If you’re considering Zettle vs Square, you’re likely looking for an affordable and user-friendly solution to process payments and manage sales.

Zettle and Square offer card readers, mobile POS apps, and online payment options but differ in pricing, features, and usability. The guide will compare these two platforms to help you decide which is best for your business.

Key Takeaways

- Square offers more features and is better for businesses that need a complete POS solution with eCommerce integration.

- Zettle is a good choice for businesses that want a straightforward payment solution with lower card processing fees.

- Square offers a free plan, while Zettle has more competitive transaction rates.

- Both platforms are user-friendly, but Square provides more customization options.

Who is Zettle Useful For?

Zettle by PayPal is a POS system best suited for small businesses. It is ideal for startups, mobile vendors (food trucks, market stalls), service professionals (plumbers, roofers, interior designers), and small hospitality businesses (cafés, pubs, B&Bs). Zettle’s mobile card reader enables on-the-go payments.

Overall, Zettle is a practical, easy-to-use POS system for small retailers and service providers who need a simple, portable way to accept card payments without committing to long-term contracts or high fixed costs.

Who is Square Useful For?

Square is a point of sale system that caters to various business verticals, offering tailored solutions to meet specific industry needs.

- Retail: Square for Retail provides advanced inventory management, sales tracking, and employee management tools, enabling seamless selling both in-store and online. It supports businesses such as clothing and accessories, grocery and convenience stores, home goods and furniture, and wine and liquor shops.

- Restaurants and Food Services: Square Restaurant offers features like order management, tableside ordering, and kitchen display systems, streamlining operations for restaurants, cafés, and food trucks.

- Service-Based Businesses: Square supports appointment scheduling, invoicing, and customer management, making it suitable for professionals such as photographers and consultants.

- Mobile Vendors: Square enables on-the-go payments with mobile credit card readers, making it ideal for businesses like market stalls and pop-up shops.

Square’s flexibility and tools make it suitable for businesses of all sizes seeking efficient payment processing and business management solutions.

KORONA POS: An Alternative To Zettle and Square POS

KORONA POS is an alternative that offers advanced features, particularly in inventory management and reporting.

It is designed to provide detailed insights and control over your business operations. Compared to Zettle and Square, KORONA POS offers more specialized tools, which can benefit businesses with complex inventory needs.

It is designed to provide detailed insights and control over your business operations. Compared to Zettle and Square, KORONA POS offers more specialized tools, which can benefit businesses with complex inventory needs.

Here’s a comparison table of Zettle, Square, and KORONA POS:

Aspect | Zettle | Square | KORONA POS |

Features | - Secure payment processing - Inventory management - Daily performance reports - Accepts Venmo and PayPal QR code payments | - Seamless payment processing - Inventory management - Sales analytics - Integrations with various business tools - User-friendly interface | - Advanced inventory management - Multi-store management - Real-time reporting - Customizable dashboards - eCommerce integration |

Target Businesses | Small to medium-sized businesses seeking affordable payment processing with basic POS features | Small to medium-sized businesses needing a user-friendly POS system | High-risk merchants, small to medium-sized retail businesses, and those requiring advanced inventory and multi-location management |

POS Pricing | - No monthly fee | - Square POS for retail: $0/month to custom pricing - Square for Restaurants Plus: Starting from $69/month per location - Square Appointments: starting from $29/month | - Core Plan: $59/month per terminal - Retail Plan: $69/month per terminal - Add-ons available starting from $10/month |

Payment Processing | - In-person: 2.29% + 9¢ -Keyed-in: 3.49% + 9¢ -Invoice fees: 3.49% + 49¢ -QR code transactions: 2.99% + 49¢ | - In-person: 2.6% + 15¢ per transaction - Online: 2.9% + 30¢ per transaction - Manually entered: 3.5% + 15¢ per transaction - Invoices: 3.3% + 30¢ per transaction | Processor-agnostic |

Scalability | Suitable for small to medium-sized businesses; may have limitations for larger enterprises | Designed to grow with businesses, but may have limitations for larger enterprises | Excels in scalability with multi-store management |

Customer Support | Reliable customer support | Responsive and helpful customer support | Offers 24/7 professional support |

Security | Provides secure and reliable payment processing | Prioritizes security with robust measures | Offers strong security features |

Zettle vs. Square: Pricing Comparison

Pricing is a critical factor when choosing a POS system. Both Zettle and Square primarily operate on a transaction fee model, but they also have different hardware costs and optional add-ons that can affect the overall expense.

Zettle Pricing

Here’s an overview of Zettle’s pricing:

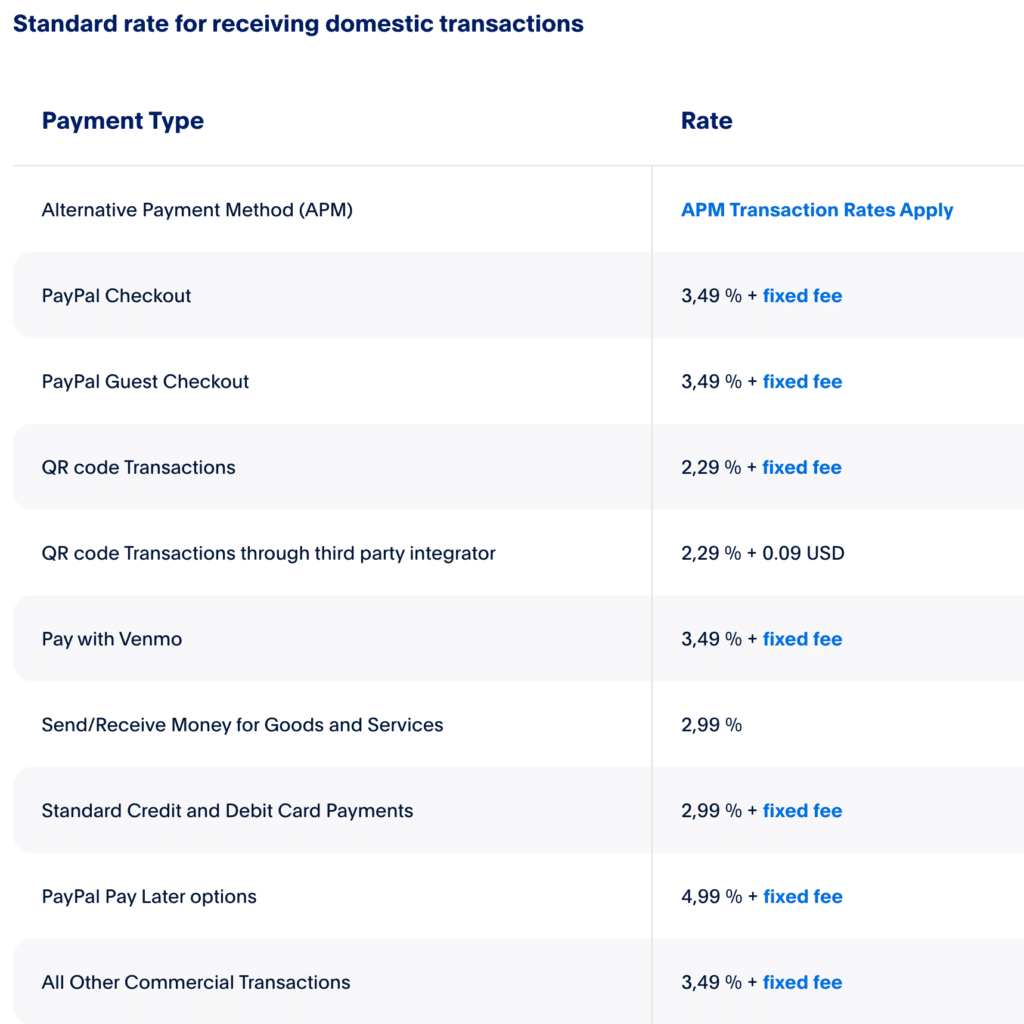

Transaction Fees

- In-person Card Payments: in the US, Zettle charges 2.29% + $0.09 for card-present transactions when a credit or debit card is swiped or inserted (QR code transactions are included for the same fee).

- Online Payments via Payment Links and Invoices: Transactions made through payment links and invoices incur a fee of 2.5%.

- Manual Card Entry (Non-Present Transactions): For transactions where card details are manually entered (i.e., not physically present), Zettle charges 3.49% plus a fixed amount per transaction.

Hardware Costs

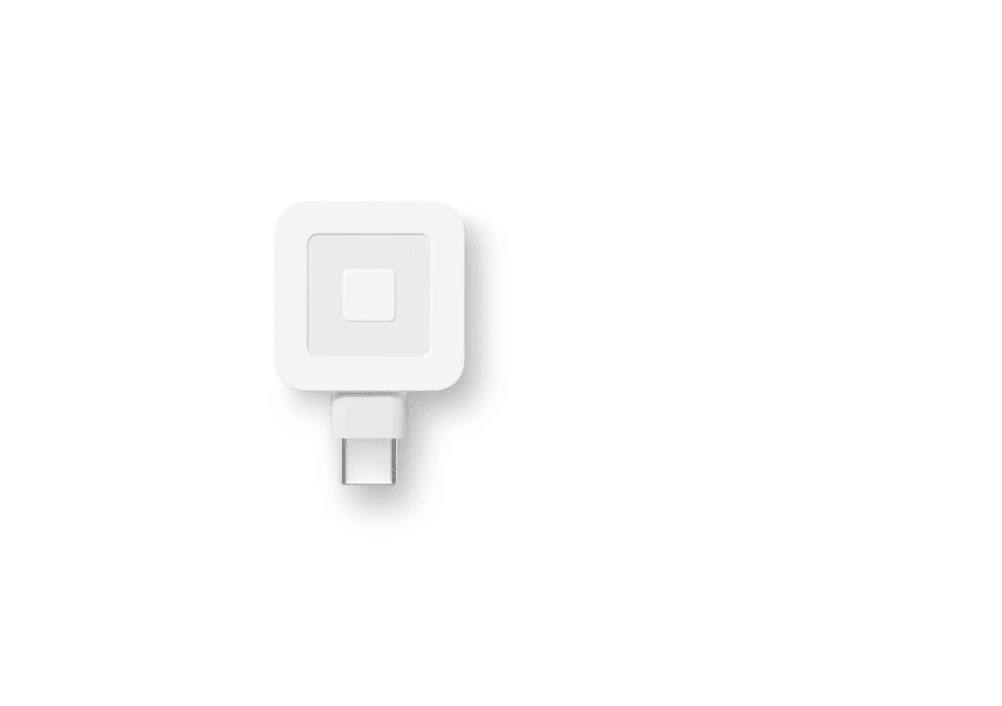

- Card Reader: The standard price for the PayPal Zettle card reader is $79, which includes a USB cable.

- Terminal: The Zettle Terminal is priced at $199.

- Store Kits: Zettle offers various store kits that bundle hardware together. For example, the Store Kit Mini, which includes a tablet stand, card reader, and dock, is priced at $229.

Square Pricing

Square provides a range of hardware, from basic card readers to full POS systems. Square POS pricing offers optional monthly subscriptions for advanced features, which can increase the cost for businesses requiring these tools.

Square Monthly Subscription Plan

Free

Best for new or very small businesses with lower sales volumes and basic needs. You pay only transaction fees.

POS app and payments

Website builder with SEO tools

Courses

Item library

Plus

$49/month

Ideal for growing businesses that need essential tools to manage a team, optimize their website, and want the benefit of a slightly lower in-person transaction rate (2.5% ).

Staff management

Expanded site customization

Loyalty rewards program

Premium ($149/month)

The most cost-effective option for high-volume sellers due to the lowest in-person transaction fee (2.4%) and the included features like 24/7 dedicated support and waived gift card load fees, which can add up to significant savings.

Advanced reporting

No gift card load fees

24/7 phone support

KORONA Ticketing

+$50/month per gate

For amusement parks, museums, water parks, and other admission-based businesses

Ticket printing

Entry gates

Ticket definitions

Customer management

Time-tracking

Cash journals

KORONA Event integration for online ticketing

KORONA Franchise

+$30/month per franchise

For franchise businesses to streamline communication and operations between franchisors and franchisees

Franchisor features

Scalability for franchisees

Customizable royalty systems

Product syncing

International options

Custom taxes and currencies

Centralized inventory management

KORONA Integration

+$45/month per token

For businesses that require custom development of niche integrations through the KORONA POS open API

Integration jobs

Integration job-workflows

Integrations services

Integration dashboard

Payment Processing Fees

Square’s Point of Sale (POS) system is known for its simple, flat-rate pricing structure. These fees apply to all major credit cards (Visa, Mastercard, American Express, and Discover) at the same rate.

Transaction Type | Standard Rate (US) | Key Information |

In-Person (Tap, Dip, or Swipe) | 2.4% + 15¢ to 2.6% + 15¢ | Applies when the customer's card is physically present and used with a Square Reader, Terminal, or Register. |

Online (eCommerce API, Square Online Store) | 2.9% + $0.30 to 3.3% + 30¢ | A higher rate due to the increased risk associated with card-not-present transactions. |

Manually Keyed-In / Card on File | 3.5% + 15¢ | The highest rate typically applies to payments entered into the Virtual Terminal or saved on file, as they carry the highest fraud risk. |

ACH Bank Transfer (via Invoice) | 1% (Min. $1) | For payments made directly from a customer's bank account. |

Afterpay (Installments) | 6% + $0.30 | Square pays you the full amount upfront, and the customer pays over time. |

PRO TIP

For the most up-to-date details, please visit Square’s pricing page for your country or contact our support team.

Hardware Costs

Square offers a range of hardware solutions to suit different business needs:

Square Reader for Magstripe: The reader allows you to accept Magstripe card payments using a mobile device. Square offers the first reader for free.

Square Reader for Contactless and Chip (2nd Generation): This reader, available for $59, supports contactless payments and EMV chip cards.

Square Terminal: At $299 or $27/mo over 12 months, this all-in-one device enables you to accept payments, print receipts, and manage transactions without additional hardware.

Square Register: Starting at $799 or $39/mo over 24 months, it is a fully integrated POS system that features a customer-facing display and is designed for seamless payment processing.

Square Stand: For $149 or $14/mo over 12 months. The Square Stand transforms your iPad into a professional POS system that supports various payment methods.

Additional Fees and Information

- Monthly Fees: Square’s POS software is free to use, but depending on the options and the type of business you run, it can cost between $29 and custom pricing.

- No Long-Term Contracts: Square does not require long-term contracts or charge equipment fees, providing business flexibility.

- Custom Pricing: Square offers custom pricing for businesses that process over $250,000 in card sales annually. Interested companies can contact Square’s sales team for more information.

- Afterpay Fees: Square charges a fee of 6% + $0.30 per transaction for transactions using Afterpay.

Verdict

For businesses prioritizing cost-effectiveness and simple payment processing, Zettle is often the better choice. However, Square provides more value for businesses that require advanced features and are willing to pay extra.

Zettle vs. Square: Ease of Use

Ease of use is essential for smooth operations. A POS system should be intuitive and straightforward, allowing staff to learn and use it quickly without extensive training.

Source: Trustpilot

- Simple Interface: Zettle is known for its clean and intuitive interface, making it easy for anyone to use.

- Quick Setup: Zettle offers a fast and hassle-free setup process, allowing businesses to start accepting payments quickly.

- Portable: Zettle’s mobile-friendly design ensures ease of use on the go.

Square Ease of Use

Source: Trustpilot

- User-Friendly: Square provides a user-friendly experience with straightforward navigation and well-organized features.

- Comprehensive System: Square’s complexity might require more time to grasp than Zettle fully.

- Hardware Integration: Square’s hardware seamlessly integrates with its software, enhancing the user experience.

Verdict

Both Square and PayPal Zettle are recognized for their user-friendly interfaces. Square offers a more feature-rich ecosystem, which may present a learning curve but provides comprehensive tools for business management.

In contrast, Zettle emphasizes simplicity and quick setup, catering to businesses prioritizing ease of use without extensive additional features. Your choice should align with your business’s specific needs and preferences.

Zettle vs. Square: Customer Support

Reliable customer support is crucial for resolving issues and ensuring smooth operations. Both Zettle and Square offer different support channels that businesses can utilize.

Zettle Customer Support

- Online Support: Zettle provides extensive online resources, including help articles and FAQs.

- Phone Support: Zettle offers phone support for urgent issues.

- Community Forums: Users can connect with other Zettle users in online forums.

Square Customer Support

- Robust Support Network: Square customer service has an extensive support network that includes online resources and community forums.

- Dedicated Support: Square offers phone support for its paid subscribers, though all support is off-shore, and hold times are often quite long.

- Extensive Documentation: Square provides comprehensive documentation and guides for troubleshooting.

Verdict

Neither Zettle nor Square offers strong customer support, but Square’s more extensive network and various support options give it a slight edge.

Zettle vs. Square: Integrations

Integrations allow POS systems to connect with other software, such as accounting tools and eCommerce platforms, enhancing functionality and efficiency.

Zettle Integrations

- Limited Integrations: Zettle has a more limited number of integrations than Square.

- Key Integrations: Zettle integrates with some accounting software and eCommerce platforms.

- Focus on Core Features: Zettle prioritizes core payment processing features over extensive integrations.

Square Integrations

- Extensive Integrations: Square offers a wide range of integrations with various software, including accounting, CRM, and eCommerce POS integration platforms.

- App Marketplace: Square has an app marketplace where users can find and install integrations.

- Enhanced Functionality: Integrations enhance Square’s functionality and make it a more versatile solution.

Verdict

Square’s extensive integrations make it a better choice for businesses that need to connect their POS system with other software tools.

Zettle vs. Square Custom Feature Name

Zettle: Customizable Receipts

Zettle lets businesses personalize receipts by incorporating essential information such as business name, contact details, and additional notes.

Key Benefits:

- Enhanced Branding: Customize receipts with your business name, logo, and contact information to reinforce brand identity.

- Operational Transparency: Include details like opening hours and return policies to set clear customer expectations.

- Efficient Updates: Easily modify receipt information through the my.zettle.com portal without affecting legal account details.

Square: Item Options and Modifiers

Square offers robust customization through item options and modifiers, allowing businesses to tailor products and services to customer preferences.

Key Benefits:

- Product Personalization: Create item options (e.g., size, color) and modifiers (e.g., special instructions) to cater to diverse customer preferences.

- Streamlined Management: Easily add, edit, or remove options and modifiers through the Square Dashboard, ensuring flexibility and control.

- Enhanced Customer Experience: Provide customers with tailored choices, improving satisfaction and potentially increasing sales.

Verdict

Zettle and Square offer customization features that enhance business operations and customer experience. Zettle focuses on receipt personalization, reinforcing brand identity, and providing essential information.

In contrast, Square’s item options and modifiers provide more product customization, catering to diverse customer preferences.

The choice between the two should align with your business’s specific needs—whether emphasizing brand consistency through receipts or offering personalized product options to customers.

How to Choose POS Software?

The best system should be reliable, easy to use, and packed with essential features to meet your business needs. Below are key considerations to help you make an informed decision.

Assess Your Business Needs

- Business Type and Size: Identify whether you’re operating a retail store, restaurant, or service-based business, as each has unique requirements.

- Inventory Complexity: Determine the scale and diversity of your inventory to ensure the POS system can handle your specific needs. Different types of inventory management systems exist, and your inventory management software should be able to meet your needs.

- Sales Channels: Consider if you need integration across multiple sales channels, such as in-store and online platforms.

Identify Essential Features

- User-Friendly Interface: Opt for an intuitive system, reducing the learning curve for your staff.

- Inventory Management: Look for real-time tracking, automatic stock level updates, and reorder alerts.

- Sales Reporting and Analytics: Ensure the system provides detailed reports on sales trends, peak hours, and product performance.

- Customer Relationship Management (CRM): Features like customer databases and loyalty programs can enhance customer retention.

- Payment Processing: The system should support various payment methods, including credit/debit cards, mobile payments, and cash.

- Security: Ensure the POS system complies with PCI DSS standards and offers robust security measures to protect sensitive customer information and prevent data breaches.

Evaluate Different POS System Types

- Traditional POS Systems: These may still be reliable but will involve higher upfront costs, less flexibility, and become outdated quickly.

- Cloud-Based POS Systems: Offer real-time updates and remote accessibility and are generally more affordable.

- Mobile POS Systems: Ideal for businesses requiring mobility, allowing transactions via tablets or smartphones.

- Self-Checkout Kiosks: Suitable for high-traffic environments, enabling customers to process their purchases.

Consider Costs

- Initial Setup Costs: Account for hardware, software, and installation expenses.

- Ongoing Fees: Be aware of monthly subscription or licensing fees.

- Transaction Fees: Some systems charge per transaction; ensure these are transparent.

- Additional Features: Advanced functionalities might come at extra costs; assess their necessity for your operations.

Additional Considerations

- Integration: Ensure the POS system integrates with your eCommerce, accounting, and marketing tools.

- Customer Support: Look for 24/7 support, live chat, and a solid knowledge base.

- Scalability: Choose a system that grows with your business, adding locations and features as needed.

- Security: Ensure PCI DSS compliance and robust data protection.

- User Reviews: Check feedback from similar businesses for reliability and ease of use.

- Demos & Trials: Test the software before committing.

Alternative To Zettle and Square: KORONA POS

KORONA POS is a cloud-based point of sale system designed to cater to various industries, including retail, ticketing, and quick-service restaurants. Its adaptability and comprehensive features make it a strong alternative to platforms like Zettle and Square.

Key Features

Find below some of the most outstanding features of KORONA POS:

Customizable user permissions

The system enables businesses to set specific access levels for staff members, ensuring that sensitive information and critical functions are only accessible to authorized personnel.

Integrated eCommerce capabilities

The platform supports seamless integration with eCommerce solutions, allowing businesses to manage online and offline sales channels from a unified system.

Customizable Reports and Analytics

Access to sales, inventory, and employee performance data is crucial for making informed business decisions. A POS system should provide detailed, customizable reports to analyze trends and optimize operations. KORONA POS offers powerful analytics features, easy-to-read dashboards, and in-depth reporting to help businesses monitor their performance.

Flexible payment processing

KORONA POS integrates with various payment processors and supports modern payment methods, including mobile payments and EMV-compliant transactions.

Many POS systems lock businesses into specific payment processors, leading to high transaction fees. A processing-agnostic POS allows you to choose any payment provider, ensuring better rates and flexibility.

KORONA POS is fully processing-agnostic, allowing businesses to work with the best payment processors for their needs without hidden fees or long-term contracts.

Are payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Inventory Management

A strong POS system should include real-time inventory tracking to prevent stockouts, reduce overstocking, and improve ordering efficiency. It should provide detailed reports and automate low-stock alerts.

KORONA POS offers advanced inventory management, allowing businesses to monitor stock levels, set reorder points, and streamline their supply chains effortlessly.

Emergency Support

Technical issues can disrupt operations, especially during peak hours. A POS system with 24/7 emergency support ensures that businesses receive immediate assistance whenever needed.

KORONA POS offers round-the-clock emergency support, running your business smoothly without downtime.

Have trouble getting your POS customer service on the phone?

KORONA POS offers 24/7 phone, chat, and email support. Call us at 833.200.0213 to see how reliable we are.

Split Payments

Customers expect flexible payment options. A POS system should allow divided payments across multiple payment methods, including cash, card, and digital wallets, without slowing checkout.

KORONA POS supports seamless split payments, letting customers pay how they prefer while keeping transactions fast and efficient.

Blind cash

Blind cash is essential to prevent employee theft and maintain accurate cash handling. This feature ensures that cashiers deposit their register balances without seeing expected totals, reducing discrepancies and fraud risk.

KORONA POS includes blind cash drops as a standard feature, enhancing cash security and accountability for businesses of all sizes.

Pricing

KORONA POS Pricing Table

Plan | Price (per terminal/month) | Features |

KORONA Core | $59 | --Unlimited users -Customizable dashboard -Core checkout functionality -Various KPI reports -eCommerce capabilities -Manager functions -Promotions and discounting and gift cards |

KORONA Retail | $59 | -Core features -Inventory counts -Stock management -Barcode automation -Supplier interface integration -Price and shelf labels -Customer management Real-time tracking -Item combination. |

Additional Modules | +$10/month per terminal to +$45/month | Features include food and beverage functionalities, order level optimization, ABC analysis, invoicing, ticketing, and franchise management. Pricing depends on specific module requirements. |

Where KORONA POS Shines

- Flexibility in Payment Processing: KORONA POS allows businesses to choose their preferred payment processors without incurring penalties, offering flexibility and potential cost savings.

- Scalability: The system is designed to grow with businesses, providing features that support expansion, such as multi-location management and franchise capabilities.

- Exceptional Customer Support: Users frequently commend 24/7 in-house support, highlighting its responsiveness and effectiveness in promptly resolving issues.

Where KORONA POS Falls Short

- Complex Terminology: Some users have reported that specific terms within the system can be confusing, particularly during the initial setup phase.

- Lack of Invoicing Features: Businesses requiring invoicing functionalities for net terms clients may find KORONA POS lacking.

- Software Updates: In some instances, updates have altered or removed functionalities, leading to operational challenges for some users.

Customer Reviews

Users have shared varied experiences with KORONA POS:

- Darlene P., a small business owner, stated, “Very user-friendly. You can customize the interface to conform to your business needs. Customer Service is in the United States, always accessible, and always awesome.”

g2.com

Who KORONA POS Is Best For

- Retailers Seeking Advanced Inventory Management: Ideal for businesses that require detailed inventory tracking and automation.

- Multi-Location Businesses: Suited for companies operating across multiple sites, offering centralized control and reporting.

- Businesses Valuing Flexible Payment Processing: Perfect for those who wish to maintain autonomy over their payment processing choices.

Which POS? Zettle, Square, or KORONA POS

Choosing between Zettle, Square, and KORONA POS depends on your business size and needs. Here’s a breakdown of the main differences between Zettle, Square, and KORONA POS:

Zettle primarily targets very small businesses and mobile vendors, such as food trucks, market stalls, and individual service providers. It’s for those who need simple, low-cost payment processing and basic POS features.

Square caters to a broader range of small to medium-sized businesses, including retail stores, restaurants, service-based companies, and mobile vendors. It is designed for those who need more comprehensive POS solutions with features like inventory management, sales analytics, and integrations.

KORONA POS focuses on businesses with more complex needs, such as those with advanced inventory requirements, multi-location operations, or a need for greater flexibility in payment processing. This includes retailers with substantial stock, businesses with multiple sites, and those who prioritize having a choice in their payment processor.

Speak with a product specialist and learn how KORONA POS can power your business.

Zettle vs. Square: FAQs

1. Which card reader has the best compatibility?

Square and Zettle offer broad compatibility, but Square readers work with more third-party apps, while Zettle is optimized for PayPal integration. The best choice depends on your POS system and payment processor.

2. Does Square work with Zettle?

No, Square and Zettle are separate payment ecosystems and do not integrate. You cannot use a Zettle reader with Square’s software or vice versa.

3. What card types do Square and Zettle take?

Square and Zettle typically accept major credit and debit cards, including Visa, Mastercard, American Express, and Discover. They also generally support contactless payments like Apple Pay and Google Pay.

4. How quickly are funds deposited into my bank account via each card reader?

Both Square and Zettle offer relatively fast deposit times, often within 1-2 business days. However, the exact timing can vary depending on your bank and the specific processing schedule. Both companies generally offer faster deposit options for a fee.