Give your customers flexibility and convenience

Join The Businesses Powered by KORONA POS

POS System Payments Made Easy:

Optimize Sales & Customer Satisfaction

Contactless NFC Payments

Accepting card payments, digital wallets, mobile payments, and other contactless payment methods with EMV credit card machines will keep your payments secure for you and your customers.

EMV Chip Payments

Accept all modern payment solutions. KORONA POS is integrated with major payment processors for smooth transactions and is EMV-compliant for secure chip card payments for enhanced security.

Prevent Credit Card Fraud

Provide secure payment processing to reinforce customer service. Regardless of your number of locations or franchisees, you can access all reports and statistics combined by region or for each store individually.

Cash Control

Track every cash payment and cash movement, whether or not it’s revenue-related. This ensures that everything is accounted for. Know exactly where things went missing so that you can take the proper action.

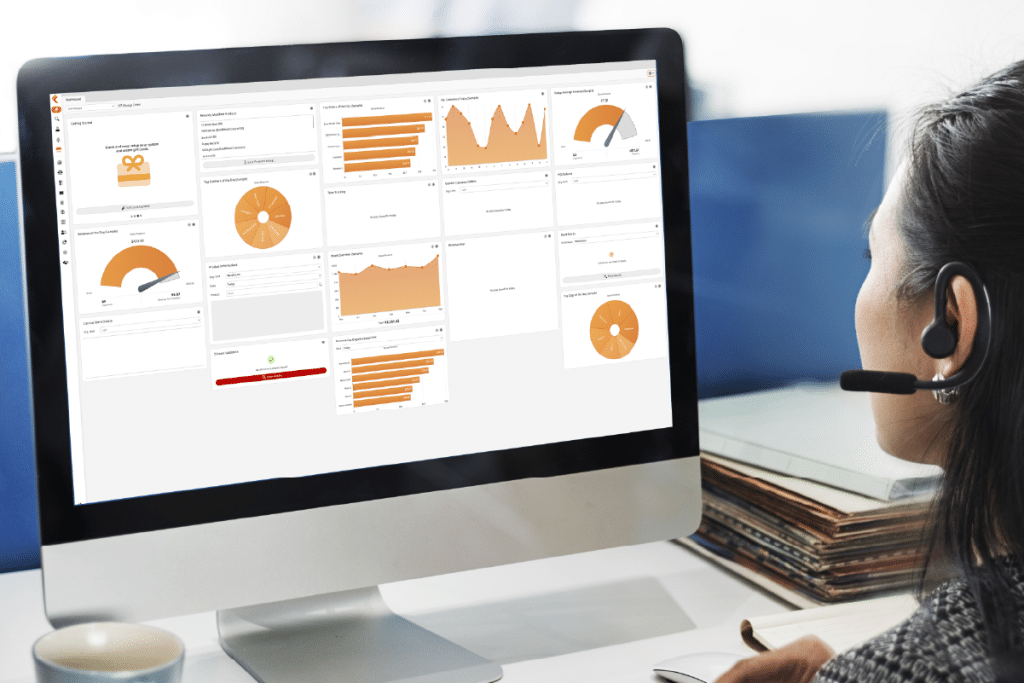

More Than Just Reports

KORONA POS doesn’t just provide reports. It actually delivers useful suggestions and even offers automation tools such as assortment cleanups and reorder level calculations.

Seamless & Secure POS Payments with KORONA POS

All KORONA POS reports and statistics are available in real-time and always reflect current numbers. You can spot issues as soon as they happen and make better decisions for a profitable business.

Get exact measures of your employees’ reliability and identify bad apples through individualized sales reports on a single unified back office platform.

Make sure employees only have access to reports and functions that they need. You have full control over what numbers are visible to employees and contractors.

Track working hours right within KORONA POS. With your QuickBooks integration, accounting and payroll just got a lot simpler.

KORONA POS tracks inventory related expenses, so you know what you are actually making with each product you are selling. In addition, it will alert you about any cost changes that call for a price adjustment.

Transform your business with KORONA POS. Getting started is simple. And free.

Unlimited Free Trial

Try out KORONA POS yourself for free. See the various point of sale features and tools you can use for your business in KORONA Studio. There’s no need for a credit card, it is completely free with zero commitments.

Schedule a live Demo

Ready to speak to a product specialist and get a full live demonstration of KORONA POS? Let us show you in-depth how our point of sale solution can improve your business. Pick a date and time to set up a demo.

Build Your OWN POS

Pair KORONA POS with top-tier hardware to ensure fast, reliable transactions every time. Choose from our pre-built bundled point of sale kits or pick individual hardware options to power your business operations.

Frequently Asked Questions

A POS system can accept payments in a number of different ways. Most simply, it can accept cash by keeping it in the drawer. Though less common, a POS can also accept personal or traveler’s checks. But most importantly, it can accept electronic payments. These include swiped, dipped, and tapped debit and credit payments. In each of these, the payment methods communicate with the POS hardware, which then sends the information through their processing company. The credit card processor is responsible for ensuring that each transaction is securely and successfully processed.

For each credit or debit transaction, businesses must pay their credit card processing company. This money is deducted from the total amount deposited in your business account at the end of each business day. The charges for payment processing are included for the service of facilitating a legitimate and successful payment.

There are now a wide variety of ways to make payments. Cash is still largely accepted, while fewer businesses continue to accept checks. Meanwhile, most consumers now pay with various methods for debit and credit transactions. Debit transactions can still be swiped with a magnetic strip, while credit must be inserted with an EMV chip. Additionally, contactless payments use near field communication technology to accept payments such as Apple and Android Pay.

Credit card fraud can cost businesses a great deal of money, especially if they haven’t followed the proper protections. Start by making sure you’re following all PCI compliance rules. For online payments, require CVV with each purchase. Keep purchase histories, require signatures, encourage strong passwords, keep product pages in HTTPS format, make anti-theft policies clear, and keep your software regularly updated.

A POS payment is any payment that goes directly through your point of sale system. A customer can elect to pay with any form of payment accepted by a certain store. This typically includes cash, check, debit, and credit transactions. In order for a retail store to accept all such payments, it’s necessary to have both the requisite hardware and software to facilitate the payment.

Thank you!

Check your email for confirmation of your free trial and follow the instructions to get started!

Advanced POS Features and tools