Long-term contracts with your point of sale solution or your credit card processor can be very dangerous for your business. They can bind you to a service that isn’t working for your store with expensive hardware commitments and massive early termination fees (ETFs). Even worse, the service itself is often overpriced with high software prices or hiked processing rates.

It’s worth noting that many of these companies serve as both POS providers and credit card processors. In these instances, merchants who subscribe to their software are also required to use their processing. Make sure to do your research, read through all the details of the contract, and get as much as possible in writing to protect your business.

In previous blogs, we’ve examined the ins and outs of credit card processing, as well as the dos and dont’s when shopping for a new POS system. So today, we’ll look the problem of POS and processing contracts, those pesky ETFs, and some ways that you can get your small business out of a bad situation.

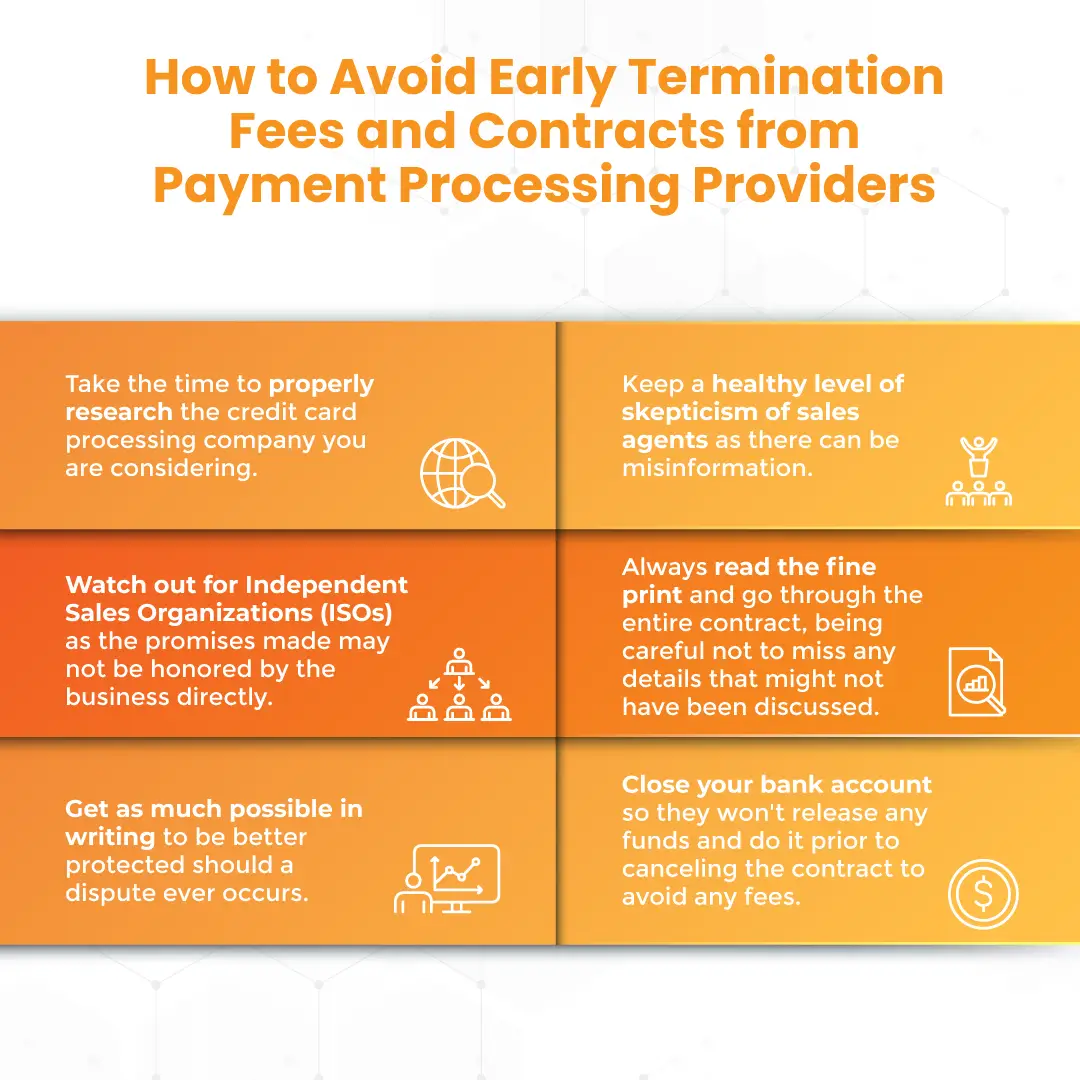

How to Prevent Getting Early Termination Fees and Bad Contracts

Be wary of any business-to-business contract, POS, processing, or otherwise. There might, however, be situations in which it’s unavoidable. Fortunately, there are steps to take that will protect your business from damage down the road. Here are a few things to keep in mind.

1) Do Your Due Diligence

It’s important to properly research any big purchase, especially one that might be a long-term POS commitment. There are plenty of bad eggs in both of these industries who profit off of uninformed small businesses. Don’t let yours be the next victim.

2) Keep a Healthy Level of Skepticism of Sales Agents

There are plenty of great salespeople. But don’t always believe everything that comes from their mouth. Misinformation can lead to bigger problems down the road. It might be malicious, but it could also just be a lack of training or knowledge on the service/product being sold. Don’t ever make a decision to purchase something solely because of what you were told by a salesperson.

3) Watch Out for ISOs

Some POS and processing solutions are sold through third-party Independent Sales Organizations (ISOs). In these instances, any promises made may not necessarily be honored by the business itself. The third-party salespeople are not employees of the business and therefore don’t represent anyone but themselves.

4) Always Read the Fine Print

There are always terms and conditions that can’t be discussed with a salesperson or representative. Take the time to go through the entire contract. And make sure you’re given the whole thing! Too often, small business owners are only given highlights, only to discover the deal wasn’t as good as it sounded. With processors, understanding the fine print is even more important: look for their interchange plus pricing rates, for instance.

5) Get as Much as Possible in Writing

Again, this is particularly important if you’re dealing with an ISO. If they refuse, it’s a huge red flag. If they don’t, you’re better protected down the road should a dispute ever occur.

6) Close Your Bank Account

You can entirely close the account or flag it with your bank so that they won’t release any funds. This is a last resort option since there are still ways for businesses to get your money if the contract is legitimate. If you got this route, just make sure to cut it off prior to canceling the contract. ETF will be debited immediately. This will also help you avoid other penalties, such as a PCI Compliance fee.

So What If You Need to Get Out of a Bad Contract?

Luckily you still have some options. Now, none of these are guaranteed to get you out of your predicament, but they can certainly help in many cases. Again, avoid putting yourself in this situation if at all possible!

1) Check for Any Changes in Fees

Review recent statements to see if the POS or processing company has changed any fees recently. If so, you have cause to cease the contract without penalty. Just be sure to properly record the evidence of any changes.

2) Collect Supporting Documentation

If the company ever breached the contract, even in minute ways, gather the proper evidence. Keep a spreadsheet showing how much you’ve paid the processor or POS company as well. If it’s clear that they’ve already made a profit through your business, any termination fees should be waived.

3) Negotiate Politely

Remember, you’re dealing with actual people, on the other hand. And there are still plenty of people out there that like to help. If you are calm, courteous, and maybe a touch desperate, you might have more luck getting someone to make an exception and release your contract.

4) Threaten Legal Action

No one likes to go to court. It’s expensive and potentially a public relations nightmare. You can even keep it more casual and threaten a bad review, a public complaint, or a Better Business Bureau phone call.

Moral of the story? Avoid contracts with both. Save yourself a headache down the road.

What Is the Ideal POS and Processing Solution?

Leaving out any discussion of point of sale features, what SHOULD you be looking for if you’re in the market for a new POS solution?

1) Cloud-Based, Software-As-a-Service

First, you want to find a point of sale that is cloud-based POS and sold as a software-as-a-service (SaaS). This means that you are paying for a subscription to the product. In a world that changes as quickly as that of the point of sale, it can be risky to invest a lot of cash into owning software. With the SaaS POS model, any upgrades and updates are included in the pricing of your subscription and are automatically performed whenever they are released.

2) No Contracts

Next, you don’t want this SaaS agreement to be anything other than month-to-month. No contract, long or short-term, is beneficial. After all, why would a company feel like they need to trap customers into something? Shouldn’t the customer simply appreciate the product? Many POS solutions advertise not long-term contracts, but they still require short-term contracts. This is better than a long-term deal, but still not optimal. Your POS system is an integral part of your business, so if it’s not working for you, it’s important to be able to make a change immediately.

3) Separate POS Solution and Credit Card Processor

You also want your POS solution to be separate from your credit card processing provider. As mentioned above, more merchant service providers now provide both services. This means you’re more likely to be locked into contracts and high credit card processing rates. Keeping the two separate provides you with more flexibility which can help you lower your credit card processing fees.

4) Avoid Early Termination Fees

If you need to sign a contract with your POS solution, stay away from ETFs. This can be cripplingly expensive for some businesses. No POS or processing company should have to keep their business profitable in this way. Often, these will come attached to offers of “free POS systems.” They might even offer you free hardware and software even, but they’ll come attached with minimum processing fees and expensive tech support.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

The Best POS Solution of All?

Who doesn’t have any contracts or early termination fees and partners with credit card processors who provide the same? You guessed it: KORONA POS! Click below to check out a free trial of our software. And call us to find out more about how we can provide your business with a great point of sale solution, contract-free, hidden fee-free, ISO-free. We also have 24/7 phone/chat/email support included in every single subscription we offer. Click below to get started with us.