Clover POS Cost Calculator

Upfront Hardware Cost: $0.00

Monthly Subscription Cost: $0.00

Estimated Monthly Transaction Fees: $0.00

Total First-Month Cost: $0.00

Total Cost Over 36 Months: $0.00

What Are Clover POS Fees?

Below, we explore Clover POS pricing, including Clover’s hardware costs, software subscription plans, payment processing fees, and add-on costs.

Clover Hardware Fees

Hardware can be purchased outright or leased, with costs varying by device and plan.

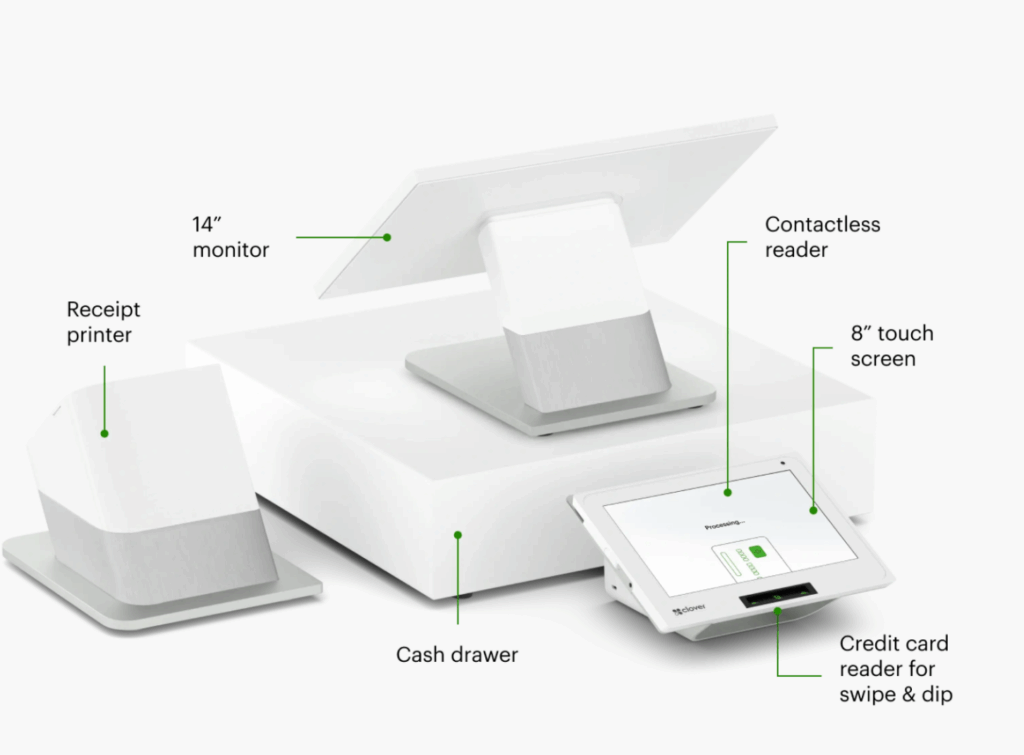

Overview of Common Clover Devices

Clover Station Solo: Ideal for retail or full-service restaurants

- Cost: $1,799 or $174/mo

Clover Station Duo: Similar to the Solo but includes a customer-facing 7-inch or 8-inch display for order confirmation, tipping, or receipts

- Cost: $1,899 or $180/mo

Clover Mini: A compact, tablet-style POS with an 8-inch touchscreen and built-in receipt printer, suitable for smaller businesses

- Cost: $849 or $45/mo

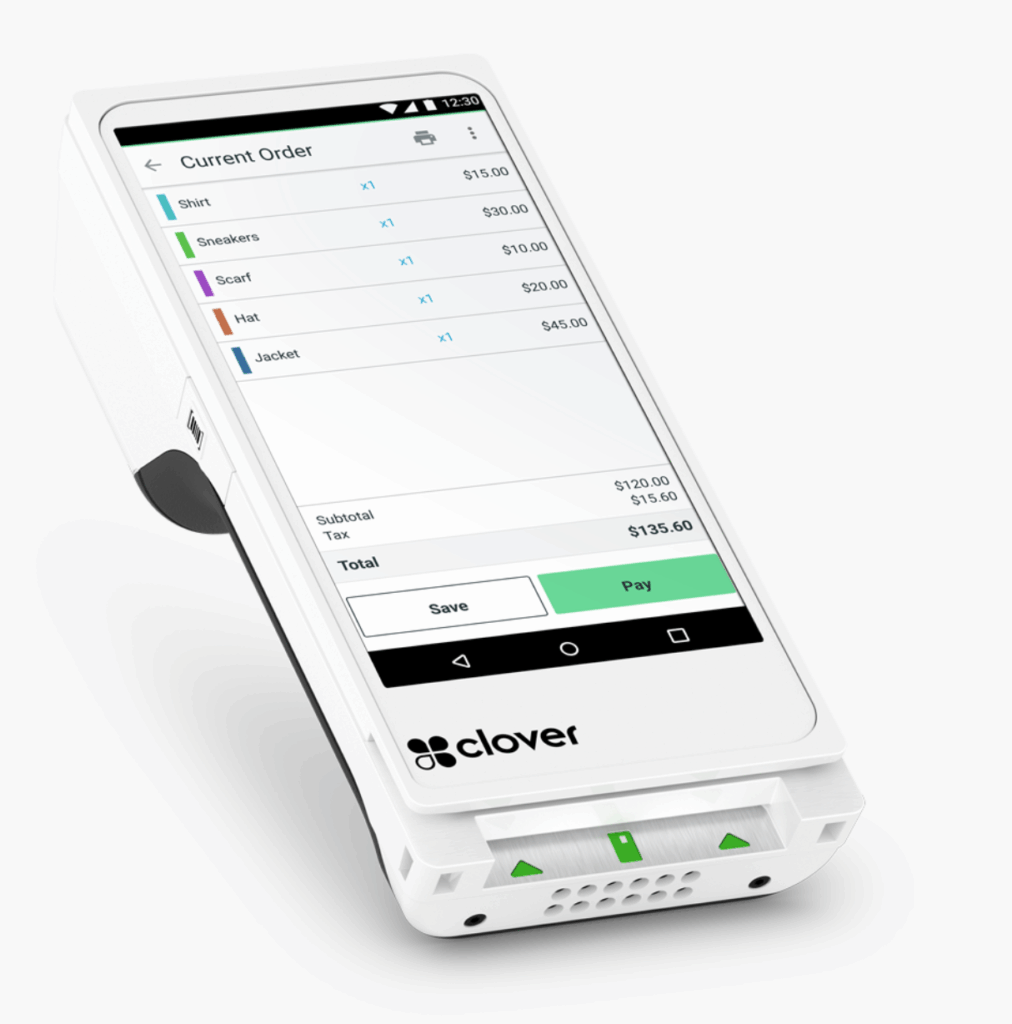

Clover Flex: A handheld POS for on-the-go payments, with a built-in receipt printer and support for WiFi or 4G/LTE

- Cost: $699 or $35/mo

Clover Flex Pocket: A lighter, more portable version of the Flex, 25% smaller for mobility

- Cost: $749 or $40/mo

Clover Go: A mobile card reader that connects to smartphones via the Clover Go app, perfect for businesses needing minimal hardware

- Cost: $49

Clover Kiosk: An all-in-one ordering station for fast-casual restaurants. Pricing is typically custom and higher than other devices

- Cost: $3,499 + $34.95/mo

Leasing can be appealing for businesses with limited upfront capital, but it’s generally advised to buy hardware outright to avoid inflated costs over time. Some plans offer interest-free financing over three months for purchases.

Build Your Own POS

Whether you run a retail store, café, or admissions booth, we have the point of sale hardware designed for your specific needs. Start building your ideal POS system now.

Clover Software Subscription Pricing

Clover’s software plans are tailored to specific industries (e.g., retail, restaurants, services) and come in tiers: Starter, Standard, and Advanced.

Monthly fees depend on the plan and hardware used, with additional fees for extra devices at the same location.

Some plans require 36-month contracts, especially for leased hardware, which may include early termination fees.

Clover Credit Card Processing Rates

Clover’s payment processing fees compared to Square are flat-rate by default but can vary if purchased through resellers offering custom pricing. Fees differ for in-person (card-present) and online/keyed-in (card-not-present) transactions.

Breakdown of In-Person and Online Processing Rates

- In-Person Transactions (Card-Present): Rates range from 2.3% + $0.10 to 2.6% + $0.10 per transaction, depending on the plan.

- Online/Keyed-In Transactions (Card-Not-Present): All plans are 3.5% + $0.10 per transaction.

Clover supports various payment methods, including credit/debit cards, contactless payments (Apple Pay, Google Pay), PayPal, Venmo, cash, checks, and gift cards.

Flat-Rate vs. Custom Pricing from Resellers

- Flat-Rate Pricing: Clover’s standard rates are transparent and predictable, ideal for small businesses with low transaction volumes.

- Custom Pricing: Resellers or third-party merchant service providers (e.g., Dharma Merchant Services, National Processing) may offer interchange-plus or tiered pricing, which can lower costs for high-volume businesses but may include additional fees.

- Reseller Risks: Some resellers impose hidden fees, long-term contracts, or tiered pricing that increases costs for certain card or transaction types (e.g., “unqualified” cards). Always review contracts carefully.

Payment processors

giving you trouble?

We won’t. KORONA POS is not a payment processor. That means we’ll always find the best payment provider for your business’s needs.

Complaints about Clover fees often stem from resellers’ lack of transparency, with some merchants reporting total fees nearing 5% due to miscellaneous charges.

Clover Add-On Costs

Beyond hardware, software, and processing fees, Clover offers optional features that can enhance functionality but add to costs.

Optional Fees for Apps, Loyalty Programs, and Gift Card Services

- Clover App Market: Offers over 200 third-party apps for payroll, inventory, accounting, but others require monthly subscriptions

- Cost: $5–$50/mo per app, depending on functionality

- Clover Security (TransArmor): Provides data encryption and tokenization for fraud protection, up to $100,000 coverage

- Cost: $5/mo per Merchant ID

- Hardware Add-Ons: Scales, barcode scanners, kitchen printers, PIN pads, or cash drawers

- Cost: $50–300, depending on the device

- Third-Party Delivery Integration: Integration with DoorDash, Uber Eats, or Grubhub is included in restaurant plans, but the platforms charge delivery fees

- Cost: Depends on integration service and plan level

- Rapid Deposit: This option, available with Clover Flex, provides faster fund access but may incur additional fees (not specified in sources)

- Cost: An additional 1.75% of the transaction

- Merchant Cash Advance: Clover offers financing, repaid via a percentage of daily credit card sales

- Cost: Vary based on terms

Factors That Influence Your Total Clover Fee Calculator

Here are the key factors that significantly influence your total Clover POS cost (going beyond the obvious):

1. Hardware Configuration & Deployment

- Choice of device—Station, Flex, Mini, Go—impacts upfront or financed costs.

- Adding accessories like scanners, drawers, and kitchen printers adds hundreds more.

2. Financing vs Upfront Purchase & Contract Terms

- Financing spreads hardware cost over 36–48 months and may include hefty early termination fees.

- Buying upfront lowers monthly spend but increases the initial cost.

3. Number of Terminals & Locations

- Each additional terminal demands its own software license and occasionally separate merchant accounts.

4. Software Plan & App Selections

- Plan tiers vary from Starter to Advanced

- Add-ons from the App Marketplace can tack on $5–50/mo per app

5. Transaction Mix & Volume

- Card-present vs card-not-present significantly changes processing fees (2.3–2.6% vs. 3.5+%).

Is Clover the Right Fit for You?

Clover POS can be a great fit for many businesses, especially small restaurants (quick-service and full-service), mom-and-pop retail stores, and independent service-based businesses, due to its versatility and user-friendly interface.

Pros:

- All-in-one solution: Clover offers integrated hardware and software for payments, inventory, sales reporting, and employee management.

- Modern, intuitive design: Its simple hardware and easy-to-navigate interface make it simple for staff to learn and use.

- App Marketplace: An extensive app market allows customization and added functionalities like loyalty programs and online ordering.

- Offline Mode: Transactions can still be processed without internet connectivity, ensuring business continuity.

- Reporting: Clover offers real-time insights into sales, inventory, and customer behavior.

Cons:

- Not Recommended for High-Risk Businesses: Clover is not suitable for high-risk retailers like liquor stores, vape/smoke shops, or CBD retailers due to reputation and processing limitations. These businesses will need a secondary processor.

- Proprietary Hardware: You’re tied to Clover’s hardware, a significant upfront investment that limits flexibility.

- Pricing Complexity/Hidden Fees: Costs can vary significantly depending on the reseller, and add-on apps can increase monthly expenses.

- Limited Customization: While the app market helps, the core software has less customization than some competitors.

- Customer Service Inconsistency: Some users report challenges with customer support responsiveness.

Before choosing Clover, consider your industry and long-term needs. While it works well for low-risk businesses seeking an all-in-one solution, high-risk merchants should explore more flexible POS options that accommodate specialized payment processors. Be prepared for monthly fees, limited processor flexibility, and some app costs.

Explore KORONA POS as a Best Alternative to Clover POS

KORONA POS presents a strong alternative for businesses looking to escape Clover’s often confusing fee structure. It’s rated as one of the best Clover POS alternatives.

Unlike Clover, which can involve layered costs from hardware leases, processing rates, and third-party markups, KORONA POS offers a clear, subscription-based pricing model with no hidden fees.

This transparency is especially valuable for small to mid-sized retailers who need predictable monthly expenses. Thanks to its industry-specific features and robust inventory management software, KORONA POS is ideal for niche industries like vape shops, liquor stores, and ticketing venues.

Additionally, it allows merchants to choose their payment processor, unlike Clover, which often locks users into one provider, giving businesses greater control over their transaction fees.

The combination of flat-rate pricing, specialized tools, and payment flexibility makes KORONA POS more affordable and a better strategic fit for retailers that aim for scalability and efficiency without sacrificing cost clarity.