Choosing the right point of sale (POS) system is a critical decision for any business owner, as it impacts everything from daily operations to profit margins. More often than not, price will be a major facet of that decision.

In this article, we’ll dive into an in-depth comparison between two leading POS providers—Clover and Square. We’ll break down their pricing plans, processing fees, and the overall value they offer. Let’s explore which platform best suits you!

Clover vs. Square POS: A Quick Overview

Clover and Square both offer competitive rates, and each brings unique strengths and value points to the table. Understanding these unique strengths can empower you to select the best POS system for your business.

|  | |

Monthly fees |

|

|

Payment processing |

|

|

Transaction fees |

|

|

Overall Rating |  |  |

Value for Money | 4/5 | 3.5/5 |

Pros |

|

|

Cons |

|

|

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. And there’s no commitment or credit card required.

Clover vs. Square Rates, Fees, and Pricing: A More Detailed Look

In the sections ahead, we’ll take an in-depth look at Square and Clover’s rates, fees, pricing models, and any potential hidden costs. Our side-by-side comparison will give you a clear picture of what you can expect to spend with each system.

Clover vs. Square: Pricing Plans

Square and Clover provide distinct pricing for software plans tailored to different business sizes and needs. Clover offers more customizable (but often pricier) options, while Square emphasizes simplicity and user-friendliness with its straightforward, minimalist approach.

Clover Subscription

Software Plans and Pricing by Industry

Retail Pricing

Monthly Cost

$349/mo or bundled at $16/mo for 36 months with hardware. Starting at 2.6% + $0.10 for in-person transactions, 3.5% + $0.10 for keyed-in transactions; Compact terminal system with 3.6″ screen

Best For

Small retail shops with minimal inventory needs

Key Features

• Basic payment acceptance

• Sales tracking

• Limited access to App Market

Monthly Cost

$1,899 + $84.95/mo or $180/mo bundled with hardware for 36 months;

Best For

Growing restaurants that need more substantial management capabilities

Key Features

• Enhanced inventory management, Station Duo – 14″ merchant-facing POS with 8″ customer screen

• item or order-level discounts

• real-time sales tracking

Monthly Cost

$2,648 + $104.90/mo or $240/mo bundled with hardware for 36 months; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Large retail with complex inventory and reporting needs

Key Features

• Advanced reporting

•Weight scale integration

• Station Duo +; 14″ and 8″ countertop displays

• Unlimited launch and consultation services

Full-Service Dining

Monthly Cost

$1,799 + $89.95 or $179/month for 36 months with hardware. Starting at 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions; Compact terminal system with 3.6″ screen

Best For

Small retail shops with minimal inventory needs

Key Features

• Online ordering

• Order management

• Limited access to App Market

Monthly Cost

$2,548 + $109.90/mo or $239/month for 36 months with hardware; Station Duo – 14″ merchant-facing POS with 8″ customer screen

Best For

Growing restaurants that need more substantial management capabilities

Key Features

• Flex – Handheld POS with an 8-hour battery life and built-in receipt printer

• Table mapping, bill splitting, pick-up, and delivery order types

• Employee management

Monthly Cost

$4,447 + $129.85/mo or $354/month for 36 months with hardware; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Large or multi-location restaurants

Key Features

•multi-location support

•Advanced POS analytics

•custom integrations

Quick-Service Dining

Monthly Cost

$849+ $89.95/mo or bundled at $135/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions;

Best For

Cafes, food trucks, or bakeries

Key Features

• Quick order processing

• Online ordering

• Basic inventory

Monthly Cost

$1,899 + $89.95/mo or $185/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Growing quick-service businesses

Key Features

• Order modifiers

• Employee scheduling

• Customer loyalty

Monthly Cost

$2,648 + $109.90/mo or $245/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

High-volume quick-service restaurants

Key Features

• Kitchen printer integration

• Advanced POS analytics and customer insights

•Weight scale integration

Professional Services

Monthly Cost

$0+ $29.95/mo; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions;

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• Basic reporting

Monthly Cost

$749+ $84.95/mo or bundled at $125/month for 36 months with hardware; Starting at 2.3% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• inventory tracking

• Clover Mini

Monthly Cost

$1,799 + $84.95/mo or $174/month for 36 months with hardware; 3.5% + $0.10 for keyed-in transactions;

Best For

Larger service businesses with complex operations

Key Features

• Station Duo

• Advanced client management

• Multi-device support

Home/Field Services

Monthly Cost

$0+ $29.95/mo, 3.5% + $0.10 for keyed-in transactions

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• Basic reporting

Monthly Cost

$199+ $29.95/mo; Starting at 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• Go-Phone paired mobile card reader

• App Market Access

Monthly Cost

$749+ $84.95/mo or $125/month for 36 months with hardware; Starting at 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions.

Best For

Larger service businesses with complex operations

Key Features

• Advanced client management

•Flex – Handheld POS

• Multi-device support

Personal Services

Monthly Cost

$349 or $16/mo for 36 months; 2.6% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Freelancers or mobile businesses with minimal hardware needs

Key Features

• Virtual terminal

• Optional Clover Go ($49) or use the existing device with the Clover app

• PayPal and Venmo

Monthly Cost

$849+ $84.95/mo or bundled at $130/month for 36 months with hardware; 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Salons, gyms, or contractors needing scheduling tools

Key Features

• Appointment scheduling

• App Market access

• Clover Mini

Monthly Cost

$1,899 + $84.95/mo or $180/month for 36 months with hardware; 2.5% + $0.10 for in-person transactions; 3.5% + $0.10 for keyed-in transactions

Best For

Larger service businesses with complex operations

Key Features

• Station Duo

•Advanced client management

• multi-device support

Square Monthly Subscription Plan

Free

Best for new or very small businesses with lower sales volumes and basic needs. You pay only transaction fees.

POS app and payments

Website builder with SEO tools

Courses

Item library

Plus

$49/month

Ideal for growing businesses that need essential tools to manage a team, optimize their website, and want the benefit of a slightly lower in-person transaction rate (2.5% ).

Staff management

Expanded site customization

Loyalty rewards program

Premium ($149/month)

The most cost-effective option for high-volume sellers due to the lowest in-person transaction fee (2.4%) and the included features like 24/7 dedicated support and waived gift card load fees, which can add up to significant savings.

Advanced reporting

No gift card load fees

24/7 phone support

KORONA Ticketing

+$50/month per gate

For amusement parks, museums, water parks, and other admission-based businesses

Ticket printing

Entry gates

Ticket definitions

Customer management

Time-tracking

Cash journals

KORONA Event integration for online ticketing

KORONA Franchise

+$30/month per franchise

For franchise businesses to streamline communication and operations between franchisors and franchisees

Franchisor features

Scalability for franchisees

Customizable royalty systems

Product syncing

International options

Custom taxes and currencies

Centralized inventory management

KORONA Integration

+$45/month per token

For businesses that require custom development of niche integrations through the KORONA POS open API

Integration jobs

Integration job-workflows

Integrations services

Integration dashboard

Clover vs. Square: Processing Fees

Both Clover and Square are designed for businesses handling a high volume of daily transactions, but their merchant service fee structures differ significantly. To determine which system will cost you less in fees, consider the typical transaction size and frequency at your business.

Clover Transaction Fees

- In-Person: Starting at 2.3%–2.6% + $0.10, depending on the plan

- Keyed-In/Online: 3.5% + $0.10 across all plans

- Rapid Deposit: An additional 1.75% of the transaction for instant fund access (optional)

Square POS Transactions Fees

Square’s Point of Sale (POS) system is known for its simple, flat-rate pricing structure. These fees apply to all major credit cards (Visa, Mastercard, American Express, and Discover) at the same rate.

Transaction Type | Standard Rate (US) | Key Information |

In-Person (Tap, Dip, or Swipe) | 2.6% + 10¢ to 15¢ | Applies when the customer's card is physically present and used with a Square Reader, Terminal, or Register. |

Online (eCommerce API, Square Online Store) | 2.9% + $0.30 to 3.3% + 30¢ | A higher rate due to the increased risk associated with card-not-present transactions. |

Manually Keyed-In / Card on File | 3.5% + 15¢ | The highest rate typically applies to payments entered into the Virtual Terminal or saved on file, as they carry the highest fraud risk. |

ACH Bank Transfer (via Invoice) | 1% (Min. $1) | For payments made directly from a customer's bank account. |

Afterpay (Installments) | 6% + $0.30 | Square pays you the full amount upfront, and the customer pays over time. |

Clover vs. Square: Hardware Costs

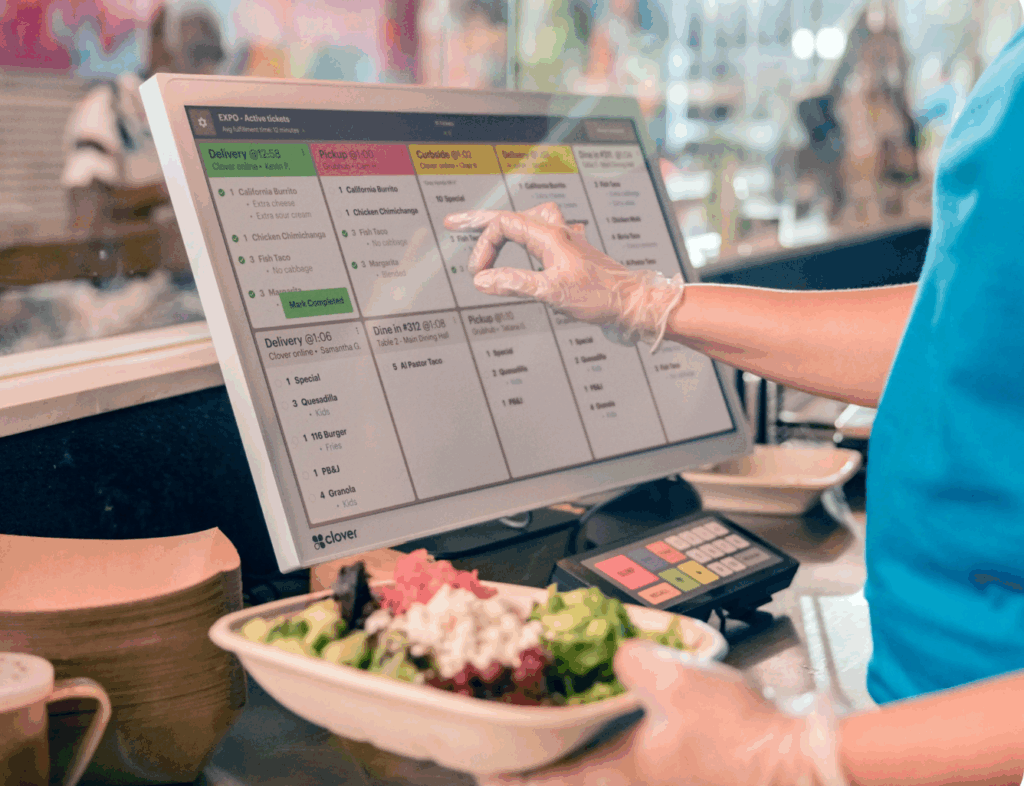

Clover and Square both offer a range of hardware options tailored to different business needs. While Square focuses on sleek, minimalist devices that prioritize versatility, Clover stands out with its more robust, customizable hardware solutions. Let’s dive into a comparison of the hardware costs for Clover vs. Square:

Clover Hardware Pricing

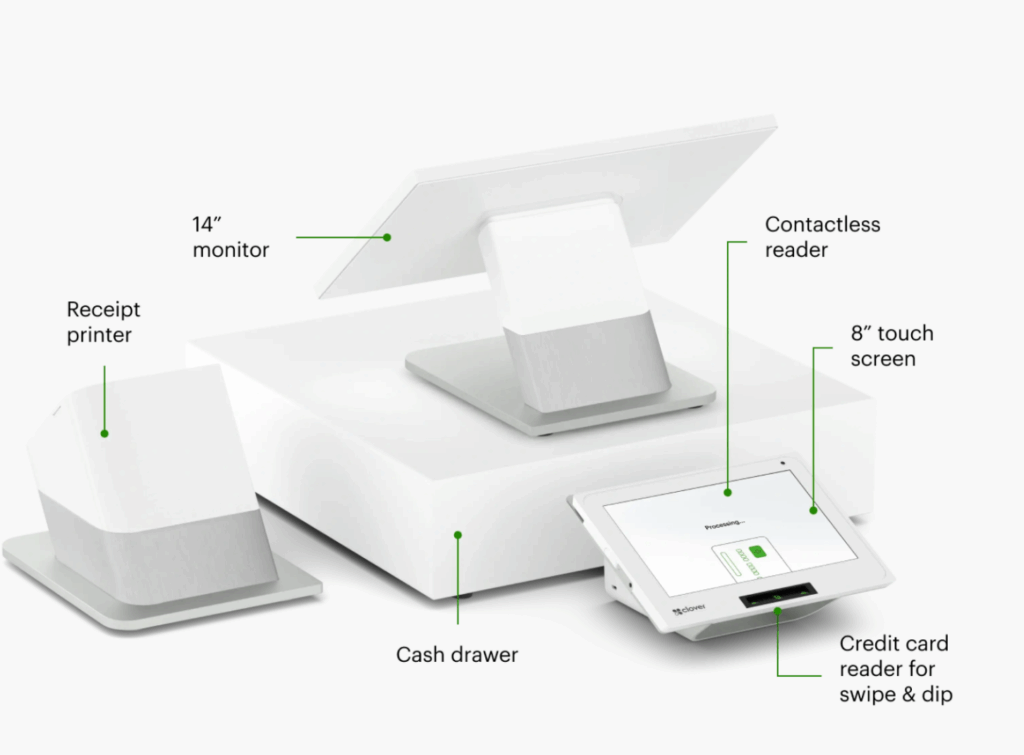

Clover’s proprietary hardware is required for in-person payments. It’s considered one You can pay upfront or opt for a payment plan (typically 36 months). Key options of Clover’s hardware include:

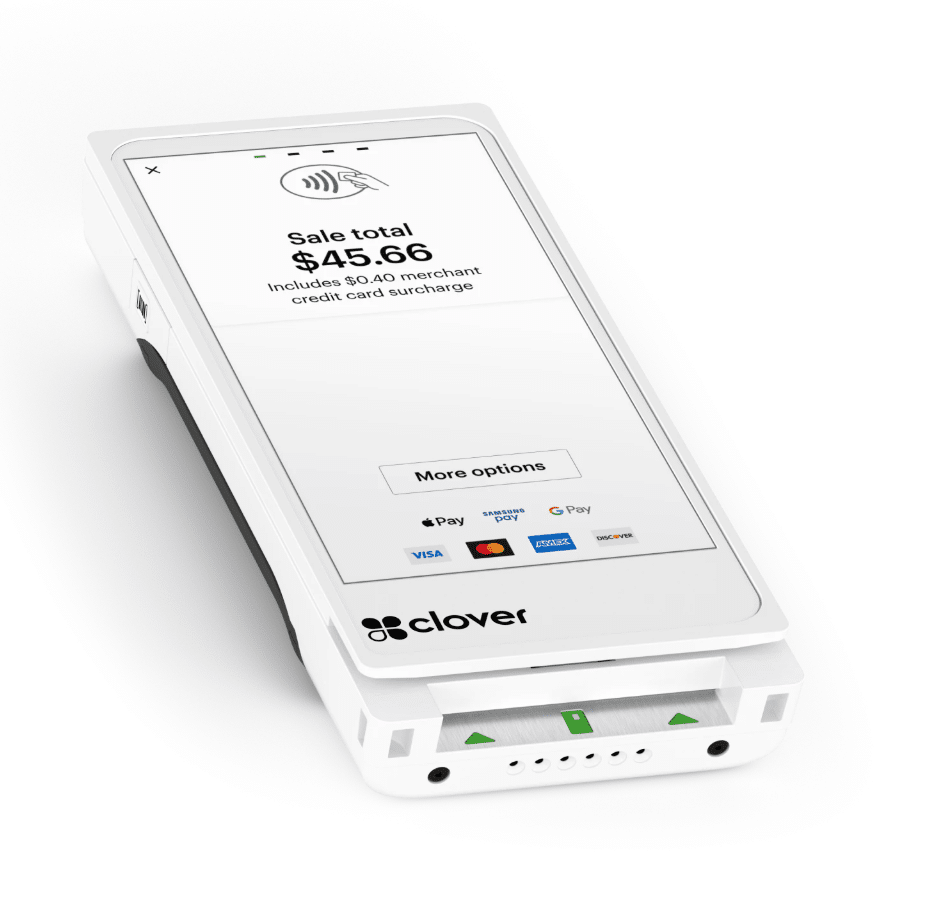

Clover Go: $199 (mobile card reader for swipe, dip, tap)

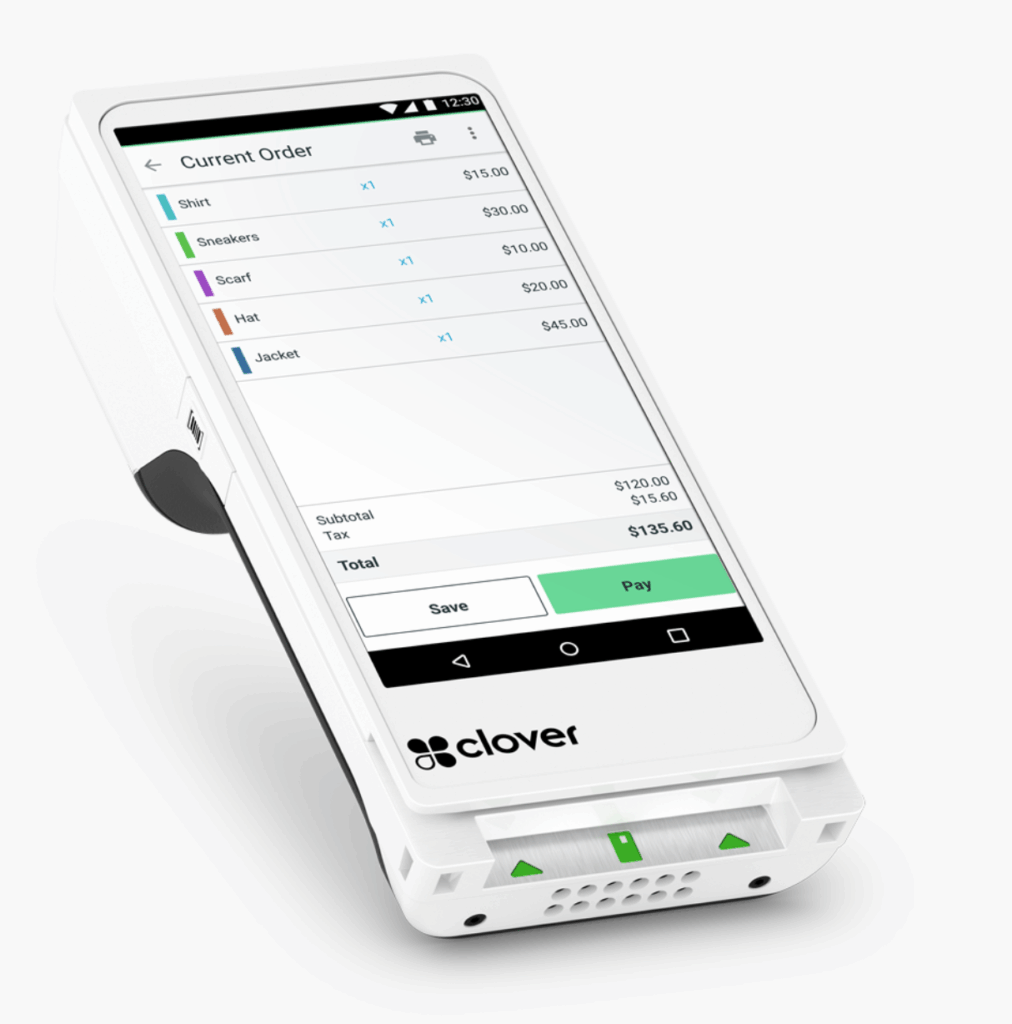

Clover Flex: $749 or $40/mo (handheld POS with receipt printer, scanner)

Clover Mini: $849 or $45/mo (compact countertop POS with an 8-inch touchscreen)

Clover Station Solo: $1,799 or $174/mo (14-inch touchscreen, cash drawer, printer)

Clover Station Duo: $1,899 or $180/mo (adds 8-inch customer-facing screen)

Clover Flex Pocket: $699 or $35/mo (handheld POS device made of durable plastic and a touchscreen interface)

Clover Kiosk: $3,499 + $34.95/mo per device (24″ touchscreen with anti-glare glass, built-in printer)

Clover Kitchen Display System: Available in 14″ and 24.” KDS 24” is $899 + $25/mo per device; KDS 14” is $799 + $25/mo per device

Square Hardware Pricing

Hardware Costs

Square offers a range of hardware solutions to suit different business needs:

Square Reader for Magstripe: The reader allows you to accept Magstripe card payments using a mobile device. Square offers the first reader for free.

Square Reader for Contactless and Chip (2nd Generation): This reader, available for $59, supports contactless payments and EMV chip cards.

Square Terminal: At $299 or $27/mo over 12 months, this all-in-one device enables you to accept payments, print receipts, and manage transactions without additional hardware.

Square Register: Starting at $799 or $39/mo over 24 months, it is a fully integrated POS system that features a customer-facing display and is designed for seamless payment processing.

Square Stand: For $149 or $14/mo over 12 months. The Square Stand transforms your iPad into a professional POS system that supports various payment methods.

Clover vs. Square: Hidden Fees and Costs

Although both Clover and Square advertise transparent pricing, there are additional costs that can sneak up on you depending on your business’s specific needs. From integration fees to optional add-ons, understanding these hidden costs is crucial to avoid surprises down the road. Let’s explore the potential fees you should be aware of with each system.

Clover Hidden Fees

- Hardware Leasing: Clover offers the option to lease hardware, but this can result in much higher long-term costs compared to purchasing the equipment outright. Leasing agreements can be tricky to exit and may lock you into long-term contracts.

- Additional Features and Software Costs: Clover’s basic software plan comes with essential features, but more advanced features like employee management, customer loyalty programs, and detailed analytics may come at additional costs, often requiring higher-tier subscriptions or third-party app integrations.

- App and Integration Fees: Clover’s app marketplace offers a wide range of third-party apps, but many of these come with monthly costs, which can add up if your business requires advanced tools beyond what’s provided in the standard package.

- Cancellation Fees: Depending on the agreement with your merchant service provider, you may face early termination fees if you decide to switch providers or cancel services before the contract ends.

Square Hidden Fees

- Advanced Features and Add-ons: Square’s base features are free, but advanced functionalities come with additional costs:

- Payroll Services: Starts at $35/mo + $6 per employee

- Marketing Tools: Pricing starts at $15/mo

- Customer Loyalty Programs: $45/mo

- Square for Retail/Restaurants: Custom pricing that adds extra costs for more advanced management features.

- Custom Hardware Costs: Square offers a free magstripe reader, but other hardware, such as the Square Register ($799) or the Square Terminal ($299), come at higher prices. Peripheral costs (e.g., receipt printers and cash drawers) can also add up.

- Dispute Fees: Square doesn’t charge for handling disputes directly, but if the dispute is lost, the associated chargeback could cost you both the transaction and a fee.

- International Card Fees: If you accept payments from international cards, you may incur additional fees, which could be higher than domestic rates.

You can also explore a comparison of POS systems with the lowest fees on our detailed guide.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Choosing Between Clover and Square

When you’re deciding between Clover and Square POS, of course, you must consider many factors. How many sales are you making in a day? What are your inventory management and reporting needs? What is the nature of your business? Considering these factors and more—and comparing them to each POS system’s offerings—will make that decision clear.

Below, we take a look into specific use cases that make either Clover or Square POS more suitable for a business:

When to Choose Clover POS

- Established Businesses with High Monthly Sales: Clover’s fee structure tends to favor businesses with higher sales volumes. Using a Clover Fee Calculator can help you estimate your monthly costs and determine if Clover’s pricing aligns with your business needs. If your business processes a substantial amount of transactions each month, Clover’s subscription-based pricing (starting at around $14.95/month) can help offset the slightly lower transaction fees, which start at 2.3% + 10¢ per transaction.

- Businesses Needing Customizable Payment Plans: Clover offers more customizable payment solutions than Square, including plans that reduce transaction fees based on your monthly sales volume. If your business operates at scale, Clover may provide opportunities to negotiate lower rates.

When to Choose Square POS

- Small or New Businesses with Lower Transaction Volume: Square doesn’t require a monthly subscription, making it favorable to smaller businesses or those just starting. Instead, Square charges a flat 2.6% + $0.10 per transaction. If your business processes a lower volume of transactions, a lack of monthly fees helps keep costs down.

- Businesses Seeking Simple, Transparent Pricing: Square’s no-commitment, pay-as-you-go structure is appealing if you prefer a straightforward pricing model without worrying about subscription tiers. It’s perfect for businesses with fluctuating sales or seasonal operations where monthly fees would not justify the usage.

Clover vs. Square: Payment Processing

We’ve looked at Clover and Square POS reviews across the board to summarize the key features that merchants like and dislike about each integrated payment processing system.

Here’s what we found:

Clover Payment Processing Reviews

Clover Positives

- 24/7 phone and email support: Provides reliable customer service around the clock, ensuring assistance is available whenever needed.

- Free plan available for mobile card reader: Clover offers a no-cost entry point for small businesses using the mobile card reader, making it accessible for startups and mobile businesses.

- Robust app marketplace: Clover’s POS system integrates with various apps, enabling custom functionality for different types of businesses (e.g., restaurants, retail, and service industries).

Clover Negatives

- Contracts required: Businesses must commit to a contract, which can be restrictive for those who prefer month-to-month flexibility.

- Termination fees: Cancelling a contract early can result in hefty termination fees, making it costly to switch providers.

- Accounting integrations through third-party apps: Clover’s native accounting capabilities are limited, requiring users to rely on third-party apps (like QuickBooks) for more comprehensive accounting features, which could add complexity and additional costs.

See our guide for Clover POS alternatives.

Square Payment Processing Reviews

Square POS Positives

- Transparent pricing: Square’s prices are clearly displayed on its website. Its payment processing fees are a flat percentage of each transaction plus a flat fee.

- Diverse hardware lineup: Square offers various mobile and stationary POS hardware options, ranging from a pocket-sized reader that plugs into your phone to a register with two touch screens. Hardware accessories, such as barcode scanners, receipt prints, and cash drawers, are also available.

- Extensive Features: In addition to Square POS’s core features, you can add additional features like a loyalty program, email marketing, payroll, or an online store to your setup.

- No chargeback fees: Many providers that handle payment processing charge the merchant a chargeback fee (anywhere from $20 to $100) whenever a customer disputes and/or reverses a credit or debit transaction. Square doesn’t do that.

Square POS Negatives

- Relatively Basic Features: Square certainly meets the needs of many of its merchants. However, other POS systems designed for a specific industry might offer even more features that meet the nuanced needs of a restaurant, for example.

- Account Freezes: A Square POS account may be frozen or deactivated for a number of reasons, including high-risk activities or account activation issues.

Check out our in-depth look at how Square’s customer service stacks up.

Clover vs Square: Who Has the Best Rates Overall?

Ultimately, the best POS system depends on your business’s specific needs. Clover offers more flexibility in payment processors and hardware, while Square provides a more affordable and user-friendly experience for smaller businesses.

If you’re looking for a robust, processor-agnostic solution, KORONA POS might be the perfect fit. Sign up for a free trial to see how it stacks up.

Speak with a product specialist and learn what KORONA POS can do for your business.

Payment Processor Agnostic Alternative to Clover and Square: KORONA POS

Both Clover and Square have benefits, but neither is fully processor-agnostic, and each has some limitations—whether in hardware or fee structures.

Alternatively, KORONA POS allows you to choose your payment processor and comes with a host of advanced features like 24/7 support and comprehensive inventory management without any hidden fees. It’s a scalable, flexible solution for businesses that need a robust POS system.

Clover vs. Square Rates FAQ

It depends on your business needs. Square offers a more affordable entry-level plan, but Clover can offer better rates for high-volume businesses with custom pricing.

Clover charges 2.3% + 10¢ per in-person transaction, with higher fees for online and custom rates for high-volume transactions.

Square charges 2.6% + 10¢ per in-person transaction, with additional fees for online and custom options for large businesses.

Yes, both Clover and Square offer custom pricing and discounts for high-volume businesses.

Neither system imposes strict transaction limits, but fees can vary based on transaction volume.

Clover Vs. Square Rates: Wrapping Up

Clover and Square offer competitive rates, but which is best for you depends on your business model. While Square is perfect for startups and small businesses, Clover’s flexibility makes it ideal for growing companies.

If neither system fits your needs, KORONA POS provides a powerful, customizable alternative that is processor-agnostic and feature-rich. Contact us today to get started!