Key Takeaways:

- Transaction Starts: Cardholder uses credit card; POS captures and encrypts details for processing.

- Authentication: Verifies cardholder identity with PIN, signature, or biometrics to prevent fraud.

- Authorization: Issuing bank checks funds, approves the transaction, and sends the code to the merchant.

- Clearing and Settlement: Transactions are batched, verified, and funds are transferred to the merchant’s bank.

- Funding: The Merchant receives funds, minus fees, in their account within days.

- KORONA POS as Payment Facilitator: KORONA POS connects retailers with compatible processors, including high-risk options, ensuring seamless integration, compliance, and cost-effective rates to avoid account issues.

There are millions of credit card transactions every single day. And the few seconds that each of these takes is amazingly complicated. The fact that it happens as fast as it does (especially if you’re using a great retail POS system) is incredible. We’ll look into this later at how credit card processing works. First, let’s sum up the basic steps of the process.

What is Credit Card Processing?

Credit card processing is the system that enables merchants to accept card payments for goods or services. When a customer uses a credit card, the merchant’s payment terminal sends transaction details to a payment processor, which communicates with the cardholder’s and merchant’s banks to authorize and settle the payment. This involves verifying funds, transferring money, and applying fees. The process ensures secure, fast, and reliable transactions, typically completed in seconds.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Key Roles in the Payment Process

Credit card processing involves several specialized players, each handling a unique part of the transaction. Together, they ensure payments are authorized, secured, settled, and delivered efficiently. Understanding these roles helps merchants make smarter decisions about partnerships, costs, and risk management.

The Credit Card Processor

The credit card processor handles the technical side of transactions, routing payment data between the merchant, card networks, and banks. It ensures fast authorization, manages settlements, and provides reporting tools.

A reliable processor reduces downtime, increases transaction speed, and ensures compliance. Choosing the right processor is critical for cost savings and business continuity.

They charge a fee (either a percentage of a transaction or a flat rate) for these services. The rates vary depending on the credit card processing company. Check out our blog on how PCI Compliance works for retailers.

It is also worth noting that some POS solutions act as payment processors. All fees—interchange, assessment, and processor, are usually bundled into one rate. While simple, this is often a higher rate than keeping your point of sale and credit card processing separate.

Credit Card Companies/Associations

The credit card companies or associations are the names everyone recognizes – VISA, MasterCard, AmEx, etc. They don’t facilitate the transactions or provide any cash to settle funds. Instead, they are responsible, along with the banks, for determining the interchange fees for each transaction.

These fees vary from business to business and transaction to transaction and cannot be negotiated with your processor. The associations set these fees based on hundreds of factors, most surrounding the determined transaction risk.

Issuing Bank

The issuing bank is the customer’s bank, which provides the credit or debit card. It verifies the transaction, checks for sufficient funds or credit, and approves or declines the request. The issuing bank also takes on fraud risk and pulls funds from the cardholder’s account to pay the acquiring bank.

Acquiring Bank

The acquiring bank is the merchant’s financial partner. It receives approved transactions, works with the processor to settle funds, and deposits money into the merchant’s account. The acquirer also assumes some financial risk on the merchant’s behalf and must ensure the business complies with security and industry requirements like PCI DSS.

Independent Sales Organizations (ISOs)

ISOs are third-party companies registered with card associations to resell payment processing services. They often act as the bridge between merchants and processors, offering onboarding, support, pricing plans, and hardware. ISOs can provide tailored solutions for small or niche businesses, but quality and transparency vary, so choosing reputable ones is essential.

Payment gateway

The payment gateway is a technology that securely captures and encrypts card details for online or mobile transactions. It acts as an intermediary, sending transaction data from the merchant to the payment processor. Gateways ensure safe, reliable data transfer and support seamless eCommerce and digital payment experiences.

Merchant

The merchant is the business or individual accepting credit card payments for goods or services. They initiate transactions using a point-of-sale terminal or online system and send card details to the payment processor.

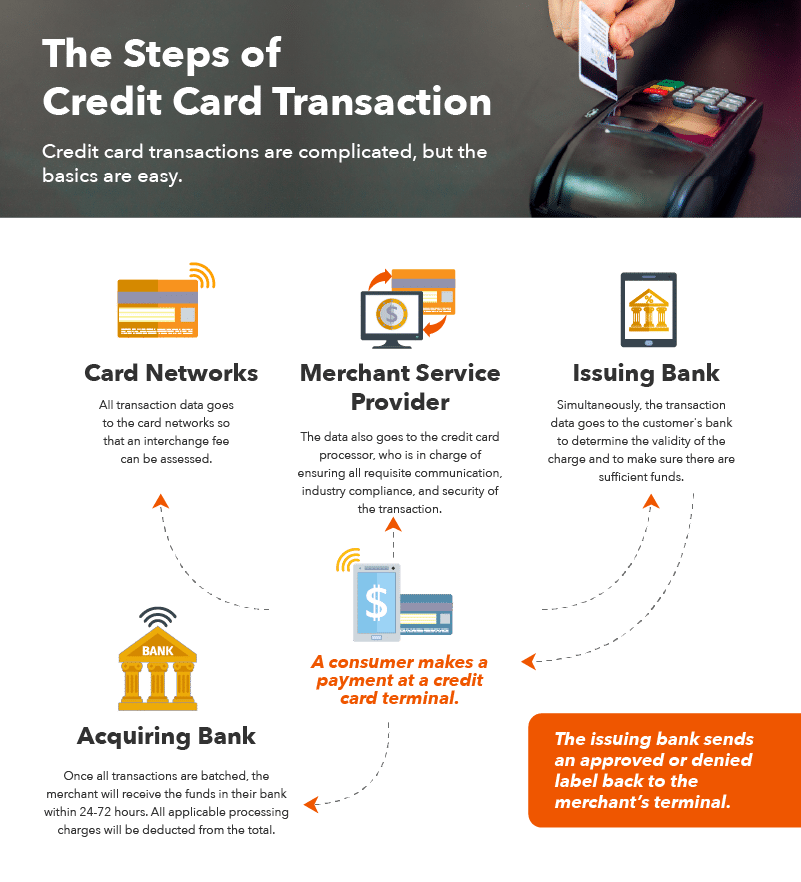

Step-by-Step Process of a Credit Card Transaction

Below is a detailed, step-by-step explanation of how credit card processing works from authorization to funding and beyond.

Cardholder Initiates Transaction

The process begins when a cardholder uses a credit card to pay a merchant for goods or services. They swipe, insert, or tap their card at a payment terminal or enter card details online. The terminal captures the card information, including card number, expiration date, and transaction amount. This data is encrypted to ensure security and sent to the merchant’s payment processor to start the authorization process. The cardholder’s action triggers a seamless flow of communication between multiple parties to complete the transaction.

Authentication

Authentication verifies the cardholder’s identity to prevent fraud. The cardholder may enter a PIN, provide a signature, or use biometric verification like a fingerprint. 3D Secure protocols (e.g., Verified by Visa) may prompt additional verification, such as a one-time password sent to the cardholder’s phone for online transactions. This step ensures the person using the card is authorized, protecting the cardholder and merchant from unauthorized transactions. Authentication happens quickly, often within seconds.

Authorization

The merchant’s payment processor sends the transaction details to the card network (e.g., Visa, Mastercard). The network forwards the request to the cardholder’s issuing bank, which checks the cardholder’s account for sufficient funds or credit and validates the transaction for fraud risks. If approved, the bank sends an authorization code back through the network to the merchant’s terminal, confirming the transaction can proceed. This step typically takes a few seconds to ensure a smooth customer experience.

Batching

After authorization, the merchant stores the approved transaction in a batch, a collection of transactions processed throughout the day. Batching occurs at the merchant’s point-of-sale system, where transactions are grouped for submission to the payment processor at a scheduled time, often at the end of the business day. This step organizes transactions for efficient processing, reducing the number of individual submissions to the processor. Batches include details like transaction amounts and authorization codes for later settlement.

Clearing

During clearing, the merchant’s payment processor submits the batched transactions to the card network. The network distributes each transaction to the respective issuing banks. The issuing bank verifies the transaction details, confirms the authorization, and prepares to transfer the funds. Clearing ensures all parties agree on the transaction details, including amounts and fees, before money changes hands. This step typically occurs overnight and is crucial for reconciling transactions across the payment ecosystem.

Settlement

Settlement involves the actual transfer of funds. The issuing bank sends the transaction amount, minus interchange fees, to the card network, which then forwards it to the merchant’s acquiring bank. The acquiring bank credits the merchant’s account with the funds. Settlement typically happens within one to three business days, depending on the processor and bank agreements. This step finalizes the financial obligations, ensuring the merchant receives payment for the cardholder’s purchase.

Funding

Funding is when the merchant’s acquiring bank deposits the settled funds into the merchant’s business account, making them available for use. The amount deposited reflects the transaction total minus processing fees, such as those charged by the payment processor and card network. Funding timelines vary, typically taking one to three days after settlement. This step completes the transaction cycle, providing the merchant with the revenue from the cardholder’s purchase, which is ready for business operations.

Post-Transaction Processing

After funding, additional steps may occur, such as chargeback handling or dispute resolution. If a cardholder disputes a transaction, the issuing bank investigates, potentially reversing the payment. Merchants may need to provide evidence to contest chargebacks. Additionally, the merchant’s processor generates reports detailing transaction activity, fees, and performance. These insights help merchants manage finances and optimize operations. This step ensures ongoing accuracy and trust in the credit card processing system.

How Credit Card Processing Affects Your Business?

Credit card processing isn’t just a technical necessity—it plays a big role in how your business operates, earns, and grows. From customer satisfaction to financial stability, it influences many aspects of daily business performance. Here’s how it can affect your business:

- Increases Sales: Accepting credit cards attracts more customers, boosting revenue by offering convenient payment options.

- Improves Cash Flow: Fast transaction processing and funding ensure quicker access to funds, aiding business operations.

- Enhances Customer Experience: Seamless, secure payments improve satisfaction, encouraging repeat business.

- Incurs Fees: Processing fees reduce profit margins, requiring careful cost management.

- Reduces Fraud Risk: Secure authentication and encryption protect against fraudulent transactions.

- Requires Technology: Investment in terminals or gateways is necessary for efficient processing.

- Handles Disputes: Chargebacks and disputes demand time and evidence to resolve, impacting operations.

Credit Card Processing Fee Types?

Fees are unavoidable, but they vary greatly. And some processing solutions are much better for certain businesses than others, so it’s important to know which is best for your business.

Assessment Fees

Credit card companies provide the network for the exchange and receive a smaller percentage of these fees, plus a small assessment fee. Assessment fees vary between credit card companies. For instance, VISA’s assessment is 0.11% for debit transactions and 0.13% for credit. MasterCard has a flat assessment of 0.125% for all transactions. American Express and Discover have higher fees, which is why some retailers don’t accept payments through these networks.

Interchange Fees

Interchange fees are also commonly bundled with assessment fees into “base fees.” The issuing bank receives the vast majority of the interchange fees for assuming the risk of providing the money. The merchant’s bank will send these fees to the issuing bank as soon as funds are deposited. Together, the banks and credit card companies set these rates based on an incredible number of factors. Below are just a few:

- Card Present vs. Card Not Present (also referred to as “MOTO”) – if the card is not present, the fees will be higher.

- High Rewards Cards – bigger benefits usually means higher interchange.

- Swiped or EMV – EMV chip payments are much more secure and will lower your interchange rates.

- Keyed Transactions – manually entering a card number, even if it’s present, will result in higher fees.

- Card Type – personal, business, corporation, and municipal agency cards all have different rates.

- Your Business Type – each business must register as a certain type of company with the IRS. Some are deemed to have a higher risk of fraud than others and are therefore subject to different interchange rates. As an example, a yoga studio would benefit to register as a school rather than a gym.

Typically, you can expect base fees to be 1.5-2% of retail sales. Some credit card processors and ISOs insist that these are non-negotiable. While they’re technically right that these fees aren’t altogether avoidable, don’t let that discourage you from doing everything you can to LOWER these fees.

Processor Fees

Credit card processors also take a percentage. This part certainly is negotiable. The lowest rates you’ll usually find are around 0.25% (this is, of course, in addition to the interchange fees). These fees can also come as a percentage of each transaction, a flat fee, or a combo of the two. Additionally, some processors bundle their fees with interchange rates, offering a simple single fee that you’ll pay. While easier to understand, your processor almost always inflated these rates. Lastly, ISOs, as mentioned earlier, act as liaisons between the merchant the credit card processor. Their cut is passed on to the merchant in the form of, you guessed it, additional fees.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

How Retail POS Systems Work With Credit Card Processing?

Retail point of sale systems integrate seamlessly with credit card processing to streamline transactions, manage sales, and enhance customer experiences. Understanding this integration is crucial for store owners’ operational efficiency and security. Below is a detailed breakdown of how these systems work together.

- Transaction Initiation: The POS system captures card details via swipe, chip, or contactless methods. It encrypts data for security and sends it to the payment processor, ensuring compliance with PCI DSS standards.

- Authorization Request: The POS communicates with the payment processor, which routes the request through the card network to the issuing bank. The bank verifies funds and sends an approval code back to the POS, typically in seconds.

- Inventory and Sales Tracking: POS systems sync transaction data with inventory, updating stock levels in real-time. This helps store owners manage inventory, track sales trends, and generate reports for business insights.

- Batch Processing: Approved POS payments are stored in the POS for batching, typically at the end of the day. The POS sends batched data to the processor for clearing, streamlining settlement, and reducing manual work.

- Security Features: POS systems use tokenization and end-to-end encryption to protect cardholder data, minimizing fraud risks. Advanced systems flag suspicious transactions, safeguarding both the store and customers.

- Customer Experience: Integrated POS systems offer fast checkouts, support loyalty programs, and enable digital receipts, enhancing customer satisfaction and encouraging repeat business.

Payment Gateway vs Processor: What’s the Difference?

A payment gateway securely captures and encrypts card details for online transactions, acting as a bridge between the merchant’s website and the payment processor.

A payment processor handles the transaction logistics, routing authorization requests, clearing, and settling funds between banks and the merchant.

The gateway focuses on secure data transfer, while the processor manages the entire transaction flow, including fund transfers and fee calculations. In short: the gateway collects the data, while the processor moves the money and coordinates the backend steps.

How to Choose the Right Credit Card Processor?

Ask questions! Your processing fees all together shouldn’t be much above 2% at the most. If you get quoted more than that, find out why and how you can lower it.

Don’t get locked into a POS solution that requires a long-term contract, especially without understanding the full cost of credit card machine and associated processing agreements.

Read the small print and ask your processor to explain it to you. And make sure you’re not dealing with an ISO. They’re good at masking their real identity. But they provide no benefit to the merchant and only cost you more money. There are plenty of ways to lower your credit card processing rates.

If you really want to get into the nitty-gritty, here are some interchange rates for VISA and MasterCard. Have fun!

Click below to find out more about the KORONA POS solution. We are NOT a payment processing company, but we can help you find one that is a good fit for your business.

See How KORONA POS Makes Payments Easier

KORONA POS streamlines payment processing for retailers, particularly those in high-risk industries like vape and smoke shops, by offering robust features that ensure flexibility, compliance, and operational efficiency. Below are key ways KORONA POS simplifies payments while addressing critical challenges.

Dual Pricing Support: KORONA POS supports dual pricing, allowing retailers to set separate cash and credit/debit card prices. For example, a vape shop can offer a lower cash price for a product while charging slightly more for card payments. Dual pricing is seamlessly integrated at checkout to maintain transparency and boost profitability without manual adjustments.

High-Risk Processor Compatibility: KORONA POS is processor-agnostic, integrating with high-risk-friendly processors like Paybotic or Best Rate Merchant Service, which is ideal for vape, smoke, and CBD shops.

Avoiding Account Shutdowns: Choosing an unsuitable processor for high-risk products like kratom or CBD can lead to account terminations, frozen funds, or costly chargebacks, devastating cash flow. KORONA POS mitigates this by connecting with specialized high-risk processors, ensuring stable, compliant transactions.

Enhanced Security and Compliance: KORONA POS integrates age verification and ID scanning, crucial for high-risk retail, to ensure regulatory compliance. Its secure, EMV-compliant terminals and encryption protect against fraud, reducing chargeback risks.

If you want to learn more about KORONA POS, click below to get started.