💡 Key Takeaways:

- Retail businesses should aim to fully comprehend merchant statements to uncover hidden fees behind competitive rates.

- Select a payment processor that offers clear statements, real-time information access, and alignment with your business’s financial needs.

- Choosing between interchange-plus and flat-rate pricing will affect how your fees are presented on merchant statements.

In the world of retail payment processing, businesses demand straightforward financial information.

Deciphering processing statements, navigating various fee structures, and conducting comparisons among companies are crucial to pinpoint the best financial match for your business.

This article will explain how to read merchant statements, the importance of transparency, and why statements can differ depending on your partner.

What is a Merchant Statement?

A merchant statement is a monthly report from a payment processor detailing a business’s credit and debit card transactions, processing fees, chargebacks, and other account activity.

It breaks down total sales, transaction counts, interchange fees, processor markups, and any additional charges.

Merchants use it to reconcile payments, identify hidden fees, and analyze costs.

Statements vary by provider but typically include a summary, fee breakdown, and deposit details. Understanding it helps businesses control processing costs and negotiate better rates.

Importance of Reviewing Statements Each Month

Reviewing merchant statements monthly is crucial to catch hidden fees, pricing changes, and billing errors that increase costs.

It helps identify fraudulent transactions, chargebacks, and incorrect processing rates.

Businesses can track sales trends, verify deposits, and ensure accurate reporting. Regular reviews also provide leverage for negotiating better rates and identifying when to switch processors.

Ignoring statements can lead to unnecessary expenses and missed discrepancies, directly impacting profitability.

Find out how much you’re spending.

Payment Processing Fees

Processors present rates as percentages, flat fees, or a mix of both—e.g., 1.9% + $0.10 per transaction. Statements may also list terms like “chip,” indicating an in-person transaction (an important factor in determining a final rate).

Rates are usually consistent for swiped, chip, or contactless payments, but card-not-present (CNP) transactions often have higher fees due to fraud risk.

Understanding these charges helps identify unnecessary costs.

Chargebacks and Fraud

A chargeback is a forced transaction reversal initiated by a cardholder’s bank, usually due to fraud, disputes, or processing errors. It refunds the customer but can result in fees and losses for the merchant.

Payment fraud refers to unauthorized or deceptive transactions, such as stolen card use, chargeback abuse, or merchant identity fraud. It increases costs, risks account termination, and damages a business’s reputation.

Monitoring transactions, using fraud prevention tools, and responding to chargebacks quickly can help reduce financial losses.

How to Read a Merchant Statement

Reading a merchant statement can be tricky, but understanding it is crucial for identifying fees, ensuring accuracy, and optimizing processing costs. Here’s how to break it down systematically:

1. Identify the Statement Structure

Merchant statements vary by provider, but most contain these sections:

- Summary Section – An overview of total sales, transaction counts, fees, and net deposits

- Processing Fees Breakdown – Detailed fees, including interchange, assessments, and processor markups

- Batch/Transaction Details – A list of daily transactions and settlements

- Chargebacks & Adjustments – Any chargebacks, retrievals, or adjustments applied to the account

2. Understand the Key Components

A. Volume & Sales Data

- Total Sales Volume – The total dollar amount processed

- Transaction Count – The number of transactions

- Refunds & Returns – Any refunded transactions deducted from total sales

B. Processing Fees

Processing fees are typically split into three categories:

- Interchange Fees (Paid to card networks)

- Set by Visa, Mastercard, Discover, and Amex

- Charged per transaction based on card type, transaction method (swiped, keyed, online), and risk level

- Assessment Fees (Paid to card brands)

- Flat fees imposed by Visa, Mastercard, etc.

- Processor Markups (Paid to your payment processor)

- This is where processors make their money

- Can be tiered pricing, flat-rate pricing, or interchange-plus pricing

- Watch for hidden markups or excessive per-transaction fees

C. Additional Fees

- Monthly Fees – Statement fees, PCI compliance fees, software fees

- Chargeback Fees – Typically $15-$25 per dispute

- Non-Qualified Surcharges – Extra fees for manually keyed or high-risk transactions

3. Check for Red Flags

- Effective Rate: Divide total fees by total sales volume to find the effective processing rate (target: under 3% for most businesses)

- Hidden Markups: Compare “interchange fees” with what Visa/MC publishes to ensure there are no excessive markups

- PCI Non-Compliance Fees: Ensure you’re PCI compliant to avoid unnecessary penalties

4. Compare Pricing Models

- Tiered Pricing: Often opaque, with unpredictable “non-qualified” fees

- Flat-Rate Pricing: Simple (e.g., 2.9% + $0.30), but often more expensive

- Interchange-Plus: Most transparent, showing true costs plus a fixed markup, but fees vary each transaction

5. Take Action

- Negotiate Lower Rates – If you’re using tiered pricing, ask to switch to interchange-plus

- Eliminate Junk Fees – Ask for waivers on PCI, statement fees, or other non-essential charges

- Consider Alternative Processors – If rates are too high, switching might save money

How to Choose a Payment Processing Provider

Choosing the right payment processing provider is critical for any business that accepts payments. The wrong choice can lead to high fees, security risks, and operational inefficiencies.

The right provider, however, ensures smooth transactions, cost-effective processing, and scalability. Below are the key factors to consider when selecting a payment processor.

Pricing and Fees

Compare processing fees, including interchange rates, monthly fees, chargeback fees, and hidden costs. Avoid providers with excessive markup or long-term contracts with termination penalties.

Payment Methods Supported

Ensure the provider supports credit/debit cards, mobile payments, ACH, contactless payments, and any other method your business needs.

Processing Speed and Funding Time

Check how quickly funds are deposited into your account. Some providers offer next-day or same-day funding, while others take 2–3 business days.

Integration and Compatibility

Ensure the processor works with your POS system, eCommerce platform, and accounting software. API access and developer support are crucial if custom integration is needed.

Contract Terms and Flexibility

Avoid long-term contracts with early termination fees. Month-to-month agreements with transparent pricing are ideal.

Customer Support and Reliability

24/7 customer support is essential, especially if you operate outside regular business hours. Read reviews to gauge responsiveness and problem resolution.

Scalability and Growth Potential

Choose a provider that can scale with your business. Consider multi-location support, international payments, and advanced reporting features.

Reputation and User Feedback

Research reviews, complaints, and industry reputation. A provider with consistent issues, hidden fees, or poor support is a red flag.

Processing Agnosticism

If flexibility is a priority, consider a provider that allows you to switch processors without changing your POS system. This prevents vendor lock-in and gives you better negotiating power.

Fee Structures: Interchange Plus vs. Flat Rate Pricing

Interchange plus and flat rate pricing are two common models in the payment processing industry. Each has advantages and drawbacks.

Ultimately, the retail sector’s decision between interchange plus and flat rate pricing depends on the business’s specific needs and transaction characteristics.

Unsurprisingly, the choice between interchange plus and flat rate pricing significantly influences how payment processing costs are presented on merchant statements.

Interchange Plus

Interchange plus pricing is characterized by transparency, as it separates interchange fees set by card networks from the processor’s markup.

Larger retailers often favor this model with higher transaction volumes, allowing for more cost control and potential savings.

With interchange plus pricing, statements typically display a detailed breakdown, delineating the interchange fees, card association fees, and the processor’s markup separately.

This transparency allows retailers to precisely understand the components of their transaction costs, aiding in strategic decision-making and cost optimization.

However, the detail and intricacy of interchange plus merchant statements can be a headache for small businesses looking for a straightforward solution. We will cover this more in the next couple of sections.

Flat Rate

On the other hand, flat rate pricing simplifies billing by charging a fixed percentage and/or transaction fee.

This can be advantageous for smaller retailers with predictable sales patterns, and it is generally much easier to read and comprehend.

Nonetheless, flat rate pricing may not be as cost-effective for high-volume transactions, making it crucial for retailers to evaluate their sales volume and transaction types carefully.

Easy-to-Understand Merchant Statements

Many payment processors offer merchant statements that are unnecessarily complex.

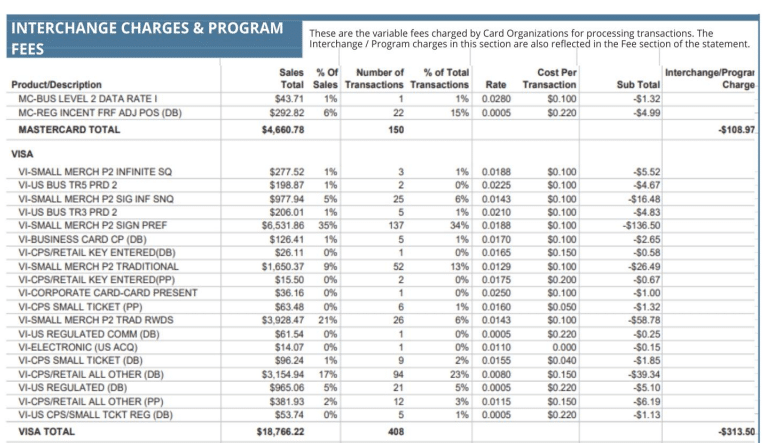

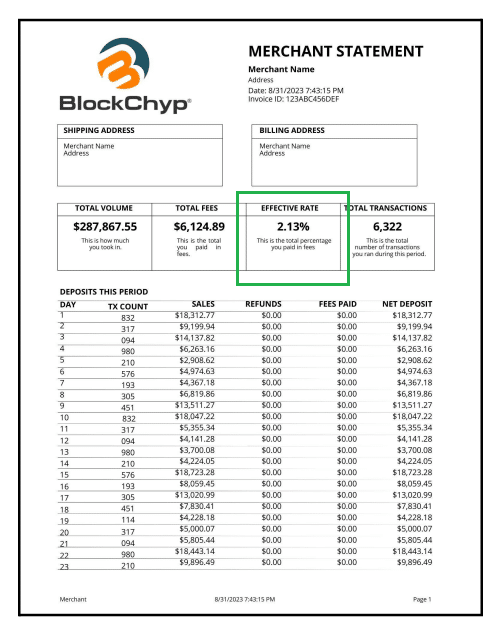

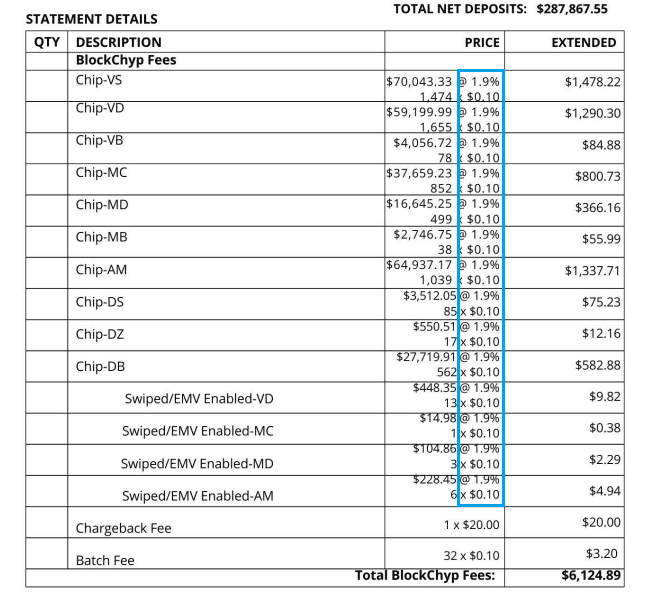

With interchange plus, numbers and figures can often be overly complicated for small businesses. As previously mentioned, you might be presented with something like the chart below:

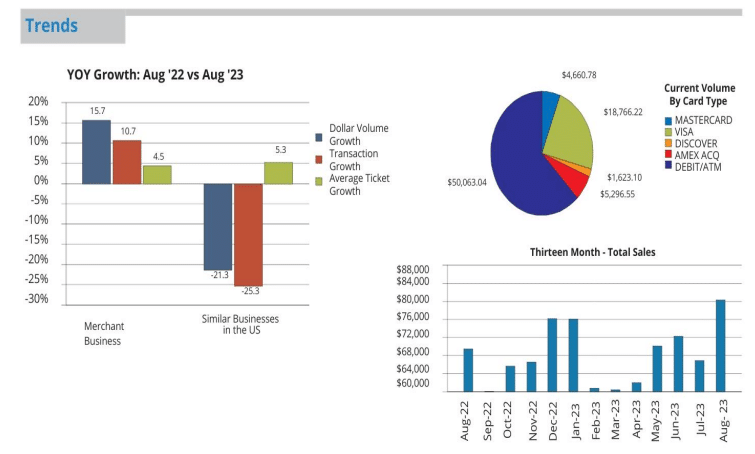

Providers often include pie charts and diagrams, pile on extra pages, and add unnecessary information that leaves business owners scratching their heads.

They tend to provide unnecessary features and confusing fees. Here are some examples:

Pie charts offering sales data and trends that are already available in your POS software.

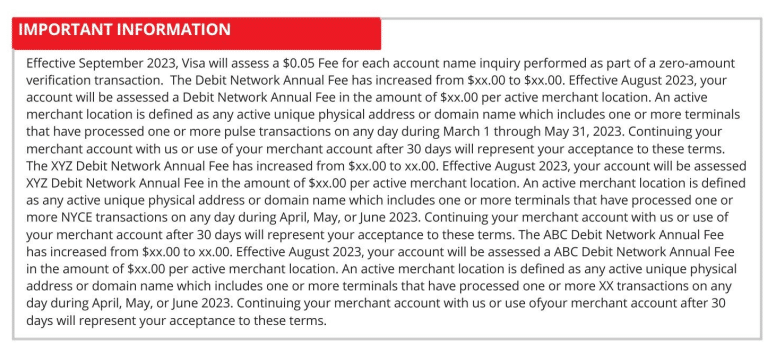

Updated policies with convoluted and complex new fees.

Clean With Important Payment Information Visible

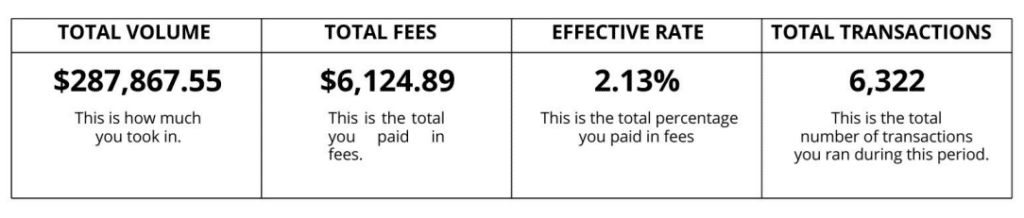

Monthly statements shouldn’t give you a headache, but they also shouldn’t be charging you inflated rates. The best processing companies provide statements that are just 2-3 pages yet provide a concise and comprehensive overview.

BlockChyp uses interchange plus pricing. Though it’s not as simple as flat rate pricing, their statements break down all fees more simply and present you with an overall effective rate (the total percentage of sales that you’re paying in processing costs).

Below is an example of a merchant statement from BlockChyp:

Access Your Transaction Data Anytime

In the cloud-based POS retail ecosystem, businesses demand real-time access to all of their data. Your payment partner should make it easy.

You must be able to access real-time transaction information and check your statements 24/7.

Downloading statements for offline use or turning data into files for your systems should be a breeze.

Don’t forget that the billing cycle should also be crystal clear, with no surprise charges throwing you off.

Pick a Transparent Merchant Partner

Selecting a payment processor can be overwhelming, but prioritizing transparency is the cornerstone of a long-term partnership.

When comparing companies, ask for a monthly statement, calculate and understand the total fees you should expect, and ensure their platform empowers you with information.

Your statement should be easy-to-understand with no hidden surprises, like this example:

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor, so we’ll always find the best payment provider for your business’s needs.

Save on Processing Fees: Partner With the Right Merchant Services Provider

Understanding the intricacies of rates, fees, and the overall statement structure allows you to make an informed decision.

Partner with a payments processor aligned with your financial objectives and who has your back so you can focus on running your business.

KORONA POS allows you to choose your merchant services provider inside your POS and be in total control of your fees.

To learn more about KORONA POS and our payment processing solutions, click the link below!