Key Takeaways

- Retail inflation means prices for store-bought goods climb steadily. Shoppers pay more for the same items over time. Businesses face tighter budgets as costs rise too.

- Profit margins shrink fast for retailers. Input costs, such as materials, outpace sales gains. Owners absorb hits to keep prices steady, risking losses.

- Consumers shift gears under pressure. They often opt for store brands over name brands. Impulse buys drop as wallets feel the squeeze.

- Smart moves help weather the storm. Track numbers weekly for early warnings. Negotiate with vendors for better deals.

- Loyalty pays off in tough times. Target repeat buyers with value-added perks. Diversify sales through online or add-ons.

If you are a retail business owner, chances are you have experienced increased prices for your products from your suppliers in the last several months. Inflation is palpable, and the ongoing geopolitical crisis between Ukraine and Russia does not make it any easier.

While economists and the National Retail Federation still expect U.S. retail sales to increase between 6 and 8 percent this year, the uncertainty surrounding the impact of inflation has left consumers and retailers looking for answers about the future of the retail industry.

One thing is sure, though: inflation will not last forever. But for now, it’s a serious concern for every retail business in 2022. After all, high inflation changes consumers’ behavior towards certain products, with retailers bearing the brunt. In this article, you will learn how inflation impacts retail and how to deal with it effectively to soften its impact on your retail business.

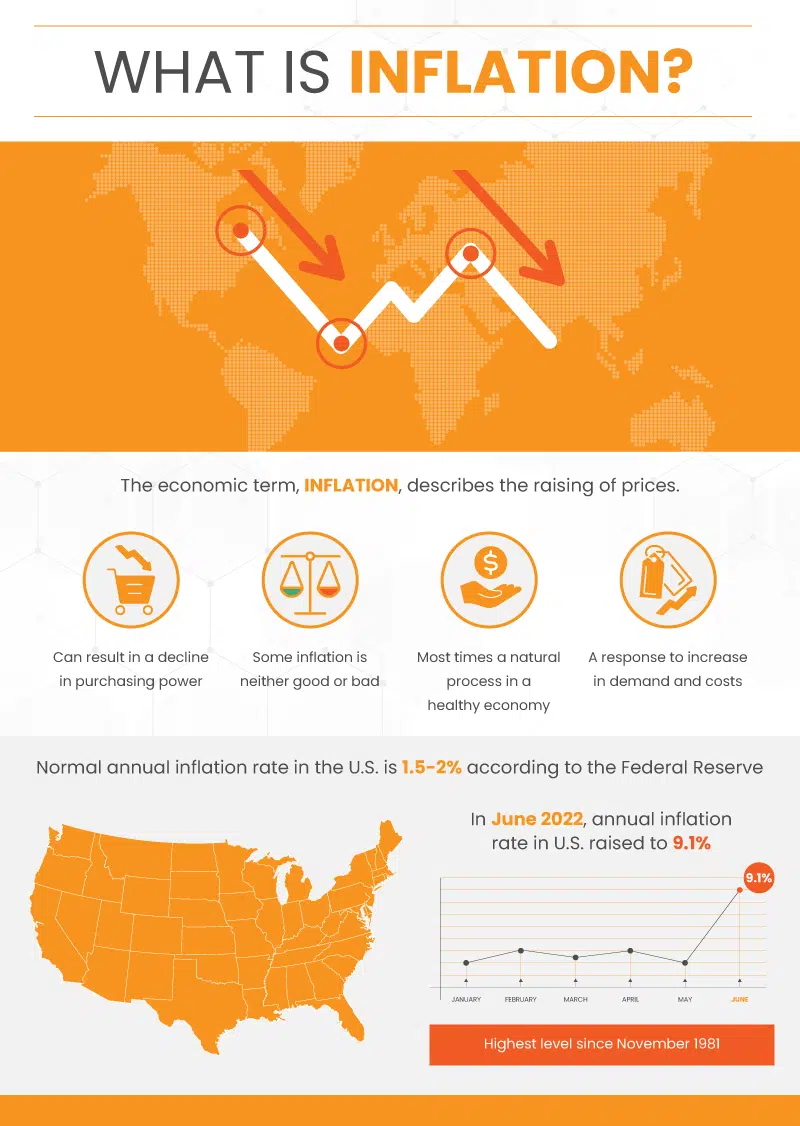

What Is Retail Inflation?

Retail inflation measures the steady rise in prices for everyday goods and services that shoppers purchase at stores, online, or in markets. Unlike broader economic inflation, which encompasses everything from wages to housing and retail, retail inflation focuses on consumer-facing costs, such as clothing, electronics, and food, directly impacting household budgets and store shelves.

It reflects how much more cash people need to buy the same basket of items over time, often driven by supply chain snags, higher production costs, or demand surges. For retailers, it signals tighter margins if they can’t pass those costs along without losing customers.

The key yardstick here is the Consumer Price Index (CPI), a monthly snapshot from the U.S. Bureau of Labor Statistics tracking price changes in a fixed set of urban consumer goods. As of the latest data for the 12 months ending August 2026, overall CPI inflation stands at 2.9%, up from 2.7% the prior month. This marks the quickest pace since January, driven by increases in energy and shelter, although core CPI (excluding food and energy) remained steady.

Take groceries as a prime example: Food prices rose 3.2% year-over-year through August 2025, outpacing the general rate. That means a $100 weekly grocery run last year now costs about $103.20, squeezing families and forcing stores to rethink sourcing or promotions. Retailers feel the pressure, supermarkets might see eggs or produce spike 5-6% due to weather or feed costs, prompting bulk-buy deals to keep aisles stocked.

Why does retail inflation matter so much? It shapes shopping habits: When prices creep up, folks hunt bargains, switch to store brands, or cut back on impulse buys like snacks or apparel. For business owners, staying ahead means monitoring these shifts closely, perhaps by locking in supplier deals early or highlighting value packs.

In the 2026 economy, marked by a choppy landscape and tariffs adding fuel, savvy retailers utilize tools like CPI reports to forecast and adapt, transforming potential pain into smarter strategies that strengthen loyalty. Overall, understanding retail inflation isn’t just numbers; it’s about grasping the real-world tug on wallets and storefronts.

Free printable templates and checklists to help you manage retail operations with ease

How Does Inflation Affect Retail Businesses?

One of the most significant impacts of inflation on your retail store is not necessarily inherited to your business. Instead, the impact comes from how your customers react to inflation with their purchasing decisions.

Shrinking Profit Margins

Inflation directly elevates the Cost of Goods Sold (COGS) because manufacturers and wholesalers pass on their higher costs for raw materials, energy, and labor. Even if a retailer raises the final sale price, they often cannot do so proportionally, as they fear losing customers. The difference between the rising wholesale cost and the restrained retail price compresses the gross profit margin, making it harder for the business to cover its fixed operating expenses and maintain a healthy profit level.

Shifts in Consumer Behavior

As the cost of living rises, customers become severely price-sensitive and more discerning with their spending. They typically cut back on discretionary items (like apparel or electronics) and prioritize necessities.

PRO TIP

- Consumers actively seek value by trading down to store brands (private labels), actively chasing promotions, or switching to discount retailers. Retailers must adapt their product mix and marketing to cater to this highly cautious, value-driven shopper.

Rising Operating Costs

Beyond inventory, inflation drives up every aspect of a retailer’s overhead. Labor costs increase as employees demand higher wages to keep up with the cost of living. Utility bills (electricity, gas) and the cost of rent often climb. The cost of running a fleet for last-mile delivery, marketing, and warehousing also increases due to rising fuel and interest rates. The cumulative effect burdens the operational budget, demanding aggressive cost-cutting elsewhere.

Supply Chain Pressures

Inflation is often compounded by, and contributes to, supply chain instability. Higher fuel prices and labor shortages increase freight and shipping costs. Suppliers may demand shorter payment terms or charge more due to their own cost uncertainty. The overall unpredictability makes inventory forecasting exceptionally difficult. Retailers risk either overstocking (tying up expensive capital) or understocking (missing sales opportunities).

Cash Flow Strain

The combination of higher input costs and a cautious consumer puts a significant strain on working capital. Retailers are forced to pay more for inventory upfront, while customers may delay purchases or demand discounts, slowing the pace of revenue generation. Higher interest rates, imposed by central banks to fight inflation, make borrowing money for daily operations or business investment significantly more expensive, putting pressure on liquidity.

13 Steps to Deal with Inflation as a Retail Business

As a result of the spike in demand that followed the reopening of the economy after the lockdown, many retailers have yet to feel the full effects of inflation. However, as interest rates rise and consumer purchasing power declines, many retailers may begin to see a decline in demand. Below are some tips to address inflation in your retail business.

Streamline Your Inventory, Sales, And Other Inefficiencies

Even if you can’t control inflation, you can review your operations and identify areas for improvement to minimize waste. These small, incremental changes can significantly impact your retail business while mitigating the effect of inflation. Here are some areas of the retail business model you could improve.

Inventory management: Most retailers do not have a good understanding of their inventory, which, along with inflation, can be one of the most costly resources for your retail business. In fact, the average retailer’s inventory accuracy is about 60 to 65 percent. If you can improve your inventory management, you can avoid overstocking underperforming items while still having your best-selling items available. Investing in automated inventory management software is the first step to better inventory management. Inventory management software lets you get notifications of low stock, overstock, and out-of-stock directly from your retail point of sale system.

Streamline Your Inventory Management With The Best Retail Inventory Management Software

Sales trends: Do you know what trends exist in your retail business? Is your business seasonally dependent? Do your customers take an average of six months to convert? If you understand the actual data on how your customers interact with your retail business, you can use it to make more informed strategic decisions.

Perhaps you are highly dependent on holiday sales to turn a profit, which may mean you only work three days a week the rest of the year to minimize overhead. Again, you’ll need accurate data before making any choices or decisions. Choosing your point of sale software is essential to ensure that you have the necessary data.

For example, the assortment feature in KORONA POS can help you better adopt your assortment planning process to take advantage of your customers’ purchase requests. It helps you determine which products to sell and where to sell them, based on seasonal demand and regional market conditions.

Fixed and variable costs: Your business expenses are often the most affected by inflation. Inflation can drive these costs up quickly, from rent to electricity, to advertising, and to wages. These are also areas where inefficiencies can be found. Perhaps you’ve noticed that advertising in the local newspaper is less efficient since the pandemic, or perhaps you can negotiate better terms with your landlord. If you can reduce costs in these areas, it can help your retail store better manage inflation.

Learn how to manage your inventory effectively with this free eGuide.

Control inflation through a steady cash flow

One of the most effective strategies to minimize the effects of inflation on your retail business is to maintain a steady cash flow. For instance, you may want to reduce your monthly overhead by negotiating more favorable lease terms with your landlord. If you want to start an eCommerce business, it’s meant to increase your revenue.

Both actions are designed to increase cash inflow while decreasing cash outflow. You have a negative cash flow when your retail business expenses exceed your revenues. If you bring in more money than you spend, you have a positive cash flow.

A consistent cash flow alleviates the impact of inflation, allowing your business to continue operating without interruption. If you have a steady flow of working capital, you don’t need to make any drastic changes. That doesn’t mean you shouldn’t always be looking to improve, but it does give you more flexibility to grow at your own pace. Retail lending solutions, such as a business line of credit and a merchant cash advance, can help alleviate your cash flow issues. Such a type of financing acts as a safety net for your retail store.

No business, large or small, has been spared from the COVID-19 crisis and high inflation. If your retail business is still alive in 2022, it means you have survived one of the most difficult times for small businesses in our history. A better way to manage inflation in your retail store is to operate more efficiently and eliminate waste in your business. This approach is not strictly reserved for times of inflation. Reducing costs such as rent, electricity, or other non-essential expenses is particularly useful for cost management. Another way to mitigate the impact of inflation is to set up good inventory planning to avoid tying up capital in inventory.

Investing in inventory management software that will allow you to eliminate guesswork and make decisions based on data is a great starting point. It’s true that you need to reduce the cost and certain expenses in your store. But if there’s one thing you shouldn’t skimp on before investing, it’s your POS software, as it’s the backbone of all the operations taking place in your store.

WE CAN HELP

And that’s where KORONA POS can help. KORONA POS is a cloud POS system that tracks your sales, the most popular consumer trends, and the evolution of your inventory. For companies that own both online and physical stores, KORONA POS enables seamless integration and offers a smooth customer experience. Need to know more about KORONA POS? Feel free to click the button below to schedule a demo with one of our product specialists.

Speak with a product specialist and learn how KORONA POS can power your business.

Know your numbers

Start by keeping a close eye on your financial data. Understand your profit margins, overhead costs, and cash flow patterns. Regularly reviewing your numbers helps you identify where inflation is eroding your profits. With accurate data, you can make informed decisions on pricing, inventory, and expenses, rather than reacting blindly to rising costs.

Consider raising prices

Raising prices can be intimidating, but small, strategic adjustments can protect your margins. Review your products or services and identify where you can increase prices without losing customers. Communicate any changes clearly and honestly, focusing on the value and quality you provide. Gradual price increases often go unnoticed but can make a big difference to your bottom line.

Identify areas of waste in your business to reduce expenses

Take time to evaluate where money or resources are being wasted. Look at things like excess inventory, energy consumption, or unnecessary subscriptions. Cutting waste doesn’t mean cutting quality, it’s about running leaner and more efficiently. Streamlining your operations can help you stay profitable even when costs rise across the board.

Support multiple payment types

Offering flexible payment options can attract more customers and improve sales. Accepting digital wallets, contactless payments, and installment options makes shopping easier and more convenient. The easier it is for customers to pay, the more likely they are to complete a purchase. Adapting to new payment technologies also helps future-proof your business.

Market to existing customers

Your current customers are often your most valuable audience. They already trust your brand, so focus on deepening those relationships. Send personalized offers, loyalty rewards, or early access deals to encourage repeat business. Retaining loyal customers is typically more cost-effective and profitable than continually trying to attract new ones.

Make smarter purchasing decisions

Be strategic when buying inventory or supplies. Compare prices across vendors, buy in bulk when possible, and track demand trends to avoid overstocking. Building strong relationships with reliable suppliers can also give you access to better deals. Smarter purchasing helps maintain profitability without sacrificing quality.

Provide discounts sporadically

Offering occasional discounts can boost sales, but use them strategically. Frequent markdowns can train customers to wait for sales, reducing your profit margins. Instead, plan limited-time offers or bundle deals that encourage larger purchases. When used sparingly, discounts can create excitement without devaluing your brand.

Re-negotiate vendor agreements

Talk to your suppliers about better pricing, payment terms, or delivery options. Vendors often value long-term partnerships and may be open to adjustments, especially if you’ve been a consistent customer. Negotiating effectively can lead to lower costs, improved terms, and a stronger business relationship.

Find other revenue streams and opportunities

Explore new ways to generate income, such as offering complementary products, selling online, or providing subscription services. Diversifying your revenue sources reduces your dependence on one stream and provides stability during inflation. Think creatively about what aligns with your brand and customer needs.

Tap into other funding options

Consider seeking financial support to manage rising costs or expand operations. Options include business loans, lines of credit, or grants for small businesses. Access to additional funding can give you flexibility to invest in inventory, marketing, or technology upgrades that help sustain growth despite inflation pressures.

Real-World Example of Retailer Navigating Inflation

Here’s a practical case study of how a major retailer adapted during inflation:

During the 2022 inflation surge, Walmart leaned into its everyday-low-price strategy and leveraged its scale to control costs. For example, the company negotiated more aggressively with suppliers such as Procter & Gamble, using data analytics to highlight where cost savings could be achieved and then passed on to shoppers.

At the same time, Walmart kept price increases on staples far lower than the overall U.S. inflation rate; an analysis found that grocery prices there rose about 3% versus a U.S. average of 7.5% in the same period. The dual approach of disciplined supplier negotiations and prudent pricing helped maintain customer trust during tight budget periods.

Common Mistakes Retailers Make During Inflation

Unfortunately, many businesses make crucial missteps that can significantly harm their profitability and customer loyalty. Here are some common mistakes retailers make when prices are rising, along with explanations of why they are detrimental.

1. Delaying or Avoiding Necessary Price Increases

A fundamental mistake is failing to adjust prices quickly enough to keep pace with rising wholesale and operational costs. Retailers often fear losing customers, so they initially absorb cost increases. While well-intentioned, prolonged absorption quickly erodes profit margins.

When they finally must raise prices, the jump is often so steep that it shocks customers and leads to greater abandonment than a series of smaller, gradual hikes would have. Waiting too long means selling goods for less than they truly cost to replace, ultimately threatening the business’s financial health.

2. Cutting Essential Services or Quality to Save Money

When costs rise, some retailers immediately look to slash budgets in areas that directly impact the customer experience, such as customer service, employee training, or product quality.

Reducing the quality of products (often through “shrinkflation,” where the size decreases but the price stays the same) or decreasing staffing levels to save on payroll only hurts the customer relationship.

Customers notice a decline in the value they receive, leading to disappointment and a switch to competitors. The short-term savings are often far outweighed by the long-term loss of loyalty and negative word-of-mouth.

3. Relying on Excessive or Deep Discounting

Using steep, frequent discounts as the primary strategy to drive sales volume during inflation is a trap that many retailers fall into. While discounts bring in immediate traffic, constantly marking down products trains customers to only buy at reduced prices.

It devalues the brand and makes it nearly impossible to sell items at their full, necessary price later on. The retailer becomes reliant on low margins to move inventory, preventing them from building the cash reserves required to weather continued cost increases.

4. Neglecting Inventory Management

Failing to analyze inventory levels and customer demand accurately is a costly error, especially when the cost of holding stock is rising due to higher interest rates and storage costs. Holding excess inventory ties up valuable working capital that could be used for more urgent operational needs.

Conversely, running out of popular items (stockouts) results in lost sales and frustrated customers who will turn to a competitor. Effective inventory management, knowing what to buy, when to buy it, and the precise velocity of each product, is crucial for maintaining cash flow and maximizing turnover.

Inventory management a headache?

KORONA POS makes stock control easy. Automate tasks, generate custom reports, and learn how you can start improving your business.

5. Ignoring Vendor and Supplier Relationships

Simply accepting new, higher prices from suppliers without negotiation is a standard passive approach that drains profits.

During inflation, retailers must be proactive in challenging supplier prices. Failing to re-negotiate terms means missing opportunities for bulk discounts, better payment schedules, or exploring alternative, more cost-effective suppliers.

A strong, mutually beneficial relationship built on effective communication can lead to better deals that mitigate the impact of inflation, but assuming prices are non-negotiable is a costly oversight.

6. Misunderstanding Customer Budgeting Shifts

Retailers often assume all customers react the same way to rising prices—by simply buying less. They fail to recognize the more nuanced shifts in consumer behavior. Inflation makes customers trade down (buying cheaper alternatives), delay non-essential purchases, and consolidate shopping trips. The mistake is not identifying these shifts for their specific customer base.

For instance, a retailer might not realize that customers are cutting back on discretionary add-ons but are still loyal to their core product; therefore, they focus marketing efforts in the wrong place. Understanding which items are now considered luxuries versus necessities is key to adjusting the product mix and marketing strategy.

Manage Costs and Inventory in Challenging Times with KORONA POS

KORONA POS helps businesses control costs and optimize operations by offering powerful, data-driven inventory management tools. Retailers can easily import products, adjust pricing, and track stock levels. With built-in order level optimization, KORONA POS ensures you only reorder what’s needed.

The system’s advanced inventory management features are specifically tailored to meet the complex needs of modern retail. KORONA POS streamlines initial setup by allowing retailers to import products and vendor details in various formats. For ongoing stock control, it features reorder levels and order level optimization, which analyze purchase history, seasons, and trends to calculate and suggest ideal stock quantities automatically.

Retailers benefit from features such as instant notifications for low stock and shipment tracking, which enables them to monitor orders from vendors and gain visibility into their supply chain.

Designed for liquor stores, vape and smoke shops, convenience retailers, and quick-service restaurants, KORONA POS offers the flexibility and precision required in fast-paced markets. Schedule a demo with one of our product specialists today or call us at 833-200-0213 to learn more.

Speak with a product specialist and learn how KORONA POS can power your business.

FAQs: How Inflation Is Affecting Retail Businesses

How does inflation affect businesses?

Inflation affects businesses in several ways. High inflation rates mean consumers’ purchasing power decreases, resulting in less consumer spending and lower business sales. This, in turn, can create excess inventory, dead stock, and therefore lost revenue for your business.

Do retailers benefit from inflation?

While the vast majority of retailers surveyed see inflation as an opportunity to increase prices and margins, nearly 54% see deflation as still having a future. Over the next 12 months, more than half expect industry revenues to increase by 5%.

Is inflation bad for retail stocks?

When inflation rises, companies must reduce their revenues and profits to stay solvent while spending more on goods. Stocks, however, appear to be a good hedge against inflation, as they should theoretically grow at the same rate as wages.

Are retail sales up or down?

According to an analysis by Insider Intelligence, global retail sales are expected to grow by 5% to over $27 trillion in revenue by 2022. Similarly, retail sales are expected to grow 4-5% annually through 2026, reaching just over $31 trillion.