With the popularity of payment technologies such as Google Pay and digital wallets like Venmo, it may seem like cash is becoming obsolete. Yet, some studies show that almost 60% of people use cash for at least one transaction per week. Having a cash drawer is generally still a necessity, especially for certain industries such as convenience stores and cannabis dispensaries. A big part of properly operating a cash register involves knowing how to properly count the till.

Setting a standard counting procedure for your cash till will avoid complications and irregularities in the future. In addition, it will appropriately assign accountability and traceability to your employees and their shifts. Read on for an ultimate guide to counting the till at your retail store.

What Is a Till?

A till is a cash register drawer. It is one of the essential retail store equipment items. Maintaining a till means counting and organizing money in slots for different denominations of paper bills, as well as compartments for coins. Tills organize cash so that cashiers can easily provide customers with change during the checkout process.

Tills are generally assigned to individual cashiers, baristas, or bartenders who are responsible for keeping track of cash sales. At the beginning and end of a shift, the money is counted and reconciled with sales data collected by point of sale software.

Why Count the Till?

Correctly counting your till is the first step of tracking your finances. Reconciling your cash flow with your cash revenue ensures that your POS sales reports are actually backed up by real paper money. By implementing a standard operating procedure for counting your till, you can make sure that your money isn’t being stolen or mishandled by employees.

Implementing such a process also ensures that your customers are being given correct change when they make purchases. Properly counting your till adds real accountability across your cash control. With till counts for every beginning and end of shift, you are better equipped to figure out what went wrong if you do run into any irregularities or problems.

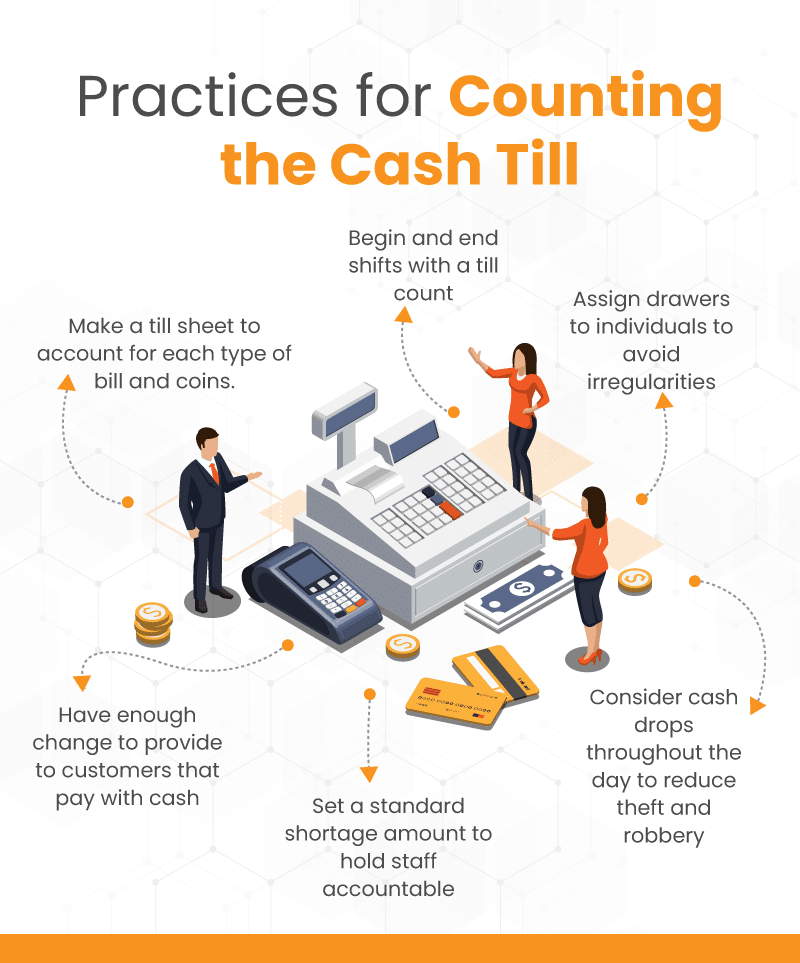

Best Practices for Counting Till

All cashiers must be trained to be able to correctly count the till. In fact, anyone handling money or opening cash registers should be trained in company-wide standard operating procedures that emphasize effective cash handling in retail. Think about implementing the following.

Make A Till Sheet

A till sheet is essentially a counting list for each type of bill and coin. Filling out exactly what denominations of cash notes are in a till serves multiple purposes. First, it ensures that you have proper change for customers in the case that they pay with bigger bills. Having to run to the bank mid-shift to grab singles for a shopper is not exactly ideal.

Secondly, you can more accurately monitor your cash count by tracking the amounts of individual bills. As a mental exercise, your employees will be less likely to make small clerical mistakes adding up their drawers.

Start And Finish With A Till Count

Counting a till is a necessary task for signing in and checking out. In other words, your cashiers should be performing this count at the beginning of their shift and at the end of their shift. Having a continuous and documented chain of cash custody will help you root out any cash shrinkage and missing money. Counting beforehand extends the link between them and the previous employee.

As previously mentioned, is it equally important to ensure that cashiers are equipped with proper change for guests that pay with cash. Therefore, conducting an opening till count should be included in pre-shift duties for all cashiers and money handling staff. Finishing with a till count is necessary in order to make proper cash drops, track transactions, and reconcile sales.

Assign Drawers To Individuals

Because till counting is about accountability, cash drawers should really only be assigned to one person. Obviously, in some businesses this isn’t possible, but in most operations, a single individual is responsible for their own drawer. Otherwise, identifying irregularities or missing cash is much more difficult.

To put it simply, the more employees reaching into your register the more obscured the accountability becomes. For example, let’s say you run a coffee shop with five people using the till and you run into a shortage or overage issue. It will be much harder to figure out what exactly happened to cause the problem than if the drawer had been assigned to a single individual.

POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support.

Call us now at 833.200.0213 to see for yourself.

Have Enough Change

As we talked about earlier in this post, being properly stocked with cash and coin denominations is crucial. Just like stocking a bar with wine and liquor, a coffee shop with beans, or a gift shop with postcards and books, retail businesses must also stock supplies they will need throughout the work day. That means receipt paper, staples, pens etc.

It also means stocking proper petty cash to quickly provide clientele with their change right on the spot. When you have your employee count the till, have them check that there are sufficient denominations to make change. For a retail SMB, keeping about $150-$200 in smaller bills should work fine.

Set Standard Shortage Amount

Many retail companies will give a $5 leeway on all cash drops for their employees. Pick an amount that you’re comfortable with and set it as your standard shortage amount. Obviously this depends on the business location, what type of company you run, and how many paper bills you accumulate over the course of the day. Nonetheless, giving your employees some wiggle room will remove some of the stress associated with handling cash while also providing a more realistic goal for counting.

Creating a healthy working environment is extremely important for all types of businesses. At the same time, establishing a standard shortage amount tells your cashiers that there are rules set in place. This helps hold staff accountable in the case of that shortage exceeding your standard set amount.

Consider Doing Cash Drops Throughout The Day

If you run a busy, high cash volume business you might want to consider midday cash drops. These drops can reduce the amount of money floating around, and lower the liability for theft and robbery.

For example, let’s say you run a cash only dispensary, or bustling coffee shop, and have high cash revenue on beautiful spring Saturdays. Naturally you will want to deposit this cash into a safe or vault mid-shift. Again, set up a standard operating procedure, and have a manager oversee the drop.

KORONA POS integrated with Brink’s for this. Businesses that have a large amount of cash on hand can drop the cash in a Brink’s vault on-site. As soon as the cash is dropped, the liability is transferred to Brink’s, who, for a small fee, picks the cash up and deposits it on a weekly basis. Reach out to us to learn more about this partnership and if it’s something your business could benefit from.

How Does KORONA POS Track Cash?

Your point of sale system should offer significant cash monitoring benefits. With KORONA POS, you can track every action that your cashiers and employees take throughout the work day. This in-depth end of day report works in conjunction with your till sheet to reconcile your cash drawer.

Our point of sale also offers employee management with custom permissions for staff members to avoid unauthorized discounts or returns. In addition, KORONA POS utilizes an immutable cash ledger for retail businesses that deal with a high volume of paper bills. Give us a call today to learn more about our cash protection and anti-fraud features!

Ready to take your business to the next level?

Boost store performance and improve sales with the advanced features and tools KORONA POS offers.

FAQs: Counting Till and Maintaining an Accurate Drawer

Counting till means tallying and adding up each bill and coin in your cash register. It is done by retail shops, bars, coffee shops, and basically any business that accepts cash as payment. Knowing how much total and individual bills and coins you have is the first step in proper cash management.

You count a till by starting with the biggest bills, and tallying the total number for each bill denomination down to the coins. Many businesses will use a till counting sheet, where the grand total will be added up and reconciled with an end of day sales report.

The amount of cash that should be in a till depends on the size and type of business. Most retail SMBs keep a standard amount of between $100 and $200. Tills should be stocked with multiple denominations of small bills in order to be able to provide change to customers.