Whether you sell products from your retail store, home, or online, obtaining the necessary licenses or permits to operate your business confidently is essential. And as a retail business owner or service provider, getting a wholesale license is vital for buying from a wholesaler to reduce your business costs and increase your profit margins.

This license not only allows you to avoid paying sales tax on the goods you sell to others but also helps customers and suppliers see you as an honest, reliable, and trustworthy purveyor. Obtaining a wholesaler’s license is usually a straightforward procedure, requiring some personal information about your business, funds, and a little patience.

But the most critical question is how to get a wholesale license. After all, your business needs suppliers. This blog post will help you understand what is a wholesale license, the different steps, and what to expect during the process.

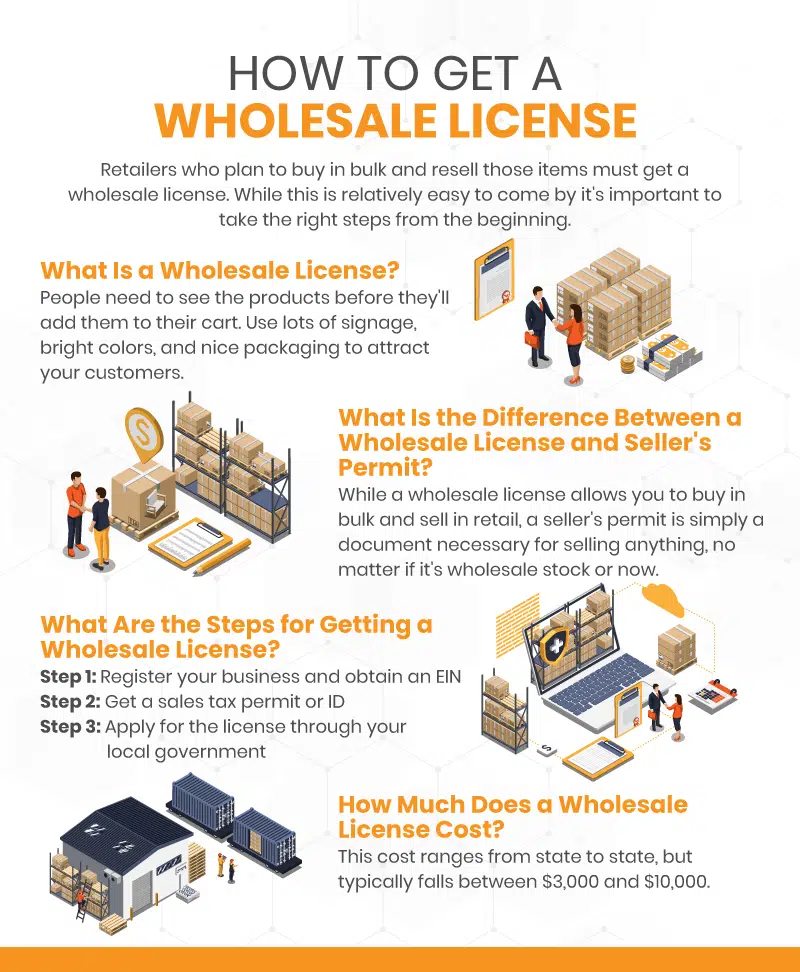

1. What Is a Wholesale License?

A wholesale license is a commercial document that grants retailers the right to legally purchase products or items in bulk from suppliers or manufacturers. Products are purchased at much lower prices and then resold at higher prices.

The wholesale license is an indication to the government, material suppliers, and retailers that you are a legal reseller of goods. This also proves that you are a business that complies with local and federal laws and follows the appropriate standards for reselling products wholesale.

The added benefit of your wholesaler’s license is that it reduces your taxes in the long term. Since most wholesalers buy goods in bulk, your license legally eliminates sales tax. Without a license, you are forced to pay sales tax on every purchase from the supplier, which adds up quickly.

Not having a wholesale license may cost you much more money and time than it would have cost you to get it in the first place. Depending on the nature and size of your business, you and the staff involved (most notably, the accounting staff) could cost your business thousands of dollars, not to mention the money you would have to pay for legal representation in the event of a legal issue. Also, note that the type of wholesale license you will be issued depends in part upon the products or items you plan to sell.

2. Wholesale License vs. Seller’s Permit

In most cases, a seller’s permit and a wholesale license are the same documents under two different names. Based on the state in which your business is located, it may also be called a vendor permit, resale card, wholesale card, retailer card, or reseller license.

Understanding the differences between wholesaler licenses and seller’s permits is crucial. For example, California does not require any business to take out a wholesale license. It is simply a misnamed California seller’s permit. Wholesale vendors need a seller’s permit to buy and sell goods that incur sales tax when sold at retail. Stores and other retail vendors are required to obtain the same permit.

It is important to remember that you will need additional licenses and documents besides the permit as a merchant. Basically, the need for any additional licenses boils down to the laws in your state. No matter what state or city your business is in, you need to get all appropriate licenses through your state’s tax office.

3. Steps to Getting Your Wholesale License

The procedure for obtaining your wholesale license is quite simple. Although wholesale license applications and fees may differ from one state to another, the basic procedures for getting a wholesale license are as follows:

Step 1: Register your business and apply for an EIN

The first step in obtaining a wholesale license is registering your business legally. Registering your business includes choosing a name and a legal structure. You must choose a name that another company hasn’t chosen to avoid legal disputes down the line.

Registering a business also means determining the legal structure under which you will operate (sole proprietorship, partnership, corporation, or limited liability company). Your legal structure or type of business will determine the amount of taxes you will have to pay and the laws that apply to your business. Contact a lawyer to discuss which legal structure is most appropriate for your needs.

Once you have set up your business as a legal entity, apply for a federal employer identification number (EIN), also known as a federal tax identification number. It allows you to hire employees, apply for bank loans, and other licenses necessary to maintain your business. Obtaining an EIN is free, and the process is done online. It usually takes four to five weeks to get an EIN.

Step 2: Getting a sales tax permit or ID

The second step is to obtain a sales tax permit or sales tax license. The sales tax permit or ID allows you to collect sales tax on your goods.

Most goods require sales tax, but it is only required once by the final buyer in the chain. The process and cost of obtaining a sales tax permit vary by state. It is essential to check with your state tax office to apply for a sales tax permit.

You may have to put down a deposit to obtain this permit. For example, a wholesale license requires a bond in the state of Texas. However, in California, only a deposit is needed.

Step 3: Apply for a wholesale license

This is the final step in the process. After obtaining your EIN and sales tax license, you are ready to apply for a wholesale license. Since application fees and procedures vary from state to state, it is essential to contact your tax office or taxing authority for additional information. Always consult your attorney and accountant to determine what exemptions you are entitled to. Again, remember that wholesale licenses go by many different names depending on your current state.

In addition to the EIN and sales taxes, you will need to know other information:

- Your full name and those of your partners in case you are not operating as a sole proprietorship

- Your DBA

- The name and nature of your business

Some wholesale licenses can be ready in as little as two to five business days. Other licenses can take up to two weeks to be approved. Once you have your wholesaler’s license, it is advisable to make a copy to have on hand for tax and reference purposes.

4. How Much Does a Wholesale License Cost?

The cost of a wholesale license can range from $3,000 to $10,000. However, the average cost is about $6,500. This variation is due to the fact that each state may charge more or less money depending on its tax laws.

Optimize Your Inventory With The Best Retail Inventory Management Software

Obtaining a wholesale license will allow you to buy in bulk from suppliers at reduced prices. Once the products are purchased, you will need to handle inventory management, a critical aspect of a successful retail business.

Good inventory management avoids excess inventory or stock-outs. For this, investing in inventory management software is a must to keep track of your stocks and know when to order products from suppliers or manufacturers.

KORONA POS is the best inventory management software for retail businesses. The software provides retailers with reorder levels, order cycles, shipment tracking, ease of receiving, inventory management notifications if you run out of stock, and many more.

KORONA POS has been a huge game changer for my overall profitability. Implementation was seamless and painless! The support staff is great and always ready to help. Had I known it would be this easy, I would have made the switch sooner!

-Kristen L.

FAQs: How To Get a Wholesale License

Buying wholesale with a seller’s permit depends on the type of license required in the state where you operate, as well as the type of business you have. Each state has its own set of regulations regarding wholesaling. Generally, the seller’s permit is still called a wholesale license. The name and some of the requirements of obtaining it can change from one state to another. To ensure you have the right information, it is advisable to contact your state’s tax office or revenue office. You can also check your state’s website for wholesale requirements. The website will provide information about other conditions, such as retail or eCommerce business licenses.

You can only buy from a wholesaler if you have a wholesale license that certifies that your business is authorized to do so. Consumers interested in wholesale products must contact the wholesaler directly rather than finding their products in a retail store or marketplace. There are very few wholesalers who sell products to the public. This is because selling smaller quantities to consumers requires a different marketing approach which is not profitable for wholesalers. Even though there are wholesalers who sell to the public, you will have to visit a factory or warehouse yourself to establish some form of partnership that will allow you to buy from them.

To buy wholesale, you need to have a wholesaler’s license, also called a seller permit, resale ID, wholesale ID, retail ID, or a reseller’s license. The name will depend on your state. Obtaining a wholesaler’s license also requires that you meet certain conditions. You must register your company and obtain your Employee Identification Number. Then obtain a sales taxes permit or ID. And finally, apply for the wholesale license at your state’s tax office.

You’ll need a seller’s permit to sell online if the products you sell are likely to be taxed. Whether your business has a physical location or operates online, most states require you to obtain a seller’s permit to collect sales tax. In addition, as an online business owner, you will need suppliers to source your products. And since most suppliers require a seller’s permit before selling, you will inevitably need a sales permit to sell online.