Key Takeaways

- It’s a Penalty, Not a Service Charge: An ETF is a fine you pay for breaking a multi-year contract with your POS provider or payment processor before the agreed-upon end date.

- Fees Can Range Wildly: The cost might be a flat fee (often a few hundred dollars) or a much more expensive “liquidated damages” fee, which aims to recover all of the provider’s lost future profits.

- Leasing Equipment Makes it Worse: If you leased hardware (like terminals or card readers), you will likely owe the full remaining balance on that equipment lease in addition to the service termination fee.

- They Lock You In: ETFs are primarily designed to discourage you from switching to a competitor, even if that new provider offers better service or lower rates.

- Read the Fine Print Carefully: The only way to know the exact fee amount and the proper cancellation procedure (like required written notice) is by reading the “Term and Termination” clause of your contract.

- You Might be Able to Avoid Them: You can often bypass the fee by canceling precisely on your contract’s end date, or sometimes by negotiating with the provider if they have repeatedly failed to deliver good service.

Early termination fees can catch many business owners off guard—especially when it comes to payment processing and POS system contracts.

These fees can quickly add up and cut into your profits if you decide to switch providers before your agreement ends. In this post, we’ll break down what early termination fees are, why they exist, how much they typically cost, and most importantly, how to avoid them.

Whether you’re opening a new store or thinking about changing systems, understanding these fees can help you make smarter, more flexible business decisions.

What is a POS Early Termination Fee?

A POS Early Termination Fee is a charge imposed by a payment processing or POS system provider when a merchant terminates their contract before the agreed-upon term ends. The fee compensates the provider for setup costs, equipment subsidies, or lost revenue.

Typically outlined in the service agreement, the fee varies based on contract length, equipment leases, or processing volume commitments.

It can range from a flat fee to a percentage of remaining contract value. Merchants should review terms carefully to avoid unexpected costs when switching providers or closing their business.

Find out how much you’re spending.

Typical Costs of Early Termination Fees

Typical point of sale and payment processing early termination fees (ETFs) vary based on the fee structure outlined in the merchant contract.

- Flat Fees are the most common and generally cost around $295 to $500.

- Prorated Fees start higher but decrease as the contract nears its end, based on the remaining term.

- Liquidated Damages are the most costly, calculated to recoup the provider’s estimated lost profit for the rest of the contract. For example, if you cancel a 36-month contract after 18 months, you might owe the remaining monthly fees. Providers offering free or discounted hardware may charge extra to recover those costs. Fees can sometimes be negotiated or waived if the business closes or upgrades to a new plan.

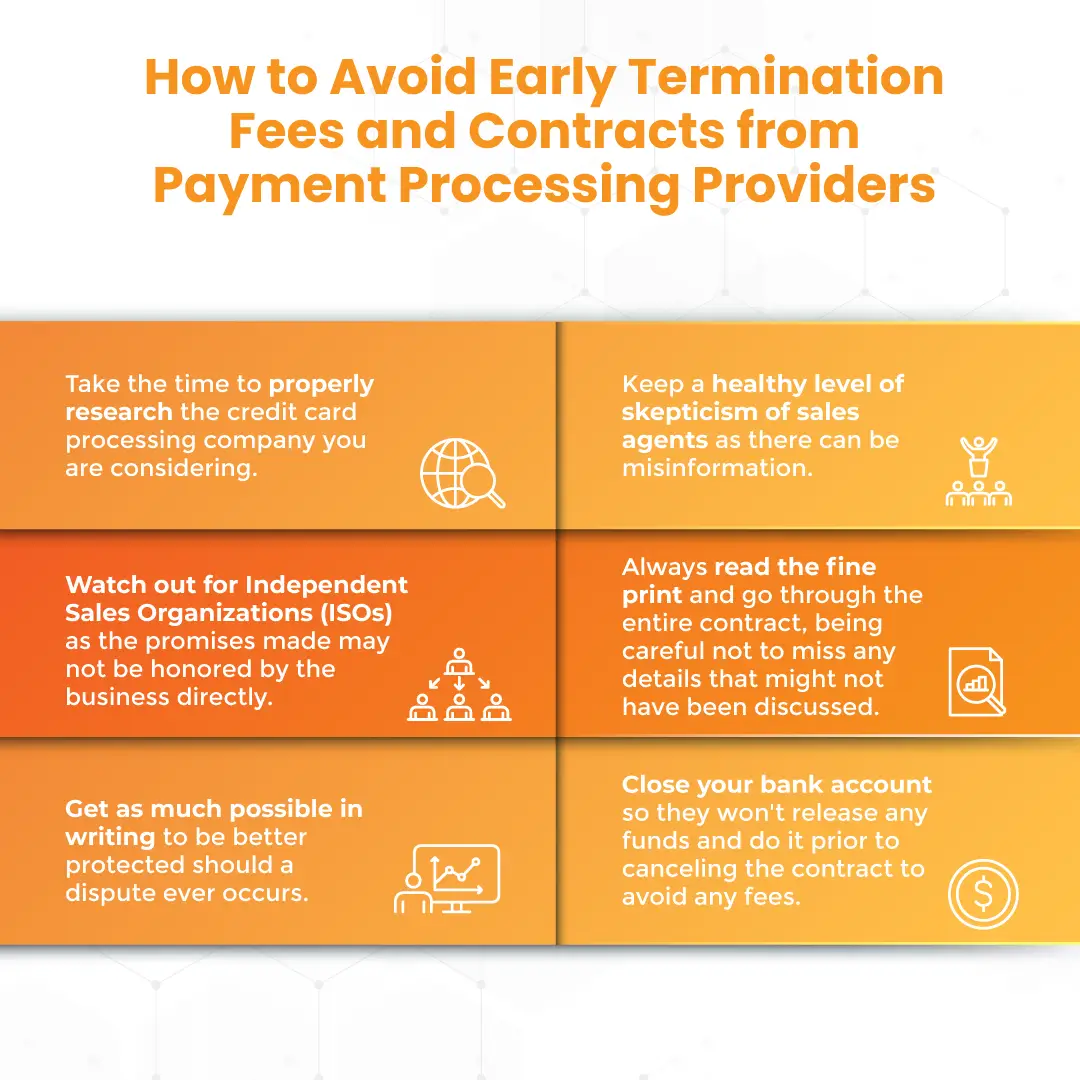

How to Prevent Getting Early Termination Fees and Bad Contracts?

Be wary of any business-to-business contract, POS, processing, or otherwise. There might, however, be situations in which it’s unavoidable. Fortunately, there are steps to take that will protect your business from damage down the road. Here are a few things to keep in mind.

1) Do Your Due Diligence

It’s important to properly research any big purchase, especially one that might be a long-term POS commitment. There are plenty of bad eggs in both of these industries who profit off of uninformed small businesses. Don’t let yours be the next victim.

2) Keep a Healthy Level of Skepticism of Sales Agents

There are plenty of great salespeople. But don’t always believe everything that comes from their mouth. Misinformation can lead to bigger problems down the road.

It might be malicious, but it could also just be a lack of training or knowledge on the service/product being sold. Don’t ever make a decision to purchase something solely because of what you were told by a salesperson.

3) Watch Out for ISOs

Some POS and processing solutions are sold through third-party Independent Sales Organizations (ISOs). In these instances, any promises made may not necessarily be honored by the business itself.

The third-party salespeople are not employees of the business and therefore don’t represent anyone but themselves.

4) Always Read the Fine Print

There are always terms and conditions that can’t be discussed with a salesperson or representative. Take the time to go through the entire contract.

And make sure you’re given the whole thing! Too often, small business owners are only given highlights, only to discover the deal wasn’t as good as it sounded. With processors, understanding the fine print is even more important: look for their interchange plus pricing rates, for instance.

5) Get as Much as Possible in Writing

Again, this is particularly important if you’re dealing with an ISO. If they refuse, it’s a huge red flag. If they don’t, you’re better protected down the road should a dispute ever occur.

6) Close Your Bank Account

You can entirely close the account or flag it with your bank so that they won’t release any funds. This is a last resort option since there are still ways for businesses to get your money if the contract is legitimate.

If you got this route, just make sure to cut it off prior to canceling the contract. ETF will be debited immediately. This will also help you avoid other penalties, such as a PCI Compliance fee.

Learn more about how credit card processing works and save your business money with this free eGuide.

What If You Need to Get Out of a Bad Contract?

Luckily you still have some options. Now, none of these are guaranteed to get you out of your predicament, but they can certainly help in many cases. Again, avoid putting yourself in this situation if at all possible!

1) Check for Any Changes in Fees

Review recent statements to see if the POS or processing company has changed any fees recently. If so, you have cause to cease the contract without penalty. Just be sure to properly record the evidence of any changes.

2) Collect Supporting Documentation

If the company ever breached the contract, even in minute ways, gather the proper evidence. Keep a spreadsheet showing how much you’ve paid the processor or POS company as well. If it’s clear that they’ve already made a profit through your business, any termination fees should be waived.

3) Negotiate Politely

Remember, you’re dealing with actual people, on the other hand. And there are still plenty of people out there that like to help. If you are calm, courteous, and maybe a touch desperate, you might have more luck getting someone to make an exception and release your contract.

4) Threaten Legal Action

No one likes to go to court. It’s expensive and potentially a public relations nightmare. You can even keep it more casual and threaten a bad review, a public complaint, or a Better Business Bureau phone call.

Moral of the story? Avoid contracts with both. Save yourself a headache down the road.

What Is the Ideal POS and Processing Solution?

Leaving out any discussion of point of sale features, what SHOULD you be looking for if you’re in the market for a new POS solution?

1) Cloud-Based, Software-As-a-Service

First, you want to find a point of sale that is cloud-based POS and sold as a software-as-a-service (SaaS). This means that you are paying for a subscription to the product. In a world that changes as quickly as that of the point of sale, it can be risky to invest a lot of cash into owning software.

With the SaaS POS model, any upgrades and updates are included in the pricing of your subscription and are automatically performed whenever they are released.

2) No Contracts

Next, you don’t want this SaaS agreement to be anything other than month-to-month. No contract, long or short-term, is beneficial. After all, why would a company feel like they need to trap customers into something? Shouldn’t the customer simply appreciate the product?

Many POS solutions advertise not long-term contracts, but they still require short-term contracts. This is better than a long-term deal, but still not optimal. Your POS system is an integral part of your business, so if it’s not working for you, it’s important to be able to make a change immediately.

3) Separate POS Solution and Credit Card Processor

You also want your POS solution to be separate from your credit card processing provider. As mentioned above, more merchant service providers now provide both services.

This means you’re more likely to be locked into contracts and high credit card processing rates. Look for a pos system that won’t force you into changing a payment processor.

Keeping the two separate provides you with more flexibility which can help you lower your credit card processing fees.

4) No or Low Early Termination Fees

If you need to sign a contract with your POS solution, stay away from ETFs. This can be cripplingly expensive for some businesses. No POS or processing company should have to keep their business profitable in this way.

Often, these will come attached to offers of “free POS systems.” They might even offer you free hardware and software even, but they’ll come attached with minimum processing fees and expensive tech support.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Choose KORONA POS as Your All-in-One Solution and No Early Termination Fees

As a retail owner, the last thing you want is to be trapped in a bad contract. Because KORONA POS is processing-agnostic, you get to choose any credit card processor you want. That means you can always shop around for the best rates and switch without losing your POS system. Look for the cheapest credit card processing companies.

KORONA POS offers flat monthly pricing starting at $59 per terminal, with no hidden costs, and ships pre-loaded hardware alongside free training. Its intuitive interface supports customizable workflows, inventory tracking with min/max alerts and automated reorders, plus CRM tools for customer loyalty.

Features like offline mode, multi-location support, dual pricing are available. Backed by 24/7 support, it scales effortlessly from single stores to chains.

Ready to experience the difference? Sign up for a free demo with a KORONA product specialist