Having your business’s funds held can be a frustrating and anxiety-inducing experience, especially when you rely on consistent cash flow. If you’re dealing with Clover holding funds, you’re not alone.

This post will clarify why Clover holds funds and, more importantly, what you can do about it. We’ll delve into the causes behind these holds, explain how long they might last, and provide actionable steps to release your money.

Later, we’ll explore alternative solutions and how switching to a payment-agnostic POS system like KORONA POS can help you avoid such issues in the future.

Key Takeaways:

- Clover holds funds due to risk, contract triggers, or processing irregularities.

- Risk assessment, rolling reserves, account freezes, and high chargeback ratios are common causes for holds.

- Funds can be held for 1-3 business days, but sometimes up to 6 months.

- To release funds, contact Clover support, identify the reason, provide documentation, and address the issue.

- If funds are held too long, escalate within Clover, contact your MSP, use social media, or file a complaint.

- Switching to a payment-agnostic POS like KORONA POS can help avoid fund holds.

- KORONA POS allows you to choose your payment processor for better terms and flexibility.

- KORONA POS offers dual pricing to reduce card transaction risks and fees.

Why Does Clover Hold Funds?

Clover (and its acquirers) may pause or withhold merchant payouts when they detect risk, contract triggers, or processing irregularities. It’s a mix of underwriting, fraud prevention, and contract terms designed to protect the processor from losses.

Risk Assessment and Underwriting

Every merchant account is subject to a thorough risk assessment, a process called underwriting. This evaluation considers your business type, processing history, transaction volume, and other relevant factors to determine your risk level.

If your business is in a high-risk industry (e.g., travel, CBD, or subscription services) or if your application contains inconsistencies, Clover may hold funds as a precautionary measure.

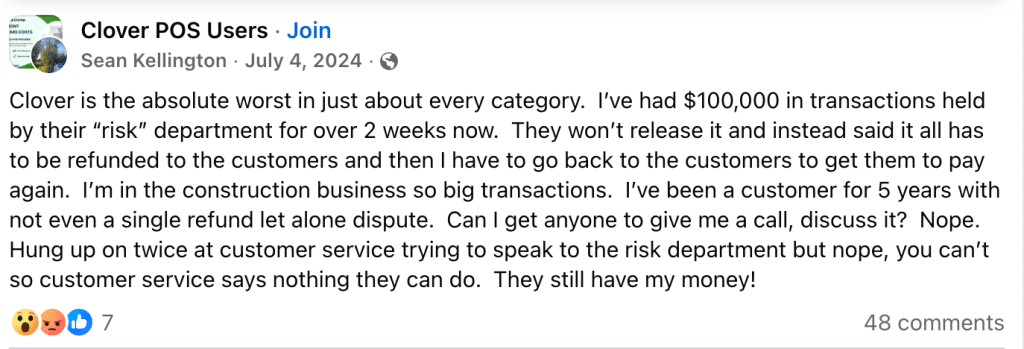

Source: Facebook

For instance, this merchant saw $100K frozen for two weeks over “risk review” on big-ticket items. They hold funds while supposedly verifying certain transactions, which can drag on if your business type (think high-risk, like CBD sales) raises red flags.

Rolling Reserves

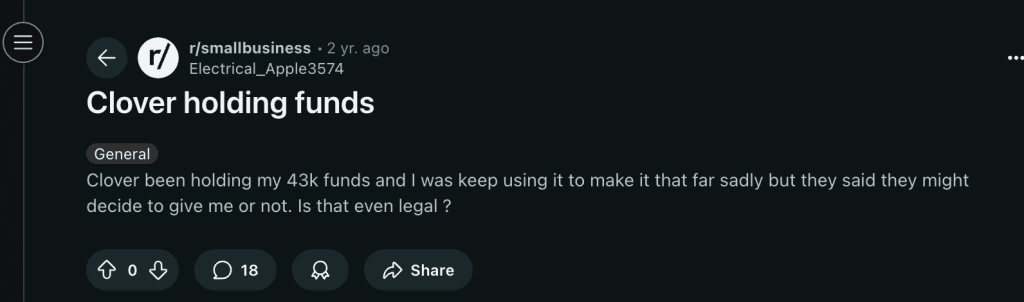

Source: Reddit

This is Clover’s go-to: they skim 5-10% of your sales into a pot that rolls over monthly, releasing older chunks as new ones build up. It’s meant to cover disputes, but new accounts or high-volume starters get hit hardest.

A rolling reserve is a common tool for mitigating risk, especially for new or high-risk merchants. It involves withholding a percentage of each day’s transactions for a set period, typically 90 to 180 days. The funds are held in a non-interest-bearing account and released on a rolling basis, meaning that the funds from Day 1 are released after the reserve period is over, followed by Day 2’s funds the next day, and so on.

Clover advertises this “forced savings” account as a safety net to cover chargebacks or other financial obligations. For example, a business with a 10% rolling reserve on a $1,000 transaction would have $100 held in reserve, which would be released after the agreed-upon period.

💡Recommended Reads

- Learn more about Clover POS Pricing in 2025, their hidden costs, fees, features & plans

Account Freezes and Suspicious Activity

Clover’s systems are designed to detect and flag unusual or suspicious activity. If your account experiences a sudden spike in sales volume, a high number of large-ticket transactions, or an increase in international transactions that are out of the norm for your business, it can trigger an automated review and an account freeze.

These freezes are often temporary and can be resolved once a risk analyst manually reviews the account and verifies the business’s legitimacy, but they often last at least several days.

High Chargeback Ratios

Chargebacks are a major reason for fund holds. When a customer disputes a transaction with their bank, the payment processor is responsible for the funds.

If a merchant’s chargeback ratio exceeds the card networks’ acceptable thresholds (typically around 1%), it signals a high-risk account. Clover may hold funds to ensure they have enough money to cover chargebacks and associated fees.

Clover POS Cost Calculator

Upfront Hardware Cost: $0.00

Monthly Subscription Cost: $0.00

Estimated Monthly Transaction Fees: $0.00

Total First-Month Cost: $0.00

Total Cost Over 36 Months: $0.00

In severe cases, a consistently high chargeback rate can lead to the termination of the merchant account, and the processor will hold funds for up to 180 days to cover any future chargebacks that may arise.

Poor Customer Support and Communication

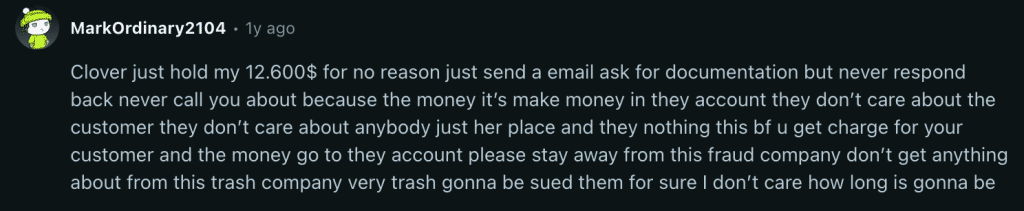

Source: Reddit

One of the most frustrating aspects for merchants is the lack of communication and support when funds are held. Many businesses, as seen in social media and forum posts, complain about the difficulty in reaching a knowledgeable representative who can explain the reason for the hold and provide a clear path to resolution.

This can turn a temporary hold into a long-term cash flow crisis for a business owner who is left in the dark.

How Long Does Clover Hold Funds?

Clover, as a payment processor, typically deposits funds from credit card and debit card transactions into a merchant’s bank account within 1-3 business days after the transaction date.

For merchants eligible for faster funding, funds may be available the next business day. However, the exact duration can vary based on several factors, including the merchant’s bank, transaction type, and whether any holds or reviews are placed on the account.

Factors That May Affect Fund Hold Times

Standard Processing Time: Most Clover merchants receive funds within 1-3 business days. Standard deposits typically take 1-2 business days, but this can be expedited with Clover’s Rapid Deposit service, which delivers funds almost immediately for a 1.75% fee.

Merchant Account Holds: Clover may place holds on funds due to unusual transaction patterns, such as a significant increase in sales volume, high-ticket transactions, or potential fraud concerns. These holds can last up to 6 months due to chargeback risk exposure, though funds are typically released sooner if the issue is resolved.

For example, if a merchant’s average transaction is $250 but they process a $1,000+ sale, Clover may hold funds pending review, requiring additional documentation like bank statements.

Risk Reviews: If Clover’s automated systems flag an account for review (e.g., due to a high volume of EBT transactions or unusual activity), funds may be held until the review is complete. This process can take days to weeks, with some merchants reporting delays of up to 20 days or more if communication with Clover’s risk management team is slow.

Pre-Authorization Holds: For certain transactions, like pre-authorizations (common in hotels or car rentals), Clover places a temporary hold on the customer’s card, which deducts the amount from their account but doesn’t transfer it to the merchant until the transaction is captured. If not captured within 1-8 business days for debit cards or up to 30 days for credit cards, the hold may expire, and funds won’t be transferred.

Bank Processing: If the merchant’s bank is different from the payment processor’s bank, transfers may take an additional day.

How to Access Your Money from Clover?

Navigating a fund hold can be stressful for any business owner. The key is acting fast with solid proof to speed up their review. Here’s a step-by-step process to pry those funds loose, usually within days to weeks if you’re proactive.

Steps to Release Held Funds

- Contact Clover Support Immediately: Your first and most crucial step is to call Clover’s merchant support line. Be prepared with your merchant ID and have recent transaction details ready. Politely but firmly request to speak with a risk analyst or someone from the risk department. General customer service representatives may not have the authority or knowledge to resolve fund-related issues. If you use Clover already and run into problems frequently, you can learn how to troubleshoot Clover POS issues.

- Identify the Reason for the Hold: Once you’re connected with a risk analyst, ask for the specific reason for the hold. Is it due to a high-ticket sale, an increase in transaction volume, or a sudden rise in chargebacks? Getting a clear explanation is essential for a targeted resolution.

- Provide Requested Documentation: Clover will likely ask for documentation to verify your business and transactions. This could include invoices, shipping confirmations, customer contracts, and proof of delivery. The faster you can satisfy their requests, the faster they can release your funds. Upload it via their portal or email it when your support ticket is open.

- Address the Underlying Issue: If the hold is due to a specific issue like a high chargeback rate, you need to show Clover you are taking steps to mitigate the problem. This might involve implementing better customer service practices, refining your return policy, or using a chargeback prevention service.

What To Do If Funds Are Held For Too Long?

- Escalate Within Clover: If you’re not getting a satisfactory response, it’s time to escalate. Ask for a supervisor or a manager within the risk department. Keep a detailed log of every conversation, including the date, time, and the name of the person you spoke with. This documentation is vital.

- Reach Out to Your Merchant Service Provider (MSP): If you didn’t get your Clover account directly from Clover, but through a third-party MSP, contact them immediately. Your MSP has a direct relationship with Clover and can often advocate on your behalf to get the funds released.

- Call Them Out on Social Media: If you’re not getting any traction through traditional channels, publicly calling out Clover on platforms like X (formerly Twitter) can sometimes get a faster response. Companies are often highly sensitive to public complaints about not delivering funds. Draft a concise and professional post detailing your situation and the lack of a clear resolution. Tag their official handle to ensure they see it. This can sometimes bypass standard customer service queues and get the attention of their social media or public relations team, who have the authority to get you a direct contact from the relevant department.

- File a Complaint: If all else fails, you can file a formal complaint. The Better Business Bureau (BBB) and the Federal Trade Commission (FTC) are common avenues. A formal complaint can sometimes prompt a faster response from the payment processor, as it affects their reputation and standing.

- Explore Switching Providers: While waiting, audit alternatives to avoid future headaches. KORONA POS stands out as a payment-agnostic point of sale system, meaning you pick your processor without lock-in. If Clover’s hold has you fed up and ready to switch both your POS and processing, KORONA’s team can guide a seamless switch for retailers, keeping your ops running smoothly.

WE CAN HELP

- Unlike Clover, KORONA POS is agnostic for payment processing. That means you can choose or switch processors without losing your POS. If your funds are being held and you want more flexibility, KORONA POS can easily help retailers migrate. Call us at 833.200.0213

Alternative Solutions for Avoiding Clover Fund Holds

If Clover is locking up your money, switching to a POS that lets you pick your own processor can give you more control. Here are five strong Clover POS alternatives:

KORONA POS: Best alternative over Clover for high-risk retail businesses (liquor, vape, smoke, wine, convenience stores)

This one’s a lifesaver if your business falls into “high risk” categories where Clover frequently carries out its account holds. KORONA integrates with any major processor you want – no forced switches or extra fees – so you negotiate rates that suit you and avoid hold-heavy contracts.

Pros: Killer inventory tools; unlimited free trial; scales with growth; perfect for avoiding Clover’s drama by keeping control over payments

Cons: Bit of a learning curve for complex setups; pricing starts at $59/mo; no contracts

Shopify POS: Best for eCommerce-first retail (online stores with physical locations, pop-ups, fashion boutiques)

If you’re blending online and in-store sales, Shopify lets you use third-party processors alongside their own Shopify Payments, though you’ll pay extra transaction fees (0.5-2% based on your plan) for outside ones. This flexibility means not getting locked into a hold-prone provider.

Pros: Seamless omnichannel sync; easy setup; robust analytics; great for avoiding funds seizures by diversifying processors

Cons: Fees add up if not using their payments; starts with a free trial, then $29/mo basic

Lightspeed: Best for multi-location hospitality (restaurants, golf courses, bars)

Lightspeed shines for growing businesses. But remember, they push their own Lightspeed Payments—opting for your own processor means extra fees on top. Still, it’s agnostic enough to integrate with processors like Worldpay, helping you sidestep Clover-style reserves by choosing a trusted partner. Learn how Lightspeed compares to Clover.

Pros: Top-notch reporting; user-friendly interface; inventory features; ideal if you want expansion without payment headaches

Cons: Spotty support; pricier for third-party use; starts at $89/mo

POS Nation: Best for everyday retail and service spots (grocery stores, convenience shops, restaurants, specialty services)

Tailored for straightforward setups, POS Nation partners with multiple processors like Heartland without long-term ties, letting you shop around for low-hold options. No forced bundles mean easier escapes from restrictive deals.

Pros: Solid reporting; scalable features; good support

Cons: No free trial; some integration limits; pricing from $69/mo

Bepoz: Best for hospitality and entertainment venues (bars, cafes, event spaces, retail hybrids)

Bepoz connects with 95% of processors, making it super flexible to keep your current setup and negotiate better terms elsewhere to avoid Clover’s fund freezes.

Pros: Strong stock control; CRM tools; transparent costs; good for dynamic environments where quick processor switches prevent cash flow snags

Cons: No trial; support can vary; starts at $69/mo with add-ons

💡Recommended Reads

Explore these other blog posts from KORONA POS to help you compare Clover to other POS systems:

How KORONA POS Helps Avoid Your Funds Being Held vs. Clover

One of the big problems many merchants face with POS systems tied strictly to one payment processor (or that force you into a bundled processing arrangement) is that you may have limited control over your transactions, chargebacks, reserves, or “holds” on funds — especially if the processor considers your business high risk or has policies that mandate freezing funds for review.

KORONA POS takes a different approach. It’s processing-agnostic, meaning you’re not forced to use a particular merchant services provider. Because of that:

- You can shop around for a payment processor that has more favorable terms, a better risk profile, or fair policies related to fund holds and reserves.

- If there are disputes, chargebacks, or delayed settlements, you are not strictly tied to an inflexible processor contract that might impose long holds or strict reserve rules.

- Since KORONA POS natively supports dual pricing (separate cash and card pricing), merchants can reduce the volume of transactions subject to processor risk and thus reduce the likelihood of holds or reserves.

By comparison, Clover bundles its own hardware/software and processor, limiting your ability to shop for processors, making you subject to whatever terms Clover’s processor (or associated merchant service) applies — including its reserve/hold policies.

How to Switch to KORONA POS?

If you’re considering moving from Clover (or another POS) to KORONA POS, here’s what the process looks like:

Explore the Features & Demo

Speak with a product specialist and learn how KORONA POS can power your business.

Before switching, it helps to see how KORONA POS works in practice. You can schedule a live demo with a product specialist directly through the “Schedule A Demo” page. A product specialist will walk you through features, hardware, integrations, and how switching works.

Try It Free / Pilot It

KORONA POS offers an unlimited free trial with no credit card required and zero commitments. This gives you a chance to test the system with your data (inventory, pricing, employees, etc.), and see how the point of sale works in real life.

Choose Your Merchant Services Provider

Since KORONA POS is processing-agnostic, you should decide what payment processor you want to use — one with favorable terms, low risk of holds, and good customer support. KORONA can help you integrate your preferred merchant or recommend trusted partners.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Migrate Hardware / Software Settings

You’ll need to set up the hardware you’ll use (terminals, registers, tablets, etc.). KORONA supports a wide range of hardware and even allows you to reuse existing compatible gear. Together with KORONA’s support team, you’ll also configure your catalogs/inventory, pricing, user roles, etc.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

Enable Dual Pricing if Desired

If you want to reduce your card-fee burden (and potential related risks), you can enable dual pricing in KORONA. You’ll configure separate price groups for cash and card, set signage, train staff, ensure the POS displays both cash and card prices, etc.

Training & Support

KORONA provides onboarding support, customer service (24/7 for emergencies), documentation, and training. Make sure your team is trained on the new system—cashiers on the front end and managers on KORONA Studio.

Have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us at 833.200.0213 to see how reliable we are.

Go Live & Monitor

Once everything is tested, you go live with the new system. Monitor transactions, ensure settlements are going through as expected, and watch for any unexpected holds or delays.

Switching isn’t instantaneous, but KORONA is built to make the move smoother, easier, and less risky, particularly in terms of processing costs, unwanted holds, and growth-scale flexibility.

Ready for an All-in-One POS System? Switch to KORONA POS Today!

Here’s why many merchants are making the switch:

- Everything in one system: POS, inventory, employee management, payments, loyalty, reporting, and multi-location and franchise management features. No need to cobble together many apps (which often cost more, have integration issues, and can lag behind in updates).

- Flexibility without vendor lock-in: Because you aren’t locked to one payment processor or limited hardware, you can choose what works best as your business evolves.

- Transparent costs, less surprise: KORONA emphasizes transparent monthly fees, no long-term contracts, unlimited free trial, etc. That reduces the risk of hidden fees, forced hardware upgrades, or processor rate hikes.

- Dual pricing built in: This is a strategic feature to help merchants reduce card-processing costs and thereby reduce the number of transactions that are susceptible to delays or oversight from processors.

- Strong support & reliability: Get reliable in-house support, 24/7 emergency phone support, thorough documentation, and training.

- Risk reduction: Your business has more tools to reduce risk because of the flexibility in payment processing, dual pricing, hardware options, etc.

If you’re ready to make the switch, KORONA POS gives you better control, more transparency, additional cost savings, and fewer unwanted surprises. Click below to learn more.