Choosing the perfect credit card terminal can be daunting, given the array of options available today. Many entrepreneurs struggle to decipher technical specifications and compare features that align with their business needs.

In this guide, we’ll navigate the complexities of selecting a credit card payment terminal that suits your business. Whether you prioritize mobility, volume, or ease of use, we’ve curated essential tips and considerations to help you make an informed decision. Let’s delve into the key factors that will simplify your terminal selection process.

Key Takeaways: Choosing the Best Payment terminal

- A credit card payment terminal is a device used to process electronic payments from credit and debit cards at retail locations.

- Styles are varied and include countertop terminals for fixed locations, mobile card readers for on-the-go transactions, integrated terminals that combine payment processing with POS software, and virtual terminals for online businesses.

- Businesses should consider their specific vertical and store requirements when selecting a payment terminal to fulfill their needs.

- Choosing a payment terminal that can adapt to evolving payment trends and technological advancements will future-proof your checkout flow.

What Are Credit Card Payment Terminals?

Credit card payment terminals are electronic devices used to process payments from credit and debit cards. They are typically found in retail stores, restaurants, and other businesses accepting card payments.

These terminals read card information, verify the transaction with the card issuer, and finalize the payment. They come in various forms, including countertop terminals, wireless terminals for mobile transactions, and virtual terminals for online payments. A retail POS kit may include some, or all of the mentioned credit card terminal options

Terminals ensure secure transactions by encrypting sensitive data to avoid retail fraud. They play a crucial role in modern commerce, offering convenience to customers and enabling businesses to accept a wide range of payment methods.

Learn more about how credit card processing works and save your business money with this free eGuide.

Credit Card Machines vs. POS Systems

Credit card machines are devices specifically designed to process credit and debit card payments. However, POS systems encompass much broader functionality beyond payment processing. For example, they offer inventory management, sales reporting, and customer relationship management.

Most modern POS systems incorporate integrated credit card processing as part of their capabilities.

Types Of Credit Card Payment Terminals And Their Features

Businesses selecting credit card payment terminals can choose from various types based on their needs. Countertop terminals are ideal for fixed checkout locations, while mobile terminals offer flexibility for on-the-go transactions. Key considerations include EMV chip compatibility, NFC (contactless) payments, and POS system integration.

Type #1: Countertop Terminals

Countertop credit card terminals are stationary devices used by businesses to accept payments from fixed checkout locations. They typically connect via wired internet or phone lines and are ideal for retail stores, restaurants, and other establishments with static payment points.

Unlike mobile or virtual terminals, countertop terminals remain in one place, offering stability and consistent performance for high-volume businesses. They support various payment methods, including chip cards and contactless payments.

Countertop terminals are preferred for their reliability, security features, and ease of integration. They are a practical choice for businesses seeking fast and efficient payment processing at dedicated checkout areas.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

Type #2: Mobile Card Readers

Mobile card readers are portable devices used to process credit and debit card payments on the go. Unlike stationary countertop terminals, mobile readers connect wirelessly to smartphones or tablets through Bluetooth or cellular networks.

These readers are ideal for businesses requiring flexibility, such as food trucks, pop-up shops, or service providers making house calls. Mobile readers offer convenience and mobility, enabling transactions anywhere within network coverage.

They support various payment methods, including chip cards and contactless payments like Apple Pay and Google Pay. Mobile card readers are compact, affordable, and integrate seamlessly with mobile apps, making them a versatile choice for mobile businesses.

Type #3: Wireless Terminals

A wireless card reader operates using a wireless connection (typically through a WiFi signal) within a fixed location or store setup. Wireless card readers typically have a limited range based on the strength of the wireless signal.

They are suitable for businesses that require flexibility in where they place their card processing stations within a specific range, without the need for physical connections like cables.

Wireless terminals help speed up checkout lanes during busy times. In addition, they allow staff to meet customers on the showroom floor to help make seamless purchases in stores like furniture or apparel shops.

Type #4: Integrated Payment Terminals

Integrated payment terminals refer to devices that combine payment processing capabilities with point of sale software. Unlike standalone terminals, integrated terminals streamline operations by consolidating payment processing, inventory management, and reporting into a single system. They often support multiple payment methods including credit cards, mobile payments, and EMV chip cards.

Integrated terminals enhance efficiency by reducing manual data entry and offering real-time insights into sales and inventory. In more literal terms, cashiers can process transactions on the POS terminal without needing to punch in the corresponding checkout amount into the payment terminal.

It’s worth noting that many integrated payment terminals come with unavoidable processing fee agreements from the POS provider. Inquire whether there is flexibility in this regard before choosing a solution like this.

Type #5: Virtual Terminals

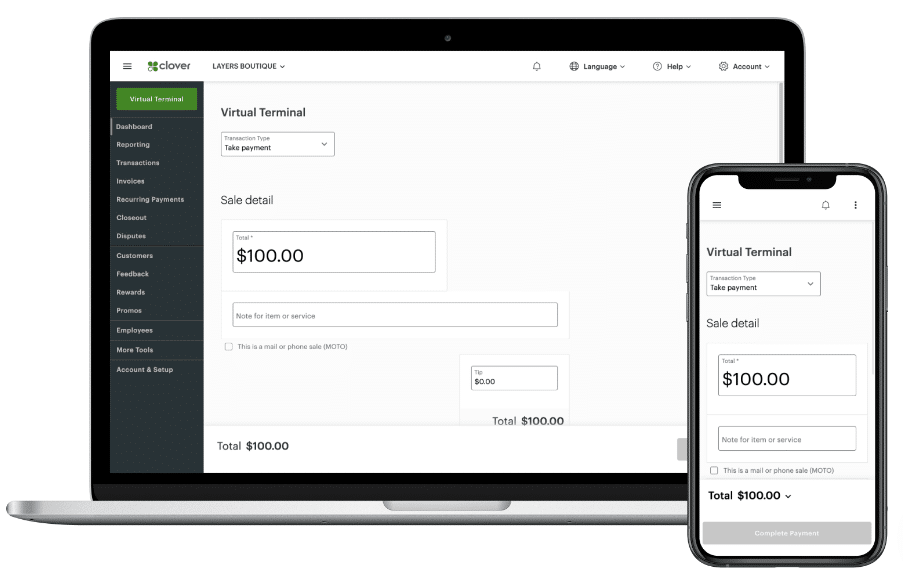

A virtual terminal is a web-based application that allows businesses to process credit card transactions from any computer or mobile device with internet access. It serves as a virtual version of a physical credit card terminal, enabling merchants to manually enter payment details for card-not-present transactions, such as phone or online orders.

Virtual terminals are valuable for businesses like mail-order retailers, delivery-only restaurants, freelancers, and pop-up shops. This solution provides a secure and convenient method to accept payments without the need for physical card readers.

They facilitate efficient payment processing, invoice management, and recurring billing, making them essential tools for businesses seeking flexible payment solutions. Nonetheless, they are not suitable for high-volume, brick-and-mortar retailers.

The best payment terminal will depend on your business needs. How much a credit card machine costs will also depend on the type you choose.

Different Options on the Market

There are countless payment terminals to choose from. New versions and features emerge every day. Here are three of the most popular options on the market:

1. Desktop Terminal Option: Ingenico Desk 3500

Features included:

- Wifi or ethernet connection

- 2.8″ display

- Built-in printer

The Ingenico Desk 3500 is a countertop credit card terminal designed for a smooth payment experience. It accepts all major card types, including chip and pin, swipe, contactless payments, and mobile wallets like Apple Pay and Google Pay.

It boasts a user-friendly interface with a keypad and color display for easy navigation. Security is a priority with the Desk 3500, featuring PCI compliance and future-proof encryption.

This terminal offers wired ethernet or WiFi connectivity for flexible placement. It comes with software updates and support for a hassle-free experience. Ingenico’s terminals are compatible with a variety of point of sale companies and payment processors.

2. Mobile Card Reader: Square Terminal

Features included:

- Wireless connection

- Larger display screen

- Built-in printer

The Square Terminal is a portable device that accepts chip cards, swipes, and contactless payments. It is ideal for both countertop and on-the-go transactions.

The user-friendly interface features a touchscreen and built-in receipt printer for a polished experience. Square Terminal only connects with Square accounts and integrates with Square’s POS software. While this is a streamlined and sleek option, users are locked into Square’s processing fees which are 2.6% + $0.10 for in-person transactions.

3. Wireless Card Terminal: Pax A920

Features included:

- Wireless connection

- 5″ touchscreen

- Built-in camera for scanning QR and barcodes

The PAX A920 is a handheld payment terminal with a large touchscreen display, advanced connectivity options, and robust processing capabilities. It is widely used in retail, hospitality, and other industries where mobility and versatility are key.

This terminal supports EMV chip, magstripe, and NFC payments like Apple Pay. Connectivity options include 4G, WiFi, Bluetooth, and ethernet.

Features include a built-in barcode and/or QR-code scanning camera and a long battery life. It’s PCI-certified for security. The Pax A920 is compatible with various payment processors and POS systems.

How to Choose The Right Payment Terminal for Your Needs

Choosing the right payment terminal takes some due diligence. Luckily, many options are designed for the wide diversity of retail and hospitality uses. Before you make your selection, think about the following:

1. Consider Your Vertical and Store

When choosing a payment terminal for retail, assess your business requirements. Determine the volume of transactions, the types of payment methods you want to prioritize, and any specific features needed. This evaluation ensures you select a terminal that aligns with your operational demands and growth plans.

For example, a grocery store will obviously have different demands than someone opening a food truck – namely, a stationary payment terminal connected to a desktop POS with an integrated scale versus a simple mobile terminal hooked up to a tablet.

Determine what kind of space, products, and workflow you have, and go from there. There are a number of good options.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

2. Do Research on Reviews and Functionality

Doing thorough research on credit card payment terminals involves several key steps.

First, review online feedback and customer testimonials to gauge other experiences with specific solutions. Look for insights on reliability, customer support, and ease of use.

Second, reach out to fellow business owners in your industry for recommendations and firsthand experiences. This direct feedback can be invaluable in making an informed decision.

Finally, consider testing the functionality of shortlisted terminals. Evaluate user interfaces, transaction speed, and compatibility with your business’s needs. Testing ensures the chosen terminal meets your expectations and integrates seamlessly into your operations.

3. Consider Integration with POS Systems

The best retail POS systems allow you to opt for a seamless payment terminal. Integration streamlines operations by syncing transaction data with inventory management, sales reporting, and customer analytics.

A unified system reduces manual errors, enhances efficiency, and provides comprehensive insights into your retail operations. Ensure compatibility and smooth integration between the payment terminal and your chosen POS solution to maximize efficiency and streamline the checkout process for your retail business.

Keep in mind that some credit card terminals will be built into POS hardware. Others will be third-party readers that connect with POS machines. This distinction may affect payment processor flexibility and transaction rates. Before deciding, be sure to lay out a complete picture of what all costs for hardware and processing will be concerning your budget and sales volume.

4. Future-Proof Your Investment

Anticipate future needs and technological advancements when choosing a payment terminal. Select a solution that can adapt to evolving payment trends, such as increased use of mobile wallets or emerging payment technologies.

Ensure the terminal is scalable to accommodate business growth and capable of receiving software updates to stay compliant with industry standards and security protocols. Future-proofing your investment ensures long-term viability and flexibility.

Final Thoughts

There are many great POS hardware options out there to choose from. KORONA POS software integrates with a number of hardware types, both for point of sale interfaces and payment terminals.

Plus, KORONA POS is payment processing agnostic. That means that clients are free to choose from the best processing rates they find. This allows added flexibility for retailers in selecting credit card terminals.

To find out more about how your point of sale can help with your payments, click below!