POS Credit Card Processing is a core part of running a retail business, yet many retailers struggle to understand how it’s set up, priced, and managed.

In the following sections, we will break down:

- The step-by-step mechanics of a modern POS credit card processing transaction.

- A transparent look at interchange, assessment, and service fees.

- How to choose between integrated and third-party processors.

- Modern security requirements and PCI compliance in 2026.

Key Takeaways:

- Prioritize Interchange-Plus Pricing: For most established retailers, “Interchange-Plus” is the gold standard for transparency.

- Embrace “Tap-to-Pay” as the Standard: Contactless payments via mobile wallets (Apple Pay, Google Pay) and NFC cards now dominate.

- Leverage Dual Pricing to Offset Costs: Many retailers are successfully adopting dual pricing or cash discount programs.

- Watch for “Junk” and Hidden Fees: Carefully review your statements for “statement fees,” “regulatory fees,” or “non-compliance fees.”

- Choose Integrated over Standalone Systems: An all-in-one POS that integrates directly with your processor reduces human error and speeds up reconciliation.

How POS Credit Card Processing Works?

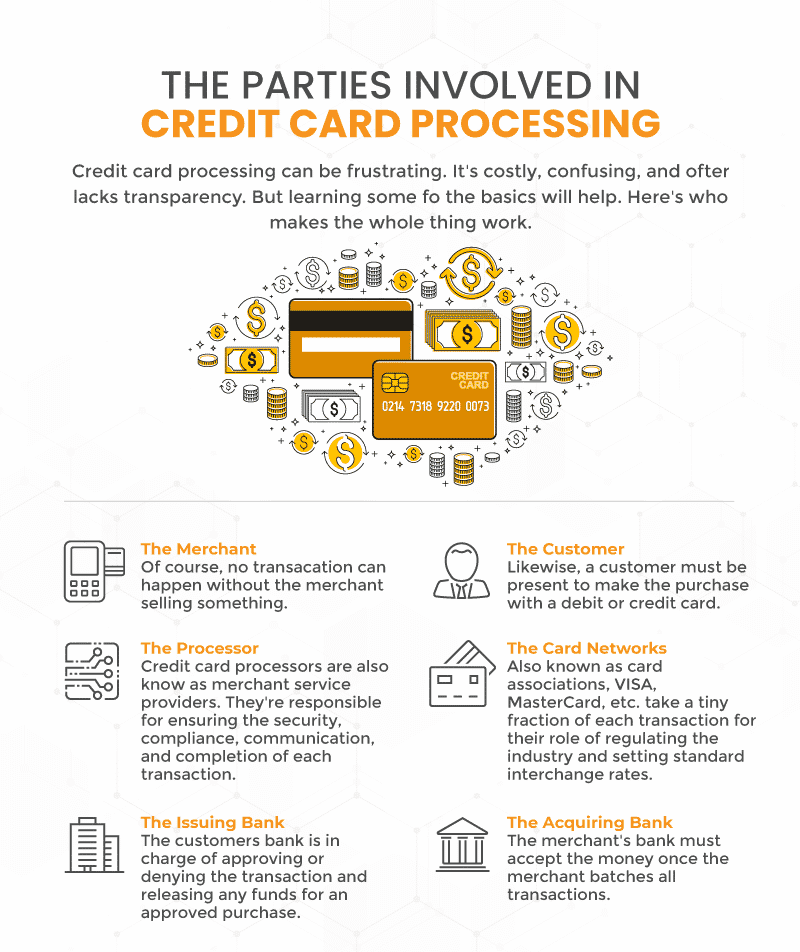

Point of Sale (POS) credit card processing is the secure, multi-step communication between a merchant, an acquiring bank, and the cardholder’s bank to finalize payments.

Step #1: Authorization Request

The process begins when the customer swipes, inserts, or taps their card. The POS system captures the account data and transmits it to the payment processor, which then forwards the request to the card network (like Visa or Mastercard).

Step #2: Verification and Routing

The card network routes the transaction to the issuing bank (the customer’s bank). This bank verifies that the account is valid and checks for sufficient funds or available credit to cover the purchase amount.

Step #3: Approval or Decline

The issuing bank sends a response code back through the network. If approved, the bank puts a temporary hold on the funds. The POS terminal then receives this message and generates a receipt for the customer.

Step #4: Authentication

In this phase, the merchant verifies the transaction, often through a signature or PIN. The transaction is now technically complete from the customer’s perspective, but the merchant has not yet received the actual money.

Step #5: Batching

At the end of the business day, the merchant “batches” all approved transactions and sends them to the acquiring bank (the merchant’s bank) to request the actual transfer of funds from the various issuers.

Step #6: Clearing and Settlement

The card network facilitates the final transfer. The issuing bank sends the funds to the acquiring bank, which then deposits the money into the merchant’s account, typically deducting processing fees during this final step.

Your Retail POS System and Credit Card Payments

Your point of sale (POS) system sits at the center of credit card payment processing, connecting hardware, software, and payment providers to complete transactions quickly and securely.

Key Points at a Glance

- Every retailer accepting cards needs a POS system and compatible card-reading hardware.

- Some POS systems act as payment service providers (PSPs), handling software and processing together.

- All-in-one PSPs offer convenience but often limit flexibility and charge higher processing rates.

- Third-party processors integrate with POS systems and allow pricing comparison and negotiation.

- POS performance directly affects checkout speed, especially for high-volume retailers.

| Feature | Integrated PSP (e.g., Square, Clover) | Third-Party Integration |

| Setup Speed | Faster; plug-and-play. | Slower; requires account syncing. |

| Pricing Model | Usually flat-rate (predictable). | Often Interchange-plus (lower cost). |

| Flexibility | Locked into one provider. | Ability to switch processors easily. |

| Support | Single point of contact for all issues. | Separate support for POS and payments. |

See related: Payment Processing: Integrated Payments vs. Non-Integrated

Major Fees for POS Credit Card Processing Payments

Credit card payment processing involves several types of fees that can vary by provider, card type, and transaction method. Understanding these core fees helps retailers better evaluate processing offers, reduce costs, and avoid unnecessary markups.

Interchange Fee

Interchange fees make up the largest portion of credit card processing costs and are set by the card networks. These fees compensate issuing banks for risk and handling transactions.

PRO TIP

Retailers can lower interchange costs by avoiding keyed entries, card-not-present transactions, and high-reward cards. American Express and Discover typically carry higher interchange rates.

Assessment Fee

Assessment fees are mandatory rates set by the card networks themselves for the privilege of using their infrastructure. Unlike interchange fees, these are significantly smaller—typically ranging from 0.13% to 0.15% of the transaction volume. These are non-negotiable and apply to every merchant regardless of their processor.

Merchant Service Fee

Merchant service fees are charged by the payment processor to facilitate transactions and ensure compliance with relevant regulations. These fees are often negotiable and may be structured as flat monthly charges or per-transaction markups. Merchant-friendly providers typically offer transparent pricing and include PCI compliance support.

ISO Fee

ISO fees come from third-party sales organizations that resell POS systems or payment processing services. They often add an extra layer of “upcharge” or hidden markups to the transaction to pay their sales teams.

PRO TIP

Many modern POS solutions allow you to bypass ISOs entirely by working directly with a Payment Service Provider (PSP) or an integrated processor to avoid these unnecessary middleman costs.

Speak with a product specialist and learn how KORONA POS can power your business.

Types of POS Systems for Credit Card Processing

When selecting a system for credit card processing, the choice often comes down to how and where you plan to interact with your customers. Modern systems have evolved beyond the simple cash register into integrated hubs that manage everything from stock levels to payment security.

Traditional POS Systems

Traditional POS systems are fixed, on-site setups that use local servers and wired credit card readers. They are common in established retail stores and restaurants that need stable, secure processing at a checkout counter with minimal reliance on internet connectivity.

Mobile POS (mPOS) Systems

Mobile POS systems run on smartphones or tablets and use portable card readers. They are useful for line-busting, events, or businesses where staff move around to take payments, though they rely heavily on mobile or Wi-Fi connectivity.

Cloud-Based POS Systems

Cloud-based POS systems store data online rather than on local servers. They allow remote access, easier updates, and simpler integrations with payment processors, making them a popular option for multi-location and growing businesses.

All-in-One Retail POS Systems

All-in-one retail POS systems are designed specifically for physical stores with complex needs, such as inventory tracking, age-restricted sales, and high transaction volumes. Solutions like KORONA POS fall into this category. KORONA POS is also processing agnostic. You can choose the merchant service provider that offers the best rates for your specific volume.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Industry-Specific POS Systems

Industry-specific POS systems are tailored to certain verticals, such as liquor stores, convenience stores, or specialty retail. They include built-in tools that address regulatory requirements and operational challenges unique to those businesses.

Choosing a Merchant Service Provider

Choosing a merchant service provider comes down to pricing transparency, flexibility, and fit for your sales volume. If your POS doesn’t include processing, selecting the right provider can significantly impact your long-term costs.

Key Factors to Consider

- Pricing model and transparency

- Ability to negotiate rates

- Compatibility with your POS system

- Transaction volume and average ticket size

- Freedom to switch processors if needed

Common Merchant Fee Structures

- Interchange Plus

Combines the card network’s interchange fee with a fixed processor markup (e.g., 0.5% + $0.20). This model is often the most transparent and cost-effective for established retailers. - Tiered Pricing

Groups transactions into pricing tiers based on card type and entry method. This structure lacks transparency and can result in higher, unpredictable fees. - Flat-Rate Pricing

Charges a single rate per transaction (commonly used by PSPs like Square). While simple, flat rates are usually more expensive for businesses with moderate to high transaction volume.

Bottom Line

Processing rates are negotiable and vary by business size and sales volume. Retailers benefit most from POS systems that allow processor choice, giving them leverage to secure the best rates. When in doubt, ask your POS provider to help identify the best-fit merchant service solution.

How to Choose the Best POS for Credit Card Payments?

Selecting the best POS system requires looking past the hardware to find a balance between cost, security, and the specific needs of your daily operations. A system that works for a high-volume cafe might be a poor fit for a small boutique.

Request Quotes From at Least 3–5 Processors

One quote is meaningless. Rates vary widely between processors, even for identical businesses. Requesting multiple quotes gives you leverage and exposes hidden markups that only appear when you compare offers side by side.

Provide the Same Business Profile to Every Processor

Quotes are only comparable if the inputs are identical. Share your average ticket size, monthly volume, card-present vs keyed transactions, and industry type. If processors quote without this data, assume the pricing will change later.

Demand Interchange-Plus Pricing in Writing

Ask explicitly for interchange-plus pricing and require the markup to be stated separately (e.g., interchange + 0.35% + $0.10). If a provider avoids this or pushes tiered pricing, that’s a red flag.

Ask for a Full Fee Schedule, Not Just the Rate

Processing costs aren’t just percentages. Request a complete list of fees, including:

- Monthly account or statement fees

- PCI compliance fees

- Chargeback and retrieval fees

- Batch, gateway, and authorization fees

If it’s not listed, it can still be charged.

Verify Contract Length and Exit Terms

Ask directly:

- Is there a contract term?

- Are there early termination fees?

- Do rates increase after an intro period?

Short-term or month-to-month agreements reduce risk and keep pricing honest.

Confirm POS and Hardware Compatibility

Ensure the processor supports your exact POS system and hardware model. Some processors quote low rates but require hardware replacement or limited integrations, increasing total cost.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

Use Competing Quotes to Negotiate Markup

Once you have multiple offers, ask processors to beat the lowest markup. Interchange is fixed; the processor’s margin is not. Even a 0.1% reduction can save thousands annually at moderate volume.

Request a Sample Monthly Statement

A sample statement shows how fees actually appear in practice. If a processor won’t provide one or the statement is hard to read, expect billing confusion later.

Get Everything in Writing Before Signing

Verbal assurances don’t matter. Ensure rates, fees, contract terms, and support commitments are documented. If it’s not included in the agreement, it doesn’t exist.

Support and Long-Term Fit

Select a POS provider that offers reliable support and can grow with your business. A system that fits your current needs and future growth prevents costly switches later.

Have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us at 833.200.0213 to see how reliable we are.

Credit Card Compliance, Performance & Fraud Security Considerations

Accepting credit card payments entails strict security requirements and financial risks. PCI compliance and fraud prevention work together to protect cardholder data, reduce chargebacks, and keep payment operations running smoothly. Understanding these responsibilities and how your POS system supports them is essential for long-term stability.

PCI Compliance Fundamentals

- PCI DSS is a mandatory security standard for all businesses that process card payments

- Requirements vary by business size and transaction volume

- Compliance focuses on protecting cardholder data, preventing breaches, and reducing fraud

- Ongoing updates reflect new security threats and payment technologies

Responsibility and Ongoing Management

- Payment processors are primarily responsible for PCI compliance enforcement

- Merchant service fees often cover compliance reporting, security audits, and documentation

- Retailers must still follow required procedures and use compliant hardware and software

Chargebacks and Financial Risk

- Chargebacks occur when customers dispute transactions through their bank

- Fees typically include:

- Retrieval fee: ~$10–$25

- Chargeback fee (if approved): ~$25+

- Businesses lose the sale, product, and fees

- Excessive chargebacks can lead to higher processing rates or account termination

Common Sources of Credit Card Fraud

- Stolen or compromised credit card usage

- Cardholders falsely claiming purchases were unauthorized

- Manual card entry and card-not-present transactions

- Outdated hardware or non-EMV-compliant systems

Fraud Prevention Best Practices

- Use EMV-enabled card readers and contactless payments

- Disable manual card entry when possible

- Save receipts and transaction records electronically

- Require signatures and ID verification for card-present payments

- Clearly communicate refund and exchange policies

- Ensure timely shipping with tracking and protective packaging

POS Installation and Configuration

- Use PCI-compliant POS hardware and software from approved vendors

- Proper installation ensures encryption, tokenization, and secure data handling

- Integrate only supported payment processors to avoid compliance gaps

Staff Training and Internal Procedures

- Train employees on secure payment handling and fraud awareness

- Establish clear procedures for refunds, disputes, and suspicious transactions

- Limit system access based on employee roles

- Reinforce consistent ID checks and signature capture

Ongoing Support and Monitoring

- Choose providers that offer responsive technical and compliance support

- Monitor chargeback reports and transaction trends regularly

- Follow guidance from your processor when disputes arise

- Stay current with PCI updates and payment industry regulations

A secure POS setup, informed staff, and strong processor support form the foundation of compliant and fraud-resistant credit card processing.

How to Accept Credit Card Payments In-Store?

Implementing in-store credit card payments requires a strategic blend of hardware and software tailored to your store’s layout and transaction volume. The right setup ensures security, speed, and a seamless customer checkout experience.

Essential In-Store Payment Components

- Hardware Selection: Choose between fixed, wired terminals for maximum stability or mobile card readers for “line-busting” and floor sales.

- Modern Payment Standards: Prioritize hardware that supports EMV (chip) and NFC (contactless/mobile wallets) to ensure transaction security and speed.

- POS Integration: Utilize a system that syncs payment data with your inventory, sales reporting, and loyalty programs to avoid manual data entry.

- Connectivity Requirements: Ensure your hardware has a reliable, encrypted connection; wired Ethernet is generally more secure and dependable than Wi-Fi or cellular signals.

- Standalone vs. Integrated: While standalone readers are an option, integrated systems prevent “double-entry” errors where the sale amount is typed into both the POS and the card reader.

- Durability and Maintenance: Invest in commercial-grade hardware, as consumer-grade mobile attachments are more prone to physical wear and connection failures in high-volume environments.

What You Need to Accept Online Payments at Your eCommerce Store

Depending on the gateway, you have the following options to accept credit cards online.

1. Send your customers a direct payment link

Obtain the payment link from your payment service provider. Based on your provider, you may be able to customize the link in various ways. Then, determine where to display the link on your website. The customer will take the following steps to complete payment:

- Click on the link to open a payment page.

- Enter the dollar amount.

- Enter their contact, credit card, and billing information.

- Click on a button to complete their order.

2. Accept credit cards with a payment page

A good example of an organization that uses this technique is St. Jude Children’s Research Hospital. The payment page is already embedded, making the completion of any payments more seamless:

- Pick a payment amount (in this case, donation) and frequency of recurrence.

- Choose a payment method.

- Enter card and billing information.

- Click the button to finalize their order.

3. Accept credit card payments online with a shopping cart

These are the checkout pages you’ve seen every time you shop online. Customers browse eCommerce stores searching for products, then add them to their shopping cart. When they’re ready to check out, they take the following steps:

- Type in their shipping information.

- Type in their credit or debit card information.

- Type in their billing information.

- Hit the appropriate submit button to complete their order.

4. Manual Payment Processing

When your business accepts credit cards over the phone, for example, if you have a restaurant that offers delivery or takeout, you might write down the credit card information and then manually enter it into a terminal or point of sale after the call is over.

Such practice is HIGHLY inadvisable. Instead, you can use a virtual terminal or payment gateway to accept payments over the phone.

- Log in to your payment gateway.

- Generate an invoice for your customer or select the Payments tab.

- Type in the payment and customer information.

- Click the button to finalize the payment.

- Select how you would like to send a receipt.

- The funds will be processed to your account after being distributed and will be visible on your dashboard.

If you have a brick-and-mortar and eCommerce location, it’s important that you get a retail POS that can serve both sides of your business. Payments, sales, inventory, etc. will all be consolidated, making your business run more efficiently.

For freedom to choose your merchant service provider in a POS system and save on fees, give KORONA POS a try.

To learn more, try out KORONA POS for free. We’ll walk you through the process and put you in touch with various processors to see what’s best for your store. We’ll also ensure your business is well-established to prevent fraud and theft. Sign up for a no-commitment free trial and get started today!

Start Processing Credit Cards with an All-In-One POS System

KORONA POS is an ideal solution for retailers seeking reliable credit card processing without being tied to a single provider. KORONA POS is processing-agnostic, meaning it integrates with multiple merchant service providers. Businesses have the freedom to compare rates, negotiate terms, and switch processors as their needs change.

KORONA POS also supports dual pricing, allowing retailers to clearly separate cash and card pricing in a compliant way, helping offset processing costs while remaining transparent with customers.

WHO CAN USE KORONA POS

KORONA POS is built specifically for complex retail environments and serves key verticals where flexibility and compliance matter most. These include liquor stores, vape and smoke shops, CBD retailers, and convenience stores.

Each of these industries faces unique challenges, including age-restricted sales, inventory control, and processor approval, and KORONA POS is designed to handle these requirements without unnecessary workarounds.

By combining flexible processing options, industry-focused features, and dependable hardware compatibility, KORONA POS gives retailers a stable foundation for accepting credit card payments in-store. To see how it works for your business, sign up for a demo with KORONA POS or call 833-200-0213 to speak with a specialist.

Speak with a product specialist and learn how KORONA POS can power your business.

FAQs

What are the benefits of accepting credit card payments?

Credit card payments increase sales by making purchases easier and faster for customers. They also reduce cash handling and provide clear transaction records.

What types of businesses can accept credit card payments?

Most businesses, including retail stores, restaurants, service providers, and online sellers, can accept credit cards. Approval depends on the business type, risk level, and processing history.

Will I get approved for a merchant account?

Most legitimate businesses are approved if they have proper documentation and a compliant setup. High-risk industries may face additional requirements or higher fees, but are still often approved.

How can I accept credit card payments for free?

Some businesses use dual pricing or cash discount programs to offset processing costs. While fees still exist, they can be passed to card-paying customers in a compliant way.