numbers for yourself.

Preparing for Toast’s Increased Processing Fees

Toast’s rate increase is coming—here’s how we recommend you prepare to keep your business thriving:

Review your current payment processing system

Before the rate increase takes effect, take some time to review your current payment processing system. Is Toast POS the best option for your business, or would another provider’s competitive rates better serve you?

Use our calculator below to do the math:

Find out how much you’re spending! Use our calculator below.

Negotiate processing fees with Toast POS

Don’t hesitate to contact Toast POS to discuss the upcoming changes. As a valued customer, you have the power to negotiate terms or request solutions tailored to your business needs. A conversation could lead to reduced rates or additional benefits, giving you more control over your business’s financial situation.

Explore alternate POS providers

If the rate increase is a concern, explore alternative payment processing providers or credit card agnostic POS systems that let you choose your preferred merchant service provider.

KORONA POS, for example, seamlessly integrates with various merchant services, allowing you to connect with your chosen merchant effortlessly. Comparing different providers can help you find a solution that minimizes costs while maintaining the same quality of service. More on that below.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Strategies to Minimize the Impact

Sticking with Toast? You can take plenty of measures to adapt to its processing fee increase. Here are some of our suggestions:

Implement cost-saving measures

Consider implementing cost-saving measures in other business areas to offset the increased processing fees. You can work on automating repetitive tasks, renegotiating supplier agreements, or optimizing staff levels to balance out this added expense.

Enhance transaction efficiency

Improving the efficiency of your transactions can also mitigate the impact of increased fees. Businesses can lower processing costs by focusing on faster and more accurate transactions and reducing chargebacks.

Educate your staff

It’s crucial that your staff is well-informed about the upcoming changes to Toast’s credit card processing fees. By providing the necessary training and communication, you can empower them to manage transactions more efficiently, reducing the risk of errors that could lead to additional costs like chargebacks and keyed-in transactions.

Alternatives to Toast POS

To navigate Toast POS’s rising fees, consider choosing an alternative POS system that suits your budget and operations. Many POS systems have their own credit card processing fees (like Toast does), while others are credit card-agnostic, giving you the power to choose.

Let’s go through some of the best Toast alternatives depending on your vertical:

Lightspeed: Best Toast alternative for full-service restaurants

We recommend Lightspeed POS as an alternative to Toast POS for full-service restaurants. Their partnership with various payment processors lets you choose one that aligns with your cost-saving goals. Lightspeed tends to have a more transparent pricing structure for processing fees, which always helps.

What’s more, Lightspeed excels in table and order management and menu customization, so it suits high-traffic and full-service restaurants. With a user-friendly interface and easy integration with third-party applications, it might just be the choice for a full-service restaurant looking to make the switch.

Square: Best Toast alternative for quick-service restaurants

If you run a counter-service restaurant or fast-casual eatery and want to switch from Toast POS, consider Square Restaurant. Square’s credit card processing fees are comparable to Toast POS, but it charges $0 in monthly fees and $0 upfront for its most basic system.

Quick-service restaurants choose Square Restaurant for its tailored features, like online order and delivery integrations and self-serve options. Additionally, Square’s hardware—its tablets, stands, and receipt printers—is less cost-intensive than Toast’s, making its system that much more accessible to fast-casual joints on a budget.

Revel: Best Toast alternative for CRM/loyalty systems

Looking for an alternative to Toast POS with a comprehensive customer loyalty program? Try Revel POS. Revel offers highly customizable loyalty program features and customer relationship management (CRM) solutions that can make your clientele feel like family.

As for credit card processing, Revel offers two options: choose your credit card processor or use its in-house solution, Revel Advantage, which charges a lower processing and monthly fee than Toast. Revel offers flexible payout options but requires a 3-year contract (commitment-phobes, beware).

KORONA POS: Best Toast alternative for complex integrations

Last, let’s talk about Toast alternatives for businesses requiring complex integration capabilities. For this route, we recommend KORONA POS. The system is credit card agnostic, allowing seamless integration with various payment processors, and giving you the power to choose providers based on your budget.

KORONA POS boasts an open application programming interface (API) and integration options making the software one of the most customizable on the market. The system integrates with your chosen accounting software and CRM system, for example, so that you can streamline your operations in one place. It’s the way to go if you’re seeking a balance between advanced functionality and cost savings in credit card processing.

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. And there’s no commitment or credit card required.

Frequently Asked Questions

Toast POS is most likely increasing its rates by 0.23% per transaction due to rising operational costs, enhanced security measures, and marked adjustments. The changes aim to address evolving technology expenses and maintain service quality.

The 0.23% fee increase means additional costs on each transaction, which can add up if you have a high transaction volume. For instance, a business with a monthly sales volume of $100,000 will pay an additional $2,760 annually with Toast’s price hike. To stay on track, you must adjust your budgets and operations accordingly.

A credit-card agnostic POS system like KORONA POS allows you to choose from various payment processors, avoiding higher fees from a single provider. This flexibility helps you find the most cost-effective payment solutions for your business.

Final Thoughts

While the 2024 Toast POS credit card processing fee increase will introduce an additional 0.23% fee per transaction, it’s important to remember that you can manage the increased costs with careful planning and strategic adjustments.

Should you choose to switch POS systems, a credit card processing-agnostic alternative could be the way to go. Whatever you choose, stay proactive and informed to keep your business thriving despite Toast’s hike in credit card processing fees.

If you’re interested in learning more about KORONA POS, click below for a free trial or product demo.