Key Takeaways

- Cost Transfer: Interchange fees are the primary fee paid by the merchant’s bank to the customer’s bank.

- Issuer Compensation: The fee compensates the card-issuing bank for risk, fraud, and the cost of funding customer rewards programs.

- Variable Rate: The rate changes based on the type of card (e.g., rewards vs. debit) and how the transaction is processed (online vs. in-person).

- Merchant Expense: The fee is the largest part of the total cost a business pays to accept credit and debit card payments.

High credit card processing costs can drain profits and frustrate business owners. The main reason behind those costs often lies in interchange fees. The interchange fees the charges set by card networks that every merchant pays per transaction.

Understanding interchange fees helps you make smarter decisions when choosing a merchant service provider or doing a credit card processing rate comparison.

In this guide, you’ll learn what interchange fees are, how they work, what factors affect them, and practical ways to reduce their impact on your business.

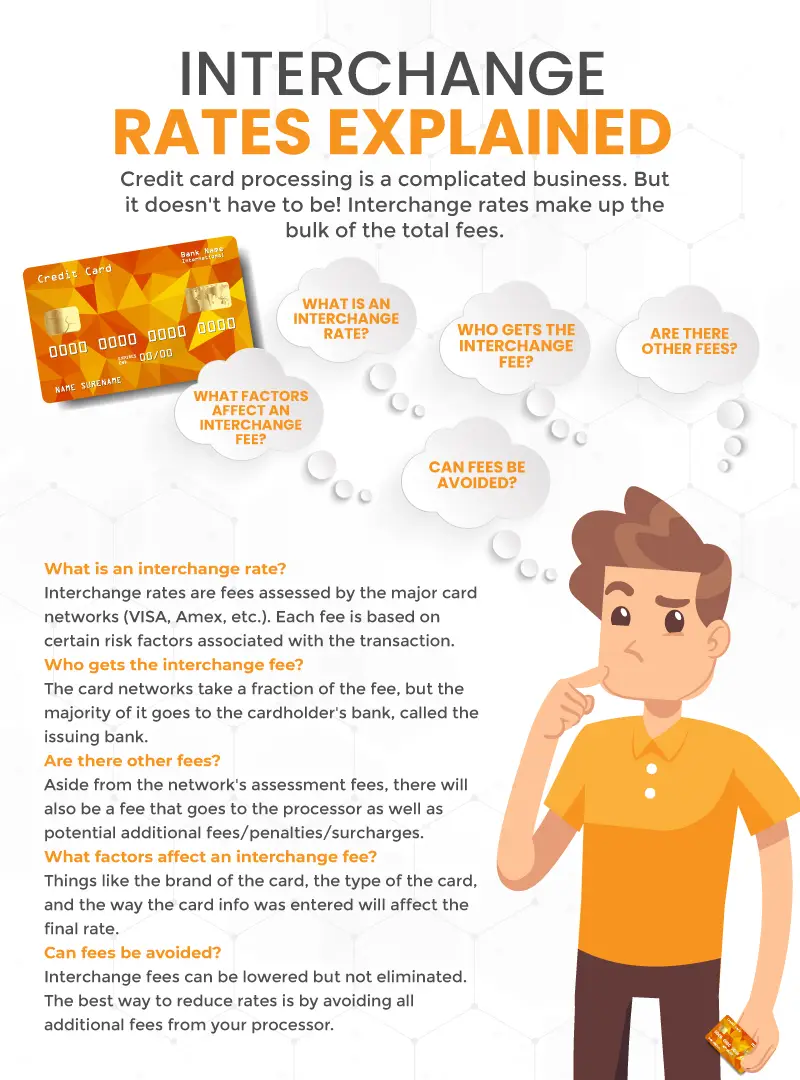

What are Interchange Fees?

Interchange fees are charges paid by a merchant’s bank to the cardholder’s bank each time a customer uses a credit or debit card for payment.

They cover costs related to transaction processing, fraud prevention, and maintaining secure payment networks. The card network also determines the exact interchange rates.

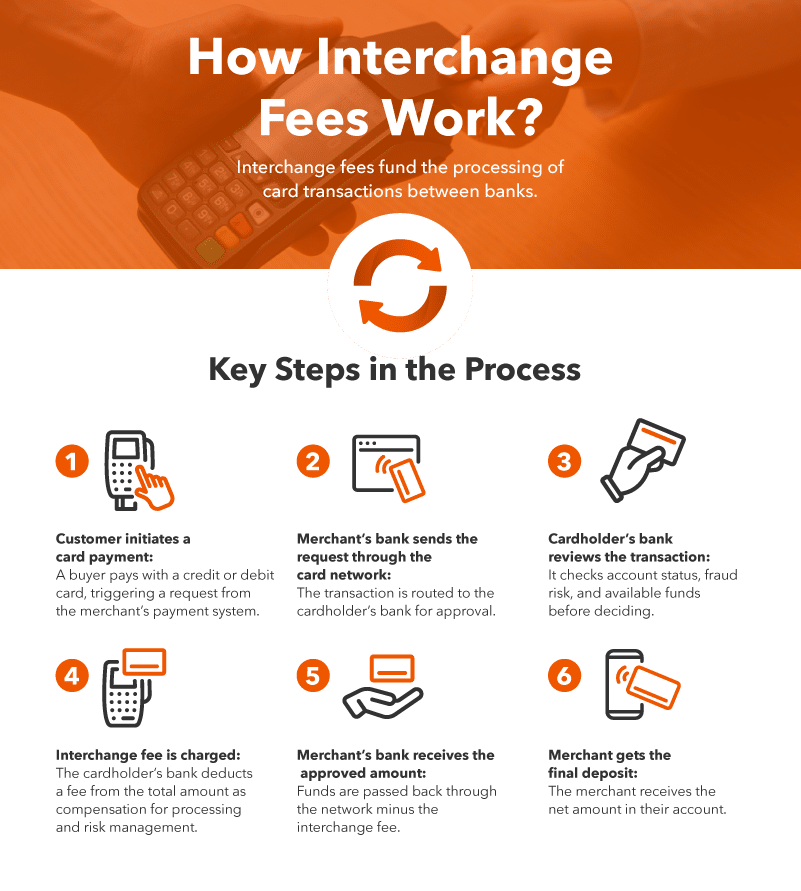

How Interchange Fees Work?

Interchange fees fund the processing of card transactions between banks.

Key Steps in the Process

- Customer initiates a card payment: A buyer pays with a credit or debit card, triggering a request from the merchant’s payment system.

- Merchant’s bank sends the request through the card network: The transaction is routed to the cardholder’s bank for approval.

- Cardholder’s bank reviews the transaction: It checks account status, fraud risk, and available funds before deciding.

- Interchange fee is charged: The cardholder’s bank deducts a fee from the total amount as compensation for processing and risk management.

- Merchant’s bank receives the approved amount: Funds are passed back through the network minus the interchange fee.

- Merchant gets the final deposit: The merchant receives the net amount in their account.

Learn more about how credit card processing works and save your business money with this free eGuide.

Example of an Interchange Rate Calculation

A customer makes a $100 purchase using a credit card. The interchange rate is 1.8% plus $0.10 per transaction. The fee equals ($100 × 1.8%) + $0.10 = $1.90.

The cardholder’s bank receives $1.90, and the merchant’s bank transfers $98.10 to the merchant. The $1.90 covers transaction processing and risk costs for the cardholder’s bank.

Are There Other Fees Besides Interchange Rates?

Although interchange fees make up the majority of total processing fees for each transaction, several other fees are also involved.

- Assessment Fees: Charged by card networks such as Visa or Mastercard, based on the total transaction volume processed by a merchant.

- Processor Fees: Collected by payment processors for managing and routing transactions between banks and networks.

- Gateway Fees: Applied for using an online payment gateway that connects eCommerce platforms to the payment processor.

- Monthly Account Fees: Fixed charges for maintaining a merchant account and accessing payment services.

- Chargeback Fees: Imposed when a customer disputes a transaction, and funds must be returned.

- Cross-Border Fees: Added when payments involve foreign cards or currencies, covering international processing costs.

Finally, watch out for extra convenience fees or surcharges. Some processors will tack on extra fees at the end of the month.

Why Interchange Fees Matter for Your Business?

Interchange fees significantly impact your business’s financial health and operations because they are typically the largest component of your total payment processing costs.

- Cost of Goods Sold (COGS): Interchange fees directly reduce your gross revenue on every card transaction. High-volume businesses can incur these fees totaling thousands of dollars monthly, affecting their profit margins just like utilities or rent

- Pricing Strategy: Understanding your interchange costs is crucial for setting competitive product or service prices. Businesses in low-margin industries often need to factor these costs into their pricing to remain profitable.

- Negotiating Power: Knowing the interchange rates you pay helps you negotiate a better deal with your payment processor. Processors charge a markup over the interchange fee; minimizing the entire rate is essential for savings.

- Payment Acceptance Decisions: High interchange rates for certain premium or rewards cards might influence your strategy, such as setting a minimum purchase amount for card use or encouraging the use of lower-cost payment methods (e.g., debit cards).

How Are the Interchange Fees Charged?

There are about 300 separate factors that determine an interchange rate. The fees, however, are usually bundled into a single percentage rate for each transaction.

Most interchange fees are calculated by taking a percentage of the sale, plus a fixed fee, so that the issuing bank secures an optimal amount it will receive.

PRO TIP!

When a transaction is completed, the fees are collected by the credit card networks, which then distribute them to the issuing bank. The issuing bank accepts the fees for its assumed risk of releasing the funds.

Interchange Fees by Card Network

The major card networks set interchange rates, but the structure and average cost vary significantly.

Amex

Higher proprietary rates, 2.3%-3.5% flat for most retail; no regulated debit caps. Direct billing to merchants raises expenses, but offers superior rewards, appealing to premium-spending customers.

Visa

Dominates U.S. market with rates of 1.5%-2.7% + $0.10 for credit, 0.05% + $0.21 for regulated debit. Rates vary by card type (with higher rewards), merchant category, and transaction method (card-present transactions are lower than online transactions).

Mastercard

Similar to Visa, credit fees 1.5%-2.95% + $0.10; regulated debit 0.05% + $0.21. Adjustments for PIN vs. signature debit; premium cards increase rates, affecting high-volume merchants.

Discover

Rates 1.5%-2.4% + $0.10 for retail credit, slightly below Visa/Mastercard. Debit mirrors regulated caps. Known for simpler structure, fewer surcharges, and benefiting smaller businesses with lower overall costs.

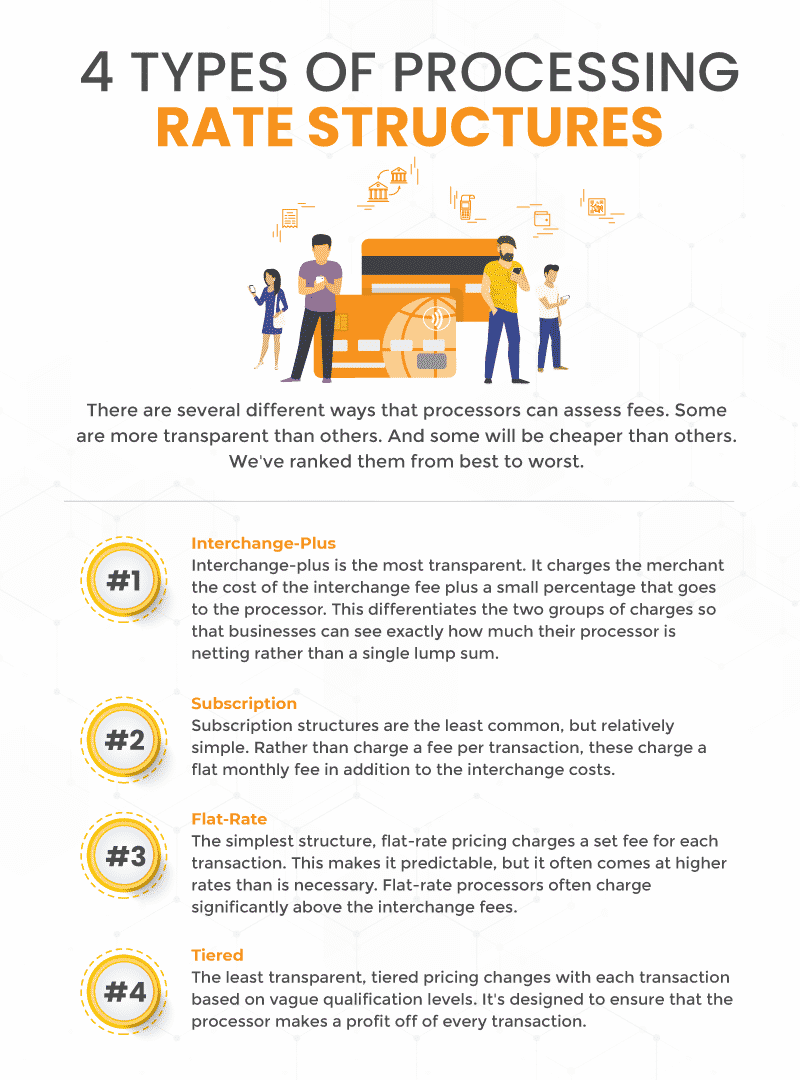

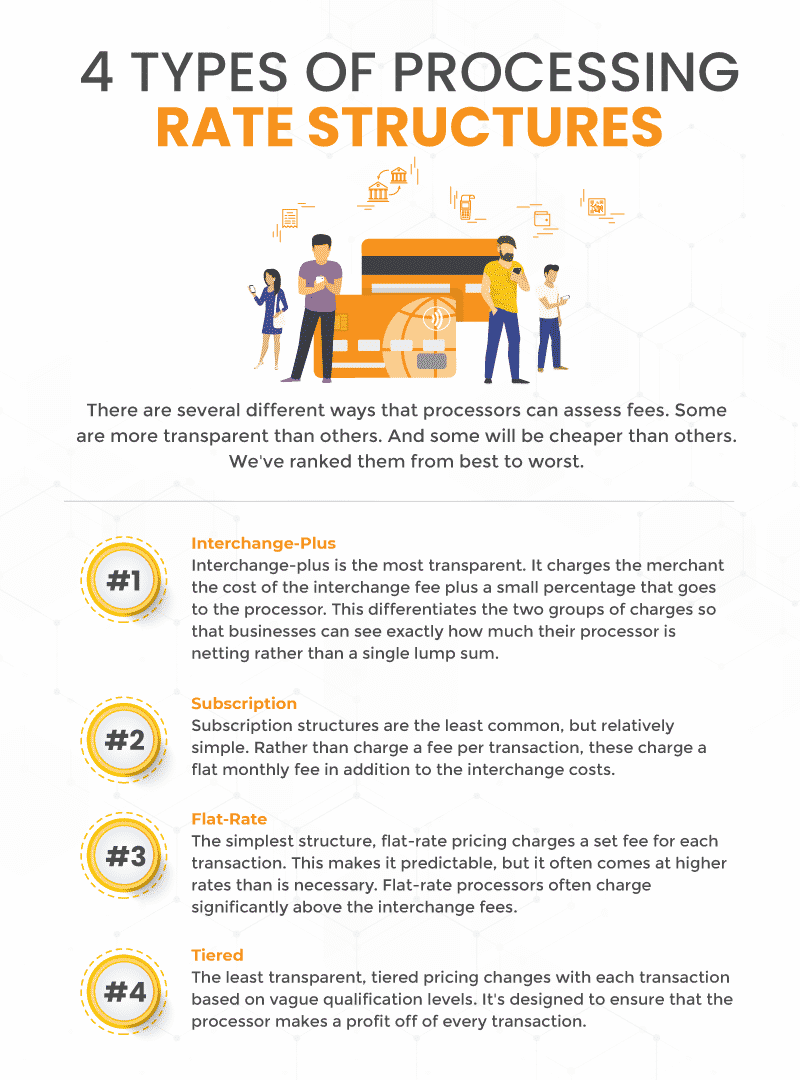

Are There Different Interchange Plans?

There are several ways to set up your processing pricing.

Flat-Rate: This charge comes as just a single, bundled rate. However, flat-rate pricing means that the interchange fees and all additional fees are compiled into one amount, leaving little transparency. Many common payment service providers use this model.

Tiered: Tiered pricing assigns each transaction as either qualified or unqualified. The two tiers are there to ensure that the processor makes a profit on every transaction. But it’s impossible to know exactly what you’re paying for because you’re most likely paying way too much. Tiered is simply never the recommended route.

Interchange-Plus: If you process over $5,000, interchange-plus is probably the best route to go. It’s the most transparent structure, and all interchange rates are just passed to the merchant with no additional markups or hidden fees. Therefore, the processing cost is added on top of the interchange so that you can see exactly what you’ve paid for.

Subscription: This also separates the processing costs from the interchange rates. However, the processing cost will be a simple monthly fee, rather than several individual fees. This would typically be recommended for high-volume businesses.

Factors That Affect Interchange Rates

Interchange fees are not fixed; they are dynamic rates set by the card networks (e.g., Visa, Mastercard) and depend on various factors related to the risk and cost associated with processing the specific transaction.

Card Type and Benefits

The type of card used by the customer heavily influences the rate. Premium or Rewards Credit Cards (e.g., those offering airline miles or significant cashback) have higher interchange rates than standard cards.

MUST-KNOW

Conversely, Debit Cards typically have the lowest interchange rates because they draw directly from the customer’s bank account, which represents significantly less credit risk for the issuing bank.

Transaction Method (Risk Level)

How the card information is captured determines the fraud risk. Card-present transactions, where the physical card is swiped, dipped (for EMV chip cards), or tapped (for contactless cards) at a point of sale (POS) terminal, typically carry a lower interchange rate.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

PRO TIP!

The presence of the card and use of secure chip technology reduces the likelihood of fraud. Card-Not-Present (CNP) transactions, such as online, over-the-phone, or keyed-in orders, incur a higher rate due to the increased risk of chargebacks and fraudulent activity when the physical card is not present.

Merchant Category Code (MCC)

Each merchant is assigned a four-digit Merchant Category Code (MCC) based on their industry. Card networks establish different interchange schedules for various MCCs, reflecting the perceived risk and cost associated with doing business in each sector.

You need to know

For instance, businesses deemed high-risk for fraud (like travel services or digital content providers) often face higher rates. Conversely, essential services or low-risk, high-volume merchants (like grocery stores) may receive slightly lower rates to encourage card acceptance.

Transaction Data Integrity

The quality and completeness of the data submitted with the transaction play a vital role in rate qualification. For Card-Not-Present transactions, providing complete data, including the Card Verification Value (CVV) and passing the Address Verification Service (AVS) check, lowers the fraud risk score.

Failing to include these security details, or having an incorrect settlement time frame, can cause the transaction to be “downgraded” by the network, resulting in it being charged at a more expensive interchange tier.

Transaction Regionality (Domestic vs. Cross-Border)

The geographic relationship between the customer’s bank (issuer) and the merchant’s bank (acquirer) is a significant factor in determining the rate.

Domestic transactions, where both the merchant and the card-issuing bank are located in the same country, generally incur the lowest interchange rates.

Cross-border or Inter-Regional transactions, where the customer uses a card issued in one country at a merchant in another, are charged a significantly higher rate.

The premium covers the increased cost and risk of processing funds across different jurisdictions and currencies.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Settlement Time Frame

Card networks impose strict requirements regarding how quickly a merchant must settle (batch out) a transaction after it has been authorized.

Transactions settled promptly, typically within 24 to 48 hours, qualify for the lowest available interchange rates because fast settlement reduces the risk of fraud and card expiration.

YOU NEED TO KNOW

If a merchant delays the settlement for several days, the transaction is often downgraded by the card network. This automatic downgrade moves the transaction into a less favorable, higher-cost interchange category as a penalty for poor data management and increased risk exposure.

Commercial Card Usage (B2B Enhanced Data)

When a transaction involves a Commercial Card (Business, Corporate, or Purchasing card), the interchange rate is substantially higher than that of a consumer card. However, merchants can access lower “Level 2” or “Level 3” interchange rates by providing enhanced transaction data.

Regulatory Environment and Fee Caps

In certain regions, government regulations place mandatory limits or caps on interchange fees, fundamentally altering the rate structure. A notable example is the Durbin Amendment in the United States, which capped interchange fees on debit card transactions for large banks.

Are There Different Interchange Plans?

There are several ways to set up your processing pricing.

Flat-Rate: This charge comes as just a single, bundled rate. However, flat-rate pricing means that the interchange fees and all additional fees are compiled into one amount, leaving little transparency. Many common payment service providers use this model. Unfortunately, they charge the same amount no matter any of the factors listed above.

Tiered: Tiered pricing assigns each transaction as either qualified or unqualified. The two tiers are there to ensure that the processor makes a profit on every transaction. But it’s impossible to know exactly what you’re paying for because you’re most likely paying way too much. Tiered is simply never the recommended route.

Interchange-Plus: If you process over $5,000, interchange-plus is probably the best route to go. It’s the most transparent structure, and all interchange rates are just passed to the merchant with no additional markups or hidden fees. Therefore, the processing cost is added on top of the interchange so that you can see exactly what you’ve paid for. Interchange-plus is a solid solution for most businesses.

Subscription: This also separates the processing costs from the interchange rates. But the processing cost will be a simple monthly fee instead of several individual fees.

Tips to Reduce Interchange Fees for Your Business

Reducing interchange fees involves optimizing transaction practices and leveraging modern technology to qualify for the lowest rates.

Upgrade to EMV and Contactless Processing

Always process transactions using the secure EMV chip (dip) or contactless (tap) methods rather than swiping. Using a modern POS system that supports these methods minimizes the risk of fraud, qualifying you for the lowest card-present interchange rates.

A processing-agnostic system, such as KORONA POS, ensures that your retail business can choose a processor that best supports these low-rate methods.

Payment processors giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Ensure Timely Settlement

Settle your batch of daily transactions promptly, ideally within 24 hours of authorization. Delays cause transactions to be downgraded to a higher-fee category by the card networks due to increased risk. Many robust POS systems automate this process.

Implement AVS and CVV for Online Sales

For Card-Not-Present (online/keyed-in) transactions, always use Address Verification Service (AVS) and require the Card Verification Value (CVV). Providing this security data to the card network reduces the perceived risk of fraud.

Negotiate an Interchange-Plus Pricing Model:

Ask your payment processor to switch your pricing structure to Interchange-Plus. This model transparently passes the exact interchange fee to you, with a separate, fixed markup added. Transparency prevents processors from obscuring high interchange costs and charging blended rates that hide true expenses.

Implement Dual-Pricing

Offer slightly lower prices for cash or debit payments while charging standard prices for credit cards. The shift costs are passed on to card users and reduce interchange fees. That’s what is called dual-pricing.

The Future of Interchange Fees

A growing push for tighter regulation and increased transparency worldwide marks the future of interchange fees.

This trend is evident in anticipated regulatory caps, such as proposed adjustments to U.S. debit fees and existing limits in the EU, aimed at lowering costs, particularly for cross-border eCommerce.

Furthermore, the growth of alternative payment methods such as real-time payments and Buy Now Pay Later (BNPL) introduces competitive pressure that could reduce reliance on traditional card networks and their associated fees.

However, despite these regulatory efforts, card networks frequently adjust fee structures, often leading to a net increase in costs for merchants.

Use KORONA’s All-In-One POS System to Save on Processing Fees

Find out how much you’re spending.

To learn more about credit card processing and associated fees, please call us at KORONA POS at 833-200-012. We’re not a processing company, but our POS system integrates with the top processors on the market. We’ll help you find the best solution for your retail store. You can also click on the button below to book a demo with one of our product specialists.