We have a LOT of blog posts covering SMB inventory management. That’s because it’s vital to your small business’s success. It takes new businesses years to find that sweet spot of having exactly the right amount of each product. After all, too little means your customers don’t have what they want, and too much means you’re using up valuable retail space and tying up too much retail capital.

An important aspect of the process of retail inventory management is your inventory turnover. Inventory turnover calculates how often a business is cycling through each product on the shelves. An ideal inventory turnover ratio is between 2 and 4. Any lower and it’s a sign that products aren’t selling fast enough and your shelves are overstocked. Any higher and it’s likely that you’re underordering and dealing with too many stockouts.

So what is inventory turnover in retail? And how does your retail store find the optimal level for your product line? Let’s cover some of the basics.

What Is Inventory Turnover in Retail?

Sometimes referred to as stock turnover, or simply inventory turn, turnover in inventory is measured by taking the number of times a certain product is sold in a single year. By calculating your inventory turnover, your business will have a better idea of overall performance and profitability.

It can be done on other timelines (bi-annually, quarterly, monthly, etc.) as well. Using shorter time periods in your calculations may be helpful for seasonal assessment. Just be sure that you use the same time frame for all calculations.

What Is the Inventory Turnover Ratio?

The ratio used to calculate your inventory turnover identifies the cycles of a certain product over a specified time frame. Understanding how fast each inventory item is sold (turnover), will help your business operations in a number of ways:

- Purchasing

- Costing

- Ordering

- Cash Flow

- Margins

- Storage

There are even more ways that understanding your inventory turnover can help manage your business operations. And when you break it down to these areas, you’ll notice just how important it all is.

You can also use our inventory turnover ratio formula and calculator tool.

How Can You Calculate Stock Turnover?

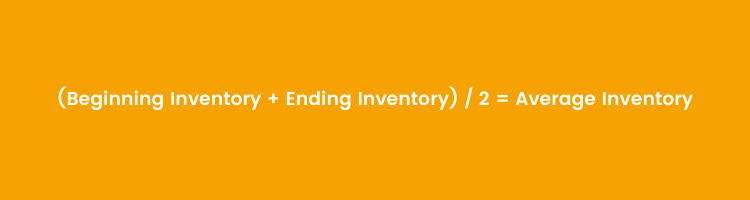

To calculate inventory turnover, divide your total sales by the average inventory on hand. Average inventory is important because the value of your inventory can change dramatically at any given time, thereby not reflecting accurate data. This is particularly important for any business that uses dynamic pricing strategies. Figuring out your stock turnover with the average inventory, therefore, will provide more reliable results.

In order to get your average inventory, add the beginning and ending inventory or the given period of time and divide by 2. For even more accurate results, take additional inventory measurements at various times. Add these to the numerator and divide by however many total counts you completed.

Once this is completed, follow the first step and get your inventory turnover ratio.

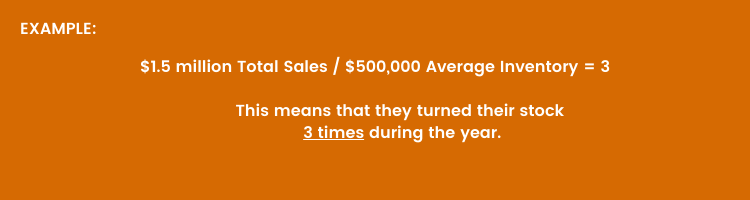

As an example of calculating this, take a liquor store. They sell $1.5 million in products for the year. If their average inventory came to $500,000, their inventory turnover would be 3.

What About Using Costs of Goods Sold to Calculate Inventory Turnover?

You can also use the costs of goods sold (COGS) as an alternative retail accounting method of calculating your inventory turnover. This helps prevent stock turnover inflation because it takes into account the costs of the materials used to produce the item.

Costs of goods take the beginning inventory of the determined reference time frame and add all production costs and new purchases made by the company. Whatever additional inventory is left at the end of the year is subtracted and the result is the final costs of goods sold. This total is subtracted from the total sales to get a gross, rather than a net, profit.

It’s important to note that calculating the costs of goods sold will be different for different businesses. For retailers who simply buy products from a wholesaler that are ready to be sold, the costs will simply be the price of the items. But for those businesses that use labor to create or finish a product, the labor, and any additional materials must also be added to the costs. You do not, however, include all expenses. Rent, sales costs, marketing, equipment, and others should not be added to this number.

What Is the Ideal Inventory Turnover Rate or Ratio?

For most retailers, the optimal range for your stock turn is between 2 and 4.

A ratio below this level means that items stay on your shelves too long. Storage costs, whether they are on your retail shelves or in your warehouse, are high. It can also be an indication that you are pricing items too high, not marketing well, or have staff underperforming. Use this information to help you identify problem areas.

It may seem like the higher the inventory turnover ratio the better. But getting too high can be an issue. You may purchase products in lower quantities than optimal, leading to higher shipping costs and perhaps out-of-stock products.

The type of retail also changes optimal turnover rates. For retailers that sell perishable goods, the stock turnover should be higher.

How Can You Improve Retail Stock Turn?

There are several ways to learn from your inventory turnover ratio and apply it to changes in your business.

Take the Total Turnover for Your Inventory – This is probably the best place to start for retail businesses that haven’t calculated this in the past. Using some basic accounting software makes this easy. Quickbooks will automatically calculate this for you.

Stock Turnover by Category or Item – Finding your inventory turnover ratio for more specific categories or individual items will give you more details about your product performance. This will clearly identify your most and least productive products.

Seasons Stock Turn – Many retail businesses have ups and downs in sales throughout the year. Analyzing sales during specific periods will help you readily identify these ebbs and flows. Once identified, calculate the inventory turnover ratios for various timeframes. During slower periods, find ways to move the stock faster, and during busier times, make sure you always have enough on hand.

Get More Advanced – Once you start piecing more and more data together you can use the information to analyze much more.

For example, if you start a marketing campaign, measure the inventory turn for a few months prior to the start of your marketing as well as for a few months after. This will show you the success of your marketing strategy. Check out this blog for additional inventory control methods, Including a detailed guidance on inventory reporting.

Pricing and promotional strategies are other areas that can be adjusted by A/B testing different time periods and measuring the stock turnover ratios.

Inventory management headache?

KORONA POS makes stock control easy. Automate tasks and get a clear picture of your entire inventory.

Find Your Retail Inventory Turnover Solution

With the right retail POS system, you can start planning your inventory better right away. Get your inventory consolidated into one database, whether you have one store or 40. With a cloud-based solution, you can also check this data off-location at any time. Your retail store will also benefit from a retail point of sale with a great inventory management system. It needs to break metrics down into digestible data points, allowing you to take measured action where necessary.

Check out KORONA POS for a powerful POS solution. Set up a free trial and demo with one of our great product specialists. We’ll walk you through all the features that can benefit your small business.