Contactless payments like Apple Pay and Google Pay have become increasingly popular among consumers. For retailers and merchants, enabling mobile wallet payments in-store is an important way to meet customer demand for fast, convenient checkout options.

But when it comes to choosing between Apple Pay and Google Pay, what is the best contactless payment system for stores? This blog post compares the features and benefits of Apple Pay versus Google Pay for retailers to determine the advantages of offering each platform.

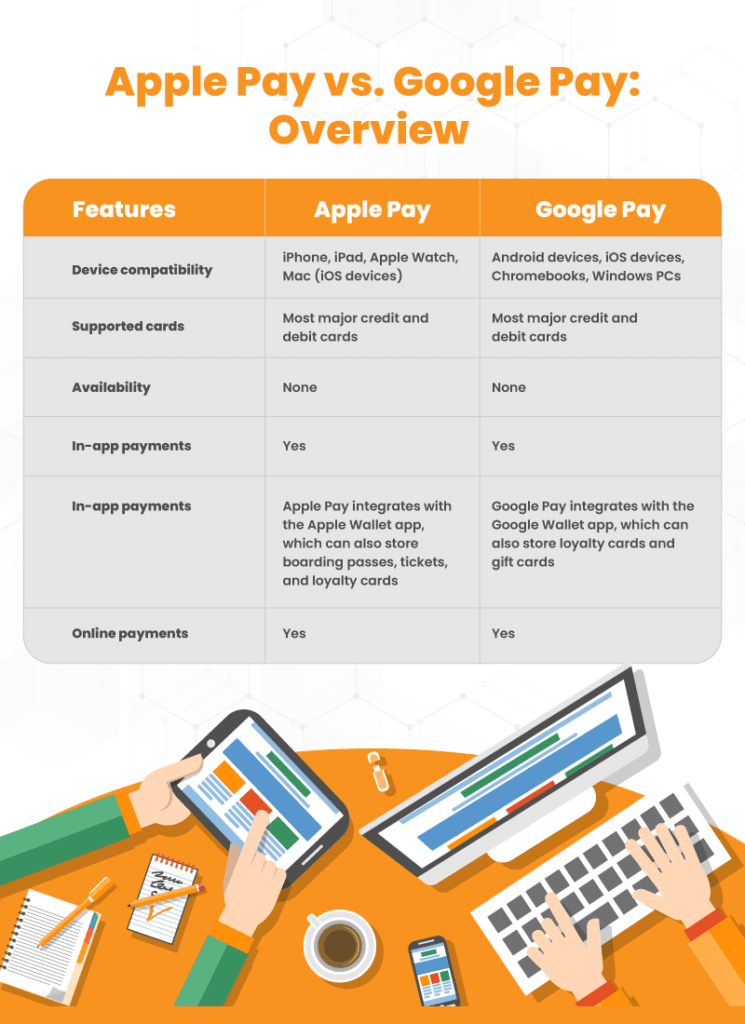

Apple Pay vs. Google Pay: Overview

How To Allow Customers To Pay With Google Pay And Apple Pay In a Store?

If you’re a retail store owner and you want to accept Google Pay and Apple Pay as payment methods in your establishment, you’ll need to ensure that your point of sale (POS) system is compatible with contactless payments. Here are the steps to set up Google Pay and Apple Pay for your retail store:

Check POS compatibility

Ensure that your current POS system payment terminal supports near-field communication (NFC) technology. Google and Apple Pay transactions are conducted through NFC, so your hardware must be capable of accepting mobile and contactless payments. If your existing hardware doesn’t support mobile wallet payments, you may need to upgrade or replace it with NFC-capable equipment. This includes contactless card readers.

Contact your payment processor

Contact your payment processor or merchant services provider to confirm that they support Google Pay and Apple Pay. They can guide you on the specific steps and requirements to set up Google Pay with your existing infrastructure.

Enable NFC payments

Make sure that NFC payments are enabled on your payment terminal. This often involves configuring the settings on your terminal. You might need assistance from your payment processor or the terminal manufacturer.

Train your staff

Train your cashiers on how to process Google and Apple Pay transactions. They should understand the steps required to accept payments using NFC technology and be able to assist customers who want to use Google Pay.

Display Google Pay and Apple logo and signs

Place the Google Pay logo or contactless payment symbols at your checkout counters to let customers know that you accept Google Pay. This will increase awareness of the payment options and encourage its use.

Test Transactions

Before fully implementing Google Pay and Apple Pay, perform test transactions to ensure that the system works smoothly and that your staff is comfortable with the process. The key is having the right POS hardware and software in place and letting customers know these mobile payment options are available. With some setup and training, stores can offer easy, convenient checkout with Google Pay and Apple Pay.

Pros of Google Pay And Apple Pay For Store Owners

Pro #1: Increased sales through faster checkout

Implementing contactless payment options like Google Pay and Apple Pay is likely to increase sales by providing customers with a more convenient, faster checkout experience.

Studies have shown that long checkout times lead to abandoned lines, carts, or repeat visits, but contactless payments allow customers to check out in just seconds with a simple tap of their phone or smartwatch. This faster payment flow improves the customer experience and makes it more likely for them to complete their purchase.

Pro #2: Lower transaction fees

For store owners, Google Pay and Apple Pay transactions incur lower processing fees compared to traditional credit card payments. By encouraging customers to use these digital wallets at checkout, stores can reduce the transaction fees they pay with every sale. These savings add up, leading to higher profit margins over time.

Pro #3: Advanced security protections

Google Pay and Apple Pay provide advanced tokenization technology that keeps customers’ actual payment details secure. This adds an extra layer of protection against retail fraud for both shoppers and merchants. Stores can confidently accept contactless mobile payments, knowing these wallets utilize the latest security protocols to prevent stolen data and malicious attacks.

Pro #4: Seamless integration

Google Pay and Apple Pay are designed to integrate smoothly into the best POS systems and work with various payment terminals. This makes it easy for store owners to set up and accept mobile wallet payments without overhauling their technical infrastructure. The setup process is simple and inexpensive.

Pro #5: Data analytics access

With Google Pay and Apple Pay purchases, merchants can access valuable customer data and analytics, such as contact details, purchase history, and shopping habits. This data provides useful business insights to help stores improve operations, marketing strategies, and customer engagement.

Based on these key benefits, implementing contactless payments through services like Google Pay and Apple Pay is a smart strategy for store owners to boost sales, reduce fees, improve security, utilize advanced data, and provide a smoother checkout experience. The convenience and simplicity of mobile wallets benefit both customers and businesses alike.

Cons of Using Apple Pay and Google Pay

The main cons of Apple Pay for retailers

Retailers, while often benefiting from the convenience and security of Apple Pay, also face some challenges and cons associated with this payment method.:

- Costs: Retailers may incur additional charges when implementing Apple Pay, including purchasing and maintaining compatible POS terminals and payment processing fees. Moreover, retailers depend on third-party payment processors to handle Apple Pay transactions, which means they are subject to the terms and costs associated with these processors. The fees can vary depending on the payment processor and the terms of the retailer’s agreement.

- Hardware and software compatibility: Retailers must invest in NFC-enabled hardware and software to accept Apple Pay payments. This can be a significant upfront cost, especially for smaller businesses with limited resources.

- Limited customer base: Apple Pay is only accessible to customers with Apple devices, which may exclude some potential customers using other mobile platforms. This limited customer base can affect sales for retailers that rely heavily on in-store purchases.

The main cons of Google Pay for retailers

Here are some of the main cons of Google Pay for retailers:

- Technical issues: Like any payment system, Google Pay occasionally encounters technical glitches, payment processing errors, or downtime that could impact sales.

- Less control over customer data: With Google Pay, Google obtains data on purchasing habits that retailers cannot access, meaning they have less control over collecting customer data. This can affect their ability to gather valuable customer insights and tailor marketing strategies.

- Requires NFC-enabled terminals: To accept Google Pay payments, just like Apple Pay, you will need to have NFC-enabled terminals. NFC terminals are less common than traditional credit card terminals and can be more expensive.

- Limited customer support: Google Pay does not offer the same level of customer support as other payment methods, such as credit cards. If a customer has a problem with their Google Pay payment, it may be difficult for them to get help.

- Transaction limits: Google Pay may impose transaction limits, which can be a limitation for retailers dealing with high-value items or larger transactions. Customers may need to resort to other payment methods for larger purchases.

- Dependency on third-party processors: Retailers depend on third-party payment processors to handle Google Pay transactions, just like Apple Pay. This subjects them to the terms and fees associated with these processors. That’s why it is also recommended to choose a POS provider that is processing-agnostic (can accept any processing payment) so that you can negotiate the rates that suit best.

Accepting Apple Pay and Google With the Right POS System

The integration of Apple Pay and Google Pay with KORONA POS offers retailers a seamless and efficient way to accept contactless payments, providing both convenience and security for their customers.

With KORONA POS, customers can make quick and secure transactions simply by tapping their smartphones or smartwatches, enhancing the shopping experience and reducing the need for physical cash or card payments. This not only caters to the preferences of tech-savvy consumers but also helps retailers keep up with the latest payment trends.

Finally, KORONA POS offers a number of other advantages:

- Processing-agnostic: KORONA POS is the only processing-agnostic POS system on the market. This means that retailers can choose to integrate with any payment processor they choose, giving them the flexibility to choose the rates that are most suitable for their business.

- Comprehensive features: KORONA POS offers a wide range of features to help retailers manage their business, including inventory management, customer relationship management (CRM), and reporting.

- Scalability: KORONA POS is scalable to meet the needs of businesses of all sizes. The system can be used by small businesses with just a few employees, as well as large businesses with hundreds of employees.

Apple Pay vs. Google Pay: Conclusion

Both Apple Pay and Google Pay offer retailers ways to accept quick, secure, contactless payments and appeal to consumers who prefer mobile payment methods. While Apple Pay may have some advantages for iOS users, Google Pay supports more devices and cards.

By implementing one or both systems with the right POS tools, stores can provide customers with their preferred payment option and create smoother, faster checkout experiences. Considering the setup costs, transaction fees, and other factors for each can help retailers decide if they should focus on Apple Pay or Google Pay or make both available in their establishments. KORONA POS is a powerful and versatile POS system that can help retailers accept contactless payments and improve their overall business operations. Click below to get started with KORONA POS.

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. And there’s no commitment or credit card required.

FAQs: Apple Pay vs. Google Pay

There is no definitive “better” between Apple Pay and Google Pay – they both allow for contactless payments and have similar features. One key difference is that Apple Pay only works on Apple devices, while Google Pay works on Android and iOS. Google Pay also supports more banks and cards.

Some users have reported issues with Google Pay not being accepted at certain merchants.

Google Pay has been criticized for its lack of transparency and privacy concerns.

Google Pay does not support peer-to-peer payments on iOS devices.

Apple Pay is considered better for Apple users due to its seamless integration with iOS devices, strong security features like Face ID or Touch ID, widespread acceptance at various retailers, and a user-friendly interface.

Some Apple users may choose to use Google Pay if they have an Android device as a secondary option, but it’s not as commonly used among Apple users due to the preference for Apple Pay’s integration with their devices.