Square POS is known for its transparent, no-surprise pricing, which appeals to small and medium-sized businesses. But is it the best choice for your business? In this guide, we break down Square’s costs—from monthly subscriptions to transaction and hardware fees—and compare it to alternatives like KORONA POS.

Square POS Cost Calculator

Estimate your Square POS setup and monthly costs based on hardware, subscription plans, and estimated sales volume.

Note: Premium plan prices are placeholders. Actual processing fees may vary.

Estimated Monthly Costs

Hardware Total: $0.00

Subscription: $0.00

Processing Fees: $0.00

Total Monthly Cost: $0.00

Square Pricing: A Quick Glance

Square Plan | Subscription Price | Transaction Fees | Benefits |

Square for Retail | Free: $0/mo per location Plus: $89/mo per location Premium: Custom Pricing | 2.6% + $0.10 -2.9% + $0.30 per transaction |

|

Square for Restaurants | Free: $0/mo per location Plus: $69/mo per location Premium: $165 | 2.6% + $0.10 -2.9% + $0.30 per transaction |

|

Square Appointments | Free (Individual): $0/mo per location Plus: $29/mo per location Premium: $69/ per location | 2.6% + $0.10 -2.9% + $0.30 per transaction |

|

Additional Costs | Square payroll: $35/mo | 3.5% + $0.15 for manually keyed-in transactions |

|

Square POS Pricing Overview

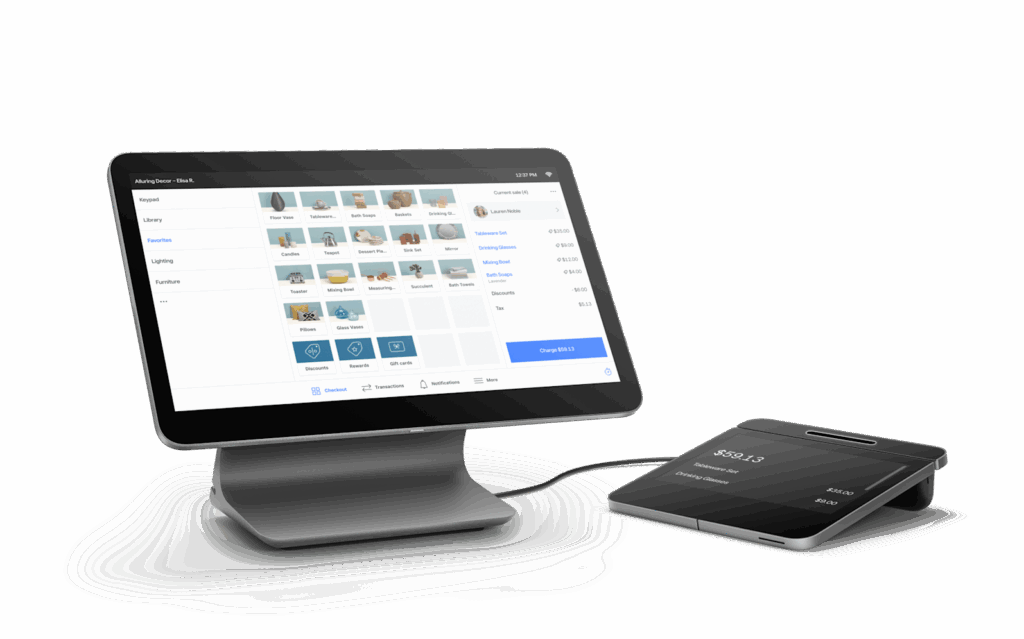

Square offers several software plans tailored to different business types. Here’s a quick screenshot:

Square POS Free

- Monthly fee: $0

- Processing fees: 2.6% + 15¢ per in-person transaction; 3.5% + 15¢ for manually entered payments.

- Key Features:

- Sales analytics

- Inventory management

- Multi-location support

- Mobile invoicing

- Card on file

Hardware required: Square reader, Stand, Terminal, or Register for accepting chip, tap, and magstripe payments.

PRO TIP!

You can find more information on Square POS hardware and its associated costs below. Keep reading!

Square for Retail

- Free Plan: $0/month/location — includes basic inventory and online selling features.

- Plus Plan: $89+/month/location — adds advanced inventory tools, vendor management, staff management for unlimited team members, and discounted processing rates.

- Premium Plan: Custom pricing — includes all advanced features, custom rates, and dedicated onboarding support.

Processing rates:

- In person: As low as 2.6% + 15¢ (Plus plan)

- Online: 2.9% + 30¢

- Keyed-in 3.5% + 15¢

- Invoices: 3.3% + 30¢

- AfterPay: 6% + 30¢

Square for Restaurants

- Free Plan: $0/month/location — supports one countertop POS device, basic order and reporting tools.

- Plus Plan: $69+/month/location — includes advanced inventory, floor plan customization, kitchen display system (KDS), and 24/7 support.

- Premium Plan: Custom pricing — designed for larger operations; includes advanced software features and custom rates.

Processing rates:

- In person: 2.6% + 15¢ (Free and Plus plans)

- Online: 2.9% + 30¢

- Keyed-in 3.5% + 15¢

- Invoices: 3.3% + 30¢

Square Appointments

- Free Plan: $0/month/location — includes unlimited staff accounts, free booking website and social media integrations, integrated payments, automatic text and email reminders, automated contracts, and a marketplace app for beauty and personal care discovery.

- Plus Plan: $29/month/location — includes everything in Square Appointments Free, plus customer confirmation texts and emails, cancellation policy and fees, class scheduling, waitlists, and appointment reports.

- Premium Plan: $69/month/location — includes everything in Square Appointments Plus, plus advanced access, scheduling features, resource management, custom staff commissions, and custom contract fields.

Processing rates:

- In person: 2.6% + 15¢ (Free and Plus plans)

- Online: 2.9% + 30¢

- Keyed-in 3.5% + 15¢

- Invoices: 3.3% + 30¢

Square Payment Processing Fees

Square’s payment processing is straightforward but can get pricey depending on your volume and method.

Standard fees:

- In-person payments: 2.6% + 10–15¢ per swipe, dip, or tap.

- Online payments: 2.9% + 30¢ per transaction.

- Manually keyed-in payments: 3.5% + 15¢ per transaction.

- ACH transfers: 1% per transaction (minimum $1).

- Afterpay installments: 6% + 30¢ per transaction.

PRO TIP!

High-volume businesses (those with annual revenues exceeding $250,000) can negotiate custom rates with Square.

Click here to try our free Processing Fee Calculator!

Find out how much you’re spending.

Square Hardware Pricing

Square offers several hardware options to fit different setups:

Square Terminal

- Price: $299

- Features: All-in-one portable device with touchscreen, built-in card reader, receipt printing, and refund processing.

Square Card Readers

- Magstripe reader: Free with sign-up.

- Contactless & chip reader: $49 — accepts tap and chip payments, pairs with mobile devices.

Square Register

- Price: $799

- Includes: two user-friendly displays, easy-to-use software options, and built-in payments

Square Stand

- Price: $149

- Features: Turns an iPad into a countertop POS with built-in card reader for swipe, chip, and contactless payments.

Square Hardware Bundles

While the Terminal and the Reader are adequate for the simple types of small businesses, most retailers need something with a bit more functionality. Square’s iPad bundles are the most popular option for these types of needs.

Square offers hardware bundles that combine essential components for streamlined POS setups. The Square Register Kit costs about $799 and includes the Square Register, a receipt printer, and a cash drawer.

Another popular bundle, the Square Stand Restaurant Kit, priced at $1,089, includes an iPad stand, cash drawer, and receipt printer tailored for restaurant businesses.

Square POS Extra Features Pricing

For businesses requiring more advanced features, Square POS offers a suite of additional features designed to streamline business operations and enhance customer engagement.

These extra tools help businesses manage finances, accept payments remotely, and build stronger customer relationships.

Square Loyalty

Square’s loyalty solution starts at $45/mo per location and enables businesses to set up loyalty programs to reward repeat customers.

Square Loans

Square offers financing options through its Square Loans program, allowing eligible businesses to access funds quickly to support growth, manage cash flow, or cover unexpected expenses. Loan amounts are based on a business’s sales history with Square, and repayment is automatically deducted as a percentage of daily sales, ensuring flexible repayment terms.

This is comparable to cash advances and the loans come with a fixed fee between 10 and 20% of the value of the loan rather than an interest rate on each monthly payment.

Virtual Terminal

The Virtual Terminal feature allows businesses to accept payments over the phone or by manually entering credit card information from any internet-enabled device. It is particularly useful for service-based businesses or those that take orders remotely. No additional hardware is required, and all transactions are securely processed through Square.

Square’s Virtual Terminal rates are the same as their keyed-in rates: 3.5% + $0.15 per transaction.

Customer Directory

Square’s Customer Directory is free and helps businesses build and manage a centralized database of customer profiles. It automatically saves customer information like purchase history, contact details, and feedback, allowing for personalized marketing and improved customer service.

Text Message Marketing

With Square’s Text Message Marketing, businesses can easily connect with customers via SMS to promote sales, special offers, and events. It allows quick setup of automated campaigns, personalized messages, and scheduling of text blasts. It also provides analytics to track engagement and effectiveness.

Pricing for Square’s Text Message Marketing is $10/mo plus an additional amount based on the total number of messages sent. This structure is outlined below:

- 1-250 text messages per month: $20

- 251 – 500 text messages per month: $25

- 501 – 1,000 text messages per month: $35

- 1,001 – 5,000 text messages per month: $60

- 5,001 – 15,000 text messages per month: $130

- 15,001 – 25,000 text messages per month: $195

- 25,001 – 50,000 text messages per month: $385

- 50,001 – 75,000 text messages per month: $570

- 75,001 – 100,000 text messages per month: $760

- 100,001 – 150,000 text messages per month: $1,135

- 150,001 – 200,000 text messages per month: $1,510

- 200,001 – 300,000 text messages per month: $2,260

- 300,001 – 400,000 text messages per month: $3,010

- $400,001 – 500,000 text messages per month: $3,760

- More than 500,000 text messages per month: Contact Square

Email Marketing

Square offers email marketing as another important feature in its suite of marketing tools. It includes unlimited email sends, POS integration, prebuilt campaign templates, and coupon redemption.

Pricing is $15 per month plus an additional monthly fee based on the number of customer contacts. These details are outlined below:

- 1 – 500: $15

- 501 – 1,000 – $30

- 1,001 – 2,000 – $40

- 2,001 – 4,000 – $55

- 4,001 – 9,000 – $90

- 9,001 – 15,000 – $150

- 15,001 – 30,000 – $225

- 30,001 – 50,000 – $350

- 50,001 – 75,000 – $425

- More than 75,000 – Contact Square

Square Payroll

Square Payroll simplifies employee management by handling payroll processing, tax calculations, and filing. Square Appointment provides a native employee scheduling software. It supports hourly and salaried employees and contractors and offers direct deposits, automatic tax withholding, and timecard integration features. Square Payroll is a comprehensive solution that ensures compliance with labor laws and tax regulations.

Square offers two different payment options for its Payroll feature:

- Full-service payroll: $35/mo plus a $6 monthly fee per person paid

- Contractor-only payroll: $6/mo per person paid

Square POS Customer Reviews

Square is easy to set up, offers seamless invoicing capabilities, and allows users to accept payments through various methods. However, it’s not without its drawbacks, particularly regarding transaction fees and unexpected account holds.

Positive Reviews

Many users commend Square POS. Square’s hardware is praised for its plug-and-play functionality. The consistent software-hardware integration ensures a smooth experience, even on mobile devices. Here are other pros of using Square:

- Easy to use: Square’s setup is incredibly straightforward, with a clean interface that’s perfect for beginners

- Efficient invoicing: Creating and sending invoices is quick, allowing easy payment collection via email

- Flexible payment options: Supports multiple hardware and payment methods.

Complaints

According to Square reviews on Software Advice, some users have experienced issues with system updates that change the layout and disrupt workflows. Another common complaint is the occasional delays due to random account reviews, which can temporarily restrict access to funds.

Here are other common negative reviews about Square:

- Frequent updates: Mandatory updates often change settings locations, causing inconvenience for regular users

- Account holds: Occasional random checks can lead to temporary bans on withdrawing funds, impacting cash flow

- High transaction fees: Processing fees can be high, especially for businesses handling large transactions

- Difficulty reaching support: Some users complain about the customer support at Square, claiming that getting phone assistance takes far too long

Square POS Alternatives and Competitors

POS System | Best For | Transaction and Processing Fees | Software Plan | Benefits |

Retail stores, vape shops, liquor stores, quick-service restaurants | Processing-agnostic; fees depend on the integrated payment processor | Starts at $59/month (no additional transaction fees) | Unlimited free trial, customizable reporting, processing flexibility, inventory management, 24/7 support | |

Retail and restaurant businesses | 2.6% + 10¢ per in-person transaction; 2.9% + 30¢ online | Starts at $69/month | Advanced inventory management, multi-location support, customizable eCommerce platform, 24/7 support | |

eCommerce retailers with physical stores | Card rates start at 2.9% + 30¢ online, and 2.6% + 10¢ USD in person | Starts at $32/month;Advanced plan at $339/month | Seamless online-to-offline integration, centralized inventory, social media selling, built-in payment gateway | |

Full-service restaurants and bars | - | Starts at $0/month- Custom Pricing | Industry-specific features, menu management, built-in payroll, online ordering, extensive hardware options | |

Small to medium-sized businesses | 2.3% + 10¢ (in-person); 3.5% + 10¢ (keyed-in transactions) | Starts at $0/month (payments only); Essentials plan at $14.95/month | Easy setup, versatile hardware options, built-in payment processor, loyalty programs, integrations with 200+ apps |

Square POS Overall Review

Square POS is ideal for small to medium-sized businesses, including retail shops, restaurants, and service-based industries like salons and appointment-based businesses. It’s easy to use and provides seamless integration with Square’s payment processing.

One of the key advantages of Square POS is transparent pricing. Businesses can start with a free plan and upgrade as needed. The system is also highly flexible, with hardware options ranging from mobile card readers to full-fledged registers.

However, some drawbacks include limited customization for larger enterprises, occasional fund holds for high-risk transactions, and higher fees for manually keyed-in payments. Overall, it’s a cost-effective, user-friendly solution for small businesses. Square isn’t ideal for certain businesses like high-risk retail businesses (Liquor stores, vape, and smoke shops, convenience stores, etc)

KORONA POS: A Popular Alternative to Square

KORONA POS offers a range of features that make it ideal for retail stores, from its intuitive interface to its sophisticated feature set. Some of the most noteworthy features of KORONA POS include the following:

Automatic Minimum and Maximum Inventory Levels

Most point of sale software enables manual inventory replenishment. If you have close to 1000 products, this process can take hours. On the other hand, KORONA POS helps you streamline this process with its auto-stock replenishment feature, saving you a whole lot of time and labor.

Processing-agnostic

KORONA POS is processing-agnostic, meaning merchants have the freedom and flexibility of using any payment processor with their POS. It’s particularly ideal for vape shops, liquor stores, and other businesses that need flexibility in their payment options.

Security

KORONA POS has strict security protocols, including regular vulnerability penetration testing and encrypting all payment data according to industry standards (PCI-DSS). You can also set up two-factor authentication in KORONA Studio.

With Square POS, you are at greater risk of being scammed. Most of Square POS’s consumer support is done via email. You may receive suspicious emails claiming a problem with depositing funds or asking for personal details with clickable links containing malware.

Flexible Integrations

KORONA POS also offers seamless integrations into various online platforms, like eCommerce and loyalty software, so merchants can manage online and offline operations from a unified point of sale system. An open API means that any retailer can easily build custom integrations into the platform.

Real-Time Inventory Tracking

With robust inventory tracking, you can always stay on top of your store’s inventory levels and be sure that you have the right amount on hand without worrying about overstocking or running out unexpectedly. Square offers no in-depth inventory management, supplier relationship management, stock notifications, or automated inventory features.

Comprehensive Reports and Analytics

The reports and analytics tool in KORONA POS allows you to track and monitor your retail store’s performance in real-time so that you can make informed decisions about how best to run your business. With detailed insights into every aspect of your sales data, KORONA POS also makes forecasting easier.

Square POS Costs FAQs

Square offers several card readers, with costs ranging from $0 for a basic magstripe reader to $49 for the contactless and chip reader. The Square Terminal costs $299 and includes more advanced features like printing receipts. These readers don’t have monthly fees, but they do charge processing fees for each transaction.

Square’s payment processing fees typically range from 2.6% + $0.10 per tap, dip, or swipe to 3.5% + $0.15 per manually keyed-in transaction. However, these rates can vary depending on the merchant’s specific plan with the Square and the individual transaction type.

Square is generally transparent about its fees. However, there might be additional charges for specific services, such as:

– International fees: processing international transactions

– Chargeback fees: a customer disputes a charge

– Refund fees: refunding a transaction

Yes, Square is popular with small businesses due to its easy setup, affordable pricing, and all-in-one POS and payment solutions. Square’s range of tools—from basic POS features to inventory and customer management—supports small businesses without extensive upfront costs or long-term commitments.

While you can’t directly charge customers a fee for using Square, you can choose to include the processing fee in your overall product or service price. This is a common practice in many industries. However, surcharging is regulated and varies by state, so it’s essential to check local laws.

Calculate the total transaction cost, including Square’s processing fee, and increase the price accordingly to pass on fees. For instance, add a small percentage to cover the 2.6% + $0.10 in-person fee. Be transparent with customers and ensure compliance with state regulations on surcharging. This is also sometimes referred to as cash discounting.

Yes, Square reports sales data to the IRS for businesses processing over $20,000 and completing over 200 transactions per year. The tax report information is reported on a 1099-K form, which Square provides to eligible businesses each tax season to help them file accurately.

Square POS Pricing Wrap-Up

This article has provided a detailed overview of Square’s POS pricing and why it may or may not be ideal for some businesses. While Square is a popular choice that works well for some merchants, it’s essential to consider multiple options when searching for a new POS.

If you want to cut down on Square’s high fees and save money on your POS system, consider KORONA POS. We’re an alternative that offers competitive pricing for a complete retail POS system. KORONA is ideal for retailers looking for a more feature-rich solution with more transparent pricing. Click below to get started.