Retail companies must use many important measures to assess their health, efficiency, valuation, and profitability. From key performance indicators to inventory analysis to profit margins, there are plenty of ways to analyze different aspects of your business.

Of course, one of the most important things to consider is the cost and value of your inventory. And though it’s a headache for many small business owners, understanding the basics of your retail accounting is hugely important. Here’s a little guide detailing retail store accounting methods.

What Is Retail Accounting?

Retail accounting refers to methods of tracking inventory from a stock and monetary perspective. It involves all the numbers and formulas that tell you how much money you have invested in your stock and your profit margins. Computing it includes various equations, including cost of goods sold (COGS) and more.

Why Is Utilizing Retail Store Accounting Methods So Important?

Retail accounting is not just a helpful way of analyzing your business. It is also required for tax purposes. So for business operators, some form of formal computation and reporting is mandatory.

Accounting for the cost and value of inventory also provides businesses with accurate inventory valuations and balance sheets. Ideally, performing retail accounting calculations will allow you to make assessments about your stock without having to constantly do manual counts.

Remember, however, these formulas are not necessarily exhaustive, and retail businesses with more complex or diverse items will run into some complications.

Different Types Of Retail Store Accounting Methods:

Businesses have some options when it comes to methods for retail accounting. All of these will help you determine the cost of goods sold and gross profit. Choosing which type of formula is best will depend on the type of products you sell, your reporting intentions, and in which country you do business.

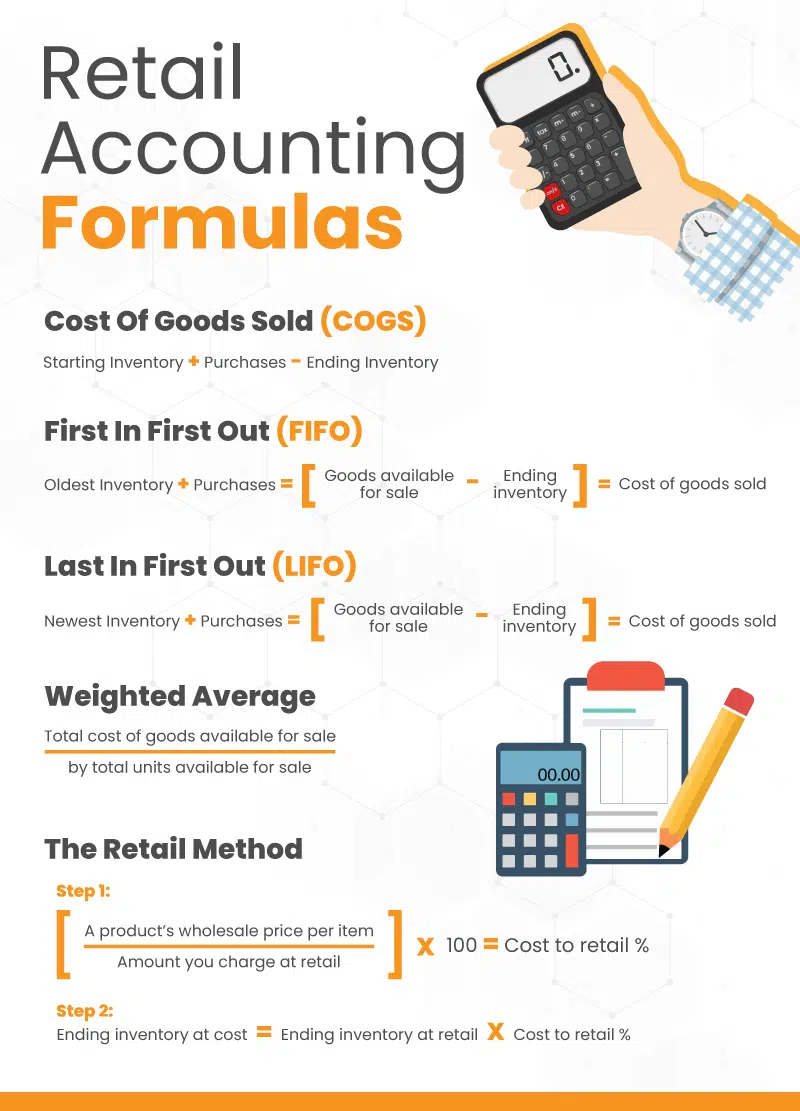

Retail Accounting 101: Cost Of Goods Sold

First, and most basically, retail businesses will want to determine their cost of goods sold before they start doing any other formulas or calculations.

Starting Inventory + Purchases – Ending Inventory

The point of figuring out the COGS is to determine how much you paid to acquire the goods that you sold within a certain period. This number gives retail businesses a place to start examining their margins and profitability. There are four other popular formulas to think about when performing retail accounting. Below is an explanation for each of them:

Retail Bookkeeping With First-In-First-Out (FIFO)

FIFO is a retail accounting method that assumes that the oldest items in your inventory will be the first ones sold. The method is commonly used by retail companies that sell time-sensitive items, such as high fashion apparel or convenience store inventory management. For example, a c-store will want to sell the oldest perishable items – like milk and eggs – first.

The formula goes like this:

Oldest Inventory + Purchases = Goods available for sale – Ending inventory = Cost of goods sold

FIFO is also a good formula to use when companies want to increase their valuation by showing lower cost per unit and higher profit margins. Thus, this method is often used by companies that hope to enhance their acquisition appeal or entice additional investors.

On the flip side, this first-in-first-out formula often forces retail companies to pay higher taxes on these improved margins.

Last In First Out (LIFO) Accounting For Retail Business

LIFO, on the other hand, evaluates inventory based on current wholesale market prices rather than what businesses actually paid for products in the more distant past. It typically calculates a higher cost of goods sold and in turn a lower profit margin, meaning this formula is used by businesses that want to lower their tax liability.

The actual formula is the same as is used for FIFO, however the inventory in question is the newest instead of the oldest.

Let’s use a coffee shop as an example. When you first open, you purchase 30 french press coffee makers at $10 each wholesale. A couple months down the line you still have 10 french presses left, and you make another order to replenish your stock.

This time, however, because of inflation, the wholesale cost of these french presses is $15 dollars each. When you do the calculations for your profit margins, you will enter $15 as your cost of goods. Therefore your margins and overall profit will appear to be lower on the books.

Because LIFO gives a somewhat inaccurate and unflattering picture of company profits, it’s actually illegal in most parts of the world. In fact, as of 2022, only the U.S. and Japan allow it as a retail accounting method.

Average Cost Retail Method

Retail companies that sell many similar products should consider the weighted average method. Having your inventory mixed and mingled and constantly replenished often necessitates this type of approach to figuring out COGS and profit margins. This retail store accounting method formula is also quite simple:

Total cost of goods available for sale / by total units available for sale

Essentially, the weighted average unit finds a middle ground between FIFO and LIFO.

To put it in numerical terms, let’s say you sell socks. In Q1, you bought 50 black ankle socks for $4 dollars apiece. Then, in Q2, you bought 50 black ankle socks at $6 each, again, perhaps due to inflation or supply chain issues. Your total cost of goods available for that period would be $200 (50 socks x $4 each) + $300 (50 socks x $6 each) = $500. Divide that by the 100 items (50 in Q1 + 50 in Q2), and you get a weighted average of $5 for each item.

If, over the course of that period, you sold 50 out of 100 units, you now have a cost of goods sold of $250 (50 items X $5 weighted average cost per unit).

The weighted average is similar to the average unit retail measurement. It can give you a clearer picture in some respects than FIFO or LIFO. Nonetheless, be aware that industries with intense price fluctuations can cause inaccurate reporting within certain periods of time.

Retail Method Of Accounting

Finally, many businesses will use a technique called the retail method. By performing the retail method, you can get an idea of how much stock you have of individual items as well as the overall monetary value of those total items without having to do a full physical count. Again, this saves time and money for small business owners.

In this method, you first figure out the cost-to-retail percentage:

(A product’s wholesale price per item / Amount you charge at retail) x 100

For example, if you buy watermelons from a farm for $2 and you sell them at a fruit stand for $5 your cost-to-retail percentage would be 40% (2 / 5 = .40, or, 40%).

Next, determine the goods available for sale by adding your starting inventory + purchases. Then subtract the net sales from the goods available for sale at retail. Finally, you can convert your ending inventory at retail to inventory at cost by multiplying it by the cost-to-retail percentage. In other words:

Ending inventory at cost = Ending inventory at retail x Cost ratio

Many businesses prefer this method because of its simple and cost-effective approach. Also, while the formula helps businesses hone in on accurate estimates regarding inventory, they do not account for phenomena such as shrinkage, returns, and theft.

KORONA POS has been a huge game changer for my overall profitability. Implementation was seamless and painless! The support staff is great and always ready to help. Had I known it would be this easy, I would have made the switch sooner!

-Kristen L.

Keeping Track Perpetually Can Help Immensely

With the right technology and software, much of your retail accounting can be simplified and streamlined. For most companies, the first order of business is investing in a point of sale that accounts for all omnichannel purchases and collects that data in one central place.

KORONA POS offers comprehensive inventory management for retail industries across many different verticals and many different sizes. Plus, a perpetual inventory system reduces the labor burden for retail accounting. And a fully customizable KPI dashboard makes it easy for your team to learn. Give us a call today to learn more about KORONA POS!

FAQs: Retail Accounting

Retail accounting refers to a set of methods to assess the value of your inventory. It also helps determine aspects like profit margin. There are several different formulas to compute retail accounting figures, but almost all examine the cost of goods sold (COGS).

The basic formula for the retail method uses the cost-to-retail ratio. This takes the cost of goods available and divides it by retail value of goods available, then multiplies it by 100 to get a percentage point. Once you determine that, you can look at cost of goods sold, cost of sales, and ending inventory.

Retail accounting can certainly be somewhat hard if you have a large or diverse amount of products in your inventory. Nevertheless, using retail accounting formulas can take away a fair amount of the manual labor involved with tracking inventory value. In addition, investing in a robust point of sale system will make omnichannel retail inventory tracking much more streamlined and automated.