Key Takeaways:

- Controllables are what you can manage directly, like inventory, pricing, and staff workflows.

- Uncontrollables are external factors, like customer behavior, competitors, or demand swings.

- Knowing controllable vs. uncontrollable costs helps you spend smarter and operate efficiently.

Retail can feel unpredictable when sales fluctuate and traffic swings without warning. Understanding controllables and uncontrollables helps you focus on what you can manage.

This guide breaks down the difference, shows which costs you can control, and explains how to optimize operations. By focusing on controllables, you’ll reduce stress and make better business decisions.

What Are Controllables and Uncontrollables?

Controllables are actions, inputs, systems, and preparation—anything you can directly influence. Uncontrollables are outcomes, external events, or other people.

Recognizing the difference helps retailers prioritize efforts and avoid wasting energy on what’s beyond their control.

Why People Struggle with this Distinction

Humans naturally focus on results, not actions. This creates stress when outcomes depend on factors you can’t control.

Retail adds pressure with sales metrics, media comparisons, and unpredictable foot traffic. Understanding controllables keeps your energy on areas you can actually influence.

Retail relevance:

Foot traffic and demand swings are unpredictable, yet operational focus — like pricing and inventory — can mitigate their impact.

Sales dips and spikes can feel personal, but you can’t control customer behavior.

Examples of Controllables and Uncontrollables

Area | Controllables | Uncontrollables |

Sales | Marketing campaigns, pricing, promotions | Customer decisions, competitor actions |

Inventory | Stock ordering, supplier relationships | Supplier delays, shipping disruptions |

Operations | Staff scheduling, training, workflows | Weather, local events, regulations |

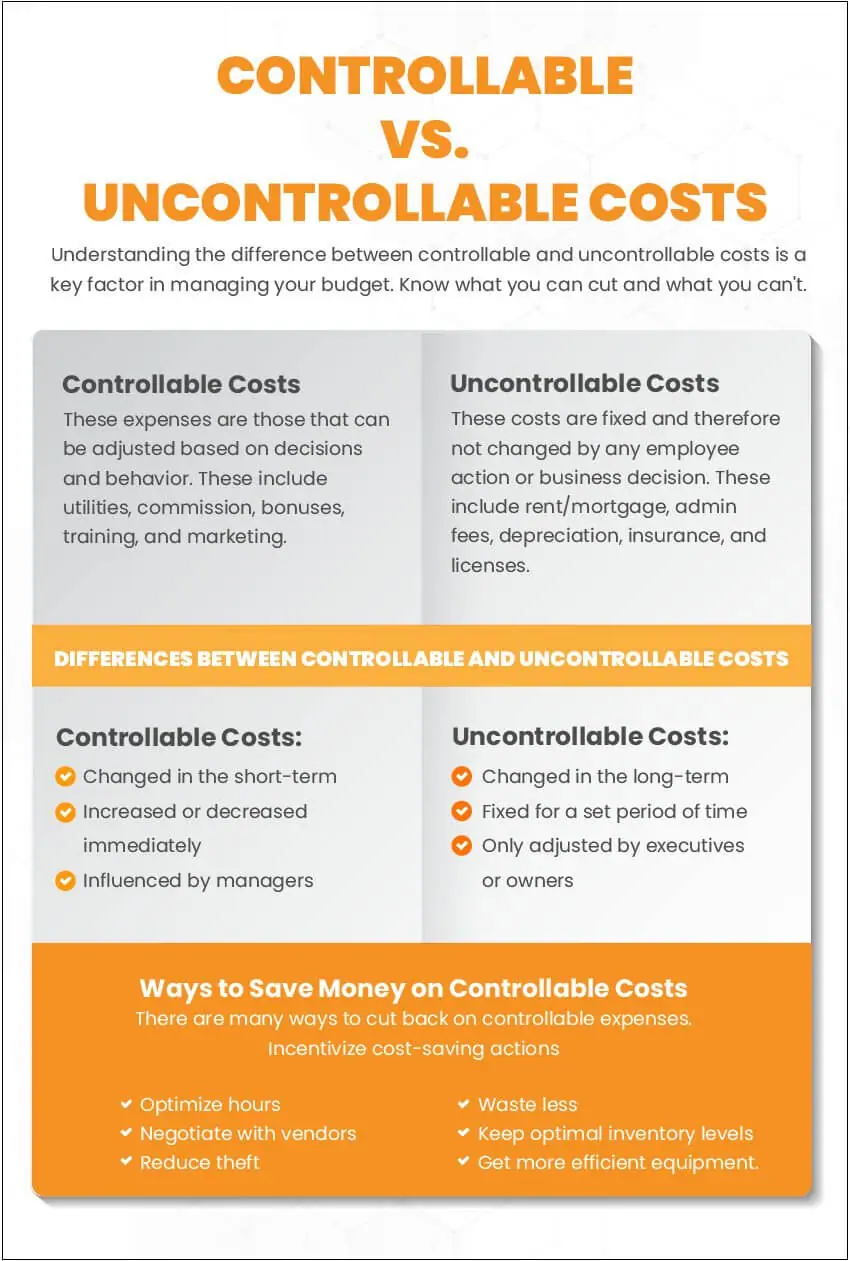

What Are Controllable Costs?

Variable costs change with business activity, like product materials, packaging, and hourly labor. Incremental costs are extra expenses tied to specific actions, like running a promotion.

Managing these costs helps retailers adapt quickly without overspending.

What Are Uncontrollable Costs?

Fixed costs are regular expenses you can’t adjust, like rent, insurance, and utilities. Regulated costs come from rules or laws, such as minimum wage or taxes.

You can plan around these costs, but you can’t directly change them.

Free printable templates and checklists to help you manage retail operations with ease

What Are the Differences Between Controllable and Uncontrollable Costs?

Controllable costs are flexible and within your influence, while uncontrollable costs are set by external factors. Understanding this helps prioritize spending and strategy.

Focus on controllables to save money and optimize operations, while planning for unavoidable uncontrollable expenses.

Controllable Costs | Uncontrollable Costs |

Costs you can manage and adjust | Costs outside your direct control |

Inventory, promotions, hourly labor | Rent, taxes, minimum wage, utilities |

High flexibility – can reduce or optimize | Low flexibility – must plan around them |

Directly impacts budgeting and operations | Requires adaptation and contingency planning |

Goal: save money, improve efficiency | Goal: minimize risk, plan ahead |

How Can You Save Money on Controllable Costs?

Track variable and incremental costs carefully and adjust based on sales data. Streamline workflows and reduce waste to maximize efficiency.

Using tools like KORONA POS lets you monitor costs, manage inventory, and optimize operations from one platform.

Track Variable and Incremental Costs

Use KORONA POS to monitor product costs, promotions, and hourly labor in real time. Seeing where money is spent helps you cut waste and optimize every dollar.

Optimize Inventory Management

Avoid overstocking or stockouts with automated inventory tracking. KORONA POS alerts you to slow-moving items and helps plan orders based on demand.

Streamline Pricing and Promotions

Set competitive pricing and run promotions confidently. KORONA POS gives instant insights into sales performance so you only spend where it drives results.

Improve Staff Scheduling and Workflows

Allocate staff efficiently to match foot traffic patterns. With KORONA POS, you can track hours, schedules, and performance, reducing labor overspend.

KORONA POS has exceeded my expectations in every way. It’s a powerful, adaptable solution that has transformed our operations for the better.

-James B.

Manage Inventory, Pricing, and Operations With KORONA POS

KORONA POS gives retailers control over what they can manage—inventory, pricing, and staff workflows. Reduce stress, save money, and make faster, smarter decisions with real-time insights.

Start your free trial today and see how KORONA POS helps retailers cut costs, every day.