To accept credit card payments at a retail store or restaurant, you need a point-of-sale (POS) system with a card reader or credit card terminal that can process transactions independently. However, there are different ways to accept credit cards online. Depending on the gateway, you have the following four options to accept credit cards online: The first option is to send your customers a direct payment link. The second option is to accept credit cards with a payment page. The third option is to accept credit card payments online with a shopping cart, and finally, the last option is to manually process the payments.

As a small or medium-sized business owner, accepting card payments can be a lifeline for your business. Respondents to a recent Federal Reserve Bank survey revealed that more credit cards are being used today and that the average national credit card debt is also on the rise. According to the same survey, 70% of the U.S. population has a credit card, and 34% of Americans have three or more cards. Yet, there are still millions of small businesses across the United States that don’t accept credit or debit cards. While there are still some niche businesses that can thrive on the cash-only model, most SMBs that currently don’t take plastic would see a spike in sales if they did.

But, simply buying a credit card reader isn’t quite going to cut. While you don’t need to know the ins and outs of how credit cards work and the processing behind the scenes, it’s important to know the basics before getting your store set up for accepting them. Check out our checklist on how to accept credit cards both online and in-store.

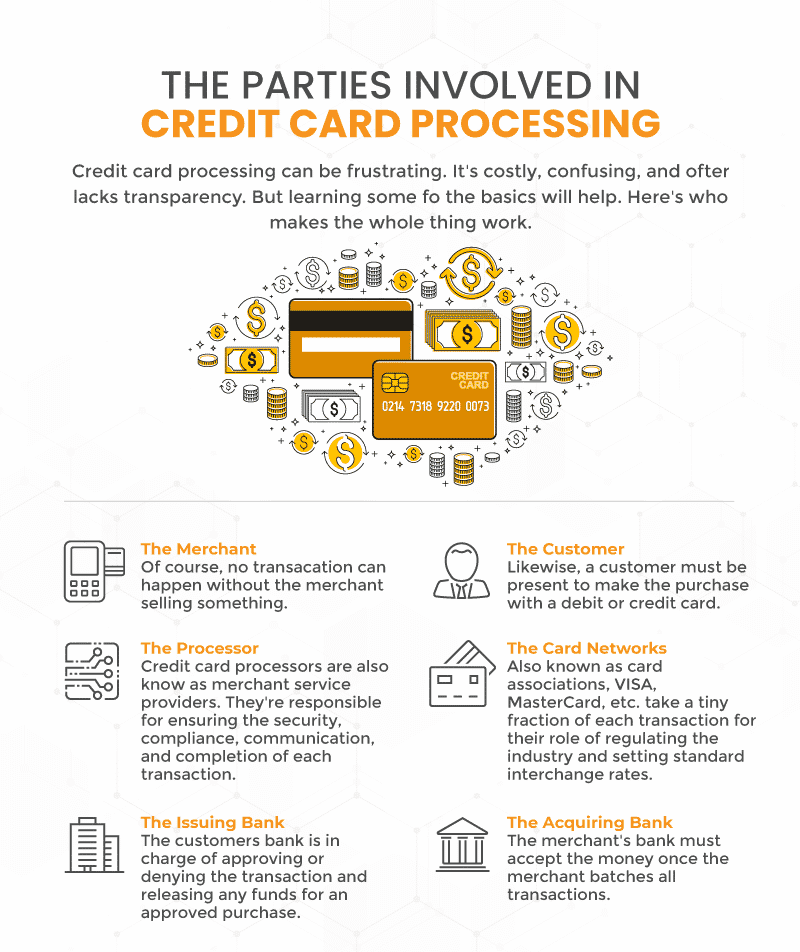

The first step in getting your store ready to accept credit card payments is understanding who’s involved. The process of a credit card transaction is complicated but there are just a few main entities that facilitate it. For a more in-depth look, check out our guide to credit card processing, but we’ll briefly cover the process here, too.

Credit Card Associations – Also known as credit card networks, these are the companies that are familiar to just about everyone: Visa, Discover, American Express, Mastercard. They each set their own rates and fees. For instance, American Express offers consumers bigger benefits so they charge retailers higher fees in return. These card networks can issue their own cards directly, or partner with specific banks.

Issuing Banks – The issuing bank is the party that releases the funds for the transaction. The consumer chooses to buy something and their bank either approves or declines the transaction.

Acquiring Banks – This is the retailer’s business bank. They accept the funds from the issuing bank when a transaction is complete.

Merchant Service – More commonly called credit card processors, these companies help the payment terminal communicate with both the issuing bank and acquiring bank. They also ensure that each transaction is secure and in PCI compliance.

The Steps of a Credit Card Transaction

- Information from a credit card is input into the payment system. This might be in the store, online, or over the phone. And the means of inputting the data could be swiped, dipped, tapped, or keyed-in.

- Once entered, the card data is transferred to your business account by your payment processor. This will be done through a payment gateway that your processor works with.

- At the same time, the information stops by your customer’s bank to check that they have sufficient funds, available credit, or suspicion of fraud.

- The payment is either approved or declined.

- The funds will be transferred to your bank account after the merchant service provider deducts all fees from the transaction.

Your Retail POS System and Credit Card Payments

The point of sale system is the physical center of the entire process. Every store that accept credit card payments must have a point of sale system that is either a merchant service provider itself (payment service provider – PSP), or integrates with other merchant service providers. Your system will also require credit card machines to accept the payment.

As mentioned above, some POS systems are credit card processors. This means that the same company that provides your software also performs the role of facilitating the completion of the transaction. These PSP solutions seem convenient, but they leave retailers with no choice in service. Such POS providers often advertise cheap or free point of sale software but charge above average processing rates that add up quickly.

Other processing solutions come from third-parties. The processor must simply integrate with the hardware that’s run through the POS. These solutions leave business owners with a variety of choices and allow for negotiation to find the best fit on the market.

Finally, your point of sale is largely responsible for the speed of transaction. If you have a high volume of sales and long line, check with your point of sale solution that it can process transactions quickly.

See related: Payment Processing: Integrated Payments vs. Non-Integrated

The Major Fees for Processing Payments

Unfortunately, payment processing includes various fees, most of which can change based on provider and type of transaction. This, of course, adds to retailers’ confusion and frustration. Not to worry, we’ll break them down to their basics:

Interchange Fee – Composing the majority of the total processing fees, interchange fees are set by and go to the card associations. These processing fees can be minimized by setting a store policy on credit cards. Eliminating keyed entries, cards with high rewards, and CNP transactions will lower your interchange fees. American Express and Discover also charge higher interchange rates, which is why some businesses don’t accept them.

Assessment Fee – These rates are also set by the card associations, but are much smaller than interchange fees. While the interchange rates are compensation for the assumed risk of processing a transaction and transferring money, the assessment fees are simply for the task of doing so.

Merchant Service Fee – The credit card processing company will also charge a fee for their services. These fees and the way they are structured are the primary negotiable factor of the process. Merchant-friendly solutions come with a simple flat fee for their services of ensuring PCI Compliance. TSYS, one of KORONA’s trusted processor solutions, charges $6.25/month and files all PCI paperwork for you. More on PCI stuff below!

ISO Fee – Independent sales organizations are third-party entities that might sell point of sale software or credit card processing. They will upcharge their customers for an additional slice of each transaction. These fees are ALWAYS avoidable; their salesforce, however, is good at making you think that they aren’t. Talk to us at KORONA POS – we’ll make sure you’re never working with an ISO.

Choosing a Merchant Service Provider

This can be the hardest part of the process since there is a lot of technical jargon involved. If you’re not using a POS system that also provides merchant services, you’ll need to select a processor. First, there are two main types of structuring the merchant service fees:

Interchange Plus – This plan combines the interchange rate issued by the card networks with additional fees from the merchant service provider. These rates often come as a fraction of a percent of the transaction plus a flat fee. For instance, it might be 0.5% plus $.20.

Tiered Pricing – These fees vary for each type of transaction based on many factors. These include the type of card used, the rewards program on the card, and the way that the data was entered into the system. Overall, tiered pricing is less transparent and leaves room for being overcharged.

Flat-Rate – This pricing model typically comes with PSPs. Square, for instance, offers its customers a flat rate of 2.75% per credit card transactions (slightly higher rates if it’s keyed in), but this service makes financial sense for very few businesses.

When shopping for a new merchant service provider, remember that you can negotiate. There will be some solutions that are better for your business than others: processing rates range based on average transaction volume and total sales. This is part of the reason that it’s wise to leave your business with options for a processor instead of getting one that is tied to your point of sale system. Ask your point of sale provider to help you find the best solution for your retail store.

Learn More About Credit Card Processing Cost Comparison In This Video

PCI Compliance and Credit Card Processing

PCI Compliance is a security industry standard that all payments must abide by. It’s always evolving to adapt to new security threats and fraud. In its essence, it’s meant to protect both consumers and merchants.

There are various levels of PCI Compliance based on the type of retailer. Smaller businesses require lesser security, for instance.

Ensuring that a business is adhering to PCI Compliance laws is the responsibility of the credit card processing company. This is the primary reason for the merchant service fees.

Credit Card Fraud and the Steps to Protect Your Business

Chargebacks are the biggest risk that a business assumes by accepting credit card payments. These occur when a customer asks for a refund for a prior transaction through your business. Generally, they request the chargeback through their bank or card network. The request will set the process in motion and, if approved, will result in the reverse of a sale.

Even before a refund is issued, a business must pay a fee for the retrieval process. This is usually between $10 and $25. If the chargeback is granted, the retailer must pay an additional fee of $25. Altogether chargebacks are very bad for business: you lose the sale, the product, and have to pay whatever fees come with the process.

Unfortunately, chargebacks are a common avenue for retail fraud. Most often, it’s a thief using a stolen card. The owner of the card realizes it’s been stolen and files for a chargeback. Less frequently, the card owner themself will claim that a purchase was never made and request a chargeback.

It’s important for small businesses to take the right precautionary steps to avoid chargebacks if you start accepting credit card payments:

- Communicate clearly with your customers about store refund and exchange policies.

- Make it easy for customers to contact you.

- Ship items on time and in adequately protective material.

- Follow instructions from your merchant service provider.

- Save receipts and transaction histories electronically.

- Check all IDs for credit card payments and get their signatures electronically.

- Follow all new EMV regulations and industry standards.

- Disable manual entry on your POS system credit card machine hardware.

How to Accept Credit Card Payments In-Store

You’ll likely need a wired credit card reader or point of sale system if you run a brick-and-mortar retail operation. However, you can get a mobile card reader if your cashiers walk around your establishment to accept payments. Wired systems tend to be more secure than mobile systems, which require a good mobile signal. Moreover, the hardware for mobile payment devices, such as phone attachments, is much more likely to break.

The best point of sale systems come with a complete set of hardware and software that give you a range of valuable tools, such as the ability to track sales by product, period, and promotion. A POS system also allows you to track inventory levels and set up a loyalty program with associated discounts while processing credit card transactions. Even if your POS system isn’t the payment processor, it still must integrate and communicate with the processor.

You can purchase a stand-alone credit card reader if you have an existing point of sale system that does not include payment processing. Additionally, if you have both a POS and credit card processing solution, you should be able to Most modern fixed credit card readers accept both reader and chip (EMV) transactions, and many accept contactless (NFC) payments. Modern credit card hardware should accept modern payments, particularly contactless and EMV payments. These facilitate fast transactions and help prevent fraud

What You Need to Accept Online Payments at Your eCommerce Store

Depending on the gateway, you have the following options to accept credit cards online.

1. Send your customers a direct payment link

Obtain the payment link from your payment service provider. Based on your provider, you may be able to customize the link in various ways. Then, determine where to display the link on your website. The customer will take the following steps to complete payment:

- Click on the link to open a payment page.

- Enter the dollar amount.

- Enter their contact, credit card, and billing information.

- Click on a button to complete their order.

2. Accept credit cards with a payment page

A good example of an organization that uses this technique is St. Jude Children’s Research Hospital. The payment page is already embedded, making the completion of any payments more seamless:

- Pick a payment amount (in this case, donation) and frequency of recurrence.

- Choose a payment method.

- Enter card and billing information.

- Click the button to finalize their order.

3. Accept credit card payments online with a shopping cart

These are the checkout pages you’ve seen every time you shop online. Customers browse eCommerce stores searching for products, then add them to their shopping cart. When they’re ready to check out, they take the following steps:

- Type in their shipping information.

- Type in their credit or debit card information.

- Type in their billing information.

- Hit the appropriate submit button to complete their order.

4. Manual Payment Processing

When your business accepts credit cards over the phone – for example, if you have a restaurant that offers delivery or takeout – you might write down the credit card information and then manually enter it into a terminal or point of sale after the call is over.

Such practice is HIGHLY inadvisable. Instead, you can use a virtual terminal or payment gateway to accept payments over the phone.

- Log in to your payment gateway.

- Generate an invoice for your customer or select the Payments tab.

- Type in the payment and customer information.

- Click the button to finalize the payment.

- Select how you would like to send a receipt.

- The funds will be processed to your account after being distributed and will be visible on your dashboard.

If you have a brick-and-mortar and eCommerce location, it’s important that you get a retail POS that can serve both sides of your business. Payments, sales, inventory, etc. will all be consolidated, making your business run more efficiently.

For freedom to choose your merchant service provider in a POS system and save on fees, give KORONA POS a try.

To learn more, try out KORONA POS for free. We’ll walk you through the process and put you in touch with various processors to see what’s best for your store. We’ll also make sure your business is set up well to avoid fraud and theft.

Sign up for a no-commitment free trial and get started today!

Get started with KORONA POS today!

Explore all the features that KORONA POS has to offer with an unlimited trial. And there’s no commitment or credit card required.

FAQs: How To Accept Credit Card Payment

Accepting credit card payments makes it easier for customers to buy from you. It can lead to more significant growth. Since cardholders typically spend more than cash buyers, accepting credit cards will also help you increase your sales. Since 90% of online purchases are made with credit and debit cards, it’s a MUST for eCommerce businesses to accept card payments. Credit card payments improve cash flow, speeding up payment times and reducing late payments.

Almost all types of businesses can accept credit card payments, including the following:

brick-and-mortar businesses, eCommerce businesses, quick-service businesses, independent

professional services firms, and more. In all of these cases, accepting credit card payments will allow customers to pay more quickly and, thus, increase your sales.

Obtaining approval for a merchant account is not a sure thing. However, if your business already exists, there is a good chance it will be approved. A few things make it easier to get approved and can lower your costs once approved, such as a good personal and business credit rating,

a business that has been operating for at least three years, an open commercial bank account, and a solid record of any previous merchant accounts. If you lack one or more of these qualifications, you can probably be approved, but the costs will be higher.

It is impossible to accept credit cards without paying a fee, as this is one of the primary ways that credit card networks are compensated for their service. However, you can avoid fees by adding a surcharge to credit card payments or by increasing prices. You can incentivize cash payments by offering a discount to customers who pay with cash. You can also conduct extensive research to determine the suitable payment processor to provide you with the best rates.