We’ll explain what alcohol control states are, list all 17 states, compare their systems, outline the licensing process, and examine the pros and cons for liquor store owners.

Alcohol control states operate under a fundamentally different system than open markets. Seventeen states maintain government monopolies over liquor distribution and sales, with seven prohibiting private retail stores entirely. Understanding how these states work is critical if you plan to open a liquor business or expand operations. Read on!

Key Takeaways:

- 17 states operate under alcohol control systems where the government maintains a monopoly over distribution and sales.

- Private retailers in wholesale control states must follow state pricing guidelines and cannot discount below the mandated minimum.

- Licensing takes 45 days to 6 months and requires extensive documentation. Incomplete applications cause the most common delays.

- Success requires specialized tools and knowledge of state regulations. Control states enforce strict inventory tracking, age verification, and reporting requirements.

What Is a Liquor Control State?

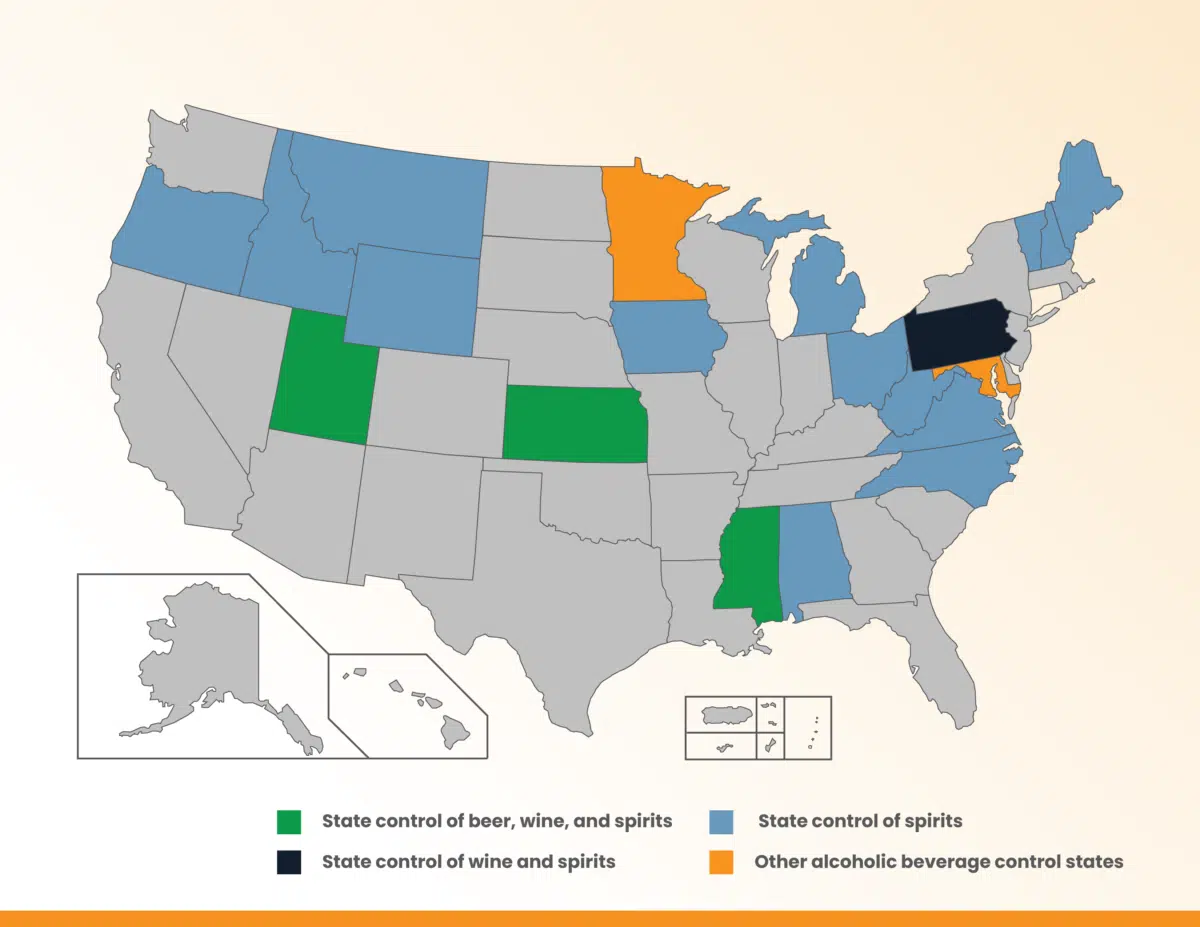

A liquor control state, or ABC state, is where the government maintains a monopoly over alcohol distribution and sales. State agencies typically run wholesale operations and often own retail stores too. They set minimum prices for all products. Currently, 17 U.S. states operate under control systems, while 33 states allow private retailers to sell alcohol.

What Are The 17 Alcohol Control States (2026 Updated List)

The 17 alcohol control states are: Alabama, Idaho, Iowa, Maine, Michigan, Mississippi, Montana, New Hampshire, North Carolina, Ohio, Oregon, Pennsylvania, Utah, Vermont, Virginia, West Virginia, and Wyoming.

In seven states (Alabama, Idaho, New Hampshire, North Carolina, Pennsylvania, Utah, Virginia), you cannot open a private liquor store—the state runs all retail outlets. The remaining ten allow private retailers but control wholesale distribution and pricing.

What Are The Differences Among Control States?

Control Type | Key Features | Primary States |

Strict Control | The state owns and operates all retail liquor stores. | AL, ID, NH, NC, PA, UT, VA |

Wholesale Only | Private retailers sell liquor, but the state controls distribution and pricing. | IA, ME, MI, MS, MT, OH, OR, VT, WV, WY |

There are two distinct groups among the 17 control states. The first group is stricter and ultimately limits alcohol sales to state-run ABC stores. These states include Alabama, Idaho, New Hampshire, North Carolina, Pennsylvania, Utah, Virginia, and Washington.

The second group is where the state plays a more subtle role in controlling alcohol sales and distribution. Instead of asserting power at the retail level, these states allow alcohol to be sold in private outlets and work at the distribution/wholesale level.

If you would like a more detailed look at alcohol policies in each state, check out the comprehensive guide from the National Alcohol Beverage Association.

How to Apply for a License in an Alcohol Control State?

The procedures for applying for a state liquor license vary from state to state.

Step 1: Determine Your State’s Control Level

First, identify whether your state operates retail stores or only controls wholesale distribution. Group 1 states (Alabama, Idaho, New Hampshire, North Carolina, Pennsylvania, Utah, Virginia) prohibit private liquor stores entirely. Group 2 states allow private retail but control wholesale operations and pricing.

PRO Tip

If you’re in a Group 1 state, you cannot open a traditional liquor store. Consider related opportunities like wine distribution or exploring options in open states where the licensing process differs significantly—for instance, getting a liquor license in California follows a completely different framework than in Pennsylvania.

Step 2: Register with Federal Authorities

Complete your Alcohol Dealer Registration form with the U.S. Department of the Treasury’s Alcohol and Tobacco Tax and Trade Bureau (TTB). Submit it to the address listed on the form. Some wholesale operations also require a federal Basic Permit under the Federal Alcohol Administration Act.

PRO TIP

Start this process 90-120 days before your planned opening. Federal registration must be approved before most states will process your application.

Step 3: Identify Your License Type

Control states offer different license categories based on your business model. Determine whether you need retail, wholesale, distributor, or specialty permits. Each state maintains detailed lists—Pennsylvania alone has over 80 different license types. Review your state ABC website for classifications and fees.

Step 4: Verify Zoning and Quota Availability

Confirm your location is properly zoned for alcohol sales and check if your county allows such businesses. Many control states operate quota systems that limit licenses based on population. Contact your local municipality and state ABC office to verify availability before investing in property or lease agreements.

PRO TIP

Some areas are “dry” (no alcohol sales) or “mixed” (limited sales). Pennsylvania, North Carolina, Ohio, and Michigan have mixed counties where regulations vary by location.

Step 5: Compile Required Documentation

Gather essential documents, including your business license, EIN, proof of occupancy, financial statements, and ownership details. Most states require background checks and fingerprints for all owners, officers, and major shareholders. Prepare documentation proving your source of funds and financial stability.

PRO TIP

Create a checklist specific to your state. Pennsylvania requires Individual Questionnaires (PLCB-196) for all officers and directors. Processing delays commonly occur due to incomplete applications.

Step 6: Submit Your Application and Fees

Complete your state’s application through their online portal or in-person at the ABC office. Pay the non-refundable application fee, which ranges from $100 to several hundred dollars depending on license type. Group 2 control states typically allow private retailers but maintain strict wholesale requirements.

PRO TIP

Many states now use online systems (Pennsylvania’s PLCB+, Washington’s BLS portal). Apply approximately 90 days before your opening date. If you plan to sell wine online, check if additional permits or interstate shipping licenses apply in your control state.

Step 7: Post Public Notice

Display the required public notice at your business premises stating your intent to obtain a liquor license. Some jurisdictions require newspaper advertisements or mailed notifications to nearby residents and businesses. Community members can contest your application during this period, typically 30-45 days.

Step 8: Undergo Background Investigation

State authorities will investigate your background, business structure, and premises. Expect inspections of your physical location for compliance with health, safety, and fire codes. The ABC board reviews your financial history, criminal record, and previous business operations.

PRO TIP

Address any potential issues proactively. Past violations, tax problems, or zoning conflicts can delay or derail your application. Schedule inspections early to resolve compliance issues.

Step 9: Attend Hearings (If Required)

Some applications require public hearings, especially if contested by community members. Be prepared to present your business plan, demonstrate community benefit, and address concerns. Bring all documentation and legal counsel if needed. Hearings are open to the public in most jurisdictions.

Step 10: Receive Approval and Begin Operations

Processing times vary from 45 days to 6 months, depending on the state and application complexity. Once approved, pay your annual license fee. Some states offer temporary permits allowing you to operate while final approval processes. Display your license prominently at your business.

PRO TIP

Pennsylvania’s process takes 40 days to 6 months. Washington and North Dakota average 45 days. Budget for delays and maintain compliance from day one—violations can result in suspension or revocation.

Step 11: Maintain Ongoing Compliance

Renew your license annually and submit required reports. Control states enforce strict pricing, product selection, and record-keeping requirements. Implement age verification systems, attend mandatory training, and follow state purchasing protocols. Keep detailed records of all transactions for potential audits.

PRO TIP

In Group 2 control states, you must purchase inventory through state-approved wholesalers at state-set minimum prices. Pennsylvania licensees receive a 10% discount ordering through the state’s LOOP system.

Free printable templates and checklists to help you manage retail operations with ease

Pros & Cons of Control State Systems

Control states operate under fundamentally different rules than open markets. Understanding both advantages and drawbacks helps you assess whether opening a liquor business in these jurisdictions aligns with your goals.

Pros

Revenue for Public Services: State-run liquor operations generate substantial revenue that funds education, healthcare, roads, and other public services. Well-managed ABC stores often produce consistent profits that benefit local communities.

Regulated Competition: Control states limit the number of licensed retailers, reducing direct competition. Fewer stores in an area can mean steadier customer traffic and more predictable sales for licensed operators.

Public Health Benefits: Higher minimum prices and limited store hours can reduce alcohol-related incidents. Control states often report lower rates of alcohol abuse and drinking-and-driving cases compared to open markets.

Product Quality Oversight: State control ensures products meet safety standards before reaching shelves. The vetting process protects consumers and reduces retailers’ liability concerns.

Cons

Restricted Operating Hours: ABC regulations mandate specific business hours, often with closures on holidays and limited Sunday operations. These restrictions reduce revenue opportunities compared to open states, where retailers set their own schedules.

Limited Marketing Freedom: Control states typically prohibit promotional discounts, special offers, and creative pricing strategies. You can’t run “buy one, get one free” promotions or adjust prices to move inventory.

Product Selection Constraints: The state determines which products you can stock. Craft breweries and small distilleries struggle to get shelf space, limiting your ability to offer unique selections. Starting a winery or distributing craft products faces extra hurdles in control states.

Complex Licensing Process: Strict requirements and lengthy approval timelines create barriers for new businesses. The process demands significant time, money, and patience.

Shipping Limitation: Shipping alcohol across state lines becomes complicated under control state regulations, affecting online sales and customer convenience.

How To Get Listed in a Control State

Registration

Some states require a brand to obtain a state control code for each product before it can be offered for sale, while others issue their own state code once the product is active.

The control state code is a unique six-digit code assigned by the National Alcohol Beverage Control Association (NABCA) that can be used in all states that use the control state coding system.

Establishing Demand Through Testing

A product must generate interest in the market it seeks to enter before it can be endorsed by the control state in which it intends to establish itself. One way to do this is through special orders.

A special order is most often referred to when a single retail account is interested in a one-time purchase to test how well the product will sell.

This process allows the product to be sold on a one-time order basis. These orders are typically smaller and, depending on the state, maybe as little as a single bottle or case. When a product is special-ordered, it is not held in bonded inventory and is not present on off-premise shelves.

Getting a listing

If demand for the product is sufficient through special orders and other retail customers in the state are requesting it, the next step is to try to obtain a full listing.

The purpose of a full listing is to generally allow the product to have an allocation in the bonded warehouse or a presence on off-premise store shelves.

Full listings require the broker to make a formal presentation to the state board for approval of the product.

Stay Compliant & Efficient in Control States With KORONA POS

Operating in control states demands precise compliance and inventory control. KORONA POS serves liquor stores, wineries, smoke shops, and multi-location retailers with features built for your industry: automated age verification, state-specific tax calculations, lot tracking, and vendor management.

The system handles complex inventory management for liquor stores and includes specialized tools that make it the best POS for liquor stores and wineries alike. You’ll get industry-leading support, processing-agnostic flexibility, and dual pricing capabilities.

Ready to streamline your control state operations? Book a personalized live demo or call KORONA POS at 833-200-0213.

Speak with a product specialist and learn how KORONA POS can power your business.

FAQs:

1. How many control states are there in the US?

There are currently 17 control states in the U.S., including Alabama, Idaho, Iowa, Maine, Michigan, Mississippi, Montana, New Hampshire, North Carolina, Ohio, Oregon, Pennsylvania, Utah, Vermont, West Virginia, and Wyoming, and Maryland.

2. What is a control state?

Control states are states in which the government is involved in some aspects of the sales and distribution process. You can only buy alcohol in strictly controlled states at state-run ABC retail stores.

3. Which states have the strictest liquor laws?

The strictest states on alcohol are Pennsylvania, Utah, and North Carolina. For example, in North Carolina, drink offers such as “buy one get one free” are completely prohibited.