A better solution that understands what your business needs.

- Personalized product demos

- Unlimited free trial

- 60-day money-back guarantee

- No credit card processing agreements

- Flat rates

- No forced contracts

- 24/7 in-house support

- Multi-location and vertical

- Zero fees or surcharges

The inventory management has been huge for us, especially integrating with the online store. KORONA POS was able to fit the bill on every single aspect.

– Bethany, Truro Vineyards

What I like about KORONA POS is the fact that we call customer support and we get answered immediately…it’s been very simple to train my employees with this POS system.

– Roger, The Cove on Harbor

KORONA POS has been a huge game changer for my overall profitability. Implementation was seamless and painless! The support staff is great and always ready to help.

– Kristen, Pine and Peoria Liquor Store

Get what your store needs.

Take control of your shop with the best retail point of sale in the business.

Advanced Inventory Management

Integrations for accounting, loyalty, eCommerce, and more

Powerful Reporting and Analytics

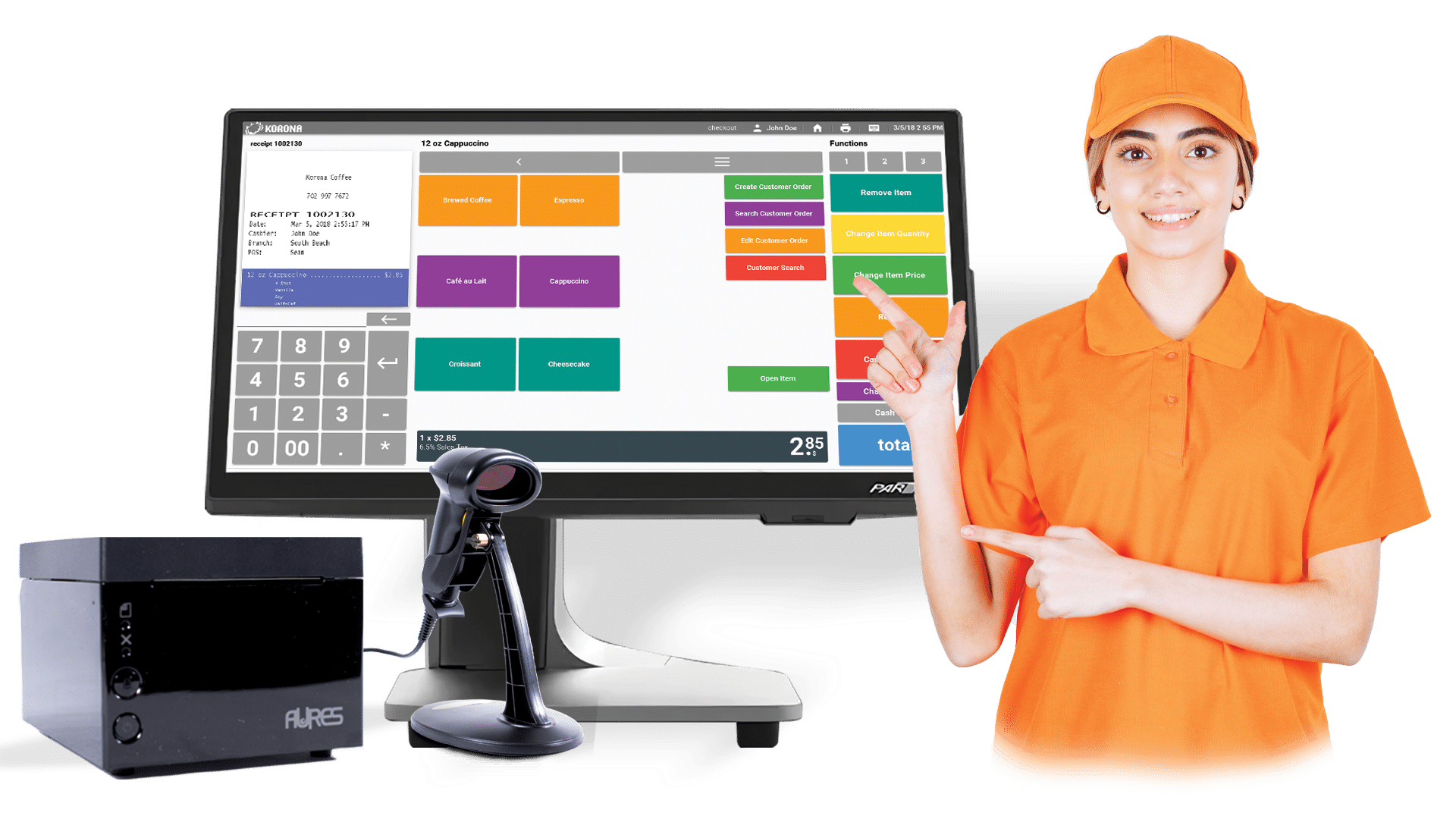

Mobile-ready point of sale to power your cafe, bakery, or coffee shop.

Intuitive Table Service Display

Employee Access Management

Scheduling and Payroll Assistance

Sell tickets, snacks, and merch all on one central platform. Online, too.

Ticketing Turnstile Integration

Group Rates, Memberships, Special Pricing

Online Ticketing Platform

Advanced Features and tools

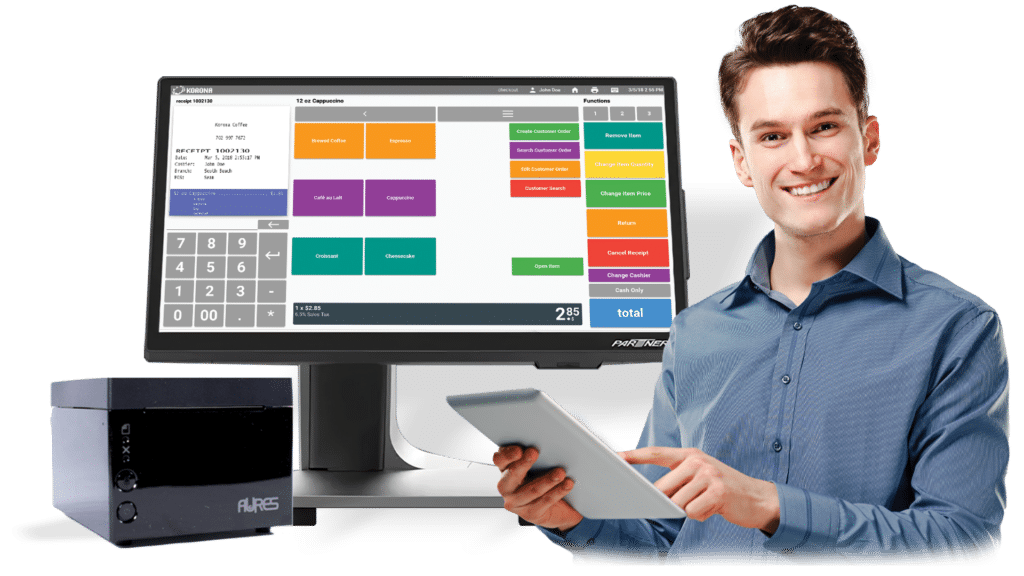

For small businesses to enterprise retailers

Easy and Quick to Start

#1

Let’s talk

Shopping for a new POS system can be hard. We’re here to help! Talk to one of our experts to learn more about the whole process.

#2

Data Import

Skip manual data entry and make things easy. We can import your existing data or vendor product list with just a few clicks.

#3

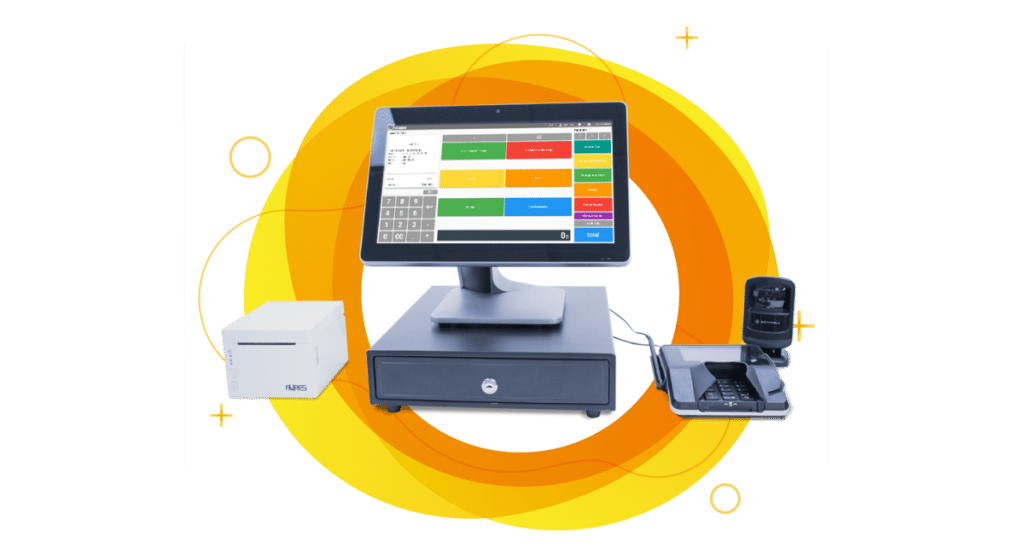

Setting Up

You can use your existing equipment or get new POS hardware delivered, pre-installed, and configured. Plug it in, and you’re set.

#4

Test

Our in-house technical support team will ensure that your POS system operates exactly as it should before going live.

#5

Start Selling

Run your business like never before and take advantage of the growing list of features, tools, and integrations from KORONA POS.

Cloud-Based Point of Sale for Modern Commerce

KORONA POS offers dynamic solutions for all types of businesses. We have the right hardware and software, no matter what you sell or where you sell it.

Our in-house technicians will help you optimize your checkout flow, understand your inventory, and optimize your product ordering and pricing. All to help you reach peak efficiency and maximize sales.

Start for freeTalk to a specialist.

Learn more about what KORONA POS offers. Reach out to us for a quote, schedule a demo, or start a free trial! No commitment required.

GET A QUOTE