Many consumers still choose to pay with cash even though most payments in brick-and-mortar and online stores are made through credit or debit cards. Although cash transactions declined globally by 16% in 2020, with a 24% drop in the United States, McKinsey suggests that cash payments will rebound following the changes from the pandemic.

Fortunately, the economy has started to recover, and an increasing number of consumers are now using cash payments in stores. Adding convenience to the payment process is critical for retailers. But cash handling comes with its own problems. Cash handling is a tedious process, opens the door for more internal theft, and can lead to reporting and inventory problems.

However, the most critical questions you need to ask yourself are how much time your employees spend on cash-handling tasks and whether you’re experiencing too many cash discrepancies and errors that harm your business financially.

It’s unlikely you’ll readily know if your cash management is costing you money, so it’s a good idea to invest your time in implementing a cash handling policy and using the right checkout equipment and software to make your job easier. Read on to learn how to go about it.

Main Reasons That Impede Better Cash Handling

Before knowing how to build an effective cash-handling system, it’s worth knowing what can potentially lead to cash-handling issues. Avoiding these problems will play a significant role in your retail cash management. There are generally three common problems in the retail industry that lead to cash handling issues:

1. Failure to do due diligence

One of the most important reasons to implement cash handling procedures is to foster due diligence. Effective cash management allows you to know where your money is, who has access to it, and how it will be used. Without concrete answers to these questions, you’ll be hard-pressed to manage your accounting effectively. You could also easily run into fraud, theft, errors, and cash flow problems.

2. No digital or paper trail

The lack of a paper or digital trail is a recurring problem in cash handling. Keeping a clear trail of your cash handling process protects you while making it easier to identify and correct errors when they occur. It lets you know where your money is and who has access to it.

That’s why it’s advisable to use automated cash management technology that can significantly reduce errors and help you identify and correct them quickly and easily. Outdated manual processes are often plagued by human error. There are smart safe and cash recycler solutions that track the activity of safe users, such as who is putting money in, how often, when, and how much.

3. Safety defects

Solving physical security flaws is not just about investing in smart safes or cash recyclers. You also need to strengthen security in the cash handling process right at checkout. Receipt cancellation, for example, is a major issue that needs to be addressed. Cashiers sometimes try to steal by erasing the transaction from the register when someone pays in cash. This means that the business has no record of the transaction, and the cashier keeps the money in their pocket. A good point of sale system does not allow cashiers to perform this action without specific authorization, which reduces employee theft.

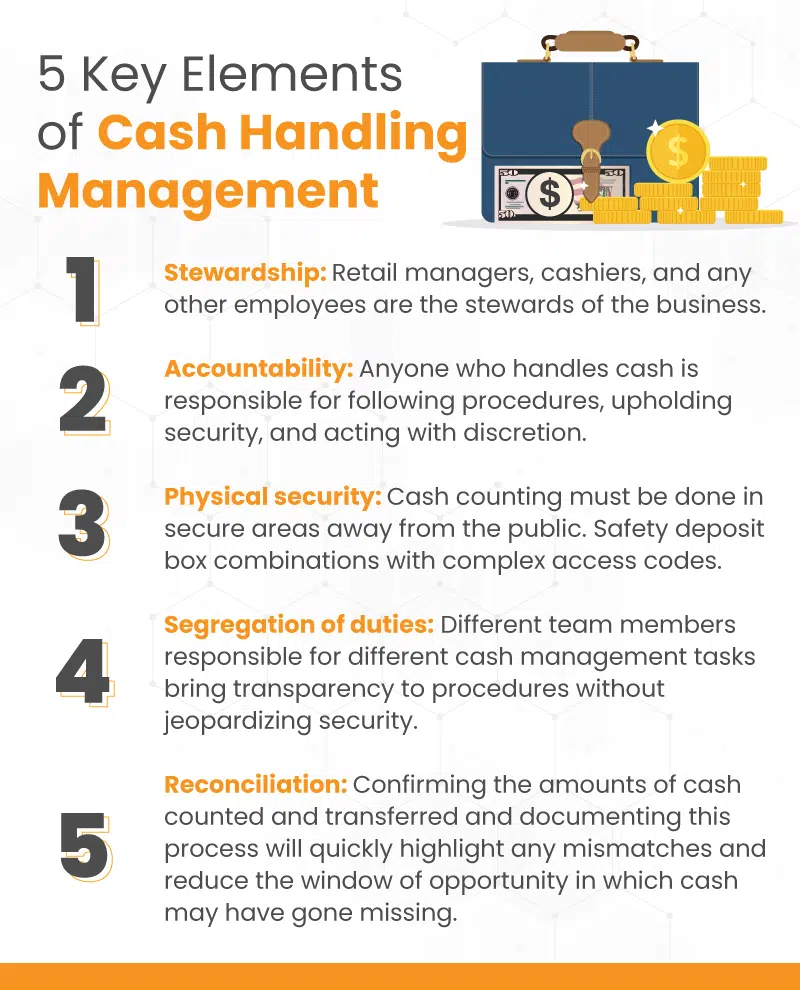

2. Key Elements of Cash Processing

According to Business and Financial Services (BFS), there are five key areas for cash handling management:

- Stewardship: Retail managers, cashiers, and any other employees are the stewards of the business and must fulfill their duties on both good and bad days.

- Accountability: Anyone who handles cash is responsible for following procedures, upholding security, and acting with discretion. All transfers of money and responsibility must be documented. In addition, a cashier or anyone who oversees the cash handling process must sign and verify overages/shortages and all voids/refunds.

- Physical security: It’s recommended that cash be kept out of sight wherever possible. Cash counting must be done in secure areas away from the public. Safety deposit box combinations and access codes should be complex and unknown to anyone not directly using them.

- Segregation of duties: Different team members responsible for different cash management tasks bring transparency to procedures without jeopardizing security.

- Reconciliation: Confirming the amounts of cash counted and transferred and documenting this process will quickly highlight any mismatches and reduce the window of opportunity in which cash may have gone missing.

Planning your cash handling procedures based on these five strong principles will ensure maximum efficiency and security when handling physical cash.

Some Best Practices To Streamline Cash Handling Process To Reduce Costs

In an industry where margins between profit and loss are thin, you can’t afford to lose money or have a poor cash management process. Below are some practices that can help you streamline cash management to reduce costs, improve efficiency, etc.

Have a standardized process for cash handling

Every business needs to be able to standardize its cash management process. The task should involve retail managers sometimes working with upper management. The process can consider how cashiers improve accepting money at the checkout and change when the money needs to be deposited in a safe or taken to the bank.

Here are some rules to follow when standardizing your cash-handling process, whether or not you use a cash-handling solution:

- Only authorized employees can handle the company’s money.

- Only the minimum amount of cash should be kept in the cash drawer. Excess cash should be regularly deposited in a safe.

- Two authorized employees should always be present when cash is being transported.

- Two authorized employees must always be present when cash is being counted.

- The employee handling the cash at the register must not be involved in depositing the cash in the safe.

- The person handling the cash at the safe must not be involved in introducing the cash into the cash register.

- The person holding the combination in the safe must not be involved in handling the cash in the safe.

- Cash drawers must be secured with a lock and key when not in use.

- Two authorized employees must always be present when cash is withdrawn or returned to a safe.

- There should be a cashier activity sheet that documents the names of persons withdrawing and returning money from the safe and cash drawer, with dates and times.

- When money is withdrawn or returned to the safe, it must be counted by two people. Both persons must sign the cash activity sheet and acknowledge that the amount recorded is correct.

- A breakdown of the cash, i.e., the number of coins, bills, checks, credit card slips, etc., must be recorded.

- When the cash is handed to the next person on the team, the person accepting the cash must count the cash and accept by signing the cash sheet.

- The cash sheet should be kept with the cash and not taken anywhere else.

- Bank deposit slips must match the cash sheet.

- All cash deposits must be recorded.

Train your employees on the cash-handling process

Successful management of the cash handling process involves training your employees. Your employees will always be an integral part of the cash-handling process. You need to train them to minimize errors and eliminate bad cash-handling practices. It’s just as important to retrain older employees as it is to train new ones for the first time. This allows your management team to be aware of any bad cash handling habits, such as depositing small bills that could be used to make change.

Invest in a quality POS system

The point of sale is the first element necessary for efficient cash management. For example, KORONA POS prevents cashiers from deleting items on a ticket if the customer pays in cash. The POS software can allow you to define your own customer settings by specifying who can cancel an item on a ticket. KORONA POS’s blind cash deposit feature prevents employees from seeing their cash deposit amount before counting their drawers. This feature helps identify recurring discrepancies. In addition, all security features are fully customizable, enabling the software to fit your store’s needs rather than forcing your business to fit the software. Learn more about KORONA POS by clicking the button below.

Ready to take your business to the next level?

Boost store performance and improve sales with the advanced features and tools KORONA POS offers.

FAQs: Cash Handling Procedures in Retail

There are several practices for handling cash in the retail store. Have employees close the cash drawer after each sale. Large amounts of cash should be counted and handled out of sight of the general public. Individuals should keep their cash funds to a minimum at all times. Excess funds must be placed in a locked device or deposited in the cashier’s office.

Cash handling procedures are related to training, cash handling, receipting, depositing, reporting, and hiring practices. These procedures apply to all retail stores or other businesses that handle cash transactions. Cash handling and storage areas must be restricted to authorized personnel.

The five principles of good cash handling are Stewardship, Accountability, Segregation of Duties, Physical Security, and Reconciliation.

Cash handling can be done in several ways. Collecting cash, issuing cash receipts, and preparing the deposit are all examples of cash handling.