The world of payments is evolving quickly. And it’s important that retailers keep up. We’ve talked a lot on this blog about credit card processing, surcharge and convenience fees, PCI compliance, interchange laws, modern payment methods, and much more. We want each of our retailers to understand exactly how this works so that they can maximize profits. Too often, retail business owners are unknowingly throwing away money in situations that are easily preventable.

So today, we wanted to cover another important topic: credit card chargebacks. What is a credit card chargeback anyway and what should you do when they happen? Plus, we’ll look at how to avoid chargebacks in the first place.

So What Is a Credit Card Chargeback in Retail?

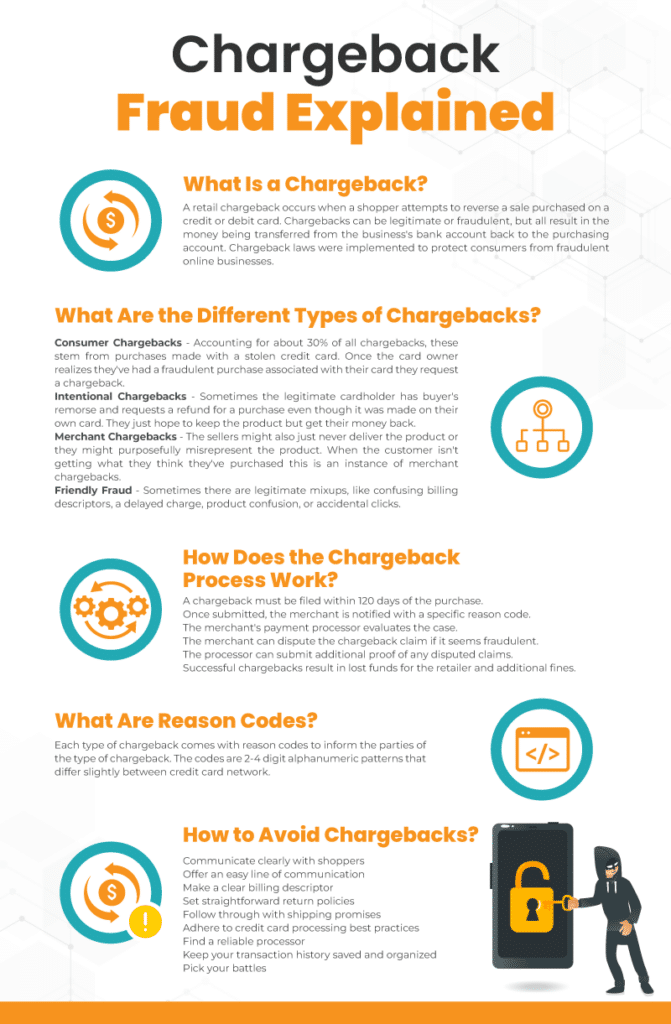

A chargeback on a debit or credit transaction occurs when the consumer attempts to get a refund through their acquiring bank or credit card network for a purchase made in the past. Simply put, it will reverse the sale, taking the money from the receiving bank and delivering it back to the issuing bank.

The laws regulating chargebacks were instituted to protect the consumer against fraudulent or unauthorized transactions. For instance, if a customer made a purchase but never received the product, they could initiate the chargeback process and file a claim to receive the money back in their account.

The process of refunding money is often a long and tedious one. The money will be withheld from both parties (the consumer and the business) until a decision is made by the issuing bank and the dispute is resolved. Often, the process will take over a month and require a great amount of wasted time.

Why Do Chargebacks on Credit or Debit Cards Happen?

There are several main reasons that chargebacks occur. And though the initial reason for creating chargebacks was to protect the consumer from merchant fraud, many cases of chargebacks are now consumer fraud on the merchant.

Consumer Chargeback Fraud

Chargeback fraud is one of the most common types of fraud in retail. Luckily, as we’ll see later in the blog, this type of fraud is almost entirely avoidable. But first, here are the two most common types of consumer chargeback fraud.

- The most common reason for chargebacks (30%) is that the purchase was made with a stolen card. For example, a thief takes someone’s card data and makes a purchase at a store. The owner of the credit card realizes it was stolen and reports the fraudulent purchase. The bank will then start the chargeback process. The most common type of credit card fraud, chargeback fraud leads to huge losses among retailers and is easily preventable – more on that later.

- Though rare, intentional chargeback fraud by the actual cardholder also occurs: buyer’s remorse sets in, but the customer still wants the product. The customer falsely claims a transaction was fraudulent even though they made the purchase. They get to keep the product and get their money returned.

Merchant Chargeback Fraud

Not all merchants are honest, and there are plenty of cases of legitimate chargeback claims. After all, regulations on chargebacks were instituted to protect the consumer from dishonest merchants.

- Another 26% of chargebacks occur because the customer never received a delivery. This could be the case of merchant fraud, meaning the merchant received the payment without ever intending on shipping the product. But more commonly, it’s a simple mistake and is typically resolved painlessly.

- A less common type of merchant fraud that leads to chargebacks is when a merchant clearly misrepresents a product, especially higher end items that are only knock offs. Servers or cashiers might also misenter a tip amount on a check, again either intentionally or accidentally. In either case, the customer can submit a request for a chargeback.

Friendly Fraud: Gray Area Cases

Some other cases are coined friendly fraud. Instances of these chargebacks can happen in various circumstances:

- Someone doesn’t recognize the purchase because of a strange billing descriptor or legal trading name on their bank statement.

- The payment is only charged once the product has shipped, such as a pre-ordered book. The customer thought the charge was placed immediately and therefore doesn’t recognize the charge that came later.

- At times, a customer will claim that a merchant misdescribed or misrepresented a product in slight ways.

- In other cases, a customer argues that they never authorized the purchase. This happens with forgotten subscription services or with accidental purchase clicks on eCommerce sites.

How Does the Process Work?

- For a consumer to file for a chargeback they must do so within 120 days of the disputed purchase.

- Pending initial review from the issuing bank, the merchant receives a chargeback reason code that explains the type of chargeback being requested on the transaction.

- The merchant’s processor will also take a look at the chargeback request.

- If they have reason to believe it is fraudulent or unjust, they can dispute the claim on behalf of the merchant. If not, the chargeback is sent to the merchant.

- Once the request is sent, the merchant has 45 days to respond by either accepting the chargeback or requesting a dispute.

- If contested, the processor will offer any additional information that the merchant provided for the issuing bank to review prior to making their decision.

The rules of the dispute and the details of the process are dependent on the credit card company and vary between the major card networks. Credit card companies are in the process of trying to shorten the amount of time this process can take. VISA, for instance, instituted a new system for chargebacks coined VISA Claims Resolution. The goal is to have any chargeback dispute fixed within 31 days.

If a disputed chargeback requires more litigation or arbitration from an outside source the process may take months. Overall, retailers lose tens of billions of dollars a year to chargebacks and countless hours spent collecting payment data, on the phone, or in legal proceedings.

What Are Chargeback Reason Codes?

It’s important for banks to quickly and clearly explain to merchants why a chargeback is being requested. To simplify this, banks file each chargeback request with a reason code attached. Each bank is different, but reason codes are 2-to-4-digit alphanumeric codes that are sent with each dispute. The retailer can either accept the dispute and refund the transaction value or contest it with evidence.

The major credit card networks handle chargeback codes similarly, although VISA’s new Claims Resolution introduced a new category and few more specific reasons for chargebacks. Below are links to each of their policies:

- VISA – Each category is identifiable by the first two digits and the more specific reason by the numbers following the decimal place.

- MasterCard – MasterCard consolidated and organized their codes in 2016 and is updated as of 2020. Each code is four digits and begins with “48.”

- American Express – A very similar system to VISA’s, AmEx uses a letter first to identify the category and numbers following to identify the specific reason.

- Discover – More alphabetic than alphanumeric, Discover’s chargeback codes are typically acronyms for the reason.

How Can Retailers Avoid Chargebacks?

Simply put, chargebacks are a pain to deal with and cost your business money. They increase retailer’s rates of returns and refunds, damage merchant/customer relations, and can waste a lot of time with mundane clerical work. Plus, some merchant services charge an additional processing fee for chargebacks, adding insult to injury. So yes, they’re good to avoid. Here are a few things to keep in mind.

Good Communication Is Essential

- Communicate clearly with your customers. Avoid the whole mess in the first place with clear communication. Allow consumers to first communicate directly with you rather than through their issuing bank so that the issue can be resolved more simply. And when they do, respond to each complaint quickly and professionally. Which brings us to the second way to avoid chargebacks…

- Give clear contact information so customers can go directly to you. Including an email and phone number for your customer service or payments departments on every receipt shows your shoppers that you are there for them if an issue arises. They will be more likely to contact you directly that way.

- Make sure your billing descriptor makes sense. Again, this fosters better communication. The billing descriptor will show up on a customer’s bank statement. Too often, retailers have obscure billing descriptors leading to avoidable chargebacks from confused customers. While the dispute is usually handled quickly, it’s a massive waste of time for both you and the cardholder.

- Make your return policies straightforward. Avoid return fraud (a type of chargeback fraud) by making your policies clear in your store, on receipts, and throughout your eCommerce site. A thoroughly defined policy will discourage thieves and leave you with strong footing during disputes.

- Follow through on all shipping promises. And if you can’t, have a plan in place of how you will appease a disgruntled customer. Inconveniences such as delayed shipping need not lead to full refunds on chargeback claims. Instead, offer a gift card, freebie, or discount on their next purchase.

Get the Right Payment Processor and Follow Their Credit Card Best Practices

- Adhere to your credit card processor best practices. For instance, confirm expiration dates and signature on all cards when the client is paying in person. Get signatures and check identification for all swiped transactions. Be careful of keyed, in-person, card-not-present transactions, a common method for chargeback fraud. Follow guidelines for card-not-present eCommerce transactions and require any additional information that your processor recommends (billing addresses, matching billing and shipping addresses, CVV codes, etc.).

- Keep your transaction history organized and detailed and save receipts. All transactions should be electronically cataloged and easily retrieved to minimize the time spent on annoying clerical work. Any paper receipts should also be saved for at least 120 days after the purchase to have on hand in cases of chargebacks.

- Look for merchant services that protect their merchants against chargebacks. The best payment processors will battle disputes off the bat on behalf of their merchants. Since many disputes can be resolved quickly, this keeps you from having to deal with the majority of credit card chargebacks. If you’ve had a history of frequent chargebacks, this service will be even more valuable.

- Pick your battles. Not all chargebacks are going to be worth your time. You don’t want to give in to fraudsters, but you also don’t have time to fight for every $5 chargeback claim.

What Can Your POS System Do to Help Prevent Credit Card Chargebacks?

In addition to your merchant services provider, your point of sale solution can also help your business avoid credit card chargebacks.

The Three Most Important POS Features to Avoid Credit Card Chargebacks

- Look for a POS solution that can capture signatures electronically at the time of payment. Saving signed paper receipts is important, but doing so digitally is even easier and more organized. Having signatures on file makes challenging a claim much faster and easier.

- Additionally, with the new EMV laws, find POS credit card machines that prompt customers to insert their chip. As we’ve discussed before, any swiped or keyed transaction leaves the retailer on the hook for potential fraud, making it much harder to contest. However, an EMV chip transaction protects the merchant from fraud claims and transfers the financial burden for fraudulent transactions to the issuing bank. With EMV prompts any card containing a chip may not be swiped, ensuring that the transaction is secure and legitimate.

- Finally, be sure that your POS devices allow you to turn off manual credit card entry. Keyed-in transactions are the most common method of chargeback fraud and the most problematic for retailers. A thief steals someone’s card information and pretends that the card can’t be read by inserting it incorrectly. They then manually enter the credit card information into the pin pad. In these cases, once the transaction is approved, it’s too late for the retailers. The actual cardholder will eventually realize their card has been stolen, dispute any fraudulent charges, and request a chargeback. For keyed-in transactions, the retailer will have no choice but to accept the request and refund the money.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

To find out more, check out KORONA POS. We protect all of our retailers by educating them on the industry and providing the most secure software and up-to-date hardware on the market. Plus, we integrate with nearly every payment processor, giving each of our customers the option of finding the best fit for their business. Take a look at our retail point of sale system and sign up for a no-commitment free trial and product demo!