If your business accepts credit cards, it needs to meet Payment Card Industry (PCI) compliance standards. This is true whether you take payments through a physical POS, an online checkout, or contactless payment.

In this post, we’ll explain PCI Compliance, why it’s essential, and what steps retailers need to take to fulfill its requirements.

Key Takeaways:

- All businesses accepting credit card payments must adhere to PCI standards

- Failure to meet PCI requirements can result in heavy fines, loss of customer trust, and increased vulnerability to cyberattacks

- KORONA POS helps retailers stay compliant by offering secure, PCI-compliant payment processing integrations

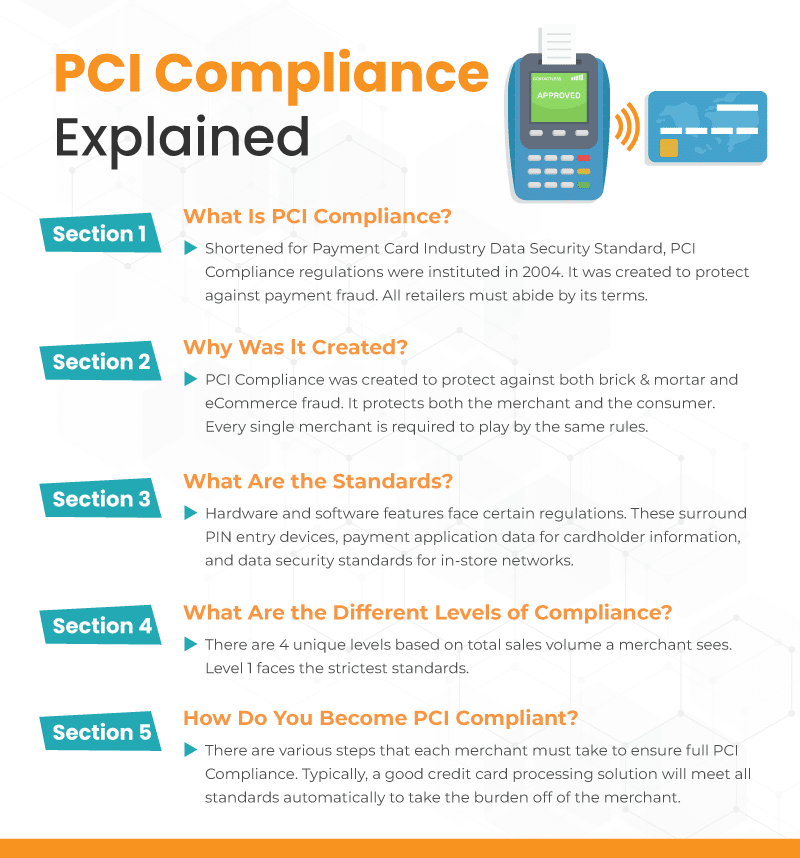

What Is PCI Compliance?

The PCI Data Security Standard (PCI DSS) is a set of best practices designed to protect merchants and consumers from data breaches and payment fraud.

PCI Compliance is regulated by the PCI SSC (Standard Security Council). This organization was founded by the main credit card associations: American Express, Visa, MasterCard, and Discover. Each credit card company can enforce the PCI standards however it sees fit.

Why Was PCI Compliance Created?

PCI Compliance was created to protect against brick-and-mortar and eCommerce retail fraud. It does so by protecting both the merchant and the shopper.

PCI Compliance sets a standard for how retailers secure payment data to ensure that all retailers follow these procedures. Big box retailers and mom-and-pop shops alike must abide by this set of rules.

The Different PCI Compliance Standards

PCI Compliance applies to merchants, hardware manufacturers, and software developers. Below, we’ve outlined several compliance standards in more detail:

PIN Entry Device (PED) standards

PCI Compliance targets companies that produce PIN-accepted payment devices. This includes all EMV devices and swiped transactions at gas stations and ATMs.

Payment Application Data Security Standard (PA-DSS)

PA-DSS goes to the next level and regulates the software that stores cardholder information and data. PA-DSS is meant to protect this software from any security breaches.

Data Security Standard (DSS)

PCI DSS, as mentioned above, is the standard that each business must meet to comply with payment regulations. Retailers must pay close attention to this and follow strict procedural policies, security management, network safety, and software.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Levels of PCI DSS Compliance

Every business must comply with PCI standards, which vary based on the type of business and the card brand used for transactions. You must check agreements made with payment processing services or contact your back to determine the PCI level relevant to your business.

Here’s how American Express, for instance defines its PCI levels:

| Category | Criteria | Requirements |

| Level 1 | • 2.5 million or more annual transactions • Any business designated a Level 1 by American Express | • Annual On-site Assessment • Annual Report on Compliance Attestation of Compliance (ROC AOC) |

| Level 2 | • 50,000 to 2.5 million annual transactions | • Annual Self-Assessment • External Network Vulnerability Scan (Every 90 days) • ASV Scan Report Attestation of Scan Compliance |

| Level 3 | • 10,000 to 50,000 annual transactions | • Report required on case-by-case basis • Annual Self-Assessment Questionnaire (SAQ) • ASV Scan Report Attestation of Scan Compliance (Every 90 days) |

| Level 4 | • Less than 10,000 transactions | • Report required on case-by-case basis • Annual Self-Assessment Questionnaire (SAQ) • ASV Scan Report Attestation of Scan Compliance (Every 90 days) |

12 Retailer PCI Compliance Requirements

To remain compliant, retailers must follow 12 key requirements and many sub-requirements. The latest PCI compliance standards as of June 2024 are as follows:

1. Implement firewalls

Businesses must configure firewalls to protect network data. These security systems filter incoming and outgoing traffic, preventing unauthorized access to sensitive information.

2. Install password protection

Retailers must enforce strong password policies for users accessing systems that contain cardholder data. Passwords must be complex and regularly updated.

3. Protect cardholder data

Cardholder data must be safeguarded from unauthorized access and stored securely through tokenization and other protective measures.

4. Encrypt cardholder data

Data encryption ensures that any sensitive cardholder information is unreadable to unauthorized users during transmission and storage.

5. Install antivirus software

Antivirus software must be regularly updated and installed on all systems to detect and prevent malicious software from accessing sensitive information.

6. Regularly update software

Retailers must consistently update all software systems, including operating systems and applications, to improve overall security.

7. Restrict access to cardholder data

Only authorized personnel should have access to cardholder information, with strict permissions and role-based controls.

8. Set up unique IDs to access data

Businesses must assign unique IDs to all users accessing sensitive information. Ultimately, this lets businesses track who accessed data and when.

9. Restrict physical access to data

Physical access to systems storing cardholder data, like POS systems, must only be limited to authorized personnel, using controlled areas and secure access protocols.

10. Maintain access logs

Access logs should be regularly monitored to track who accesses sensitive data, helping detect and respond to any unauthorized or suspicious activity.

11. Test security systems regularly

Retailers must conduct periodic vulnerability scans, penetration tests, and other assessments to identify and address weaknesses in their security infrastructure.

12. Create and document a business-wide compliance policy

A clear and documented PCI compliance policy must be in place, outlining all practices and procedures for handling cardholder data and ensuring adherence to security standards.

Learn more about how credit card processing works and save your business money with this free eGuide.

Important Reasons For Retailers to Be PCI Compliant

Not only do retailers rely on consumer trust to ensure continued business success, but a failure to comply with PCI regulations can result in detrimental fines. Below are key reasons why staying compliant should be a priority for your business:

✅ REASON 1 – PROTECT CUSTOMER TRUST

- Being PCI compliant shows customers that you take their data privacy seriously. It helps build trust, encouraging them to make purchases without worrying about data breaches or fraud.

✅ REASON 2 – AVOID HEAVY FINES

- Non-compliance with PCI standards can lead to hefty fines from card networks like Visa or MasterCard. These fines can significantly impact a retailer’s bottom line and hurt the reputation of your business.

✅ REASON 3 – REDUCE RISK OF DATA BREACHES

- PCI compliance ensures that you implement the necessary security measures to prevent data breaches. It reduces the risk of customer data theft, keeping your business and your customers protected.

✅ REASON 4 – ENHANCE BUSINESS REPUTATION

- Customers, business partners, and stakeholders view retailers who adhere to PCI standards more favorably. A compliant business stands out as a trusted and responsible entity in the marketplace.

Risks and Challenges of Not Being PCI Compliant

Failure to comply with PCI standards presents significant risks that can jeopardize your business. These risks range from financial losses to long-term reputational damage. Here’s a closer look at the potential dangers.

❌ Risk 1 – FINANCIAL PENALTIES

- Non-compliant retailers face substantial penalties, often including charges for each compromised transaction or a fixed fee for each month of non-compliance. These fees can add up quickly and impact your business.

❌ Risk 2 – LOSS OF CUSTOMER TRUST

- A data breach due to non-compliance can lead to a loss of customer trust. Once customers lose confidence in your ability to protect their data, they may take their business elsewhere.

❌ Risk 3 – INCREASED RISK OF CYBERATTACKS

- Without the required security protocols, your business is more vulnerable to cyberattacks and hacking attempts. Hackers often target retailers with inadequate protection systems, increasing the chance of data loss or theft.

❌ Risk 4 – LEGAL CONSEQUENCES

- Retailers who fail to comply with PCI regulations can face legal action from customers or financial institutions. This can lead to lawsuits, further reputational damage, and additional financial burdens.

Speak with a product specialist to learn exactly what you need and how we can help.

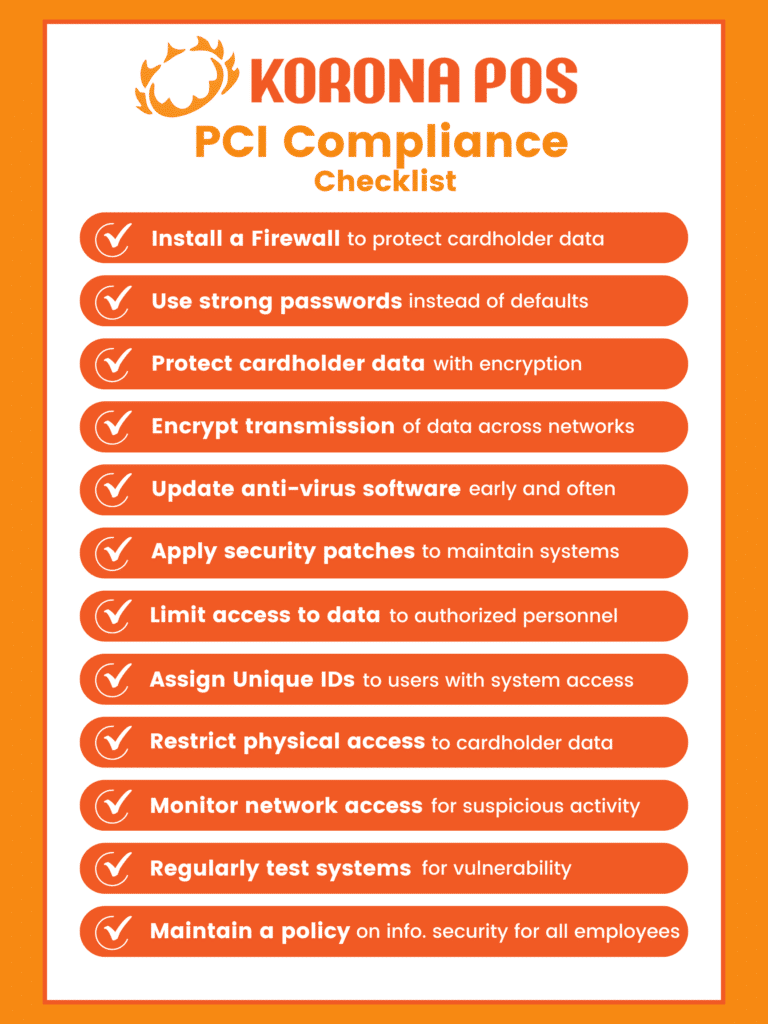

PCI Compliance Checklist for Retailers

Retailers must follow strict guidelines to secure cardholder information, reduce fraud risks, and maintain trust. Below is an easy-to-follow checklist to help your business stay PCI compliant.

Here’s what you need to do:

- Install and maintain a secure firewall to protect cardholder data.

- Use strong passwords instead of vendor-supplied defaults.

- Protect stored cardholder data with encryption.

- Encrypt transmission of cardholder data across public networks.

- Regularly update anti-virus software to prevent malware threats.

- Maintain secure systems and applications by applying security patches.

- Limit access to cardholder data to only authorized personnel.

- Assign unique IDs to users with system access.

- Restrict physical access to cardholder data and storage.

- Monitor and track network access to detect suspicious activity.

- Regularly test security systems and processes for vulnerabilities.

- Maintain a policy on information security for all employees.

Achieve PCI Compliance With KORONA POS

Maintaining PCI compliance in your retail store is an ongoing process that requires consistent attention.

KORONA POS is strictly a POS software provider, not a credit card processing company. However, it integrates with credit card processors, supporting each merchant’s PCI Compliance through our point-of-sale payment system.

Get in touch with us today to start implementing the best security practices for your business!