Key Takeaways:

- Accuracy is Paramount: Your inventory value directly impacts your financial statements, including profit and loss, so inaccurate counts or valuations can mislead you and investors.

- Choose a Consistent Method: Stick with a valuation method like FIFO or weighted-average cost. Switching methods without a reason can make your financial reports inconsistent and confusing.

- Don’t Ignore Damaged or Obsolete Stock: Regularly write down the value of any spoiled, damaged, or outdated inventory; keeping it on the books at full cost inflates your assets.

- Landed Costs Matter: The true cost of your inventory isn’t just the purchase price; it includes shipping, duties, and handling fees, and you must consider these for an accurate valuation.

- Regularly Reconcile: Perform regular physical counts and compare them to your digital records to catch and correct discrepancies early, preventing small errors from becoming major problems.

As a retail manager or owner, having an accurate picture of inventory valuation is paramount to making purchasing decisions and avoiding situations such as dead stock or excess inventory.

Inventory is an asset to an organization, and it must have a financial value to be recorded on the balance sheet. As reported on its financial statements, inventory valuation affects a company’s profitability and potential value.

In this article, you’ll learn more about the different inventory valuation methods and key factors that play into choosing your business’s best inventory valuation strategy.

What Is Inventory Valuation?

Inventory valuation is the accounting process of determining the cost associated with all unsold inventory at the end of a reporting period. Measuring the value of merchandise and knowing how it affects the business’s profitability is essential. Understanding inventory valuation helps keep your company’s financial statements accurate and up-to-date.

In addition, it should be noted that the inventory valuation method you use also comes with certain tax implications. The IRS requires that you stick to one method, such as the first-in, first-out (FIFO), or weighted average cost (WAC) method, in your first tax year. If you plan to change your inventory valuation approach in subsequent years, you must notify the IRS, which must grant you permission. Such a rule is intended to prevent tax fraud.

Proper inventory valuation involves considering all prime costs attributable to acquiring and preparing the goods for sale and the purchase price (excluding indirect costs such as marketing or administration). These costs include labor, taxes, transportation, etc.

There are many methods of inventory valuation to help control fluctuations in the market price of your inventory. However, the most appropriate method will depend on the nature of your business.

Why Inventory Valuation Is Important?

The purpose of inventory valuation is to provide an accurate picture of a company’s gross profitability and financial position. Gross profitability on a company’s income statement is determined by subtracting the cost of goods sold (COGS) from net sales (total sales – returns and rebates and any other non-sales-related income).

Part of why inventory valuation is so important is because retail inventory management is becoming more onerous for retail merchants. Estimates show that by 2024, retailers will be exposed to a shortage of 140 million square feet of storage, increasing the cost of warehousing. As a result, retail stores will need to control inventory better.

In addition, the need to use automated inventory management software will be ever more apparent. An accurate grasp of your inventory’s valuation will allow you to make more informed decisions regarding your suppliers or manufacturers and whether to increase or decrease warehouse space. There are some other benefits of inventory valuation, too:

Loan implications

On your company’s balance sheet, inventory is listed as an asset. You invest money to buy or create your products and future sales, then turn the investment into revenue. If you want to apply for a loan, lenders will look at the value of the ending inventory on your balance sheet before approving it. Higher valuations give the lender more confidence that you will repay the loan.

In addition, lenders may restrict the allowable proportion of current assets to current liabilities, known as the loan ratio. The lender may require prepayment if you can’t meet the target ratio. Since inventory is often the most significant component of loan ratios, tracking the value of your inventory can help you meet the target ratio.

Influence on taxes

Your choice of inventory valuation method is directly related to how you report your taxes. For example, the first-in, first-out (FIFO) method will produce more taxable income than the last-in, first-out (LIFO) method. Using the correct valuation method, you can ensure that you pay the right amount of taxes and avoid an IRS audit.

How to Value Inventory?

Choosing the right method is important as it impacts your financial statements, affecting everything from your cost of goods sold to your gross profit. The following methods are commonly used to value inventory

1. Item-by-Item Method (“Lower of Cost or Market”, on each item)

How it works

- For each individual inventory item (SKU or serial unit), you compare cost (what you paid or produced it for) versus market value (or net realizable value) and choose the lower of the two.

- Then you multiply that chosen (lower) value by the quantity you hold of that item.

- Sum across all items.

- This method is the most conservative and precise, because it handles declines in value per item.

This is exactly what many textbooks mean when they say “lower of cost or market applied on an item-by-item basis.”

Example table (modeled after CFI style)

| Item | Quantity On Hand | Cost per Unit | Market/NRV per Unit | Lower Value Used | Total Value |

|---|---|---|---|---|---|

| Widget A | 100 | $10.00 | $9.00 | $9.00 | $900.00 |

| Widget B | 200 | $5.50 | $6.00 | $5.50 | $1,100.00 |

| Gadget C | 50 | $20.00 | $18.00 | $18.00 | $900.00 |

| Totals | $2,900.00 |

- For Widget A, cost = 10, market = 9 → pick 9 → 100 × 9 = 900

- For Widget B, cost = 5.50, market = 6 → pick cost 5.50 → 200 × 5.50 = 1,100

- For Gadget C, cost = 20, market = 18 → pick market 18 → 50 × 18 = 900

- Sum = 2,900

Pros/cons:

| Advantage | Disadvantage |

|---|---|

| Very precise; captures losses at the item level | Requires more detailed data, can be tedious, more computations |

| Conservative — you won’t overstate inventory | You lose benefit of “offsetting gains” across items |

2. Major Category Method

How it works

- Instead of comparing cost vs. market for each individual item, you first group inventory into categories (for instance, by product line, by type, by engine size, etc.).

- For each category, you total the cost and the market/NRV for that entire category. Then you apply the “lower of cost or market” rule at the category level.

- Finally, sum across categories.

Because you’re grouping, gains in one item can offset losses in another within the same category (so it’s less conservative than item-by-item).

Example table

Suppose we have two categories, “Electronics” and “Accessories”:

| Category | Total Quantity | Cost (sum of cost × qty) | Market/NRV (sum of market × qty) | Lower Value Used | Category Value |

|---|---|---|---|---|---|

| Electronics | — | $500,000 | $480,000 | $480,000 | $480,000 |

| Accessories | — | $200,000 | $220,000 | $200,000 | $200,000 |

| Total | — | 700,000 | 700,000 | 680,000 | $680,000 |

Here, for “Electronics”, cost > market, so we use the category’s market number; for “Accessories”, cost < market, so we use cost. Sum gives $680,000.

Pros/cons:

| Advantage | Disadvantage |

|---|---|

| Easier computationally (fewer comparisons) | Less conservative — may mask declines in particular SKUs |

| Less bookkeeping burden | Requires sensible categories; miscategorization can mislead |

3. Specific Identification Method

This is a more precise method especially useful for high-value, unique, or serial-numbered items (think custom machinery, jewelry, unique pieces).

How it works

- You track exactly which cost (or batch) is associated with each specific unit.

- When valuing inventory, you take those specific costs of the items still on hand.

Example table

| Unit / Serial No. | Cost | Status | Value in Inventory |

|---|---|---|---|

| Machine #001 | $15,000 | On hand | $15,000 |

| Machine #002 | $17,500 | On hand | $17,500 |

| Machine #003 | $15,500 | Sold | — |

| Total | $32,500 |

Pros/cons:

| Advantage | Disadvantage |

|---|---|

| Very accurate when items are distinct | Not practical when many identical goods |

| Good for high-value / low-volume items | Can be manipulated if management picks which cost to assign |

4. Average Cost (Weighted Average Method)

While this is one of the classic inventory-valuation methods, it works differently from “LIFO / FIFO” and is often acceptable (unless disallowed in your jurisdiction).

How it works

- You take the total cost of all goods available for sale (beginning inventory + purchases) and divide by the total number of units to get an average cost per unit.

- That “average cost” is then applied to all units (sold and unsold).

- For unsold units (ending inventory), multiply average cost × quantity on hand.

Example table

Assume:

- Beginning inventory: 100 units at $10 = $1,000

- Purchases: 200 units at $12 = $2,400

- Total units available = 300, total cost = $3,400

- Ending inventory: 80 units

| Description | Units | Cost per Unit (avg) | Value |

|---|---|---|---|

| Ending Inventory | 80 | $ (3,400 / 300) = $11.33 | 80 × 11.33 = $906.40 |

You’d also use the same average for cost of goods sold, etc.

Pros/cons:

| Advantage | Disadvantage |

|---|---|

| Smoothes cost fluctuations | Can mask sudden declines or increases in specific SKUs |

| Easy in systems with many homogeneous units | Less precise when items differ significantly |

5. Replacement Cost (or “Current Cost” / Market Cost) Method (with “Lower of Cost or Market” overlay)

Sometimes, instead of just looking at historical cost, you might want to value inventory based on what it would cost now to replace it (i.e., current market/replacement cost), subject to constraints.

How it works

- For each item (or category), determine “replacement cost” (how much you’d pay now to replenish it).

- But accounting rules (like “lower of cost or market”) often place constraints: you don’t pick something higher than net realizable value, or lower than NRV minus a normal profit margin.

- Then you choose the lower of (historical cost) vs (designated market/replacement), or per rules.

Example table

| Item | Quantity | Historical Cost per Unit | Replacement Cost | NRV / constraints | Lower Value Used | Total |

|---|---|---|---|---|---|---|

| Part X | 500 | $8.00 | $9.50 | NRV is $9.00 | Lower = $8.00 | $4,000 |

| Part Y | 300 | $12.00 | $11.00 | NRV is $11.50 | Lower = $11.00 | $3,300 |

| Total | — | $7,300 |

Here, for Part X, cost < replacement, so cost used. For Part Y, replacement < cost, so replacement used.

Pros/cons:

| Advantage | Disadvantage |

|---|---|

| More up-to-date in reflecting market pressures | Requires current data on replacement costs, more volatile |

| Good for planning / internal decision-making | Can lead to frequent write-downs if prices fluctuate |

Types of Inventory Valuation Methods and How They Work

There are primarily four inventory valuation methods that you can apply as a retail business owner. However, it is worth noting that using a certain inventory valuation method for accounting purposes differs from using it as an inventory system.

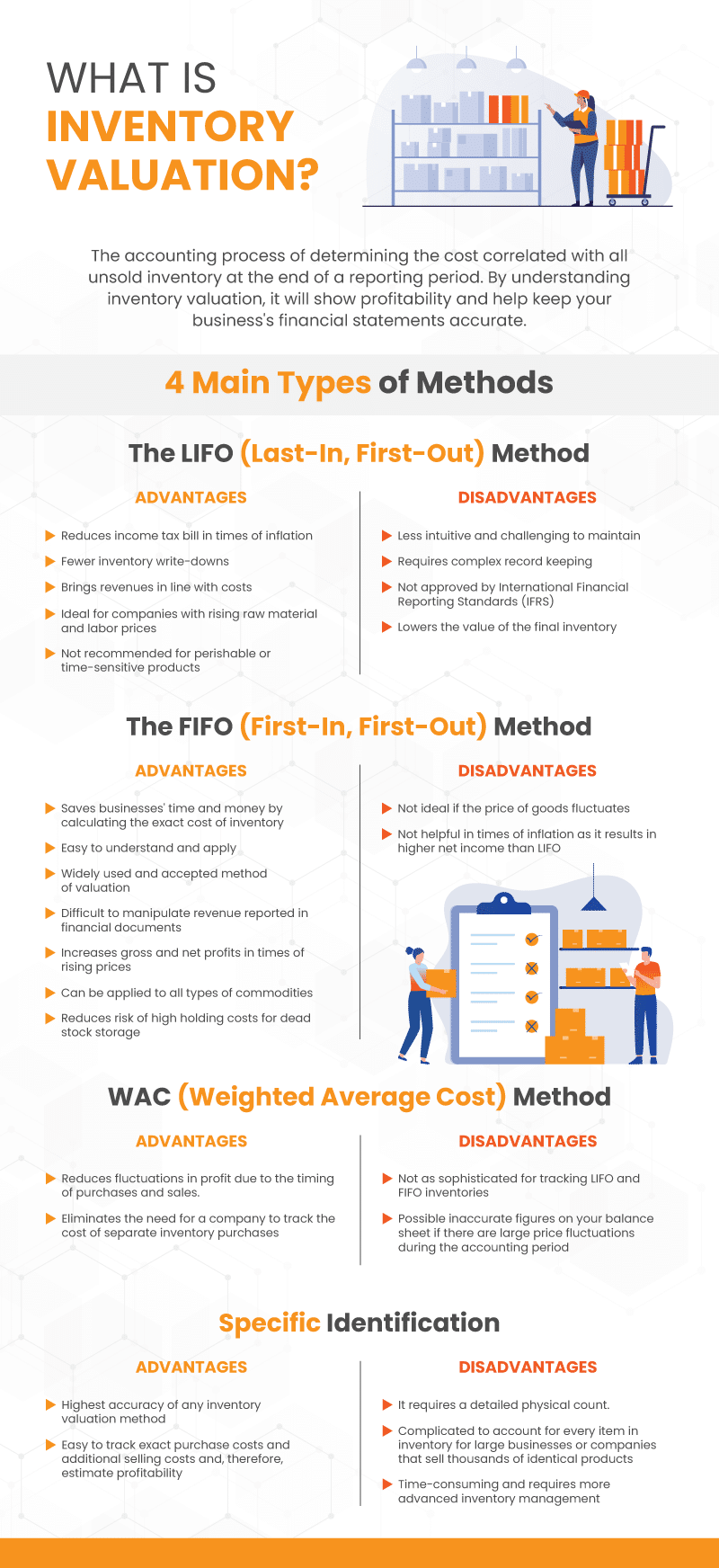

The LIFO (Last-In, First-Out) Method

The LIFO method is one of the most common inventory valuation methods used in retail. It is based on the principle that the goods produced or acquired last are the first to be sold. In other words, the most recently purchased items in your inventory will be the first to be sold.

LIFO allows a company to benefit from a lower tax rate because it makes less profit, which can ultimately be beneficial to the bottom line. On the other hand, LIFO is not ideal for brands that are expanding internationally, as it is only legal in the United States.

Advantages of the LIFO method

- Reduces the income tax bill in times of inflation

- Less inventory write-downs

- Brings revenues in line with costs

- Ideal for companies with rising raw material and labor prices

- Not recommended for perishable or time-sensitive products such as convenience stores or grocery stores

Disadvantages of the LIFO method

- Much less intuitive and challenging to maintain

- Requires complex record keeping

- Not approved by International Financial Reporting Standards (IFRS)

- Lowers the value of the final inventory

The FIFO (First-In, First-Out) Method

Unlike the LIFO method, FIFO is the most common method of inventory valuation for retailers. It is based on the premise that the oldest items in your inventory are sold first. This inventory valuation strategy is ideal for businesses that operate in an industry where product prices remain stable.

Benefits of the FIFO method:

- Saves businesses time and money by calculating the exact cost of inventory

- Easy to understand and apply

- Widely used and accepted method of valuation

- Makes it difficult to manipulate revenue reported in financial documents

- Increases gross and net profits in times of rising commodity prices

- It can be applied to all types of commodities

- Reduces the risk of high holding costs for dead stock storage

Disadvantages of the FIFO method

- Not ideal if the price of goods fluctuates

- Not helpful in times of inflation as it results in higher net income than LIFO

WAC (Weighted Average Cost Method)

The weighted average cost method is the middle ground between LIFO and FIFO. It involves taking all inventory costs to find the average rather than giving weight to newer or older inventory.

To determine the weighted average cost, divide the total cost of goods purchased by the number of units available for sale. The weighted average cost method is most suitable for businesses that sell many identical or very similar items. It simplifies inventory costing and avoids tracking the cost of individual inventory purchases when calculating profit and tax liability.

Advantages of Weighted Average Cost (WAC)

- Reduces fluctuations in profit due to the timing of purchases and sales.

- Eliminates the need for a company to track the cost of separate inventory purchases

Disadvantages of the Weighted Average Cost (WAC)

- Not as sophisticated for tracking LIFO and FIFO inventories

- You can get inaccurate figures on your balance sheet if there are large price fluctuations during the accounting period

Specific identification

This inventory valuation method is a system of tracking individual items from the time they enter the inventory until they are sold. Each product is tagged with its cost and any additional costs incurred until it is sold. The specific identification method is only possible if a company uses RFID data collection to label units with serial numbers or stamped receipt dates. This means it is best suited for retailers who sell specialty or unique items that require authentication.

Benefits of specific identification

- Provides the highest accuracy of any inventory valuation method

- Easy to track exact purchase cost and additional selling costs and, therefore, estimate profitability

Disadvantages of specific identification

- It requires a detailed physical count.

- It is complicated to account for every item in their inventory for large companies or companies that sell thousands of identical products

- Time-consuming, and it requires more advanced inventory management

How to Choose the Right Inventory Valuation Method?

The Type of Inventory and Industry 📦

The nature of your goods is a primary consideration. For perishable goods or items with a short shelf life (like food, pharmaceuticals, or seasonal clothing), the First-In, First-Out (FIFO) method is the most logical choice. It assumes you sell the oldest inventory first, which aligns with the physical flow of these products and helps minimize spoilage and waste.

For non-perishable, fungible goods (items that are all alike, like oil, coal, or sand) where it’s impossible to tell one unit from another, the Weighted Average Cost method is often the most practical. It smooths out cost fluctuations and is simpler to apply than other methods.

If you sell unique, high-value items with distinct features or serial numbers (like cars, art, or custom jewelry), the Specific Identification method is the most accurate. This method tracks the actual cost of each individual item, providing a precise cost of goods sold.

Cost Flow Assumption

Each method assumes a different flow of costs, not necessarily physical goods. FIFO assumes older inventory is sold first, aligning costs with earlier purchase prices. LIFO assumes newer inventory is sold first, matching recent expenses to revenue. The Weighted Average Cost method smooths out price fluctuations by averaging costs. Specific Identification tracks actual costs of individual items, ideal for high-value or unique goods like jewelry. Select a method that aligns with your actual inventory flow or streamlines cost tracking according to your operations.

Financial Reporting Goals

Your financial strategy shapes the choice. FIFO often shows higher profits in inflationary times by assigning lower, older costs to goods sold, boosting reported income. LIFO can reduce taxable income by matching higher recent costs to revenue, appealing for tax savings. Weighted Average Cost provides stable, predictable margins. Consider whether you prioritize higher reported profits, tax efficiency, or consistent financial statements when selecting a method.

Tax Implications

Tax rules vary by country, and not all methods are allowed everywhere. For example, LIFO is permitted in the U.S. under GAAP but banned under IFRS, which is used in many other countries. FIFO and Weighted Average Cost are universally accepted. If tax minimization is a goal, LIFO can lower taxable income in environments with rising prices, but compliance with local regulations is required. Check with a tax professional to ensure your choice aligns with legal requirements and tax strategy.

Price Trends

Market price trends for your inventory affect the method’s impact. In inflation (rising prices), FIFO increases reported profits but raises taxes, while LIFO lowers profits and taxes. In deflation (falling prices), the reverse happens—FIFO reduces profits, and LIFO increases them. Weighted Average Cost mitigates price volatility effects. Analyze historical and projected price trends for your inventory to pick a method that supports your financial outcomes.

Inventory Turnover Rate

High-turnover businesses, like food retailers, benefit from FIFO since it closely matches the physical flow of goods and keeps valuations current. Low-turnover businesses, like furniture or luxury goods, might prefer Specific Identification for precision or Weighted Average Cost to avoid complex tracking. Evaluate how quickly your inventory moves to choose a method that reflects your stock’s lifecycle accurately.

Complexity and Cost of Implementation

Some methods require more effort and cost to implement. Specific Identification demands detailed tracking of each item, which is resource-intensive but precise for high-value goods. FIFO and LIFO are simpler but need consistent record-keeping to assign costs correctly. Weighted Average Cost is the easiest for businesses with large, similar inventory batches, as it avoids tracking individual purchases. Assess your accounting resources and software capabilities to pick a method you can sustain without excessive cost.

Regulatory and Compliance Requirements

Accounting standards dictate permissible methods. GAAP allows FIFO, LIFO, Weighted Average Cost, and Specific Identification, but IFRS prohibits LIFO. Public companies or those seeking investors may need to align with stakeholder expectations, often favoring FIFO or Weighted Average Cost for transparency. Ensure your choice complies with applicable standards and meets audit requirements to avoid penalties or restatements.

Technology and Systems

Your inventory management system must support the chosen method. Specific Identification requires robust tracking software for individual items. FIFO and LIFO need systems to log purchase dates and costs accurately. Weighted Average Cost is less demanding, as it relies on aggregate data. Review your current technology and its ability to handle the method’s data requirements, or budget for upgrades if needed.

Future Scalability

Consider how the method will hold up as your business grows. FIFO and Weighted Average Cost scale well for businesses with expanding inventories due to their simplicity. LIFO can complicate long-term reporting, especially if disallowed by future regulations. Specific Identification may become unwieldy with larger inventories unless you sell high-value, low-volume items. Choose a method that won’t hinder your operations as transaction volumes increase.

Common Mistakes to Avoid in Inventory Valuation

Here are some of retailers’ most common inventory-valuation mistakes, why they matter, how to spot them, and precisely what to do about each.

Inaccurate Counting and Record-Keeping 📉

Accurate counting is a fundamental mistake in inventory valuation. This happens when physical counts of inventory don’t match the records. It can be caused by human error, theft, damage, or poor tracking. The result is a skewed valuation that misrepresents the company’s assets.

For instance, if you physically have 100 units of an item but your records say 120, you’re overstating your inventory and inflating your profits.

Conversely, if you have more than you’ve recorded, you undervalue your assets. Retailers should implement a robust system of regular cycle counts or annual physical inventories to ensure accuracy.

Mismatching Valuation Methods 🔄

Retailers often make the mistake of not consistently using the same inventory valuation method. The three primary methods are: Switching between these methods without a valid reason can distort financial statements and mislead stakeholders.

It’s crucial to select a method that best reflects your business’s nature and stick with it. Any change requires formal justification and disclosure in financial statements.

Ignoring Obsolescence and Damage 🗑️

Another significant error is failing to account for obsolete or damaged inventory. Inventory is not always perfect and sellable. Items can become outdated (e.g., last year’s phone model), spoiled (e.g., expired food), or physically damaged.

When this happens, the value of that inventory must be written down to its net realizable value (selling price minus any disposal costs). Keeping these items at their original cost inflates the value of your assets and overstates your profitability.

A critical part of accurate valuation is regularly reviewing inventory for these issues and writing off the value of unsellable stock.

Overlooking Landed Costs 🚚

Many retailers simply use the purchase price of an item for their inventory valuation. This is a mistake. The true inventory cost includes all costs to get it to its saleable location. This includes:

- Shipping and freight charges

- Import duties and tariffs

- Insurance during transit

- Handling and storage costs

These are often called “landed costs.” Ignoring them leads to undervalued inventory, resulting in understated profit margins and inaccurate pricing strategies. For accurate valuation, these costs must be included in the cost of goods sold.

Skipping Regular Reconciliation 📊

Not regularly reconciling your physical inventory to your book inventory is a recipe for disaster. It means comparing your records (what your system says you have) with an actual physical count.

This process, often done through cycle counts, helps identify discrepancies early. If a store’s system shows they have 50 boxes of a product, but a physical count reveals only 40, there’s a problem.

It might be due to theft, misshipment, or a data entry error. Timely reconciliation prevents these small discrepancies from snowballing into major valuation errors.

How KORONA POS System Can Simplify Inventory Valuation

KORONA POS is inventory management software specifically designed for retail businesses. It streamlines inventory with perfectly customizable features. The software automatically detects problems and lets you prioritize products with negative stock or that are selling less.

Likewise, KORONA POS can adjust the appropriate permissions for certain users. For example, you can have your staff perform counts without giving them full access to your inventory and values. If you want to learn more about KORONA POS, click the button below for a demo with one of our product specialists.

FAQs: Inventory Valuation Strategies

What Are The 4 Inventory Valuation Methods

Four accepted inventory valuation methods are First-In, First-Out (FIFO), Last-In, First-Out (LIFO), Specific Identification, and Weighted Average Cost.

What Is The Best Method Of Inventory Valuation?

There is no single best method of inventory valuation. Instead, the best method depends on the business. Companies consider many factors, such as financial goals, market conditions, company size, etc. However, for many retailers, FIFO and WAC are excellent ways to determine inventory value and easily keep accurate records.

How Do You Do Inventory Valuation?

Inventory value can be calculated by multiplying the number of items in inventory by their unit price. Per GAAP, inventory valuation should be based on the company’s lower market price or cost.

What Is the LIFO Method Of Inventory Valuation?

Under the LIFO method, the most recently purchased products (or items) are the first to be sold. This method is used only in the United States and is governed by generally accepted accounting principles (GAAP), which is beneficial for companies that do not have a sophisticated inventory management system.